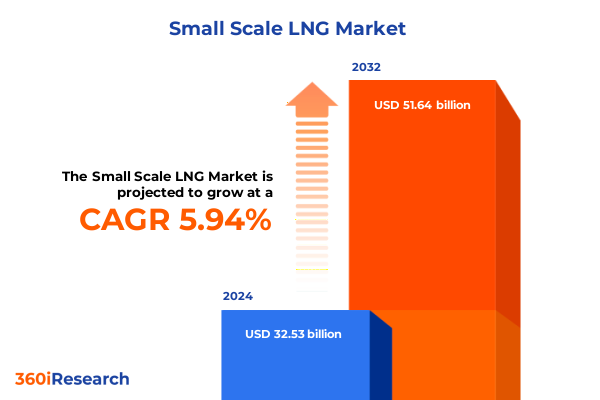

The Small Scale LNG Market size was estimated at USD 34.39 billion in 2025 and expected to reach USD 36.36 billion in 2026, at a CAGR of 5.97% to reach USD 51.64 billion by 2032.

Pioneering the Next Frontier in Small Scale LNG: Driving Operational Excellence and Sustainable Access Across Diverse Global Markets

Small scale liquefied natural gas has emerged as a pivotal solution to address evolving energy demands, regulatory pressures, and the drive for cleaner fuel alternatives. In recent years, decentralized liquefaction and regasification facilities have made it possible to deliver LNG to remote and off-grid locations that were previously reliant on diesel or other higher-emission fuels. This shift underscores the strategic importance of modular infrastructure capable of bridging gaps between supply basins and end-use markets. Moreover, environmental policies and corporate sustainability commitments are reinforcing the value proposition of LNG as a transitional fuel pathway toward a lower-carbon future.

Against this backdrop, stakeholders across the LNG value chain are prioritizing innovation in cryogenic storage, miniaturized liquefaction units, and turnkey distribution systems. These technological advances are complemented by evolving financing models, including project-specific joint ventures and public-private partnerships, which facilitate capital-efficient deployment. The confluence of technology, policy, and capital is redefining operational paradigms and unlocking new revenue models. In turn, this dynamic environment presents both challenges and prospects for operators, equipment suppliers, and regulators alike.

This executive summary distills the most critical developments shaping the small scale LNG landscape, offering a concise yet comprehensive overview of transformational trends, tariff impacts, segmentation nuances, regional dynamics, competitive positions, and actionable strategies. It serves as a strategic compass for decision-makers seeking to navigate the complexities of this rapidly evolving market and to harness its potential for sustainable growth.

Embracing Transformative Shifts: How Technological Advancements and Policy Evolution Are Redefining the Dynamics of Small Scale LNG Markets

The small scale LNG arena is undergoing profound shifts driven by both technological breakthroughs and regulatory reforms. Digitalization and the integration of advanced analytics are enhancing operational visibility across liquefaction and distribution assets, enabling predictive maintenance and optimizing throughput. At the same time, these innovations are supporting next-generation modular liquefiers that reduce CAPEX and improve scalability. Floating and skid-mounted units are facilitating rapid deployment, while enhanced cryogenic materials and insulation technologies are redefining safety and performance standards.

Concurrently, policy evolution is reshaping the competitive landscape. Tighter emissions mandates and carbon pricing mechanisms are elevating the appeal of LNG as a cleaner alternative, particularly in power generation and heavy-duty transport. Emerging frameworks for LNG bunkering are unlocking new maritime routes, and regional incentives are accelerating microgrid applications in remote communities. As a result, collaborative financing structures, such as blended public-private funds and strategic off-take agreements, are becoming the norm, empowering stakeholders to share risk and expedite project timelines.

Taken together, these converging trends are forging a new paradigm in small scale LNG, one that prioritizes flexibility, sustainability, and resilience. The capacity to adapt quickly to shifting regulatory requirements and technological frontiers is already distinguishing market leaders and will continue to define competitive success in the years ahead.

Examining the Cumulative Effects of Recent Tariff Adjustments in 2025: Navigating Trade Implications and Strategic Responses in Small Scale LNG

In 2025, the United States updated key tariff provisions affecting capital equipment and components essential for small scale LNG infrastructure. These adjustments, rooted in long-standing trade measures, have introduced incremental cost pressures across the supply chain. Equipment manufacturers and project developers are contending with increased duties on items ranging from high-grade steel to specialized cryogenic valves. This has prompted a comprehensive reassessment of procurement strategies, spurring a wave of supplier diversification and contract renegotiations to mitigate cost escalations.

