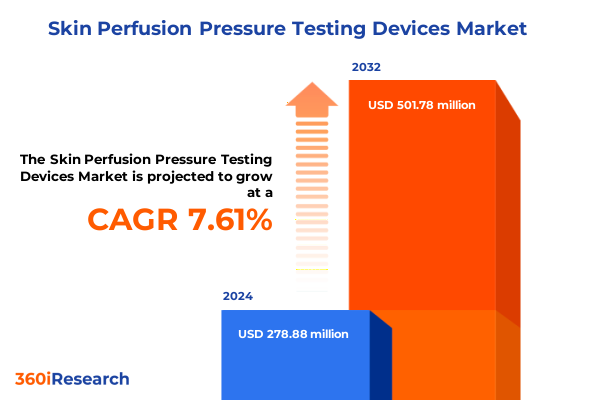

The Skin Perfusion Pressure Testing Devices Market size was estimated at USD 299.22 million in 2025 and expected to reach USD 321.65 million in 2026, at a CAGR of 7.66% to reach USD 501.78 million by 2032.

Revolutionizing Peripheral Vascular Assessment Through Precision Skin Perfusion Pressure Testing Devices That Inform Clinical Decision Making

The field of skin perfusion pressure testing has emerged as a cornerstone of peripheral vascular assessment, offering clinicians unprecedented precision in evaluating microcirculatory health. By measuring the minimum pressure required to restore capillary blood flow, these devices provide critical insights into tissue viability, ulcer risk, and wound healing potential. As the prevalence of diabetes, peripheral arterial disease, and chronic wounds continues to rise, the demand for accurate perfusion assessment tools has intensified, catalyzing innovation and attracting significant attention from healthcare institutions and device manufacturers alike.

This executive summary distills the most salient findings from a robust research framework that encompasses technological evaluation, end user analysis, application trends, distribution channels, price sensitivity, and geographic disparities. It highlights transformative shifts reshaping the market, examines the implications of evolving tariff policies in the United States, and offers a granular look at segment-specific dynamics. Ultimately, this introduction lays the groundwork for strategic considerations that will guide stakeholders in navigating regulatory complexities, capital allocation decisions, and product portfolio optimization.

How Cutting-Edge Imaging, Automation, and AI-Driven Analytics Are Disrupting Traditional Skin Perfusion Pressure Testing Paradigms

Recent years have witnessed a remarkable convergence of technological advancements and data-driven analytics that is redefining the landscape of skin perfusion pressure testing. The integration of high-resolution Laser Doppler imaging with sophisticated algorithms, for instance, has elevated diagnostic accuracy while enabling real-time visualization of microvascular flow patterns. In parallel, miniaturized photoplethysmography sensors leveraging reflection and transmission methodologies are now facilitating point-of-care assessments in outpatient and home-care settings, thereby expanding access to critical vascular diagnostics.

Moreover, novel pressure chamber systems equipped with automated inflation-deflation cycles have streamlined operator workflows, reducing the potential for user error and enhancing reproducibility. This shift toward automation is further supported by artificial intelligence–enabled decision support tools that interpret perfusion metrics against customized clinical benchmarks. As interoperability with electronic health record systems improves, clinicians can seamlessly incorporate perfusion data into patient management plans, promoting personalized therapeutic strategies. Taken together, these transformative shifts are fostering a new era of precision vascular care, characterized by enhanced diagnostic confidence, improved patient outcomes, and optimized resource utilization.

Navigating the Ripple Effects of 2025 U.S. Tariff Policies on Production Costs Supply Chains and Regulatory Pathways

The introduction of new United States tariff measures in early 2025 has introduced complexity for manufacturers of skin perfusion pressure testing devices that rely on imported components such as sensors, pressure transducers, and microprocessor boards. These cost pressures have prompted production realignments, with some leading suppliers relocating key manufacturing operations to tariff-exempt regions or negotiating long-term supplier agreements to mitigate input cost volatility. Consequently, device pricing strategies have had to adapt, balancing competitive positioning with margin preservation in a market increasingly sensitive to total cost of ownership.

On the regulatory front, tariff-induced supply chain reconfiguration has underscored the importance of regulatory agility. Companies with domestic manufacturing capabilities have secured expedited FDA review pathways by demonstrating supply chain resilience and compliance with quality system regulations. Additionally, tiered pricing models and flexible financing programs have emerged as critical tools for distributors and clinical end users seeking to manage capital expenditures without compromising on device performance. Overall, the cumulative impact of the 2025 tariff landscape is driving a renewed emphasis on localized production, strategic partnerships, and innovative payment structures.

