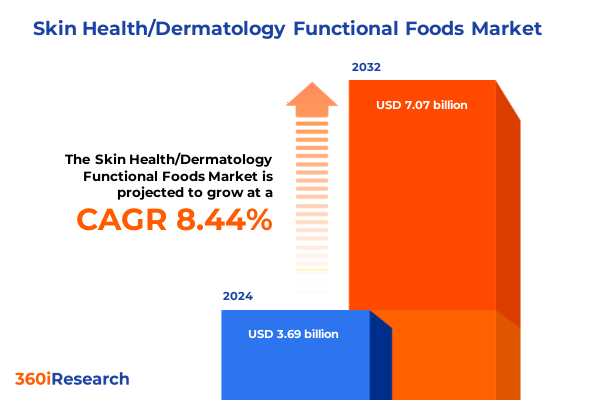

The Skin Health/Dermatology Functional Foods Market size was estimated at USD 4.00 billion in 2025 and expected to reach USD 4.34 billion in 2026, at a CAGR of 8.66% to reach USD 7.17 billion by 2032.

Pioneering Integration of Nutritional Science and Dermatology to Elevate Skin Health Through Functional Foods and Transform Consumer Wellness

In today’s rapidly evolving wellness ecosystem, the convergence of nutritional science and dermatology has given rise to a new category of interventions designed to support skin health from within. Consumers are increasingly seeking holistic approaches that transcend topical solutions and address underlying biological pathways through nutrition. As a result, functional foods and nutraceutical supplements formulated to enhance dermal architecture, support barrier function, and modulate inflammatory processes have moved to the forefront of both consumer demand and scientific inquiry. This paradigm shift reflects growing confidence among health professionals and end users in the potential for precisely engineered dietary solutions to complement traditional skincare regimens.

Fueled by advances in molecular biology and clinical research, skin health functional foods now draw upon a broad spectrum of bioactives-from bioavailable collagen peptides and micronutrients to specialized botanical extracts and probiotic strains targeting the gut–skin axis. Cross-disciplinary collaborations among agritech firms, biotech startups, and dermatological research centers are accelerating the development of formulations that balance efficacy, palatability, and safety. Concurrently, robust clinical trials and in vitro studies are generating a growing body of evidence, empowering brands to substantiate structure–function claims and meet stringent regulatory guidelines. As consumer expectations for measurable benefits intensify, the industry is poised to redefine the boundaries between beauty, nutrition, and health.

Navigating Disruptive Innovations and Evolving Consumer Expectations That Are Redefining the Future of Dermatology-Oriented Functional Nutrition

A series of transformative shifts are reshaping the landscape of skin health functional nutrition. Digital health platforms and direct-to-consumer models have democratized access to personalized regimens, enabling brands to tailor formulations based on individual skin phenotypes, lifestyle factors, and genetic predispositions. Simultaneously, the rise of social commerce and micro-influencer communities is amplifying grassroots trust, with consumers placing greater credibility in peer reviews, clinician endorsements, and user-generated results than traditional advertising channels. As a result, agility in product innovation and marketing has become a critical differentiator, driving shorter product development cycles and more dynamic engagement strategies.

On the scientific front, emerging insights into the skin microbiome and systemic inflammatory pathways are catalyzing next-generation ingredient breakthroughs. Fermentation technologies, encapsulation techniques, and precision dosing platforms are enhancing bioavailability and targeted delivery of actives. Regulators are adapting, too, introducing clearer guidelines around ingredient substantiation, labeling, and permissible health claims. In parallel, sustainability imperatives-from transparent sourcing of botanical extracts to low-carbon supply chains-are influencing both ingredient selection and packaging innovations. Together, these developments herald a more mature, evidence-driven market poised to meet sophisticated consumer demands.

Examining the Broad Consequences of 2025 United States Tariffs on Ingredients and Supply Chains Influencing Skin Health Focused Functional Food Development

In 2025, a series of new tariff measures imposed by the United States on key imported ingredients has introduced both headwinds and strategic inflection points for manufacturers of skin health focused functional foods. Increased duties on collagen peptides sourced from traditional export hubs have driven formulation costs upward, prompting many brands to reevaluate supply chain dependencies. At the same time, levies on certain botanical extracts and specialty nutrients have incentivized upstream investment in domestic cultivation and localized extraction facilities. These shifts are spurring partnerships between ingredient processors and agritech firms to develop regionally sourced actives with consistent quality profiles and reduced exposure to volatility in global trade.

