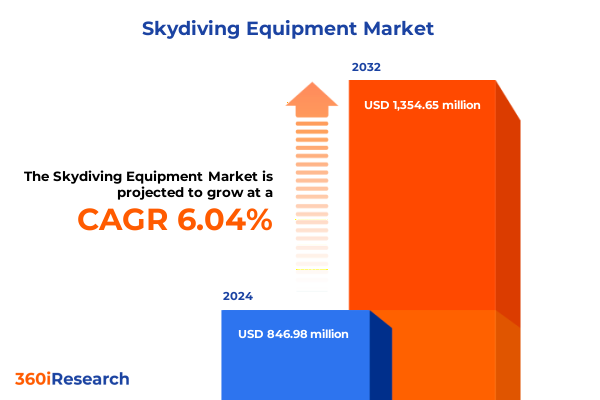

The Skydiving Equipment Market size was estimated at USD 897.82 million in 2025 and expected to reach USD 955.15 million in 2026, at a CAGR of 6.05% to reach USD 1,354.65 million by 2032.

Unveiling the Cutting-Edge Evolution and Strategic Imperatives Reshaping Today’s Skydiving Equipment Industry Amid Safety Innovation and Market Momentum

The world of skydiving has witnessed an extraordinary transformation over recent years, driven by relentless innovation and an unwavering commitment to safety. Modern equipment has evolved far beyond the rudimentary parachutes of the mid-20th century, integrating cutting-edge materials such as ultra-high-tenacity nylon and advanced composite harnesses to optimize strength-to-weight ratios. Developments in canopy design have ushered in the era of ram-air and hybrid airfoil shapes that yield superior maneuverability and glide performance, enabling both competitive skydivers and recreational enthusiasts to push the limits of aerial precision. Furthermore, the incorporation of digital altimeters and integrated automatic activation devices has set new standards for in-flight safety, delivering real-time telemetry and fail-safe deployment mechanisms. These technological breakthroughs are supported by an expanding global network of dropzones, training schools, and specialty retailers that are committed to rigorous certification programs and risk-management protocols.

Exploring the Transformative Technological, Operational, and Consumer-Driven Shifts Redefining Skydiving Equipment Manufacturing and Distribution Practices

Over the past several years, the skydiving equipment landscape has been reshaped by transformative forces across technology, consumer behavior, and operational practices. Digitalization now extends into every layer of the value chain, from online custom gear configurators that allow end users to tailor canopy and harness setups, to data analytics platforms that track equipment usage patterns and predict maintenance cycles. Simultaneously, material science advancements-such as the adoption of lightweight carbon-reinforced components and high-performance webbing-have revolutionized durability benchmarks, reducing canopy porosity and extending service life. At the distribution level, omnichannel strategies have become essential, blending an expanding ecosystem of dropzone outlets and specialty retail with sophisticated e-commerce platforms. As consumer preferences shift toward enhanced safety certifications and eco-friendly manufacturing processes, industry leaders are forging new partnerships with textile innovators and component suppliers to integrate sustainable fabrics and recycled polymers. Consequently, the market is adapting rapidly to accommodate these multidimensional shifts, driving manufacturers and retailers to reevaluate legacy supply chains, invest in digital engagement tools, and embrace agile production models to stay ahead of evolving end-user demands.

Assessing the Cumulative Impact of 2025 United States Tariffs on Supply Chains, Cost Structures, and Market Dynamics in the Skydiving Equipment Sector

The introduction of new tariffs by the United States government in early 2025 has exerted a substantial cumulative impact on the skydiving equipment sector, reframing global sourcing strategies and cost management practices. Import levies applied to key components-ranging from canopy fabrics and harness hardware to electronic altimeters and activation modules-have driven domestic end-users to absorb elevated procurement costs or seek alternative suppliers in tariff-exempt jurisdictions. In response, several manufacturers have accelerated attempts to onshore critical production stages, partnering with regional textile mills and CNC-machining workshops to mitigate exposure to customs duties. This shift has led to incremental capital investments in domestic extrusion lines for webbing and localized assembly cells for automatic activation devices. Moreover, supply chain planners have adjusted inventory buffers to accommodate extended lead times and fluctuating duty rates, recalibrating procurement models around just-in-case safety stocks while also exploring long-term contract negotiations with preferred overseas partners able to offer bonded warehousing solutions. Ultimately, these measures are reshaping cost structures and reinforcing the strategic value of supply chain agility in an environment of policy-driven volatility.