Unlocking Market Dynamics Through Multi-Dimensional Segmentation Analysis Spanning End Users Technologies Applications Channels and Pricing

The skin perfusion pressure testing market reveals nuanced opportunities when viewed through the lens of end user, technology, application, distribution channel, and price range. In ambulatory surgery centers, the adoption of photoplethysmography devices that leverage reflection sensors has accelerated due to their rapid assessment capabilities and compact form factor, whereas hospitals have exhibited a greater affinity for comprehensive Laser Doppler imaging systems, including both single‐probe and imaging configurations, in diagnostic centers that demand high-resolution perfusion maps. Specialty clinics have shown a predisposition toward air plethysmography solutions for venous insufficiency assessments, while vascular centers have integrated pressure chamber systems to support critical limb salvage programs.

Turning to applications, diabetic ulcer management has driven procurement of photoplethysmography transmission devices among outpatient wound care providers, and peripheral arterial disease assessments have become a key driver of laser-based systems in high‐volume diagnostic centers. Venous insufficiency assessment and wound healing evaluation programs in hospitals have relied heavily on pressure chamber technologies, often procured via direct sales agreements that include service-level commitments. Distribution channels reveal a bifurcated landscape: online platforms are gaining traction among smaller specialty clinics for cost-sensitive procurement, while large hospital systems continue to prefer direct sales relationships. Across all end users and applications, mid price range devices are capturing the greatest share of new contracts due to their balanced feature sets and total cost of ownership profiles.

This comprehensive research report categorizes the Skin Perfusion Pressure Testing Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Application

- Distribution Channel

Decoding Regional Growth Patterns and Strategic Imperatives Across the Americas Europe Middle East & Africa and Asia-Pacific

Regional dynamics in the skin perfusion pressure testing market demonstrate distinct trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific, each shaped by varying healthcare infrastructure maturity, reimbursement frameworks, and disease burden. In the Americas, established vascular centers and tertiary hospitals are leading the charge toward advanced Laser Doppler imaging integration, supported by well-defined reimbursement codes and a strong emphasis on outpatient wound care services. Meanwhile, in Europe, Middle East & Africa, heterogeneous regulatory landscapes and divergent reimbursement policies have necessitated tailored market entry strategies, with distributors often providing bundled service agreements to address localized training and maintenance requirements.

In Asia-Pacific, a rapidly aging population and escalating prevalence of chronic diseases such as diabetes are fueling demand for cost-effective photoplethysmography and air plethysmography devices in both urban tertiary centers and emerging rural diagnostic hubs. Stakeholders in each region are prioritizing partnerships with local distributors to navigate regulatory approvals and align with national health priorities. Furthermore, cross-border collaborations are facilitating knowledge transfer and capacity building, ensuring that the latest perfusion testing technologies are accessible to a broader patient population. Such regional insights underscore the importance of adaptive market strategies and investment in localized support infrastructure.

This comprehensive research report examines key regions that drive the evolution of the Skin Perfusion Pressure Testing Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Competitive Positioning and Strategic Collaborations That Define Market Leadership in Perfusion Pressure Testing Innovations

An analysis of leading companies in the skin perfusion pressure testing space reveals a competitive landscape characterized by innovation, strategic alliances, and product differentiation. Major medical device manufacturers have made targeted acquisitions of niche technology firms specializing in photoplethysmography and Laser Doppler systems, thereby enriching their portfolios with complementary perfusion assessment capabilities. At the same time, specialized innovators are forging collaborations with academic research centers to validate novel sensor technologies and secure intellectual property licensing agreements.

Moreover, entrants with agile production models have leveraged contract manufacturing organizations to scale air plethysmography and pressure chamber solutions without significant capital investment, allowing them to respond rapidly to shifts in clinical demand. Strategic partnerships between distributors and regional healthcare networks have enabled comprehensive service offerings, bundling device sales with training, maintenance, and data analytics support. These company-level insights highlight the pivotal role of collaboration, portfolio diversification, and operational flexibility in capturing market share within a highly dynamic and technologically complex environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skin Perfusion Pressure Testing Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADInstruments Pty Ltd

- ATYS Medical

- BIOPAC Systems, Inc.

- Collaborative Care Diagnostics, LLC

- CorVascular Diagnostics, LLC

- ELCAT GmbH

- Kaneka Medix

- Koven Technology, LLC

- Moor Instruments Limited

- Newman Medical, Inc.

- Perimed AB

- Promed Group

- Transonic Systems, Inc.