Beyond cost dynamics, the tariff-induced recalibration of sourcing strategies is reshaping product roadmaps and pipeline priorities. Stakeholders are exploring alternative ingredient categories-such as fermented postbiotic compounds or novel nutricosmetic blends-to mitigate margin pressures. Some manufacturers are opting to reformulate existing SKUs with high-margin ingredients less susceptible to import duties, while others are leveraging tariff relief programs to support research collaborations in targeted states. Although short-term supply chain disruptions have posed challenges, the cumulative impact of these policies is accelerating long-term resilience and fostering innovation within the domestic ecosystem.

Unveiling Deep Consumer Insights Across Diverse Segmentations Spanning Product Types Distribution Channels Ingredient Profiles Forms Applications and Age Cohorts

Deep exploration of consumer behaviors and purchasing preferences across six core segmentation dimensions reveals nuanced opportunities for market participants to tailor portfolios and growth strategies. When analyzing product types, it becomes clear that dietary supplements continue to command consumer loyalty for their perceived precision and efficacy, while fortified beverages are rapidly gaining traction among on-the-go users seeking convenient delivery. Fortified foods, including bars and snacks, have begun to carve out a niche in wellness aisles by offering dual functionality of nutrition and taste appeal, blurring the lines between indulgence and self-care.

Distribution channel analysis uncovers an inflection point driven by digital transformation and omnichannel convergence. E-commerce channels-ranging from direct-to-consumer subscription platforms to large-scale marketplaces and emerging social commerce communities-are delivering personalized experiences and data-driven customer journeys. Offline, pharmacies and drugstores retain an advisory role, and specialty retailers such as beauty clinics and dermatology centers are integrating ingestible regimens into clinical protocols, while spas and salons introduce customized nutritional support alongside topical therapies. Supermarkets and hypermarkets, leveraging private label initiatives, expand shelf presence with mainstream wellness offerings.

Ingredient type segmentation highlights that botanical extracts, exemplified by aloe vera’s soothing properties and green tea’s antioxidant profile, remain foundational. Collagen peptides continue to lead in anti-aging applications, whereas probiotics are emerging as essential modulators of the gut–skin axis. Vitamins and minerals, with vitamin C’s brightening potential, vitamin E’s barrier support, and zinc’s anti-inflammatory benefits, round out the portfolio. The form dimension showcases the dominance of capsules for accurate dosing, the appeal of ready-to-drink formulations for convenience, the playful innovation of gums for younger demographics, powders for customizable blends, and tablets for cost-effective shelf stability. Application-based insights demonstrate tailored solutions for acne management, anti-aging, skin brightening, moisturization, and UV protection. Age-group analysis emphasizes that adolescents show strong interest in chewable formats for breakout control, adults gravitate toward anti-aging blends in consumable forms, children’s products prioritize mild botanicals, and the elderly seek collagen and micro-nutrient support to address elasticity and hydration.

This comprehensive research report categorizes the Skin Health/Dermatology Functional Foods market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Form

- Consumer Age Group

- Distribution Channel

- Application

Dissecting Regional Dynamics That Shape Functional Food Adoption for Skin Health Across the Americas Europe Middle East Africa and Asia-Pacific

A deep dive into the Americas, Europe Middle East & Africa, and Asia-Pacific regions underscores the distinct drivers and trajectories shaping consumer adoption of skin health functional foods. In the Americas, widespread consumer awareness of “beauty from within” combined with extensive research ecosystems has established a robust retail infrastructure encompassing online direct-to-consumer platforms, brick-and-mortar pharmacies, specialty clinics, and mass-market supermarkets. Regulatory frameworks that facilitate structure–function claims further empower brands to educate consumers on the merits of scientifically substantiated formulations.

Within Europe Middle East & Africa, maturity levels vary significantly. Western European markets show strong demand for clinically validated products, supported by stringent labeling and safety standards that foster consumer confidence. In contrast, Middle Eastern regions are emerging growth hotspots, where premium formulations gain traction through partnerships with respected dermatology authorities and luxury wellness outlets. Although the African market remains nascent, urban centers are exhibiting rising interest in premium ingestible solutions, buoyed by cross-border digital commerce and targeted local activations.

