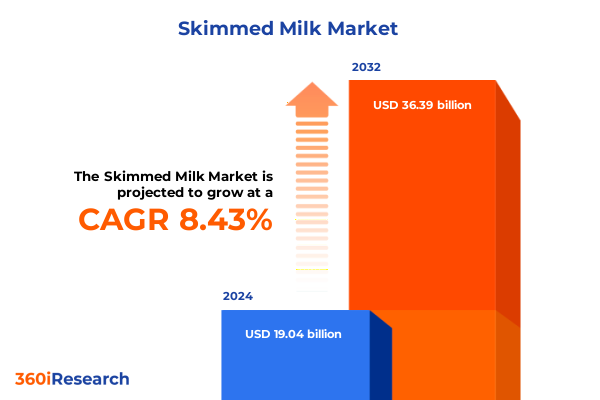

The Skimmed Milk Market size was estimated at USD 20.65 billion in 2025 and expected to reach USD 22.41 billion in 2026, at a CAGR of 8.43% to reach USD 36.39 billion by 2032.

Unveiling the Role of Skimmed Milk in Modern Dairy Markets Driven by Health Consciousness and Nutritional Trends Influencing Consumer Choices

The global dairy sector is experiencing an inflection point in which skimmed milk has emerged as a cornerstone of both health-focused product portfolios and sustainable production paradigms. Fueled by an increasing consumer emphasis on nutrient density, reduced calorie intake, and transparent ingredient sourcing, skimmed milk has transcended its traditional utilitarian role to become a symbol of wellness and dietary moderation. As lifestyle diseases and dietary intolerances shape consumption patterns, dairy producers are compelled to innovate while maintaining the fundamental quality attributes that characterize skimmed milk.

Against this backdrop, stakeholders across the value chain-from producers and processors to retailers and foodservice operators-are recalibrating their strategies. Advances in processing technologies, such as microfiltration and membrane separation, have enhanced the purity and protein content of skimmed milk, elevating its appeal among fitness enthusiasts and clinical nutrition segments. Simultaneously, consumer demand for clean-label products has prompted transparent labeling practices and traceability investments, bolstering trust in skimmed milk offerings.

Looking ahead, the interplay between evolving dietary guidelines, sustainability mandates, and consumer aspirations will continue to define the trajectory of skimmed milk. Understanding this dynamic landscape is imperative for stakeholders seeking to harness growth potential, differentiate within congested dairy portfolios, and forge resilient supply chains that meet tomorrow’s nutritional and environmental criteria.

Examining the Profound Technological, Sustainability and Consumption Shifts Reshaping the Skimmed Milk Sector’s Competitive Landscape

Over the past several years, the skimmed milk segment has been transformed by a convergence of technological innovations, shifting consumer values, and escalating sustainability commitments. Digitization across the supply chain has enabled real-time quality monitoring and predictive maintenance, resulting in higher yields and reduced waste. This technological leap has been mirrored by the rise of automation in processing facilities, where robotics-assisted sorting and advanced membrane filtration systems have elevated production efficiency and product consistency.

In parallel, environmental stewardship has emerged as a non-negotiable criterion for success in the dairy industry. Skimmed milk producers are integrating circular economy principles into their operations, repurposing whey byproducts for bioenergy generation and collaborating with feed suppliers to reduce greenhouse gas emissions. These sustainability initiatives not only mitigate ecological impacts but also resonate with eco-conscious consumers, reinforcing brand credibility.

Consumer preferences have also shifted toward multifunctional dairy beverages that deliver both nutritional value and convenience. Innovations such as fortified skimmed milk enriched with plant-based proteins, probiotics, and micronutrients are blurring the lines between traditional dairy and functional beverages. As digital platforms enable personalized nutrition recommendations, producers are increasingly leveraging data analytics to tailor product attributes, packaging formats, and marketing narratives to distinct consumer cohorts, marking a new era of demand-driven customization.

Analyzing the Far-Reaching Effects of Recent United States Tariff Measures on Skimmed Milk Trade Flows and Industry Profitability

The tariff adjustments enacted by the United States in early 2025 have had immediate and compounding effects on the skimmed milk trade and production economics. With increased duties applied to key dairy imports, domestic processors have faced both opportunities and challenges as they navigate altered cost structures. On one hand, higher import levies have afforded local producers a competitive edge in the domestic market, incentivizing capacity expansion and stimulating capital investment in processing infrastructure.

Conversely, the increased cost of imported dairy ingredients and specialty proteins has pressured margin stability for manufacturers that rely on blended formulations. Mid-sized and niche producers have encountered supply chain volatility, as sourcing strategies had to be recalibrated to mitigate elevated input costs. The ripple effect extended to export markets, where retaliatory measures and logistical constraints have introduced additional friction into established trading relationships.

Mitigation strategies have emerged in response to these cumulative pressures. Collaborative procurement alliances among dairy cooperatives have gained traction, enabling collective bargaining for raw milk and imported additives. In addition, forward-looking supply agreements and hedging mechanisms have been adopted to lock in feedstock prices and stabilize production budgets. These adaptive measures underscore the industry’s resilience, while also highlighting the ongoing need for strategic agility in the face of evolving tariff landscapes.