Illuminating Critical Segmentation Insights Across Demographics, Distribution Channels, End Users, Deployment Methods, and Product Categories Driving Strategic Focus

A multifaceted segmentation framework reveals critical insights into buyer behavior and strategic priorities across the skydiving equipment market. Based on age group, demand patterns diverge between adult participants who prioritize advanced safety features and specialized performance canopies, and younger skydivers who are drawn to accessible, modular training kits. In the realm of distribution, the landscape splits between offline experiences at dropzone outlets, specialty retail, and sporting goods stores-where hands-on fitting and equipment trials remain paramount-and online channels comprising direct company websites and third-party e-retailers that emphasize convenience and product variety. End-user segments further differentiate market dynamics: competition entities focus on precision-engineered gear for accuracy jumps, military parachuting operations require ruggedized systems built to strict defense standards, and recreational skydivers seek cost-effective assemblies offering intuitive deployment. Deployment methods introduce another layer of complexity, with accelerated freefall, solo jumps, static line training, and tandem experiences each demanding tailored canopy profiles, harness configurations, and safety accessories. Finally, product type segmentation spans essential altimeters-available in both audible/electronic and visual formats-through to automatic activation devices, classified as fully automatic or semi-automatic, canopy designs in ram-air or round configurations, container and harness assemblies in backmount or side-mount orientations, and safety accessories including goggles, helmets, and jumpsuits designed to complement specific use cases and risk profiles.

This comprehensive research report categorizes the Skydiving Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Age Group

- Product Type

- Distribution Channel

- End User

- Deployment

Mapping Key Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East and Africa, and the Asia-Pacific Skydiving Equipment Markets

Regionally, the Americas continue to lead in both recreational participation and professional jump operations, with the United States serving as the epicenter for product innovation and regulatory standards overseen by national aviation authorities. Canada and Brazil follow suit, exhibiting robust growth in adventure tourism and military training applications. In contrast, Europe, the Middle East & Africa display a diverse regulatory and economic environment, where western Europe’s stringent safety certifications drive demand for high-performance automatic activation devices, while emerging markets in Eastern Europe and North Africa are gradually embracing recreational skydiving through expanding dropzone networks. In the Middle East, premium tourism initiatives are fueling investments in tandem jump experiences, often backed by luxury resort partnerships. Across the Asia-Pacific region, rising disposable incomes and the proliferation of indoor wind tunnel facilities are democratizing access to freefall simulation, spurring demand for entry-level static line kits and youth-oriented training packages. Meanwhile, major importers such as Australia, Japan, and South Korea continually advance specialized competition canopy designs to meet increasingly sophisticated athlete requirements. Collectively, these regional dynamics underscore the importance of localized product adaptations, regulatory compliance strategies, and targeted distribution models to capture nuanced market opportunities.

This comprehensive research report examines key regions that drive the evolution of the Skydiving Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Footprints and Competitive Advancements of Leading Manufacturers and Distributors in the Skydiving Equipment Market Landscape

The competitive landscape features a blend of specialized canopy manufacturers, high-tech component innovators, and distribution networks that collectively define market trajectories. Leading canopy producers have differentiated themselves through proprietary airfoil geometries and performance tuning services, securing brand loyalty among competitive skydivers and safety-conscious recreational jumpers alike. Simultaneously, key players in the activation device segment have invested heavily in sensor miniaturization and algorithmic refinement to enhance deployment reliability across varied jump profiles. Harness and container suppliers are forging strategic alliances with material scientists to integrate advanced composite frames and ergonomic padding systems that reduce user fatigue and streamline packing protocols. Distribution leaders are expanding their global footprints by forging partnerships with dropzone consortiums, specialty retail outlets, and e-commerce platforms to deliver end-to-end gear solutions and training resources. New entrants are also emerging, leveraging digital direct-to-consumer models to offer subscription-based maintenance services and gear upgrade programs. Collectively, these maneuvers are intensifying competitive differentiation, prompting established organizations to bolster their R&D pipelines, accelerate go-to-market execution, and cultivate community-based engagement to reinforce brand relevance in a rapidly evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skydiving Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerodyne Research, Inc.

- Airborne Systems (Safran Group)

- Apco Aviation Ltd.

- Blue Skies Fabricating, Inc.

- GQ Parachutes, Inc.

- Icarus Canopies, LLC

- Mirage Systems, Inc.

- NEO SAS

- Parachute Systems.

- Paratec Industries, Inc.

- Peregrine Manufacturing Inc

- Performance Designs, Inc.

- Phoenix Skydive Center

- Rock Sky Market

- Skydive New England

- Sun Path Products, Inc.