Asia-Pacific stands out for its rapid expansion, driven by increasing disposable incomes and entrenched cultural emphasis on youthful and radiant skin. Markets such as Japan and South Korea spearhead product innovation by combining traditional botanical wisdom with advanced delivery systems. In China, tightened import regulations and tariff structures have incentivized local production of culturally tailored nutraceuticals, fostering homegrown brands that align with national safety and efficacy guidelines. Across the region, consumers demonstrate a willingness to experiment with novel formats and ingredient combinations, making it a key frontier for market entry and growth.

This comprehensive research report examines key regions that drive the evolution of the Skin Health/Dermatology Functional Foods market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Breakthroughs in Dermatology Functional Food Formulations and Market Expansion Tactics

Leading innovators and strategic collaborators are at the forefront of transforming the skin health functional food sector, employing a range of tactics from open innovation models to targeted acquisitions. Prominent supplement manufacturers are forging partnerships with biotech firms to co-develop proprietary bioactives, such as nanoemulsified collagen complexes and synbiotic blends designed to fortify skin barrier function. Simultaneously, major consumer goods conglomerates have expanded their portfolios through acquisitions of niche dermatology-focused brands, gaining access to specialized research laboratories and established clinical trial pipelines.

Concurrently, digital-first startups are challenging incumbents with direct-to-consumer strategies that emphasize transparency, traceability, and clean label credentials. These disruptors leverage data analytics to refine product formulas in near real-time based on consumer feedback, catalyzing agile iteration cycles. Meanwhile, retail chains and online marketplaces are launching private label skin health lines, bolstered by subscription offerings that drive repeat purchase and foster brand loyalty. Contract manufacturers and ingredient suppliers are also investing in scale and technological upgrades, scaling capabilities for microencapsulation, controlled-release systems, and sustainable extraction methods. Lastly, cross-industry alliances-uniting academia, professional associations, and standard-setting bodies-are co-hosting knowledge forums to align evidence standards and accelerate commercialization pathways.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skin Health/Dermatology Functional Foods market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amway Corp.

- BASF SE

- Bayer AG

- Blackmores Ltd.

- Botanic Healthcare Group Ltd.

- Chr. Hansen Holding A/S

- Danone S.A.

- FANCL Corporation

- Feel Holdings Limited

- Fermentis Life Sciences SA

- Glanbia plc

- Halenko Group Ltd.

- Herbalife Nutrition Ltd.

- Ingredion Incorporated

- Kao Corporation

- Kemin Industries, Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Lonza Group AG

- Meiji Holdings Co., Ltd.

- Nestlé S.A.

- Norax Supplements, Inc.

- Nutra Healthcare Private Limited

- Yakult Honsha Co., Ltd.

Formulating Practical Roadmaps and Omnichannel Approaches to Enhance Consumer Engagement and Drive Growth in Skin Health Oriented Nutritional Solutions

Industry leaders intent on capturing a larger share of the skin health functional nutrition market should first prioritize strategic investments in clinical validation studies. By forging alliances with universities, dermatology research centers, and independent laboratories, companies can generate robust, peer-reviewed evidence that underpins structure–function claims and bolsters brand credibility. This scientific rigor will differentiate offerings in a marketplace increasingly governed by evidence-based purchasing decisions.

Equally important is the development of a resilient omnichannel distribution strategy that harmonizes direct-to-consumer subscription models with entrenched retail relationships. Investing in immersive digital experiences-such as virtual dermatology consultations, AI-driven product customizers, and community-based social commerce activations-can reinforce consumer engagement while preserving the trusted advisory roles of pharmacies and specialty clinics. To mitigate tariff and supply chain risks, leaders should diversify ingredient sourcing by cultivating domestic partnerships for botanical extracts, exploring regional manufacturing hubs for collagen, and establishing in-house fermentation platforms for emerging bioactives.

Driving consumer trust will also require authentic collaborations with key opinion leaders. By co-creating educational content with respected dermatologists and engaging social commerce micro-influencers, brands can amplify product benefits in credible, relatable formats. Tailoring formulations to address region-specific skin concerns and demographic cohorts-from teen acne to elder hydration-will unlock niche demand pockets. Finally, embedding sustainability across the value chain-spanning responsibly sourced inputs, recyclable packaging, and carbon-footprint reduction initiatives-will resonate with eco-conscious consumers and preempt evolving ESG regulations.