Revealing Critical Insights Derived from Form, Packaging, End Use and Distribution Channel Segmentation Dynamics in Skimmed Milk Market

The skimmed milk market can be dissected across multiple dimensions to unearth nuanced performance drivers and cross-segment synergies. The distinction between liquid and powder forms reveals divergent innovation pathways: while liquid skimmed milk continues to benefit from improvements in extended shelf-life technologies and aseptic processing, powder variants are leveraging advanced agglomeration techniques to enhance solubility and functional performance in foodservice and industrial applications.

Packaging formats further delineate competitive strategies. Glass bottles and plastic containers accommodate premium and convenience-driven liquid offerings, with rigid paperboard cartons and aseptic Tetra Pak units serving as the backbone for ambient distribution. Meanwhile, flexible plastic pouches and stand-up formats are gaining traction for single-serve and away-from-home consumption scenarios. Packaging decisions not only influence logistics efficiency but also shape consumer perceptions of freshness, sustainability, and brand authenticity.

Diverse end-use channels add another layer of complexity. Household consumption remains the largest volume driver, supported by value-pack promotions and private label expansions. Foodservice operators are increasingly integrating high-protein skimmed milk into beverage menus and culinary preparations, while industrial end-users deploy specialty powders for bakery, confectionery, and nutritional product formulations. Distribution channel dynamics reflect a duality of traditional retail footprints-comprising convenience stores, hypermarkets, and supermarkets-and rapidly expanding digital platforms, where e-commerce channels encompass both company-owned portals and third-party marketplaces. This multi-dimensional segmentation underscores the imperative for tailored market approaches that align product features, pricing strategies, and promotional activities with the distinct requirements of each segment.

This comprehensive research report categorizes the Skimmed Milk market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Packaging Type

- End Use

- Distribution Channel

Exploring Regional Variations across Americas, Europe Middle East Africa and Asia-Pacific That Drive Skimmed Milk Market Dynamics

Regional nuances play a decisive role in shaping the skimmed milk ecosystem, as consumer behaviors, regulatory frameworks, and infrastructure maturity vary significantly across different territories. In the Americas, a strong emphasis on value-added formulations and dairy-based protein offerings has spurred collaborations between major dairy cooperatives and foodservice chains. Market design in this region frequently incorporates sustainability benchmarks and renewable energy targets, guiding both raw milk production and downstream processing decisions.

Across Europe, the Middle East, and Africa, regulatory oversight on nutritional labeling and environmental impact has fostered stringent quality control regimes and life cycle assessments. Skimmed milk producers in Western Europe are at the forefront of low-carbon farming initiatives, while emerging markets in the Middle East and Africa are grappling with logistical challenges related to cold chain infrastructure. Nevertheless, rising urbanization and evolving dietary preferences continue to fuel demand in this collective region.

The Asia-Pacific landscape is characterized by rapid consumption growth driven by expanding middle-class populations and shifting dietary patterns toward high-protein, low-fat options. Skimmed milk powder remains a staple in many markets, yet liquid formats are gaining momentum as modern retail networks expand. Regulatory harmonization efforts and public–private partnerships aimed at enhancing dairy production capabilities are also instrumental in defining the competitive contours of the region’s skimmed milk market.

This comprehensive research report examines key regions that drive the evolution of the Skimmed Milk market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategies and Portfolio Innovations from Leading Dairy Producers Driving Competitive Advantage in the Skimmed Milk Sector

Leading dairy producers have adopted multifaceted strategies to cement their footholds in the skimmed milk sector, focusing on product portfolio diversification, sustainability credentials, and supply chain integration. Some organizations have expanded their offerings to include high-protein and fortified skimmed milk variants tailored to fitness and clinical nutrition segments, while others have pursued private label partnerships with major retailers to capture value-sensitive consumer cohorts.

Capital investment in processing capabilities has been prioritized to enable rapid product line extensions and ensure consistency across global markets. Several key players have implemented blockchain-enabled traceability systems that allow end-to-end visibility from farm gate to shelf, reinforcing consumer trust and expediting recall responsiveness. Strategic acquisitions of niche specialty ingredients suppliers have further broadened their technical expertise and accelerated innovation pipelines.

Collaborative ventures between dairy cooperatives and technology start-ups have also emerged as a cornerstone of competitive differentiation. By integrating digital farm management platforms with automated quality assurance tools, these alliances are driving improvements in animal welfare, feed optimization, and raw milk yield. Collectively, these corporate strategies illustrate how leading entities are combining operational excellence with consumer-centric innovation to sustain market leadership in the evolving skimmed milk landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skimmed Milk market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agropur Cooperative

- Arla Foods amba

- China Mengniu Dairy Company Limited

- Dairy Farmers of America, Inc.

- Danone S.A.

- Dean Foods Company

- Fonterra Co-operative Group Limited

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Lactalis Group

- Land O'Lakes, Inc.

- Mead Johnson Nutrition Company

- Müller Group

- Nestlé S.A.

- Parmalat S.p.A.

- Saputo Inc.

- Schreiber Foods, Inc.

