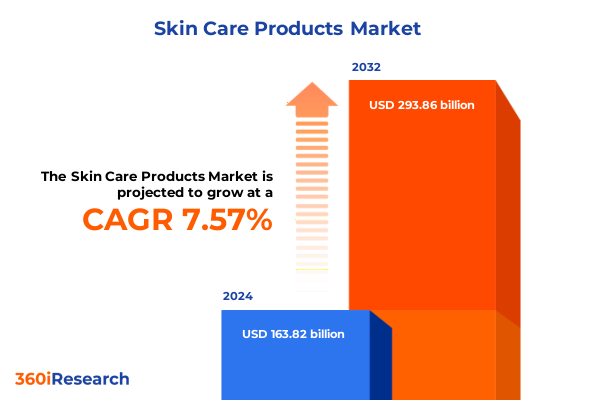

The Skin Care Products Market size was estimated at USD 176.27 billion in 2025 and expected to reach USD 187.86 billion in 2026, at a CAGR of 7.57% to reach USD 293.86 billion by 2032.

Unveiling the Skin Care Revolution Shaping Market Dynamics Through Innovation, Consumer Empowerment, and Strategic Competitive Responses

The skin care market stands at a pivotal juncture as innovation accelerates and consumer expectations evolve in tandem. In recent months, the industry has faced a critical recalibration following the post-pandemic boom, highlighting the need for brands to innovate sustainably and maintain operational agility. Notably, the slowdown in growth and rising operational costs have underscored how market saturation and intensified competition are reshaping strategic priorities across the sector.

Consumers are now more discerning than ever, demanding transparency, efficacy, and value. The 18–24 demographic, in particular, is reshaping market dynamics by prioritizing research-driven purchasing, relying heavily on social media and AI-driven tools to assess product legitimacy and performance. This cohort’s hesitation to expand beauty budgets-except in the high-return category of skin care-has driven brands to justify every dollar through clear ingredient communication and tangible results.

Against this backdrop, strategic competitive responses have become paramount. Brands are shifting away from growth-at-any-cost models towards sustainable frameworks that emphasize consumer retention over one-off virality. The imperative to optimize back-end infrastructure and refine product development pipelines has never been more urgent, setting the stage for a skin care revolution defined by resilience, innovation, and consumer-centricity.

Charting the Transformative Shifts Reshaping Skin Care Industry Landscape With Digital Disruption, Sustainability Focus, and Evolving Consumer Behaviors

Digital technologies and sustainability imperatives are driving transformative shifts across the skin care landscape. As traditional marketing channels give way to immersive digital experiences, brands are leveraging virtual consultations, augmented reality try-on tools, and AI-powered personalization engines to deliver tailored solutions at scale. Such innovations are redefining the consumer journey, creating seamless interactions that blend entertainment, education, and efficacy extracts in real time.

Meanwhile, the sustainability movement has moved from niche to mainstream, compelling brands to reformulate products with eco-conscious ingredients and rethink packaging designs for minimal environmental impact. Clean beauty and ethically sourced formulations have become prerequisites rather than differentiators, raising the bar for industry participants to demonstrate genuine commitments to planetary well-being.

These shifts are also fostering a wave of consolidation and strategic partnerships. Legacy conglomerates and emerging disruptors alike are pursuing alliances that bolster R&D capabilities and expand distribution footprints. As a result, agility has emerged as the ultimate currency: companies that can adapt rapidly to technological breakthroughs and regulatory changes are best positioned to thrive in this dynamic environment.

Analyzing the Cumulative Impact of Recent United States Tariffs on Skin Care Supply Chains, Pricing Structures, and Market Competitiveness Through 2025

The cascade of new U.S. tariffs implemented in 2025 has materially altered pricing structures and supply chain strategies within the skin care sector. Tariffs levied on key raw materials-such as packaging components and specialty ingredients imported from China-have driven up costs across the value chain. Manufacturers have faced not only higher duties but also increased freight, inspection, and customs clearance fees, leading to significant margin compression for brands prioritizing quality and consistency over cost-cutting compromises.

In response, many companies have recalibrated their sourcing strategies to mitigate tariff exposure. Nearshoring to Mexico under USMCA, diversifying ingredient procurement across Brazil and India, and exploring tariff-exempt materials have become critical tactics. Yet these shifts require substantial investment in supplier qualification, regulatory compliance, and logistical coordination, often stretching the capabilities of smaller independent brands that lack the capital buffers of larger multinationals.

