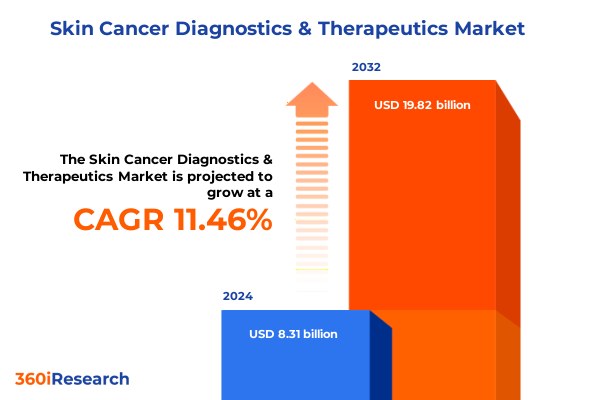

The Skin Cancer Diagnostics & Therapeutics Market size was estimated at USD 9.22 billion in 2025 and expected to reach USD 10.23 billion in 2026, at a CAGR of 11.55% to reach USD 19.82 billion by 2032.

Unveiling the Critical Foundations and Emerging Signposts Shaping the Future of Skin Cancer Diagnostics and Therapeutics Technologies

The skin cancer diagnostics and therapeutics landscape stands at an inflection point, driven by converging technological breakthroughs, evolving regulatory environments, and shifting patient expectations. Recent years have seen a surge in novel imaging modalities alongside a renaissance in immunotherapy approaches that enhance early detection and personalize treatment pathways. As incidence rates continue to climb, stakeholders across the continuum-from research laboratories to clinical practice-urgently seek comprehensive frameworks to navigate this complexity and deliver optimized patient outcomes.

Against this backdrop, it becomes essential to contextualize how pioneering techniques such as confocal microscopy and molecular diagnostics integrate with established methods like dermoscopy and skin biopsy. Equally pivotal is understanding the maturation of targeted therapies, which exploit molecular aberrations in melanoma and non-melanoma skin cancers to deliver precision interventions. Transitional paradigms in health care reimbursement and value-based care models further underscore the need for cohesive strategies that reconcile clinical efficacy, patient quality of life, and sustainable economic models. Consequently, this report lays the groundwork for an informed dialogue, illuminating the structural foundations and emerging signposts guiding the future of skin cancer management.

Revolutionary Advances and Paradigm Shifts Redefining Clinical Approaches Across the Skin Cancer Diagnostics and Therapeutics Spectrum

The past decade has witnessed transformative shifts in the global skin cancer diagnostics and therapeutics ecosystem, as interdisciplinary collaboration and digital innovation converge. Artificial intelligence–driven image analysis platforms now complement dermoscopy and optical coherence tomography workflows, enabling clinicians to identify malignant lesions with unprecedented sensitivity. Simultaneously, breakthroughs in checkpoint inhibitors and cancer vaccines have catalyzed a new era of immunotherapy, extending durable responses in metastatic melanoma patients who previously faced limited options.

Moreover, the refinement of photodynamic therapy protocols and the advent of combination regimens integrating BRAF and MEK inhibitors have blurred the boundaries between localized and systemic treatment modalities. These paradigm shifts reflect a broader trend toward personalized medicine, where real-time molecular profiling informs adaptive therapeutic sequencing. Healthcare systems are likewise embracing teledermoscopy and remote patient monitoring, bridging geographical gaps and accelerating time-to-diagnosis. Collectively, these advancements underscore a seismic change in how practitioners detect, classify, and treat skin cancer, establishing a dynamic foundation for ongoing innovation.

Assessing the Broad Implications of Recent United States Tariff Policies on Supply Chains and Cost Structures in Skin Cancer Diagnostics and Therapeutics

In 2025, cumulative United States tariff policies have introduced a complex array of cost pressures and supply chain realignments for manufacturers and healthcare providers in the skin cancer field. Ongoing Section 301 tariffs on chemical precursors and device components imported from select trading partners have elevated input costs for photodynamic lasers and targeted therapy APIs. Simultaneously, ancillary duties applied to imaging hardware such as computed tomography and optical coherence tomography systems have prompted many diagnostic equipment suppliers to reassess their North American production footprints.

These policy measures have also influenced strategic procurement decisions among hospitals and ambulatory surgery centers, which now weigh the benefits of domestic sourcing against potential capital expenditure increases. In response, several leading therapeutic developers have accelerated investments in onshore manufacturing capabilities and diversified their supplier networks to mitigate material shortages and currency fluctuations. As a result, while short-term cost increases have been unavoidable, the long-term trajectory suggests enhanced supply chain resilience and greater regional self-reliance in delivering cutting-edge diagnostics and therapies for skin cancer patients.

