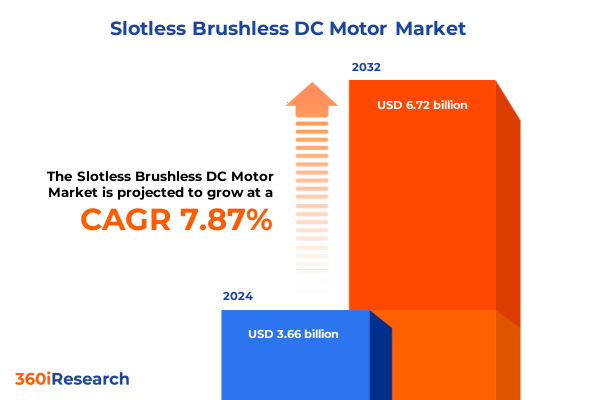

The Slotless Brushless DC Motor Market size was estimated at USD 3.93 billion in 2025 and expected to reach USD 4.23 billion in 2026, at a CAGR of 7.93% to reach USD 6.72 billion by 2032.

Unveiling the Critical Role of Slotless Brushless DC Motors in Driving Next-Generation Precision and Efficiency Across Emerging Industry Applications

Slotless brushless DC motors represent a paradigm shift in precision actuation, combining coreless design principles with advanced electromagnetic engineering to deliver unparalleled performance in compact form factors. These motors eschew traditional iron slots, enabling reduced cogging torque, minimized electromagnetic noise, and heightened dynamic response. As a result, they have emerged as the preferred choice for high-precision applications ranging from medical diagnostic devices and robotic surgical systems to aerospace control surfaces and next-generation consumer electronics. The unique architecture of slotless designs underscores a broader trend toward miniaturization and energy efficiency, driven by the relentless push for smarter, more agile technologies.

The growing demand for electrification across industries has further accelerated the adoption of slotless brushless DC motors, as they can sustain high torque densities and continuous operation at elevated speeds without compromising thermal stability. Key enablers such as advanced magnet materials, improved winding techniques, and integrated drive electronics have converged to expand the operational envelope of these motors, making them viable for both high-volume consumer products and mission-critical industrial systems. In this context, stakeholders-including original equipment manufacturers, system integrators, and component suppliers-must navigate evolving supply chains and regulatory frameworks to harness the full potential of slotless brushless DC motor technology.

Exploring the Rapid Technological Disruptions and Integration Trends That Are Reshaping the Slotless Brushless DC Motor Ecosystem Worldwide

The slotless brushless DC motor landscape is witnessing transformative disruptions driven by advances in material science, manufacturing processes, and digital integration. Emerging composite magnet alloys and nano-scale surface treatments are pushing the boundaries of torque-to-weight ratios, catalyzing new product designs that were previously unattainable. Meanwhile, additive manufacturing techniques are enabling bespoke motor geometries that optimize thermal management and reduce assembly complexity. Collectively, these breakthroughs are lowering barriers to entry for specialized applications in robotics, autonomous vehicles, and portable medical equipment.

Concurrently, the proliferation of IoT-enabled devices is fostering tighter integration between motor hardware and software-driven control systems. Real-time monitoring, predictive maintenance algorithms, and adaptive control loops are converging to redefine reliability standards. Manufacturers are increasingly embedding sensors and digital twins within slotless motor assemblies to preempt performance degradation and enable seamless firmware updates. As a result, the ecosystem is shifting from isolated component sales toward holistic solutions that encompass hardware, software, and data analytics, empowering end users to achieve unprecedented levels of uptime and operational insight.

Analyzing How 2025 United States Tariffs on Electrical Steel and Rare-Earth Components Are Reshaping Supply Chain Strategies

The introduction of new United States tariffs in 2025 on key electrical steel imports and rare-earth magnet materials has exerted significant pressure on cost structures within the slotless brushless DC motor supply chain. Motor manufacturers have faced upward pricing pressure as tariffs have extended beyond finished goods to critical subcomponents, prompting many to reevaluate sourcing strategies and explore nearshoring opportunities. This has led to an uptick in procurement partnerships within North American markets to mitigate exposure to volatile international duties and enhance supply chain resilience.

To counterbalance escalating component costs, firms have accelerated investments in material substitution research and in-house magnet production capabilities. Some industry leaders have negotiated long-term offtake agreements with domestic rare-earth refiners, while others have pursued collaborative R&D initiatives to develop lower-cost, high-performance alternatives. Although these measures have partially alleviated tariff-induced margin compression, the cumulative impact of layered duties continues to incentivize innovation in both design and supply chain models, reinforcing the imperative for agile operational frameworks.