Despite the challenges, innovative players are finding pathways to absorb or offset added costs without undermining product integrity. Strategic supplier partnerships, long-term procurement contracts, and optimized packaging designs have emerged as effective levers. As tariffs persist, the agility to redesign supply ecosystems and maintain consumer-facing value propositions will determine which brands can sustain competitiveness through 2025 and beyond.

Unlocking Key Segmentation Insights Across Product Types, Distribution Channels, Skin Concerns, and End User Demographics for Strategic Market Penetration

Market segmentation offers a nuanced lens through which skin care brands can tailor offerings and capture value across diverse consumer needs. By examining product types-ranging from cleansers in cream, foaming, and gel formulations to moisturizers available as creams, gels, and lotions, as well as face masks, serums, and sunscreens-companies can identify white spaces for innovation. Distribution channels also reveal varied consumer paths, encompassing traditional pharmacy drugstores, specialty boutiques, and large-format supermarkets alongside brand websites and major e-commerce platforms.

Skin concerns drive distinct usage occasions, from acne-focused solutions to anti-aging treatments centered on brightening, firming, and wrinkle reduction, as well as formulations addressing dryness, pigmentation, and sensitivity. Each concern demands specific actives, delivery systems, and marketing narratives to resonate effectively. Finally, end user demographics-spanning men, unisex, and women-underscore the importance of targeted communication and packaging design. A holistic understanding of these interlocking segmentation layers equips brands with the strategic clarity needed to refine product portfolios, align distribution strategies, and deliver personalized consumer experiences.

This comprehensive research report categorizes the Skin Care Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Skin Concern

- Distribution Channel

- End User

Revealing Key Regional Insights into Skin Care Market Dynamics and Growth Drivers Spanning the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics profoundly influence the skin care market’s contours, reflecting disparate growth drivers and consumer preferences across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, strong demand for premium and dermatologically backed formulations has spurred innovation in both heritage brands and indie startups. The U.S. remains a critical battleground for brand presence, with omnichannel penetration fueling consumer convenience and loyalty.

Across Europe, the Middle East, and Africa, heritage beauty powerhouses underscore a blend of tradition and regulatory rigor. European markets emphasize ‘Made in’ credentials, stringent ingredient standards, and sustainability claims, while emerging Middle Eastern and African markets display rapid adoption of international prestige brands alongside homegrown clean beauty offerings. Regulatory complexity and diverse consumer tastes require bespoke go-to-market strategies that respect local cultural nuances.

Asia Pacific continues to lead in rapid innovation and consumer engagement. Home to K-beauty trailblazers, the region excels in dynamic product rituals and novel delivery formats. Despite tariff-induced cost pressures, brands rooted in Korea and Japan maintain global appeal through proven efficacy and digital-first marketing. Partnerships with regional distributors and direct-to-consumer platforms amplify reach, ensuring Asia Pacific remains a crucible for trends that resonate worldwide.

This comprehensive research report examines key regions that drive the evolution of the Skin Care Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Leading Skin Care Companies Shaping the Market Through Innovation, Strategic Alliances, and Operational Excellence in a Competitive Landscape

A cohort of leading companies is defining the future of skin care through focused innovation, strategic acquisitions, and global expansion. Estée Lauder has fortified its portfolio by leveraging high-value acquisitions and amplifying omnichannel capabilities, while L’Oréal continues to invest in personalized beauty platforms and sustainable ingredient pipelines. The Ordinary, under a strategic sub-brand model, exemplifies how value-led propositions can capture Gen Z engagement by offering clear communication around actives and pricing.

Galderma’s strengthened 2025 outlook, driven by double-digit net sales growth in dermatological skin care and injectables, underscores the resilience of medically oriented brands in high-growth markets. With over 40 percent of revenue anchored in the U.S. and an expanded manufacturing footprint, the company has navigated tariff uncertainties by incorporating additional duties into its financial forecasts.

Meanwhile, niche brands such as Rare Beauty and Beauty of Joseon demonstrate how founder-led narratives and culturally resonant formulations can achieve rapid traction. Their success highlights the importance of storytelling, ingredient authenticity, and lean operational models in capturing niche segments and driving broader brand equity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skin Care Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amorepacific Corporation

- Amway Corporation

- Beiersdorf AG

- Chanel Limited

- Colgate-Palmolive Company

- Coty Inc.

- Deciem Beauty Group

- Galderma Group S.A.

- Haleon plc

- Henkel AG & Co. KGaA

- Johnson & Johnson Services, Inc.

- Kao Corporation

- KOSÉ Corporation

- L'Oréal S.A.

