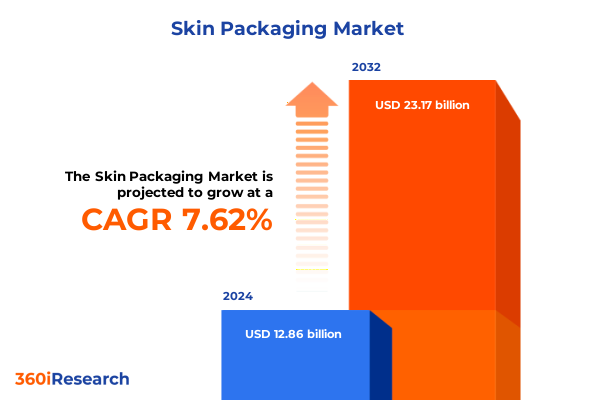

The Skin Packaging Market size was estimated at USD 13.74 billion in 2025 and expected to reach USD 14.68 billion in 2026, at a CAGR of 7.74% to reach USD 23.17 billion by 2032.

Unveiling the Evolution of Skin Care Packaging Through Technological Innovation Sustainability Consumer Behavior and Market Dynamics

The importance of packaging in skin care extends far beyond aesthetics; it shapes consumer perceptions and directly influences the efficacy and safety of each product. As beauty and personal care brands seek to differentiate themselves, packaging is now viewed as a critical touchpoint that communicates brand values, supports regulatory compliance, and preserves product integrity. Today's consumers demand transparency, and nearly two-thirds of leading beauty brands emphasize refillable systems, reflecting a broader shift toward sustainable engagement with packaging as both a functional and ethical asset.

At the same time, innovations in materials science and manufacturing technologies have accelerated, enabling lighter, more durable, and eco-friendly designs. Biocompatible biopolymers and advanced airless systems now complement traditional glass and aluminum formats, offering improved protection against oxidation and contamination. As a result, packaging has evolved from a passive vessel into an active component of product formulation, supporting both stability and customer interaction.

Charting Transformative Shifts in Skin Packaging From AI Personalization to Circular Economy and HyperPersonalized Consumer Experiences

The landscape of skin packaging is undergoing transformative shifts driven by converging pressures from sustainability, digitalization, and personalization. Brands are integrating smart packaging features such as NFC chips and AR overlays to elevate consumer engagement, delivering tailored product information and virtual try-on experiences directly from the package surface. This trend toward interactive design not only enriches brand-to-consumer dialogue but also generates valuable data for product refinement and loyalty programs.

Meanwhile, the pursuit of circularity has redefined material selection and end-of-life considerations. Refillable ecosystems are transitioning from pilot initiatives to mainstream offerings, supported by modular cartridge systems and loyalty incentives. Mono-material designs facilitate recycling, while compostable innovations-ranging from seaweed-based films to mushroom mycelium-address concerns over plastic waste without compromising usability. These shifts reflect a deeper alignment of packaging design with product ethics and environmental stewardship.

On the innovation frontier, biotechnology and artificial intelligence are converging to enable hyper-personalized solutions. DNA-coded skincare, wearable nanotech sensors, and exosome-based delivery systems illustrate how packaging and formulation are becoming inseparable in achieving cellular-level efficacy. Brands like Estée Lauder and pioneering start-ups are leveraging AI-driven diagnostics and smart sensors embedded in packaging to tailor not only product formulations but also real-time usage recommendations, heralding a new era of preventive and regenerative beauty.

Assessing the Cumulative Impact of New United States Trade Tariffs on Skin Packaging Costs Supply Chains and Sourcing Strategies

In 2025, new trade measures have introduced unprecedented cumulative duties on skin packaging components, compelling brands and suppliers to reexamine sourcing strategies. For packaging sourced from China under Section 301 and IEEPA provisions, cumulative tariffs now reach up to 55% for paper-based formats and more than 145% for specialty glass and plastics, marking one of the most significant cost inflections in recent memory. These duties not only elevate unit costs but also extend lead times as customs complexities increase, driving many companies to diversify or nearshore production.

While some active ingredients and biopolymers remain exempt under Annex II of the Reciprocal Tariff order-benefitting materials such as PLA, certain waxes, and cellulose derivatives-most finished packaging formats face full levies. This discrepancy is reshaping the value chain, prompting strategic shifts toward domestic suppliers and integrated supply networks that can absorb or mitigate tariff exposure. Nearshoring and regional partnerships are emerging as preferred risk-management strategies, enabling brands to maintain quality control while stabilizing cost structures amid volatile trade policies.

