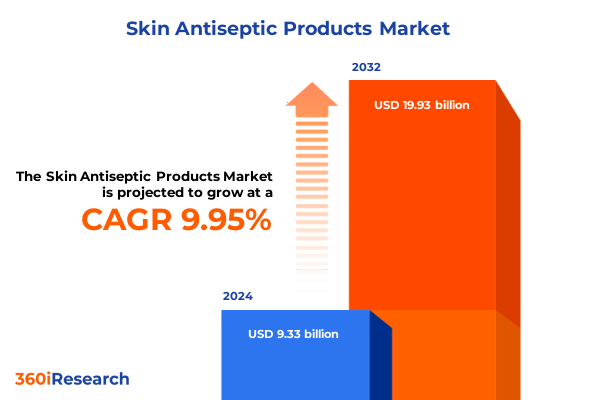

The Skin Antiseptic Products Market size was estimated at USD 10.24 billion in 2025 and expected to reach USD 11.25 billion in 2026, at a CAGR of 9.97% to reach USD 19.93 billion by 2032.

Harnessing Heightened Infection-Control Mandates and Technological Advancements to Elevate Skin Antiseptic Applications Across Diverse Care Settings

In an era defined by heightened vigilance toward infection prevention, skin antiseptic products have emerged as indispensable tools in both healthcare and consumer settings. The introduction of COVID-19 protocols accelerated investments in hygiene infrastructure, and the imperative to minimize healthcare-associated infections has only grown more pronounced. Recent guidelines from leading authorities continue to underscore the critical role of effective skin antisepsis in clinical procedures, from catheter insertions to surgical site preparations, shaping procurement priorities across hospitals, clinics, and home care environments.

Simultaneously, advances in formulation science have expanded the product spectrum beyond traditional solutions. Innovations in foams, gels, impregnated wipes, and aerosol sprays reflect evolving user preferences and workflow efficiencies. As healthcare systems grapple with cost pressures and a renewed focus on patient safety, stakeholders are seeking formulations that balance rapid antimicrobial action with residual protection. This confluence of clinical imperatives and technological progress establishes the backdrop for exploring transformative shifts, tariff impacts, and segment-specific opportunities in the U.S. skin antiseptic market.

Converging Clinical Imperatives and Sustainability Mandates Driving Innovation in Skin Antiseptic Formulations and Formats

The landscape of skin antiseptic products has undergone transformative shifts as regulatory bodies and healthcare providers adapt to emerging threats and operational imperatives. Heightened focus on antimicrobial resistance (AMR) has prompted rigorous evaluations of active ingredients such as chlorhexidine gluconate and povidone iodine, inducing manufacturers to develop novel combination chemistries that deliver broad-spectrum efficacy without contributing to microbial tolerance.

Concurrently, sustainability considerations have reshaped product development priorities. The emergence of fully biodegradable, plastic-free disinfectant wipes-capable of rapid hospital-grade disinfection-demonstrates how environmental imperatives are aligning with infection-control goals. These eco-conscious formats, supported by 94.3% relative biodegradation in accelerated landfill tests, underscore a pivotal shift toward circular economy principles within the antiseptic sector.

Navigating Section 301 and Section 232 Tariff Enhancements Shaping U.S. Supply Chain Resilience for Skin Antiseptic Components

Effective January 1, 2025, the United States Trade Representative finalized Section 301 tariff increases on select medical import categories, raising duties on rubber medical and surgical gloves to 50%. While gloves and facemasks may not directly encompass antiseptic formulations, these measures signal a broader environment of supply chain pressure for infection-control paraphernalia sourced abroad.

In parallel, probes under Section 232 initiated in April 2025 target pharmaceutical and semiconductor imports, with potential tariffs of 10–25% on active pharmaceutical ingredients including components used in antiseptic agents. Stakeholders must monitor evolving exclusion processes and public comment periods to mitigate risk and secure preferential sourcing strategies. Such tariff-induced cost headwinds reinforce the urgency for localized manufacturing and strategic inventory management across the skin antiseptic supply chain.

Deep-Dive Analysis of Product Forms, Active Chemistries, End Users, Channels, and Clinical Applications Reveals Targeted Opportunities

The market’s product form dimension is characterized by the enduring prevalence of solutions, especially alcohol-based and aqueous variants, driven by their rapid penetration and residual antimicrobial action. Yet foams have carved out distinct roles in clinical hand hygiene due to their ease of dispensing and lower drying times, while impregnated wipes offer standardized dosing and convenient single-use formats for both surgical prep and general skin cleansing.