- The a2 Milk Company Limited

- The Kraft Heinz Company

- Yili Group

Empowering Industry Leaders with Data-Driven Strategic Initiatives to Enhance Growth, Operational Efficiency and Consumer Engagement in Skimmed Milk

Industry leaders must adopt a proactive stance that balances cost efficiency with innovation to capture emergent market opportunities in the skimmed milk space. First, aligning product development with health and wellness trends-such as fortification with proteins, probiotics, and micronutrients-can differentiate offerings and command premium positioning. Investing in next-generation processing technologies will be crucial to maintaining cost parity while enhancing sensory and functional attributes.

Second, embedding sustainability at the core of operational frameworks will yield tangible benefits in brand equity and regulatory preparedness. Prioritizing renewable energy integration, reducing water usage through closed-loop systems, and valorizing dairy byproducts into high-value co-products can mitigate environmental footprints and appeal to eco-conscious consumers. Transparent communication of sustainability milestones through digital platforms will further enhance stakeholder engagement.

Lastly, optimizing distribution by leveraging omnichannel strategies is imperative. Strengthening e-commerce capabilities alongside traditional retail partnerships enables brands to meet consumers wherever they shop. Deploying advanced analytics to monitor consumption patterns, inventory turnover, and customer feedback will inform agile adjustments in pricing, promotions, and inventory allocation. Through these combined initiatives, industry leaders can accelerate growth, fortify resilience, and solidify their market standing.

Detailing Robust Research Methodology and Analytical Techniques Employed to Generate Insights on the Skimmed Milk Market Landscape

The research framework underpinning this analysis integrates a comprehensive blend of primary and secondary data sources to ensure both depth and rigor. Primary research comprised in-depth interviews with senior executives at dairy processing facilities, detailed conversations with supply chain managers, and structured dialogues with procurement specialists at leading retail and foodservice organizations. These engagements provided firsthand insights into operational challenges, strategic priorities, and innovation pathways.

Secondary research leveraged an extensive review of industry publications, regulatory guidelines, and trade association reports. Detailed examination of import-export databases, environmental impact assessments, and nutritional profiling documents informed the contextual understanding of regional and global market dynamics. Advanced analytical techniques-including comparative SWOT assessments, PESTEL evaluations, and supply chain mapping-were applied to synthesize qualitative inputs with quantitative indicators.

Data triangulation methodologies were employed to reconcile conflicting information, ensuring that final conclusions reflect the most accurate depiction of the skimmed milk landscape. This iterative validation process, combined with expert panel reviews and scenario impact testing, underpins the robustness and credibility of the findings presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skimmed Milk market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skimmed Milk Market, by Form

- Skimmed Milk Market, by Packaging Type

- Skimmed Milk Market, by End Use

- Skimmed Milk Market, by Distribution Channel

- Skimmed Milk Market, by Region

- Skimmed Milk Market, by Group

- Skimmed Milk Market, by Country

- United States Skimmed Milk Market

- China Skimmed Milk Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings into a Cohesive Perspective for Stakeholders to Navigate Future Opportunities in Skimmed Milk Markets Globally

The comprehensive examination of the skimmed milk segment reveals a confluence of health, sustainability, and innovation forces that are reshaping the industry’s competitive contours. Technological advancements are unlocking new product capabilities, while evolving regulatory standards and consumer expectations are driving transparency and environmental stewardship across the value chain. Regional dynamics underscore the need for tailored strategies that account for diverse consumption patterns, logistical infrastructures, and policy landscapes.

Segmentation insights highlight the multifaceted nature of the market, demonstrating that form, packaging, distribution, and end use each require bespoke value propositions. Key corporate strategies emphasize the importance of portfolio diversification, traceability, and strategic alliances, underscoring the critical role of collaboration between incumbents and technology innovators. Furthermore, the impact of recent tariff measures reinforces the necessity for agile sourcing strategies and risk-mitigation frameworks.

Looking forward, stakeholders that embrace data-driven decision making, prioritize sustainability, and foster cross-functional synergies will be best positioned to capitalize on the emerging opportunities within the skimmed milk market. By integrating the findings outlined in this report, industry players can confidently navigate a rapidly evolving marketplace and drive long-term value creation.

Engage with Ketan Rohom to Secure Comprehensive Skimmed Milk Market Intelligence and Drive Informed Strategic Decisions Today

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, offers a direct pathway to tailor comprehensive skimmed milk market intelligence that aligns precisely with your strategic imperatives. By collaborating with an experienced industry authority, decision-makers gain prioritized access to in-depth analyses, bespoke data compilations, and exclusive interpretive guidance that illuminates emerging opportunities and competitive challenges alike.

Reaching out today enables swift mobilization of resources to equip your organization with the insights necessary for decisive action. Whether you are seeking differentiated positioning through product innovation, optimizing distribution networks, or fortifying supply chain resilience, Ketan Rohom stands ready to guide you through the process of acquiring the full market research report. Connect now to secure a detailed proposal, customize research parameters to your unique context, and accelerate your journey toward sustainable growth in the evolving skimmed milk landscape

- How big is the Skimmed Milk Market?

- What is the Skimmed Milk Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?