Despite these headwinds, many industry participants are leveraging nearshoring and regional sourcing to stabilize lead times and maintain pricing discipline. Furthermore, collaborative alliances between engineering firms and local fabricators are emerging as creative solutions to navigate tariff complexity. By incorporating tariff clauses and hedging mechanisms into long-term agreements, stakeholders can preserve financial predictability and safeguard project viability.

Strategically, the shifting tariff landscape is also influencing cross-border trade flows. Exporters to neighboring markets are recalibrating their logistics networks to optimize customs treatment and duty exemptions. In turn, this realignment is fueling the development of new distribution corridors and intermediate storage hubs. While the cumulative impact of these tariffs demands vigilance, it has simultaneously catalyzed an era of supply chain innovation that will bolster resilience against future trade uncertainties.

Uncovering Key Segmentation Insights: Infrastructure, Terminal Types, Capacity, Installation Modalities, and Application Spectrum in Small Scale LNG

The small scale LNG market can be parsed through multiple segmentation lenses that reveal distinct operational and investment dynamics. When viewed by infrastructure type, core assets include distribution terminals, liquefaction terminals, regasification terminals, and storage facilities. Within storage, further granularity is provided by horizontal cryogenic tanks and vertical cryogenic tanks, each offering unique footprint, insulation, and maintenance profiles. Exploring terminal type yields insights into both offshore LNG terminals and onshore LNG terminals, where site selection, environmental permitting, and marine access become critical decision variables.

Capacity segmentation highlights the strategic trade-off between systems designed for less than 100 tonnes per day and those exceeding that threshold, with the former emphasizing mobility and agility, and the latter focusing on economies of scale. Installation type differentiates between fixed LNG stations, which integrate into permanent distribution networks, and mobile LNG stations, which deliver temporary or peak-shaving support to diverse end-users. Finally, application segmentation underscores the spectrum of uses spanning commercial, industrial, power generation, residential, and transport. Within the transport category, marine bunkering and road transport underscore the expanding role of LNG as a cleaner alternative for vessels and heavy-duty fleets.

Taken together, these segmentation dimensions provide a layered view of market opportunities and operational considerations. By understanding which combinations of infrastructure, capacity, and application drive value in specific regions or end-use cases, industry participants can better align their portfolios with evolving demand patterns.

This comprehensive research report categorizes the Small Scale LNG market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Facility Type

- Equipment

- Terminal Type

- Capacity

- Installation Type

- Application

Probing Critical Regional Dynamics in Small Scale LNG Adoption: Assessing the Drivers and Challenges Across Americas, EMEA, and Asia-Pacific

Regional dynamics in small scale LNG are shaped by a multitude of factors, from natural gas resource endowments to regulatory frameworks and logistical constraints. In the Americas, abundant shale gas reserves have fostered a robust midstream ecosystem that supports both domestic distribution and cross-border exports. Innovations in micro-liquefaction have enabled remote communities and industrial off-takers to secure LNG supplies independent of traditional pipeline networks.

Across Europe, the Middle East, and Africa, diversification and energy security imperatives are driving investment in continental regasification and re-liquefaction hubs. European coastal jurisdictions are advancing small scale LNG terminals to service maritime trade lanes and reduce reliance on pipeline imports. Meanwhile, Middle Eastern producers are expanding regional bunkering infrastructure to capture bunkering and re-export opportunities, leveraging their established liquefaction experience. In sub-Saharan markets, modular LNG solutions are accelerating the electrification of mining and rural off-grid initiatives.

In Asia-Pacific, rapid industrialization and urbanization are propelling demand for cleaner fuels. China and India are deploying mobile and fixed LNG stations to stabilize power generation and decarbonize transport corridors. Southeast Asian nations are collaborating on cross-border distribution networks, while Australia’s LNG export facilities are recalibrating to address small scale demand surges. These regional variations underscore the importance of aligning project design and service models with local market drivers and infrastructure realities.

This comprehensive research report examines key regions that drive the evolution of the Small Scale LNG market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Company Profiles and Competitive Dynamics Shaping Innovation and Collaboration in the Small Scale LNG Industry

Leading companies in the small scale LNG sector are distinguished by their ability to deliver integrated solutions across liquefaction, storage, and distribution. Equipment providers are forging joint ventures with engineering firms to co-develop modular cryogenic units that reduce supply chain complexity and speed up deployment. At the same time, technology licensors are partnering with local fabricators in key markets to ensure on-the-ground support and compliance with regional standards.

Service providers are also enhancing their value propositions by embedding digital twins and remote monitoring platforms into their offerings, enabling real-time performance tracking and proactive maintenance. Meanwhile, logistics specialists are collaborating with port authorities and shipping lines to establish dedicated bunkering corridors, thereby streamlining LNG marine refueling and positioning LNG as a competitive bunker fuel.