Unlocking Strategic Understandings by Integrating Type, Rotor, Commutation, Power, Voltage, Distribution and End-User Industry Perspectives

When examining the market through the lens of type, stakeholders recognize that linear slotless motors bring exceptional positioning accuracy and minimal mechanical backlash, whereas rotary slotless variants offer continuous rotational motion with superior smoothness. Insights based on rotor configuration reveal that external-rotor designs deliver high torque at lower speeds, making them ideal for direct-drive fan and pump applications, while internal-rotor configurations excel in high-speed precision drives. Assessing structural differences highlights that ironcore constructions enable higher magnetic flux density, suitable for heavy-duty industrial machinery, whereas ironless frameworks are prized in applications demanding near-zero inertia, such as microfluidic pumps.

Delving into commutation methods, sensored motors ensure precise rotor alignment and repeatable performance under fluctuating loads, whereas sensorless architectures reduce overall system complexity and cost. Evaluations across power tiers illustrate that sub-750 watt units cater to wearable and portable devices, mid-range 750 watt to 3 kilowatt models dominate in robotic automation and consumer appliances, and above 3 kilowatt systems serve heavy-duty industrial applications requiring sustained torque. Voltage assessments indicate that configurations up to 10.5 volts are standard for battery-operated tools, 10.5 to 24 volts are prevalent in automotive and mobile robotics, and higher voltage systems above 24 volts are increasingly adopted in advanced manufacturing and aerospace platforms. Distribution channel insights underscore the vital roles of OEM partnerships in large-scale industrial projects and aftermarket channels in maintenance-intensive sectors. Evaluating end-user industries reveals that aerospace and defense prioritize reliability and redundancy, automotive emphasizes efficiency and integration, consumer electronics values miniaturization, healthcare demands biocompatibility and precision, industrial and manufacturing seeks robustness and uptime, and renewable energy focuses on efficiency under variable environmental conditions.

This comprehensive research report categorizes the Slotless Brushless DC Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Rotor Type

- Structure

- Commutation Type

- Power

- Operating Voltage

- Distribution Channel

- End-User Industry

Examining Regional Nuances That Drive Demand and Innovation in the Americas, EMEA and Asia-Pacific Markets

Geographical dynamics are pivotal in shaping the slotless brushless DC motor market’s trajectory, with the Americas leading in innovation due to robust automotive electrification initiatives and a growing emphasis on domestic supply chains following recent trade policy shifts. Demand centers in North America have gravitated toward advanced sensorless architectures in consumer electronics and mid-power automation solutions in manufacturing hubs. Conversely, regions within Europe, the Middle East, and Africa have concentrated on integrating motors into renewable energy systems, leveraging mature infrastructure for wind and solar farms alongside stringent emissions regulations that favor high-efficiency designs.

In the Asia-Pacific region, the rapid expansion of robotics manufacturing and consumer electronics assembly lines has fueled significant uptake of compact, ironless slotless motors. Governments across East and Southeast Asia continue to incentivize electric vehicle production and industrial automation, driving localized R&D and production scale-up. In addition, cross-border collaboration agreements among regional industrial conglomerates are expediting technology transfers, enabling emerging markets to access cutting-edge motor designs. Ultimately, these regional nuances underscore the importance of tailored market strategies that account for local policy frameworks, end-user priorities, and supply chain complexities.

This comprehensive research report examines key regions that drive the evolution of the Slotless Brushless DC Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Collaboration-Driven Differentiation Among Industry Leaders and Agile Innovators in Slotless Brushless DC Motors

Leading companies in the slotless brushless DC motor arena are distinguished by their commitments to advanced material science, integrated electronics, and precision manufacturing. Global tier-one players have expanded vertically, incorporating magnet production and winding operations to secure critical raw materials and enhance quality control. Simultaneously, specialized mid-market firms differentiate through agile prototyping capabilities, enabling rapid customization for niche applications in medical robotics and aerospace control systems.

Strategic partnerships between traditional motor manufacturers and technology startups are becoming increasingly prevalent, as incumbents seek to embed digital control features and predictive analytics into their product portfolios. Joint ventures focused on additive manufacturing are reducing time-to-market for complex motor geometries, while licensing agreements for proprietary commutation algorithms enhance performance benchmarks. Collectively, these collaborative efforts are fostering an innovation ecosystem that balances scale efficiency with specialized expertise, positioning key players to address evolving customer requirements across diverse industrial segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Slotless Brushless DC Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Motion Technologies Inc.

- Allient, Inc..

- AMETEK, Inc.

- ARK ELECTRONIC MOTION CONTROLS INDIA PRIVATE LIMITED

- Celera Motion by Novanta Inc.

- Delta Line SA

- Dongguan Faradyi Technology Co., Ltd..

- ElectroCraft, Inc.

- Elinco International, Inc.