Active ingredient segmentation highlights the primacy of alcohol-based formulations for broad-spectrum efficacy, closely followed by chlorhexidine gluconate, which provides sustained residual activity. Meanwhile, hydrogen peroxide and povidone iodine retain critical niches in settings where alcohol intolerance or specific microbial targets necessitate alternative chemistries. End users span from high-volume hospital operating rooms-both private and public facilities-to ambulatory surgical centers, clinics, and home care, each demanding tailored product attributes.

Distribution channels reflect an omnichannel evolution. Direct sales and hospital pharmacies traditionally secured institutional volumes, whereas drugstore pharmacies and online retail channels-via company websites and e-commerce platforms-have emerged as growth engines, particularly for over-the-counter antiseptic solutions and wipes essential for home first-aid and telehealth–enabled care. Application insights underscore preoperative skin prep-spanning catheter insertion to surgical site prep-as a critical growth axis, alongside hand antisepsis protocols and routine general skin cleansing.

This comprehensive research report categorizes the Skin Antiseptic Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Active Ingredient

- End User

- Distribution Channel

- Application

Comparative Regional Dynamics Highlight Unique Regulatory, Infrastructure, and Consumer Adoption Patterns Across the Americas, EMEA, and Asia-Pacific

In the Americas, robust healthcare infrastructures and stringent infection-control mandates have driven widespread adoption of advanced antiseptic systems. The United States remains the epicenter, with hospital-grade alcohol-based and chlorhexidine formulations commanding premium positions, while Latin American markets are progressively expanding uptake as part of broader public health initiatives.

Across Europe, Middle East & Africa, regulatory harmonization under agencies such as the European Medicines Agency fosters streamlined approvals for new antiseptic innovations, boosting the penetration of biodegradable wipes and foam-based hand hygiene solutions. Market dynamics in GCC countries underscore infrastructure investments in tertiary care centers, while public hospitals in regions like North Africa are increasingly prioritizing cost-effective antiseptic agents.

In Asia-Pacific, accelerating elective surgical volumes in countries like India and Japan are fueling demand for both legacy povidone iodine formulations and newer alcohol-based combinations. E-commerce platforms have gained traction in urban India and Southeast Asia, enabling direct-to-consumer access to antiseptic sprays and wipes for home care applications. Regional consumer preferences, regulatory pathways, and distribution networks continue to evolve, shaping differentiated go-to-market strategies.

This comprehensive research report examines key regions that drive the evolution of the Skin Antiseptic Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How Market Leaders Are Accelerating R&D, Scaling Capacity, and Championing Sustainable Innovation to Strengthen Market Positions

Leading multinational companies are fortifying their market positions through portfolio expansions and strategic investments. Becton, Dickinson and Company celebrated the 25th anniversary of its ChloraPrep™ line, underscoring more than seven billion applicators distributed and demonstrating the value of consistent brand innovation in chlorhexidine-alcohol formulations.

3M is augmenting its antiseptic capabilities through a $3.5 billion R&D commitment to accelerate new product launches, including novel film-forming applicators and faster-acting blends, reinforcing its role as a science-driven leader. Mölnlycke’s record €115 million expansion in Maine exemplifies localization strategies to secure supply and reduce lead times for wound care and skin prep products within the U.S. market.

Ecolab’s introduction of a 100% plastic-free, readily degradable disinfectant wipe marks a watershed in sustainable infection control, delivering hospital-grade disinfection in one minute while achieving over 94% biodegradation in accelerated tests. These moves, alongside targeted acquisitions and collaborative research agreements, highlight an industry converging on performance-driven, eco-conscious solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skin Antiseptic Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- ConvaTec Group PLC

- Ecolab Inc.

- GOJO Industries, Inc.

- Johnson & Johnson

- Mölnlycke Health Care AB

- Smith & Nephew plc

- STERIS plc

Strategic Roadmap for Industry Stakeholders to Secure Supply Resilience, Navigate Regulatory Hurdles, and Expand Omnichannel Reach

Industry leaders should prioritize diversifying sourcing strategies by expanding domestic production capabilities for critical active ingredients and substrates. This will mitigate tariff-driven cost pressures while ensuring uninterrupted supply, especially for high-demand alcohol-based and chlorhexidine formulations under evolving trade policies.