Decoding the Complex Segmentation Dynamics That Illuminate Critical Patient Profiles Diagnostic Modalities and Therapeutic Pathways in Skin Cancer Care

An in-depth segmentation analysis reveals how therapeutic approach, cancer type, diagnostic modality, and end-user settings shape market dynamics and clinical decision-making. Within therapeutic approaches, cryotherapy continues to offer rapid lesion ablation for low-risk populations, while photodynamic therapy provides a non-invasive alternative for superficial carcinomas and precancerous lesions. Immunotherapy has emerged as a cornerstone for advanced stages, with checkpoint inhibitors complemented by experimental cancer vaccines and cytokine therapies to harness the patient’s immune system. Targeted therapy further refines precision care by exploiting key oncogenic drivers; BRAF and MEK inhibitors have become especially integral for melanoma patients harboring specific mutations.

Distinct cancer types demand tailored diagnostic and therapeutic pathways. Basal cell carcinoma and squamous cell carcinoma predominantly leverage confocal microscopy and dermoscopy for early identification, whereas melanoma frequently relies on molecular diagnostics and high-resolution imaging modalities, including ultrasound and magnetic resonance imaging, to assess depth and metastatic potential. Skin biopsy remains the definitive diagnostic standard, guiding subsequent intervention strategies across ambulatory surgery centers, dermatology clinics, home care settings, hospitals, and specialty cancer centers. Understanding these interrelated segmentation layers equips stakeholders with a nuanced perspective to target innovations effectively and optimize resource allocation.

This comprehensive research report categorizes the Skin Cancer Diagnostics & Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Approach

- Cancer Type

- Diagnostic Type

- End User

Navigating Diverse Regulatory Frameworks and Adoption Trends Across the Americas Europe Middle East Africa and Asia Pacific Regions

Regional dynamics in the skin cancer diagnostics and therapeutics arena highlight divergent adoption patterns and regulatory environments across the Americas, Europe Middle East & Africa, and Asia-Pacific zones. In the Americas, established reimbursement frameworks and robust private-sector investment have underpinned rapid uptake of digital imaging solutions and novel immunotherapies. North American markets benefit from streamlined regulatory pathways that prioritize accelerated approvals for breakthrough therapies, fostering a fertile climate for clinical trials and real-world evidence generation.

Across Europe, Middle East & Africa, heterogeneous healthcare infrastructures and varying levels of public funding have shaped market entry strategies. While Western European countries consistently integrate advanced diagnostics such as molecular assays and confocal microscopy into standard care, certain regions within EMEA navigate cost containment pressures and evolving health technology assessment criteria. In the Asia-Pacific region, surging healthcare spending and expanding oncology centers drive demand for teledermoscopy and compact imaging devices. Reimbursement reform in key markets, coupled with domestic manufacturing expansion, is creating new avenues for growth. A granular understanding of these regional nuances informs strategic localization of product offerings and partnership ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Skin Cancer Diagnostics & Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Initiatives and Innovation Portfolios of Leading Organizations Shaping the Skin Cancer Diagnostics and Therapeutics Market

Leading organizations are deploying differentiated innovation portfolios and strategic partnerships to capture value in the skin cancer diagnostics and therapeutics space. Major pharmaceutical entities have intensified oncology R&D investments, advancing checkpoint inhibitors and combination regimens to broaden utility beyond melanoma into high-risk squamous and basal cell carcinomas. Concurrently, diagnostics companies are integrating artificial intelligence into dermoscopy platforms, enhancing lesion classification accuracy while streamlining clinician workflows.

Collaborative ventures between device manufacturers and biotechnology firms have yielded integrated systems that combine imaging with real-time molecular analysis, enabling point-of-care stratification and adaptive treatment algorithms. Mergers and acquisitions remain a tactical lever, with larger corporations absorbing specialized startups to expand their footprint in niche segments such as optical coherence tomography and skin microbiome profiling. As competition intensifies, organizations that prioritize flexible manufacturing, agile regulatory engagement, and patient-centric digital tools will likely define the next wave of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skin Cancer Diagnostics & Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Castle Biosciences, Inc.

- DermTech, Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Genentech, Inc.

- Illumina, Inc.

- Iovance Biotherapeutics

- Merck & Co., Inc.

- Moderna, Inc.

- Novartis AG

- Pfizer Inc.

- Qiagen N.V.

- Regeneron Pharmaceuticals, Inc.

- Sanofi S.A.

- Siemens Healthineers AG

- Sun Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific Inc.