- FAULHABER Group

- Kollmorgen Corporation

- Lin Eng. Inc.

- Mabuchi Motor Co., Ltd.

- Maxon Motor AG

- MOONS

- Nanotec Electronic GmbH & Co. KG

- PORTESCAP PRIVATE LIMITED

- Sinotech, Inc.

Empowering Industry Stakeholders with Strategic Roadmaps for R&D, Supply Chain Agility and Sustainable Growth

Industry leaders should prioritize investment in dual-track R&D initiatives that balance incremental design enhancements with disruptive material and manufacturing breakthroughs. By dedicating resources to both composite magnet development and advanced winding automation, organizations can mitigate raw material cost pressures while accelerating time-to-market. In parallel, establishing regional control centers that integrate data from IoT-enabled motors will enable predictive maintenance offerings, strengthening customer retention and opening recurring revenue streams.

Moreover, executives must adopt a strategic supplier diversification plan, leveraging nearshore manufacturing hubs to counter tariff volatility and bolster supply chain agility. Cultivating co-development partnerships with semiconductor and sensor providers will facilitate the rapid rollout of sensored motor variants optimized for emerging robotics and electric mobility platforms. Ultimately, by embedding sustainability metrics into product roadmaps and operational targets, companies can align with evolving regulatory landscapes and brand value propositions, ensuring long-term competitiveness in a rapidly evolving technological ecosystem.

Detailing a Robust Mixed-Method Research Framework Combining Executive Interviews, Surveys, Patent Analysis and Field Observations

The research methodology underpinning this analysis combined qualitative insights from C-level executive interviews with quantitative data gathered through a proprietary supplier and end-user survey. An extensive desk research exercise was conducted to map patent filings, regulatory developments, and emerging material innovations. Key primary data sources included engineering design specialists, procurement managers, and application engineers across target industries. Secondary sources comprised industry white papers, journal publications on electromagnetic materials, and trade association reports.

Data validation procedures involved triangulating survey feedback with field observations from plant visits and attendance at leading automation trade shows. Advanced analytics tools were employed to identify technology adoption curves and design divergence across geographic regions. This mixed-method approach ensures a holistic perspective, capturing both high-level market dynamics and granular technical nuances essential for strategic decision-making in slotless brushless DC motor investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Slotless Brushless DC Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Slotless Brushless DC Motor Market, by Type

- Slotless Brushless DC Motor Market, by Rotor Type

- Slotless Brushless DC Motor Market, by Structure

- Slotless Brushless DC Motor Market, by Commutation Type

- Slotless Brushless DC Motor Market, by Power

- Slotless Brushless DC Motor Market, by Operating Voltage

- Slotless Brushless DC Motor Market, by Distribution Channel

- Slotless Brushless DC Motor Market, by End-User Industry

- Slotless Brushless DC Motor Market, by Region

- Slotless Brushless DC Motor Market, by Group

- Slotless Brushless DC Motor Market, by Country

- United States Slotless Brushless DC Motor Market

- China Slotless Brushless DC Motor Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Synthesizing Technological, Supply Chain and Regional Dynamics to Chart the Future of Precision Motion Control Solutions

Slotless brushless DC motors are poised to redefine precision motion control across a broad spectrum of applications, driven by continual advances in materials, manufacturing, and digital integration. As global trade dynamics evolve, cost pressures from tariffs and supply chain realignment will spur innovation in nearshore production and material substitution. Benchmarking segmentation insights across type, rotor configuration, structure, commutation, power, voltage, distribution, and end-user industries provides vital clarity for tailored product strategies.

Regional variations in policy incentives, end-user priorities, and infrastructure maturity underscore the necessity for market entrants to adopt nuanced approaches specific to the Americas, EMEA, and Asia-Pacific landscapes. Collaborative partnerships between established motor houses and technology disruptors are accelerating the development of next-generation designs that harmonize efficiency, reliability, and smart capabilities. By following the actionable recommendations outlined herein, stakeholders can navigate the complexities of this dynamic market, ensuring sustained leadership in the era of electrification and intelligent automation.

Seize Strategic Advantage by Connecting with Associate Director Ketan Rohom to Acquire Definitive Slotless Brushless DC Motor Market Intelligence

Harness the opportunity to elevate your organization’s engineering capabilities and strategic planning by securing this comprehensive market research report. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to obtain in-depth insights, tailored data analyses, and exclusive executive briefs. By partnering with Ketan, you will gain personalized guidance on leveraging critical intelligence for product development, regulatory compliance, and competitive positioning in the slotless brushless DC motor industry. Reach out today to transform your growth trajectory and stay at the forefront of technological innovation in precision motor applications.

- How big is the Slotless Brushless DC Motor Market?

- What is the Slotless Brushless DC Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?