It is imperative to deepen engagement with regulatory stakeholders to shape pragmatic approval processes for novel formulations, particularly biodegradable wipes and foam formats that align with environmental directives. Proactively participating in public comment forums for Section 232 investigations will enable companies to secure exclusions or phased implementations, preserving margin integrity.

Moreover, forging partnerships with digital health and e-commerce platforms can unlock new customer segments, especially in home care and telemedicine channels. Tailoring marketing strategies to emphasize both clinical efficacy and sustainability credentials will resonate with institutional procurement and consumer audiences alike. Finally, ongoing investment in real-world evidence and clinical studies will reinforce product differentiation and support premium pricing strategies.

Comprehensive Mixed-Methods Approach Combining Secondary Data, Expert Interviews, and Quantitative Validation to Ensure Rigorous Insights

This study integrates a multi-tiered research framework. Secondary data collection encompassed public filings, regulatory databases, and industry publications from the U.S. FDA, USTR, and WHO, ensuring comprehensive coverage of tariff measures and clinical guidelines. Primary research involved in-depth interviews with key opinion leaders across infection control, procurement, and clinical practice, capturing insights into evolving form factor preferences and sustainability imperatives.

Quantitative validation leveraged data triangulation techniques, reconciling trade statistics with proprietary shipment databases and financial disclosures from leading market participants. A structured market model guided analysis across segmentation dimensions-product form, active ingredient, end user, distribution channel, and application-facilitating granular insights without disclosing model specifics. Findings underwent iterative reviews by an expert advisory panel comprising epidemiologists, supply chain specialists, and regulatory affairs professionals to ensure methodological rigor and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skin Antiseptic Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skin Antiseptic Products Market, by Product Form

- Skin Antiseptic Products Market, by Active Ingredient

- Skin Antiseptic Products Market, by End User

- Skin Antiseptic Products Market, by Distribution Channel

- Skin Antiseptic Products Market, by Application

- Skin Antiseptic Products Market, by Region

- Skin Antiseptic Products Market, by Group

- Skin Antiseptic Products Market, by Country

- United States Skin Antiseptic Products Market

- China Skin Antiseptic Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Aligning Clinical Efficacy, Environmental Stewardship, and Supply Chain Resilience for Sustainable Growth in Skin Antiseptics

The skin antiseptic products market stands at a crossroads of medical necessity and ecological responsibility. Clinical imperatives to curb healthcare-associated infections coalesce with environmental mandates, shaping a competitive landscape where efficacy and sustainability are no longer mutually exclusive.

Tariff-induced supply chain complexities underscore the need for localized manufacturing and strategic regulatory engagement. At the same time, segmentation analysis reveals pockets of opportunity across product forms and channels that can be harnessed through targeted innovation and omnichannel distribution.

As industry leaders accelerate R&D investments and embrace biodegradable formats, the market is poised for a new era of high-performance, eco-conscious antiseptic solutions. By leveraging the insights and recommendations outlined herein, stakeholders can navigate regulatory headwinds, optimize portfolio strategies, and capture value across a dynamic global marketplace.

Empower Your Strategic Decisions Today by Contacting Ketan Rohom to Obtain the Definitive Skin Antiseptic Products Market Research Report

Are you ready to unlock comprehensive insights and strategic foresight in the dynamic skin antiseptic products market?

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive market research report that will inform your next pivotal decisions. By collaborating with Ketan, you gain direct access to tailored executive summaries, detailed segment analyses, and actionable recommendations designed to propel your organization ahead of market shifts. Whether you require deeper dives into tariff impacts or region-specific growth drivers, Ketan will ensure you receive the precise insights your teams need to excel.

Don’t miss the opportunity to equip your leadership with the data-driven intelligence essential for navigating evolving regulatory landscapes, optimizing product portfolios across foam, gel, spray, and solution formats, and capitalizing on emerging channels like online retail and home care. Reach out now to Ketan Rohom to transform uncertainty into competitive advantage and chart a path toward sustained growth in the skin antiseptic sector.

- How big is the Skin Antiseptic Products Market?

- What is the Skin Antiseptic Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?