Deriving Actionable Insights From Key Segmentations Including Packaging Format Material Distribution Channel End User and Sustainability Criteria

As packaging formats evolve, airless systems-such as airless bottles, pumps, and jars-have gained traction for their ability to protect sensitive serums and emulsions from oxidation, driving a shift away from multi-compartment compacts and single-use tubes. Consumers now expect formats that combine hygiene, convenience, and aesthetic appeal, influencing R&D priorities in format design. Concomitantly, material innovations favor biopolymers like PLA and PHA, alongside premium glass variants, as brands balance sustainability goals with the need for premium tactile experiences.

Distribution channels also play a pivotal role, with e-commerce and specialty retail channels-particularly brand websites and beauty boutiques-outpacing mass-market department stores. This shift underscores the importance of packaging that is optimized for shipping durability and unboxing experiences. In parallel, pharmacy-and-medical-spa channels demand packaging that conveys clinical efficacy, driving growth in precise pump dispensers and tamper-evident closures.

On the consumer side, end-user segments such as serums and sunscreens have elevated requirements for protective packaging that safeguards active ingredients against UV exposure and maintains stability. Refillable and returnable systems are gaining momentum under the sustainable packaging axis, enabling brands to reduce single-use waste while fostering ongoing customer engagement through incentive programs and refill station collaborations.

This comprehensive research report categorizes the Skin Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Format

- Material

- Sustainable Packaging

- Distribution Channel

- End User

Navigating Divergent Growth Patterns Across Americas EMEA and AsiaPacific Through Cultural Preferences and Regulatory Environments

In the Americas, regulatory scrutiny and consumer activism have accelerated adoption of refillable and curbside-recyclable packaging formats. Several U.S. states have implemented plastic reduction mandates, encouraging brands to innovate with curbside-compatible lamination alternatives and plant-based compostables. This regulatory landscape, coupled with the robust influence of direct-to-consumer e-commerce platforms, fosters a market where packaging must deliver both sustainability credentials and premium unboxing experiences to capture customer loyalty.

Meanwhile, Europe, Middle East & Africa is spearheading comprehensive packaging reform through the Packaging and Packaging Waste Regulation, which came into force in February 2025. The PPWR mandates that all packaging be recyclable by 2030, introduces binding reuse targets for 2030 and 2040, and restricts specific single-use formats in hospitality settings. These measures are catalyzing investments in high-quality mono-material systems and deposit-return schemes, especially for refillable cosmetic and toiletry products in the hotel and HORECA sectors.

In the Asia-Pacific region, rapid e-commerce expansion and cutting-edge innovation are shaping skin packaging trends. Brands in South Korea, Japan, and Greater China are integrating smart sensors and AI analytics into packaging to deliver real-time usage insights and skin diagnostics. Concurrently, local sustainability initiatives are driving the adoption of seaweed-based films and mycelium-derived materials, positioning APAC at the forefront of next-generation eco-material development for beauty packaging.

This comprehensive research report examines key regions that drive the evolution of the Skin Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leadership in Skin Packaging Innovation Sustainability and Digital Integration From Top Global Packaging Companies

Amcor has emerged as a leader in flexible and rigid skin packaging by investing heavily in eco-engineered materials. The company’s AmPrima line uses advanced orientation technology to produce ultra-clear, heat-resistant films that are fully recyclable, enabling brands to deliver premium aesthetics without sacrificing sustainability. Amcor’s commitment to making all its packaging recyclable or reusable by 2025 underscores its role as a sustainability pioneer in the industry.

Berry Global has built its reputation on scalable innovation, offering customizable solutions for luxury and mass-market skin care brands. With a portfolio that includes PCR-based tubes and foam-pump dispensers, Berry Global emphasizes a circular approach to packaging, working closely with clients to reduce single-use components and integrate recycled content. Its collaborations with major beauty houses have reinforced its position as a go-to supplier for brands balancing performance and environmental goals.

AptarGroup distinguishes itself with advanced dispensing technologies and digital partnerships. Notably, its collaboration with TerraCycle’s Loop platform enables reusable packaging loops for high-end skin care brands, promoting refillable ecosystems at scale. Aptar’s accolades for sustainability, including repeated recognition by Barron’s and Newsweek, reflect its leadership in renewable energy use and its strategic integration of circular solutions into product portfolios.

In the high-end glass segment, Gerresheimer offers precision-engineered vials and jars that combine artisanal craftsmanship with pharmaceutical-grade quality. Its focus on lightweight glass formulations and anti-counterfeiting technologies meets the dual demand for luxury user experiences and consumer safety. Gerresheimer’s consistent output of innovative glass packaging solutions underscores its commitment to premium brand differentiation in skin care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skin Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- AptarGroup, Inc.

- Berry Global Group, Inc.

- CCL Industries Inc.

- Clondalkin Group Holdings B.V.

- Coveris Holdings S.A.

- Crown Holdings, Inc.

