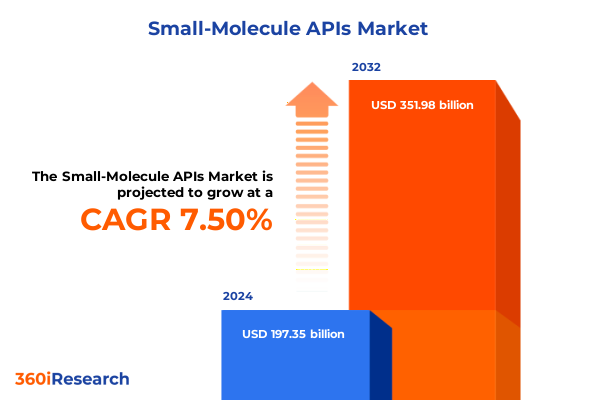

The Small-Molecule APIs Market size was estimated at USD 212.05 billion in 2025 and expected to reach USD 226.77 billion in 2026, at a CAGR of 7.50% to reach USD 351.98 billion by 2032.

Establishing Context for Small-Molecule Active Pharmaceutical Ingredient Markets with Core Drivers, Scope, and Industry Relevance in Contemporary Healthcare

The small-molecule active pharmaceutical ingredient (API) domain represents a foundational pillar of contemporary drug development, powering a vast array of therapeutic modalities and delivering critical health solutions across multiple disease classes. Small-molecule APIs are characterized by low molecular weight structures that readily diffuse across cellular membranes, enabling precise modulation of biological targets. As such, they stand in contrast to biologics and serve as the workhorses of many life science pipelines due to their established manufacturing protocols, chemical stability, and cost advantages. This introduction sets the stage for a detailed exploration of market forces shaping the landscape, including the convergence of regulatory expectations, supply chain configurations, and technological advances in synthesis methods.

To appreciate the near-term and long-term trajectories of the small-molecule API market, it is essential to frame the scope of this analysis within the broader pharmaceutical ecosystem. Core drivers include the sustained demand for generics and new chemical entities, mounting pressures on cost containment, and evolving patient demographics that fuel therapeutic innovation. Regulatory bodies globally continue to refine quality and safety standards, driving throughput efficiency and compliance requirements in manufacturing operations. Equally important are the dynamic partnerships among drug originators, contract development and manufacturing organizations, and technology providers, which collectively determine access to capacity, speed to market, and overall resilience of the supply chain. This contextual foundation provides the necessary lens through which subsequent sections articulate the transformative shifts, tariff implications, segmentation insights, regional nuances, and strategic recommendations that define the current small-molecule API narrative.

Unraveling Transformative Shifts in Small-Molecule API Development Highlighting Technological Innovations, Regulatory Reforms, and Collaborative Ecosystem Dynamics

In recent years, the small-molecule API landscape has undergone an accelerated evolution driven by technological breakthroughs, reformulated regulatory frameworks, and a reconfigured ecosystem of collaboration. At the heart of this transformation is the adoption of continuous flow synthesis, which promises significant enhancements in reaction control, waste reduction, and scalability compared to traditional batch processes. Continuous flow reactors reduce reaction times and improve process safety, while enabling real-time monitoring and adjustment of critical quality attributes. These capabilities have catalyzed a shift toward intensified manufacturing, which in turn demands sophisticated automation, advanced analytics, and digital twins to replicate bench‐scale success at commercial volumes.

Moreover, regulatory authorities across major jurisdictions have introduced expedited review pathways and harmonized quality guidelines, stimulating investments in modular, flexible facilities designed for multi‐product use. As a result, manufacturers are embracing single-use technologies, advanced process control architectures, and cloud-based data management platforms to ensure both compliance and agility. Concurrently, cross‐sector partnerships are forging integrated value chains that extend from research through formulation and clinical supply, fostering co‐innovation models and risk‐sharing frameworks. Together, these technological, regulatory, and collaborative shifts have redefined capacity planning, cost structures, and strategic positioning of stakeholders in the small-molecule API arena.

Evaluating the Cumulative Impact of 2025 United States Tariff Measures on Small-Molecule API Supply Chains, Cost Structures, and Global Competitive Positioning

The implementation of revised United States tariff measures in early 2025 has introduced new variables into the global small-molecule API equation, with cascading effects on cost structures, supplier choices, and strategic sourcing models. By increasing duties on select precursor chemicals and finished APIs imported from key manufacturing regions, the policy recalibration has compelled both originators and contract manufacturers to reexamine their downstream cost assumptions and inventory buffers. As tariff differentials rise, the landed cost of goods may increase substantially, prompting firms to explore alternative suppliers, repatriate production, or negotiate long-term price agreements to hedge against volatility.