Strategic Directives and Tactical Approaches Industry Leaders Must Embrace to Capitalize on Evolving Opportunities in Skin Cancer Management

To remain competitive and responsive amid rapid technological and policy shifts, industry leaders should pursue a multi-pronged strategic agenda. First, investing in localized manufacturing and supply chain diversification will reduce exposure to tariff-induced cost fluctuations and ensure continuity in the delivery of diagnostic equipment and therapeutic agents. Second, forging cross-sector partnerships-spanning academia, digital health startups, and patient advocacy groups-will accelerate the co-development of AI-enabled diagnostics and personalized immunotherapy platforms.

Additionally, organizations must engage proactively with regulatory bodies to shape adaptive approval pathways and secure reimbursement frameworks that reflect real-world treatment value. Prioritizing digital health integration-through telemedicine, remote monitoring, and advanced analytics-will not only enhance patient access but also generate the longitudinal data needed for outcome-based contracting. Finally, expanding presence in high-growth regional markets by collaborating with local stakeholders and tailoring offerings to unique epidemiological profiles will unlock sustainable growth opportunities in underserved areas.

Outlining the Rigorous Multi-Tiered Research Methodology Employed to Deliver Comprehensive Insights into Skin Cancer Diagnostics and Therapeutics Trends

This report synthesizes insights derived from a rigorous, multi-tiered research methodology designed to triangulate quantitative and qualitative data. Primary research encompassed in-depth interviews with key opinion leaders, including dermatologists, oncologists, and procurement officers across ambulatories, hospitals, and specialty centers. These discussions provided frontline perspectives on diagnostic utilization, therapeutic adoption, and infrastructure constraints. Secondary research involved comprehensive reviews of peer-reviewed journals, regulatory agency publications, patent filings, and conference proceedings to map emerging technologies and competitive dynamics.

Quantitative data were sourced from proprietary hospital databases and public health registries, delivering case volume trends and treatment outcome metrics. A robust validation process incorporated cross-referencing among multiple data sources, complemented by expert panel reviews to ensure analytical accuracy and relevance. This structured approach underpins the report’s framework, offering a credible foundation for strategic decision-making and future scenario planning in the skin cancer diagnostics and therapeutics space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skin Cancer Diagnostics & Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skin Cancer Diagnostics & Therapeutics Market, by Therapeutic Approach

- Skin Cancer Diagnostics & Therapeutics Market, by Cancer Type

- Skin Cancer Diagnostics & Therapeutics Market, by Diagnostic Type

- Skin Cancer Diagnostics & Therapeutics Market, by End User

- Skin Cancer Diagnostics & Therapeutics Market, by Region

- Skin Cancer Diagnostics & Therapeutics Market, by Group

- Skin Cancer Diagnostics & Therapeutics Market, by Country

- United States Skin Cancer Diagnostics & Therapeutics Market

- China Skin Cancer Diagnostics & Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Discoveries and Charting the Road Ahead for Stakeholders in the Rapidly Evolving Field of Skin Cancer Diagnostics and Treatment

In conclusion, the skin cancer diagnostics and therapeutics ecosystem is poised for sustained innovation driven by synergistic advances in imaging, molecular profiling, and immuno-oncology. The interplay between regulatory evolution, tariff landscapes, and regional heterogeneity underscores the need for adaptive strategies that reconcile cost, access, and clinical efficacy. Stakeholders who harness detailed segmentation insights-spanning therapeutic approaches, cancer types, diagnostic modalities, and end-user channels-will be uniquely positioned to align their value propositions with evolving market demands.

Looking ahead, the convergence of digital health platforms, AI-enabled analytics, and precision therapies heralds a new era of patient-centric care. Industry leaders that embrace cross-disciplinary collaboration, engage dynamically with policy makers, and invest in resilient supply chains will drive the next wave of breakthroughs. By integrating the actionable intelligence and research rigor encapsulated in this report, organizations can confidently navigate uncertainties and capitalize on emerging opportunities to improve outcomes for skin cancer patients worldwide.

Connect with Ketan Rohom to Gain Exclusive Access to In-Depth Market Insights and Drive Strategic Decision-Making in Skin Cancer Diagnostics and Therapeutics

To gain unparalleled strategic insights and actionable intelligence that will drive your initiatives forward in the rapidly evolving skin cancer diagnostics and therapeutics arena, secure your copy of the comprehensive market research report today. You can directly connect with Ketan Rohom, Associate Director, Sales & Marketing, to discuss how this report addresses your specific informational needs and supports your strategic decision-making process by leveraging deep-dive analyses, expert interviews, and forward-looking recommendations. Don’t miss the opportunity to arm your organization with the critical knowledge required to stay ahead of regulatory shifts, technological breakthroughs, and competitive dynamics shaping the future of skin cancer care. Reach out to Ketan Rohom to transform insights into impact.

- How big is the Skin Cancer Diagnostics & Therapeutics Market?

- What is the Skin Cancer Diagnostics & Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?