- LVMH Moët Hennessy Louis Vuitton

- Mary Kay Inc.

- Natura &Co Holding S.A.

- Procter & Gamble Company

- Puig Brands S.L.

- Revlon, Inc.

- Shiseido Company Limited

- The Body Shop

- The Estée Lauder Companies Inc.

- The Hut Group

- Unilever PLC

Strategic Recommendations Empowering Skin Care Industry Leaders to Enhance Competitive Advantage, Optimize Supply Chains, and Foster Sustainable Growth

Industry leaders must act decisively to secure long-term advantage in an increasingly complex environment. First, optimizing supply chain resilience through multi-sourcing strategies and long-term supplier agreements can hedge against tariff volatility and logistics disruptions. Brands should invest in nearshoring options and localized manufacturing to reduce lead times and strengthen cost predictability while ensuring compliance with evolving trade regulations.

Second, prioritizing consumer engagement via digital personalization and data-driven insights will deepen loyalty and drive repeat purchase. Leveraging AI-powered diagnostics and customized regimens enables brands to offer tailored solutions that meet specific skin concerns, enhancing perceived value and differentiation. Transitioning from transactional promotions to subscription and membership models can further stabilize revenue streams.

Third, embedding sustainability at the core of product development and packaging design is no longer optional. Transparent sourcing, eco-friendly packaging formats, and clear environmental impact reporting foster consumer trust and regulatory goodwill. Brands that champion measurable sustainability goals can unlock premium positioning and mitigate risks associated with environmental regulations.

Detailing Rigorous Research Methodology Employed to Uncover Comprehensive Skin Care Market Insights Through Robust Data Collection and Expert Analysis

This research employs a rigorous, multi-phase methodology to ensure comprehensive, actionable insights. Primary research included in-depth interviews with key stakeholders across the value chain-brand executives, ingredient suppliers, distribution partners, and regulatory experts-to capture diverse perspectives and validate emerging trends. Additionally, consumer focus groups and digital ethnography provided nuanced understanding of evolving purchase drivers and usage patterns.

Secondary research encompassed a thorough review of industry publications, trade association reports, regulatory documents, and financial disclosures to establish foundational context and identify historical benchmarks. Data triangulation techniques reconciled findings across sources, ensuring reliability and mitigating potential biases.

Finally, quantitative analysis of segmented market data was conducted using advanced analytics tools to model consumer preferences across product types, distribution channels, skin concerns, and end user demographics. This integrated approach ensured that strategic recommendations align with observed market behaviors and projected competitive dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skin Care Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skin Care Products Market, by Product Type

- Skin Care Products Market, by Skin Concern

- Skin Care Products Market, by Distribution Channel

- Skin Care Products Market, by End User

- Skin Care Products Market, by Region

- Skin Care Products Market, by Group

- Skin Care Products Market, by Country

- United States Skin Care Products Market

- China Skin Care Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesis of Key Findings and Future Imperatives Highlighting the Strategic Imperatives for Sustained Growth and Innovation in the Skin Care Sector

The skin care sector’s trajectory is defined by its capacity to navigate transformative shifts, from digital innovation to sustainability imperatives and trade policy complexities. Strategic segments-encompassing product formulations, distribution ecosystems, consumer concerns, and demographic nuances-offer clear pathways for differentiation and growth. Companies that harness agile supply chain models, deliver hyper-personalized experiences, and anchor their propositions in authentic storytelling and environmental stewardship will emerge as market leaders.

Moreover, the ongoing recalibration triggered by U.S. tariffs underscores the need for proactive risk management and strategic investment in nearshoring and supplier diversification. As brands adapt to new cost structures, those capable of preserving product integrity while maintaining accessible price points will capture premium loyalty among discerning consumers.

Ultimately, the convergence of consumer empowerment, technological advancement, and global regulatory dynamics demands a cohesive approach-one that balances innovation, operational excellence, and sustainable practice. Stakeholders who internalize these imperatives will not only survive but thrive in the competitive skin care landscape.

Take the Next Step by Engaging With Ketan Rohom, Associate Director of Sales & Marketing, to Secure Your Comprehensive Skin Care Market Research Report

Engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing, ensures you gain immediate access to this indispensable resource. By purchasing the comprehensive skin care market research report, you will unlock actionable insights, strategic recommendations, and detailed analyses tailored to empower your organization’s growth trajectory. Take advantage of this opportunity to leverage expert-driven data, refine your market approach, and secure a competitive edge. Reach out today to begin transforming these insights into impactful business outcomes.

- How big is the Skin Care Products Market?

- What is the Skin Care Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?