These changes have also tested the resilience of just‐in‐time inventory strategies that were optimized for minimal carrying costs prior to tariff escalation. In response, many small-molecule API stakeholders are diversifying their supplier bases across multiple geographies or investing in dual‐sourcing architectures that balance proximity to target markets with cost competitiveness. In parallel, strategic hedging practices and tariff mitigation schemes are being developed in collaboration with logistics partners to offset incremental duties. Ultimately, the 2025 tariff adjustments have crystallized the need for enhanced supply chain visibility, agile production networks, and proactive regulatory intelligence to navigate the evolving trade environment.

Illuminating Segmentation Insights across Production Technology, Therapeutic Use Cases, and End User Categories to Guide Strategic Market Engagement

A nuanced understanding of market segmentation reveals critical inflection points in small-molecule API development and commercialization strategies. Based on production technology, the market partitions into chemical synthesis, which itself bifurcates between traditional batch synthesis and advanced continuous flow operations, fermentation routes that leverage microbial or enzymatic catalysis, and semi‐synthetic pathways that combine natural feedstocks with chemical transformations. The selection among these methods dictates process complexity, cost profiles, and lifecycle management opportunities, requiring stakeholders to align technology investments with therapeutic pipeline needs.

When examined through the lens of therapeutic application, small-molecule APIs serve diverse clinical areas, including anti-infective treatments spanning antibiotics, antifungal agents, and antiviral compounds; cardiovascular therapies that encompass both anticoagulants and antihypertensives; and specialty domains such as dermatology, gastrointestinal health, neurology, oncology-with its subdivisions of chemotherapy, immunotherapy, and targeted therapy-and respiratory care. Each therapeutic segment carries distinct safety requirements, dosage form considerations, and commercial exclusivity windows, shaping the prioritization of production capacities and regulatory filings.

End user segmentation further delineates the landscape into biotechnology companies pioneering novel mechanisms of action, contract development and manufacturing organizations providing outsourced manufacturing expertise, and established pharmaceutical companies with integrated development and production capabilities. The interplay between these end user categories drives competitive dynamics, as biotech firms often pursue nimble alliances with CDMOs, while pharmaceutical companies may leverage internal platforms or strategic acquisitions to augment their API portfolios. Recognizing the synergies and tensions across these segmentation axes is essential for crafting targeted engagement and investment plans.

This comprehensive research report categorizes the Small-Molecule APIs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Technology

- Therapeutic Application

- End User

Examining Regional Dynamics Shaping Small-Molecule API Trends in Americas, Europe Middle East and Africa, and Asia-Pacific to Inform Market Engagement Approaches

Regional dynamics exert a profound influence on small-molecule API trends, reflecting variations in regulatory regimes, infrastructure maturity, and cost bases. Within the Americas, North America remains a hub for innovation and quality compliance, supported by world-class research universities and a network of CDMOs with specialized capabilities. Latin American markets are gradually expanding, driven by domestic generics manufacturing and localized demand for essential medicines, though they often face challenges in scale and regulatory harmonization.

Across Europe, the Middle East, and Africa, Western Europe continues to set benchmarks in process validation, environmental standards, and clinical trial integration, while Eastern European and Middle Eastern markets are emerging as competitive low-cost manufacturing centers with improving quality oversight. Africa presents a growing landscape for public health initiatives and international partnerships aimed at securing supply chains for critical small-molecule APIs.

In the Asia-Pacific region, China and India dominate output volumes, supplying a significant share of global generic APIs. Their rapid capacity expansions and cost efficiencies have reshaped global trade flows, even as recent policy shifts emphasize quality certifications and environmental compliance. Meanwhile, Japan, Korea, and Southeast Asian economies maintain advanced process capabilities and strong innovation pipelines, contributing to a diversified regional matrix that balances price, quality, and technological sophistication.

This comprehensive research report examines key regions that drive the evolution of the Small-Molecule APIs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Intelligence on Leading Small-Molecule API Manufacturers Including Their Innovation Pathways and Collaborative Ventures for Market Growth

Leading small-molecule API manufacturers continue to differentiate through targeted investments in high‐value chemistries, process intensification, and tailored customer collaborations. Several global CDMOs have announced tiered service platforms that integrate custom synthesis, analytical development, and regulatory consulting, aiming to deliver end‐to‐end solutions under unified quality management systems. Simultaneously, vertically integrated pharmaceutical companies are reinforcing their API divisions with specialized R&D units focused on next-generation delivery and impurity profiling, underscoring a shift toward in‐house innovation alongside outsourcing alliances.

Corporate partnerships and joint ventures have also proliferated, particularly among technology providers offering in situ process monitoring, machine learning‐enabled reaction prediction, and single‐use skids for modular plant installations. By coupling these capabilities with strategic alliances, manufacturers are accelerating process validation cycles and reducing time‐to‐clinical supply shipments. Additionally, leading players are exploring green chemistry principles to mitigate environmental footprints, adopting bio‐based feedstocks, and implementing solvent recycling. This collective thrust towards operational excellence and sustainability infrastructure highlights the competitive imperative to balance cost efficiency with regulatory compliance and environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Small-Molecule APIs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- AstraZeneca PLC

- Aurobindo Pharma Limited

- BASF SE

- Bristol-Myers Squibb Company

- Cambrex Corporation

- Catalent Inc.