- Vasamed Incorporated

- Viasonix

Proactive Paths for Industry Players to Drive Innovation Scale Production and Champion Value-Based Adoption in Vascular Diagnostics

To maintain a competitive edge, industry leaders must prioritize investments in R&D that drive miniaturization and integration of multimodal perfusion assessment technologies, ensuring seamless interoperability with clinical information systems. Establishing center‐of‐excellence partnerships with leading vascular research institutes will not only accelerate clinical validation but also facilitate evidence generation for reimbursement justification. In parallel, expanding localized manufacturing footprints can mitigate supply chain vulnerabilities and unlock faster regulatory approvals while enabling cost-competitive pricing strategies.

Furthermore, adopting outcome-based service agreements that tie device utilization to patient health metrics will resonate with value-based care initiatives and reimbursement models. Leaders should also explore subscription-based software licensing for AI-driven analytics platforms, creating recurring revenue streams and deepening customer engagement. Finally, enhancing digital marketing and education initiatives targeted at specialty clinics and ambulatory surgery centers will broaden adoption of point-of-care perfusion testing devices, reinforcing brand authority and accelerating market penetration.

Employing Rigorous Primary and Secondary Research Frameworks to Illuminate Trends Innovations and Competitive Dynamics

This research leverages a multi-faceted methodology combining primary interviews with key opinion leaders, clinical end users, and executive stakeholders alongside secondary data triangulation from scientific publications, regulatory filings, and patent databases. The primary research phase involved structured consultations with vascular surgeons, wound care specialists, and device procurement managers to capture qualitative insights into clinical workflows, purchase decision criteria, and technology preferences. Concurrently, secondary research entailed systematic reviews of peer-reviewed journals, white papers, and conference proceedings to map the evolution of sensor technologies and perfusion metrics.

Quantitative data were synthesized through an extensive analysis of regulatory submissions and patent filings to assess innovation trends and product development pipelines. Manufacturing and supply chain dynamics were evaluated via confidential discussions with contract manufacturers and logistics providers. Finally, competitive positioning was benchmarked using company disclosures, collaboration announcements, and market intelligence databases. This rigorous approach ensures that the findings and recommendations presented herein are grounded in validated evidence and reflect the current state of the skin perfusion pressure testing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skin Perfusion Pressure Testing Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skin Perfusion Pressure Testing Devices Market, by Product Type

- Skin Perfusion Pressure Testing Devices Market, by Technology

- Skin Perfusion Pressure Testing Devices Market, by End User

- Skin Perfusion Pressure Testing Devices Market, by Application

- Skin Perfusion Pressure Testing Devices Market, by Distribution Channel

- Skin Perfusion Pressure Testing Devices Market, by Region

- Skin Perfusion Pressure Testing Devices Market, by Group

- Skin Perfusion Pressure Testing Devices Market, by Country

- United States Skin Perfusion Pressure Testing Devices Market

- China Skin Perfusion Pressure Testing Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Technology Advances Regulatory Challenges and Strategic Partnerships Into a Blueprint for Sustainable Market Leadership

In conclusion, the skin perfusion pressure testing market stands at the nexus of technological innovation and evolving healthcare imperatives, driven by the urgent need to improve outcomes for patients with vascular and chronic wound conditions. The confluence of advanced imaging modalities, automated pressure control systems, and AI-driven analytics is redefining diagnostic precision, supporting personalized treatment pathways, and enabling value-based care models. Simultaneously, shifting tariff landscapes and regional regulatory complexities underscore the importance of supply chain resilience and localized market strategies.

As the market continues to evolve, stakeholder success will hinge on the ability to foster strategic collaborations, invest in evidence-based innovation, and adopt flexible business models that align with emerging reimbursement and care delivery frameworks. By leveraging the insights and recommendations presented in this report, industry leaders can chart a course for sustainable growth, delivering superior clinical value and driving broader adoption of skin perfusion pressure testing solutions across diverse healthcare settings.

Engage With an Expert to Secure Your Definitive Market Insights Report From Ketan Rohom for Strategic Advancement in Vascular Diagnostics

Engaging with an authoritative analysis of the competitive landscape and technological innovations in skin perfusion pressure testing devices empowers decision-makers to enhance vascular care strategies and drive market growth by aligning product development with clinical demands while leveraging actionable insights for strategic investments and partnerships This comprehensive report offers a concise yet powerful overview of market dynamics, adoption hurdles, and emerging opportunities, serving as a critical resource for stakeholders seeking to optimize market positioning and capitalize on the evolving regulatory and reimbursement environment

- How big is the Skin Perfusion Pressure Testing Devices Market?

- What is the Skin Perfusion Pressure Testing Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?