Detailing a Multilayered Research Framework Combining Quantitative Analyses and Expert Inputs to Validate Insights in the Skin Health Functional Food Domain

This report’s findings derive from a multilayered research framework blending quantitative analyses with expert qualitative inputs to ensure comprehensive coverage of the skin health functional food domain. Secondary data sources included regulatory filings, trade databases, and peer-reviewed journals, which were systematically analyzed to map industry trends, ingredient adoption rates, format innovations, and distribution channel dynamics. These insights were cross-validated against historical data to detect emerging inflection points and continuity in consumer preferences.

Primary research involved structured interviews with dermatologists, nutritionists, ingredient suppliers, and supply chain experts, providing firsthand perspectives on clinical efficacy, regulatory challenges, and operational constraints. Six core segmentation axes-encompassing product type, distribution channel, ingredient class, form factor, application category, and consumer age group-were defined to distill precise market insights. Regional assessments incorporated intelligence from local industry associations and in-market consultants to capture cultural, economic, and regulatory nuances across the Americas, Europe Middle East & Africa, and Asia-Pacific.

Company profiling was grounded in an exhaustive review of corporate disclosures, patent filings, press releases, and investor presentations. Strategic initiatives, partnership agreements, and investment trajectories were mapped to reveal competitive positioning and innovation pathways. All data underwent rigorous triangulation and validation to ensure accuracy and reliability, supporting the actionable recommendations and strategic roadmaps presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skin Health/Dermatology Functional Foods market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skin Health/Dermatology Functional Foods Market, by Product Type

- Skin Health/Dermatology Functional Foods Market, by Ingredient Type

- Skin Health/Dermatology Functional Foods Market, by Form

- Skin Health/Dermatology Functional Foods Market, by Consumer Age Group

- Skin Health/Dermatology Functional Foods Market, by Distribution Channel

- Skin Health/Dermatology Functional Foods Market, by Application

- Skin Health/Dermatology Functional Foods Market, by Region

- Skin Health/Dermatology Functional Foods Market, by Group

- Skin Health/Dermatology Functional Foods Market, by Country

- United States Skin Health/Dermatology Functional Foods Market

- China Skin Health/Dermatology Functional Foods Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Strategic Observations on Maturation Trajectory and Vital Success Drivers Steering the Evolution of the Skin Health Functional Nutrition Landscape

The trajectory of skin health functional nutrition is one marked by rapid evolution and crystallizing opportunities. As scientific understanding deepens around mechanisms such as the gut–skin axis, antioxidant pathways, and collagen synthesis, formulations will become more targeted and efficacious. Consumer demand for holistic beauty solutions continues to rise alongside expectations for clinical validation, transparency, and sustainability. Navigating tariff pressures and supply chain complexities will require strategic flexibility and collaborative innovation.

Brands and manufacturers poised to excel will be those that integrate robust clinical research with agile product development, tailoring offerings to granular consumer segments and regional preferences. The convergence of digital personalization, omnichannel distribution, and evidence-based marketing is forging a more mature industry ecosystem. Ultimately, the emerging landscape presents a compelling opportunity: to redefine the intersection of dermatology and nutrition and to deliver measurable skin health benefits that resonate with today’s discerning wellness consumers.

Engage with Ketan Rohom to Access Comprehensive Skin Health Functional Food Market Intelligence and Drive Growth Through Tailored Research Assistance

To explore the comprehensive insights and bespoke analysis presented in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Leveraging extensive expertise in skin health and functional nutrition, he can guide your team through the depth of consumer segmentation findings, regional dynamics, and competitive benchmarks. By partnering with Ketan, your organization will gain privileged access to the wealth of research methodologies, expert interviews, and strategic roadmaps outlined in this study. He stands ready to arrange a personalized walkthrough of the data and assist in aligning its applications with your unique growth objectives. Engage with Ketan today to secure the detailed market intelligence that will inform product development, distribution strategies, and investment decisions for the next wave of skin health functional food innovations.

- How big is the Skin Health/Dermatology Functional Foods Market?

- What is the Skin Health/Dermatology Functional Foods Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?