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly and Company

- Evonik Industries AG

- GlaxoSmithKline PLC

- Hikma Pharmaceuticals PLC

- Johnson & Johnson Services Inc.

- Lonza Group AG

- Lupin Limited

- Merck & Co. Inc.

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Roche Holding AG

- Sanofi S.A.

- Siegfried Holding AG

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Delivering Actionable Strategic Recommendations to Propel Small-Molecule API Industry Leaders Towards Excellence and Sustainable Innovation Pathways

To capitalize on the identified market dynamics, industry leaders should prioritize investments in process modernization initiatives such as continuous flow and advanced analytics platforms, which can substantially reduce batch cycle times and enhance product consistency. Equally, deepening supplier relationships and pursuing dual or multi‐sourcing frameworks will bolster supply chain resilience against geopolitical shifts, tariff fluctuations, and raw material shortages. A parallel focus on digital transformation-encompassing end‐to‐end visibility through cloud‐based supply chain dashboards and AI‐driven demand forecasting-can further optimize inventory levels and operational agility.

On the innovation front, integrating cross‐disciplinary collaborations with biotech firms and academic research centers can unlock novel chemistries and expand therapeutic pipelines, especially in specialty and orphan indication segments. Embracing sustainable manufacturing practices, including solvent recovery systems and bio‐based reagents, will not only meet tightening environmental regulations but also resonate with increasingly eco-conscious stakeholders. Finally, establishing robust regulatory intelligence units and tariff mitigation task forces will enable proactive navigation of evolving trade policies and compliance landscapes, thus safeguarding profitability and market access.

Detailing the Robust Qualitative and Quantitative Research Methodology Underpinning Small-Molecule API Insights to Ensure Rigor and Data Integrity

This report synthesizes a multifaceted research methodology combining both primary and secondary data sources to achieve comprehensive analytical depth and reliability. Extensive secondary research involved reviewing industry journals, regulatory databases, patent filings, and corporate publications to map historical trends, technological adoption curves, and competitive positioning. This desk research was complemented by in‐depth primary interviews with senior executives from contract development and manufacturing organizations, regulatory experts, supply chain specialists, and academic thought leaders to validate emerging themes and gain forward‐looking perspectives.

Data triangulation was employed to cross-verify information across multiple sources, ensuring consistency between macroeconomic indicators, production capacity metrics, and application‐specific adoption rates. Quantitative analyses incorporated descriptive statistics and correlation assessments to elucidate relationships between technology uptake, regulatory changes, and market responsiveness. Qualitative insights were coded and synthesized to surface strategic themes, challenges, and best practices. Throughout the research process, strict protocols for data integrity and transparency were maintained, with clear documentation of assumptions, limitations, and potential areas for further investigation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Small-Molecule APIs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Small-Molecule APIs Market, by Production Technology

- Small-Molecule APIs Market, by Therapeutic Application

- Small-Molecule APIs Market, by End User

- Small-Molecule APIs Market, by Region

- Small-Molecule APIs Market, by Group

- Small-Molecule APIs Market, by Country

- United States Small-Molecule APIs Market

- China Small-Molecule APIs Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Imperatives from Small-Molecule API Analysis to Illuminate Future Trajectories and Optimized Decision Pathways

The collective analysis converges on several core findings: the ascendancy of advanced manufacturing technologies is reshaping cost and capacity paradigms; evolving regulatory and tariff landscapes necessitate proactive mitigation strategies; and nuanced segmentation across production methods, therapeutic applications, and end user categories unlocks precision targeting opportunities. From a regional standpoint, diversified market access strategies are essential to balance innovation leadership in mature markets with cost competitiveness in high-growth zones.

Strategic imperatives emerge around enhancing process flexibility, deepening collaborative innovation networks, and embedding environmental sustainability within core operational frameworks. Decision makers are encouraged to leverage these insights to prioritize capital allocation, streamline supply chain architectures, and align pipeline development with evolving quality and trade compliance benchmarks. By synthesizing quantitative rigor with qualitative nuance, this report equips stakeholders with the actionable intelligence needed to navigate an increasingly dynamic small-molecule API ecosystem.

Engage with Ketan Rohom to Secure Comprehensive Small-Molecule API Market Intelligence and Propel Strategic Growth through Tailored Research Solutions

The depth of this comprehensive analysis underscores the imperative for decision makers to leverage expert market intelligence in optimizing product pipelines and achieving sustained competitive advantage. To access the full suite of actionable insights, detailed segmentation breakdowns, and rigorous supply chain evaluations that will equip your team for strategic growth, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with an experienced industry liaison, stakeholders will gain bespoke support in translating research findings into high-impact commercialization strategies tailored to small-molecule active pharmaceutical ingredient initiatives. Engage today to secure the full market research report and unlock pathways to enhanced innovation, cost optimization, and global expansion.

- How big is the Small-Molecule APIs Market?

- What is the Small-Molecule APIs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?