- DS Smith plc

- DuPont de Nemours, Inc.

- Flexopack S.A.

- G. Mondini S.p.A.

- Gerresheimer AG

- Klöckner Pentaplast

- LINPAC Packaging Ltd.

- Plastopil Hazorea Co., Ltd.

- Sealed Air Corporation

- Silgan Holdings, Inc.

- Sonoco Products Company

- Stamar Packaging

- WestRock Company

- Winpak Ltd.

Implementing Strategic Roadmaps for Industry Leaders to Drive Resilience Sustainability and Competitive Advantage in Skin Packaging

Industry leaders should prioritize the development of integrated material strategies that balance sustainability aspirations with functional performance. Establishing partnerships with certified biopolymer and glass producers will enable faster scale-up of compostable and recyclable formats, while dedicated R&D investments in barrier coatings and anti-microbial finishes will preserve product efficacy.

To mitigate tariff exposure, organizations must diversify their supply chains by integrating nearshore and regional manufacturing hubs. Leveraging free trade agreements and exploring reshoring opportunities can reduce dependency on high-duty sources. Concurrently, brands should engage with customs and trade specialists to maximize exemptions available for active ingredients and sustainable packaging components.

Embracing smart packaging technologies, from NFC-enabled tamper evidence to AI-driven diagnostics, will differentiate offerings and create new avenues for consumer data capture. Piloting digital refill platforms and subscription models can transform packaging from a one-time use to a recurring touchpoint, strengthening loyalty and reducing waste.

Finally, fostering collaborative forums with regulatory bodies and industry associations will ensure proactive alignment with evolving packaging regulations across regions. By co-creating best practices for labeling, deposit-return schemes, and certification transparency, stakeholders can accelerate the transition to a truly circular packaging ecosystem, enhancing both environmental impact and brand reputation.

Detailing a Robust Research Methodology Combining Primary Insights Secondary Data and Rigorous Validation for Market Intelligence

This research combines primary and secondary methodologies to deliver robust market insights. Primary interviews were conducted with senior packaging engineers, procurement executives, and brand directors across North America, Europe, and Asia-Pacific, providing firsthand perspectives on emerging priorities and pain points.

Secondary data were gathered from authoritative sources including industry association reports, regulatory databases, and peer-reviewed journals. Comprehensive desk research synthesized tariff schedules, legislative texts, and materials-science publications to map competitive landscapes and regulatory frameworks.

Data triangulation and cross-validation were applied to ensure the reliability of findings, with iterative feedback loops between quantitative analyses and qualitative expert reviews. This rigorous approach underpins the credibility of segmentation insights and strategic recommendations, ensuring alignment with real-world market dynamics and enabling informed decision-making for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skin Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skin Packaging Market, by Packaging Format

- Skin Packaging Market, by Material

- Skin Packaging Market, by Sustainable Packaging

- Skin Packaging Market, by Distribution Channel

- Skin Packaging Market, by End User

- Skin Packaging Market, by Region

- Skin Packaging Market, by Group

- Skin Packaging Market, by Country

- United States Skin Packaging Market

- China Skin Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4134 ]

Concluding Critical Takeaways on Skin Packaging Evolution Tariff Implications Segmentation Strategies and Regional Market Dynamics

The skin packaging landscape is at a pivotal juncture, shaped by transformative shifts in sustainability, digital engagement, and regulatory complexity. Biodegradable and refillable formats are redefining consumer expectations, while AI and smart sensors are elevating the role of packaging in personalized skin care routines.

Concurrently, significant U.S. tariffs and evolving trade policies have underscored the importance of supply chain resilience and strategic sourcing. Brands that proactively diversify manufacturing geographies and leverage tariff exemptions for eco-materials will secure a competitive cost base.

Segmentation insights highlight that format innovation, material selection, and distribution channel optimization remain central to capturing each end-user segment effectively. Regional disparities in regulatory mandates further emphasize the need for tailored packaging strategies that align with local sustainability targets and consumer preferences.

As leading packaging companies continue to invest in advanced technologies and circular solutions, the convergence of innovation, collaboration, and regulatory foresight will define market leaders. Organizations that integrate these elements into cohesive roadmaps will be best positioned to navigate the complexities of the skin packaging market and drive sustainable growth.

Connect With Associate Director Ketan Rohom to Secure Comprehensive Skin Packaging Market Research and Accelerate Strategic DecisionMaking

If you’re ready to gain a decisive advantage in the skin packaging market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan can guide you through the unique insights and strategic recommendations contained in the full market research report tailored for your needs. Connect directly with Ketan to secure your copy of this in-depth analysis and empower your organization with actionable intelligence that supports sustainable growth and competitive differentiation in skin packaging.

- How big is the Skin Packaging Market?

- What is the Skin Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?