- United Parachute Technologies, LLC

Driving Growth and Competitive Advantage Through Strategic Innovations, Supply Chain Resilience, and Customer-Centric Partnerships in the Skydiving Equipment Industry

Industry leaders can harness several strategic imperatives to fortify their market positioning and drive sustainable growth. Emphasizing research and development investments in novel fabrics, lightweight composites, and sensor-based safety mechanisms will enable early entry into emerging performance niches while reinforcing brand credibility. Concurrently, diversifying supply chains through a blend of regional sourcing partnerships and flexible manufacturing alliances can mitigate exposure to policy shifts and logistical disruptions. Augmenting digital channels with immersive virtual fitting tools and data-driven maintenance platforms will elevate customer engagement and create new touchpoints for value-added services. In parallel, establishing collaborative frameworks with dropzone operators, training academies, and regulatory bodies can accelerate the adoption of standardized best practices and reinforce safety certifications that underpin consumer trust. To complement these efforts, companies should explore modular product architectures and subscription-based upgrade paths to increase wallet share and foster long-term loyalty. Collectively, these initiatives form a cohesive roadmap for executives seeking to optimize operational resilience, capture untapped market segments, and reinforce competitive advantage in an industry defined by dynamic technological and regulatory shifts.

Detailing the Rigorous Multi-Method Research Framework and Analytical Processes Underpinning This Comprehensive Analysis of Skydiving Equipment Markets

This analysis is grounded in a robust multi-method research framework that blends quantitative data aggregation with qualitative expert validation. Secondary intelligence was collected from specialized industry publications, regulatory filings, trade association reports, and technical white papers to establish a comprehensive baseline of market developments. Primary research involved in-depth interviews with manufacturers, component suppliers, distribution channel partners, and key end-users across competitive, military, and recreational segments to capture firsthand perspectives on product performance, adoption barriers, and emerging demand drivers. The segmentation framework was rigorously applied to classify market dynamics by age group, distribution channel, deployment method, and product type, ensuring nuanced insights into each sub-segment’s unique requirements. Regional analysis incorporated extensive field surveys and dropzone network mapping, while tariff impact assessments were based on customs data review and supply chain modeling scenarios. Triangulation techniques were employed to cross-verify quantitative findings with qualitative input, thereby enhancing the reliability and validity of strategic conclusions. Throughout the process, methodological rigor was maintained via continuous peer review and alignment with industry research best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skydiving Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skydiving Equipment Market, by Age Group

- Skydiving Equipment Market, by Product Type

- Skydiving Equipment Market, by Distribution Channel

- Skydiving Equipment Market, by End User

- Skydiving Equipment Market, by Deployment

- Skydiving Equipment Market, by Region

- Skydiving Equipment Market, by Group

- Skydiving Equipment Market, by Country

- United States Skydiving Equipment Market

- China Skydiving Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings and Strategic Implications to Navigate Emerging Opportunities and Challenges in the Skydiving Equipment Market

In summary, the skydiving equipment industry stands at a pivotal juncture defined by rapid technological advancement, evolving safety standards, and shifting regulatory landscapes. The combined effect of material innovation, digital integration, and policy-driven tariff measures is reshaping cost structures, supply chain configurations, and go-to-market strategies. Segmentation analysis underscores the importance of tailored offerings for adult and youth demographics, specialized end users, varied deployment methods, and a diverse suite of product types ranging from altimeters to safety accessories. Regionally tailored approaches remain essential, as growth trajectories diverge across the Americas, Europe Middle East & Africa, and the Asia-Pacific. Competitive pressures are intensifying, with leading players responding through R&D investments, distribution partnerships, and community engagement models. Moving forward, industry participants must prioritize agile innovation, robust supply chain diversification, and customer-centric service enhancements to seize emerging opportunities and mitigate disruptions. By aligning strategic initiatives with the detailed findings presented herein, executives can position their organizations to thrive in a dynamic market environment characterized by both exhilarating potential and rigorous safety imperatives.

Seize Market Intelligence Today by Engaging Ketan Rohom to Secure Personalized Access to the Definitive Skydiving Equipment Market Research Report

Ready to transform your strategic approach and gain unparalleled clarity into the skydiving equipment market? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to unlock a tailored consultation and secure your personalized access to the full in-depth market research report. With expert guidance and comprehensive insights, you’ll be equipped to make data-driven decisions, capitalize on emerging trends, and outpace the competition. Don’t miss this opportunity to elevate your market intelligence-reach out to start your journey toward industry leadership today.

- How big is the Skydiving Equipment Market?

- What is the Skydiving Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?