Across the board, strategic acquisitions are consolidating capabilities in project management, systems integration, and aftermarket services. Companies that combine manufacturing scale with engineering agility are best positioned to address bespoke client requirements and emerging niche applications. Looking ahead, those that cultivate cross-sector alliances-from airports seeking to decarbonize ground support equipment to municipalities pursuing carbon reduction targets-will set the pace for industry innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Small Scale LNG market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anthony Veder Group N.V.

- Avenir LNG Limited

- Black & Veatch Holdings

- Chart Industries, Inc.

- Chiyoda Corporation

- Engie SA

- Excelerate Energy, Inc.

- Exxon Mobil Corporation

- General Electric Company

- Honeywell International Inc.

- Hyundai Heavy Industries Co., Ltd.

- IHI Corporation

- Kawasaki Heavy Industries, Ltd.

- Linde PLC

- Mitsubishi Heavy Industries, Ltd.

- Nikkiso Cryogenic Industries

- PAO Novatek

- Petronet LNG Limited

- Royal Vopak N.V.

- Shell PLC

- Siemens AG

- Sofregaz S.A.

- Stabilis Solutions, Inc.

- Teekay Corporation

- TotalEnergies SE

- Wartsila Corporation

Actionable Strategic Recommendations for Industry Leaders to Accelerate Growth, Enhance Sustainability, and Strengthen Resilience in Small Scale LNG Operations

Industry leaders should prioritize the rapid adoption of digital solutions to enhance asset reliability and operational efficiency. By deploying advanced analytics and machine learning models, they can forecast maintenance needs and optimize throughput across decentralized liquefaction and regasification units. Furthermore, establishing federated data platforms with suppliers and offtakers will streamline collaboration and accelerate decision-making under volatile market conditions.

Investment in flexible, modular infrastructure will also be critical. Companies can leverage mobile LNG stations to address peak demand and trial new applications without incurring permanent facility costs. Simultaneously, fixed stations can be designed with expansion modules to accommodate future capacity increases. This dual-pronged approach enables both short-term responsiveness and long-term scalability.

To mitigate tariff and geopolitical risks, stakeholders are advised to diversify their supply chain through regional partnerships and bilateral agreements. Incorporating dynamic procurement clauses and leveraging local fabrication capabilities will help control costs and reduce lead-time uncertainties. Lastly, proactive engagement with policymakers and industry associations can shape conducive regulatory environments and unlock incentive programs that bolster small scale LNG adoption.

Exploring Rigorous Research Methods Combining Interviews, Secondary Data, and Triangulation to Deliver Clear Small Scale LNG Insights

This research draws upon a robust methodology that integrates qualitative and quantitative approaches to deliver reliable insights. Secondary intelligence was gathered from proprietary industry databases, regulatory filings, technical journals, and public policy documents to establish a foundational understanding of market drivers and technology trends. To validate and enrich these findings, expert interviews were conducted with senior executives, project managers, technology developers, and regulatory officials across key regions.

Data triangulation was employed at every stage, ensuring consistency between market observations, stakeholder perspectives, and empirical performance metrics. Primary insights were further corroborated through case study analyses of recent small scale LNG installations, where operational data and contractual structures were examined in depth. The result is a nuanced view that balances macro-level trends with granular, site-specific learnings.

Recognizing inherent limitations, the study accounts for potential biases in expert projections and acknowledges variability in regional reporting standards. Future updates will incorporate evolving policy landscapes and real-world performance data as small scale LNG applications continue to expand and mature.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Small Scale LNG market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Small Scale LNG Market, by Facility Type

- Small Scale LNG Market, by Equipment

- Small Scale LNG Market, by Terminal Type

- Small Scale LNG Market, by Capacity

- Small Scale LNG Market, by Installation Type

- Small Scale LNG Market, by Application

- Small Scale LNG Market, by Region

- Small Scale LNG Market, by Group

- Small Scale LNG Market, by Country

- United States Small Scale LNG Market

- China Small Scale LNG Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Summarizing Strategic Conclusions and Highlighting Opportunities to Propel Sustainable and Efficient Growth in Small Scale LNG Environments

The small scale LNG sector stands at a crossroads where innovation, policy, and market forces intersect to create unparalleled opportunities. By leveraging modular liquefaction technologies and digital monitoring platforms, stakeholders can optimize capital deployment and operational uptime. Simultaneously, regional tariff adjustments and evolving regulatory incentives underscore the importance of adaptive supply chain strategies and proactive policy engagement.

Segmentation analysis reveals that differentiated approaches based on infrastructure type, terminal classification, capacity thresholds, and application domains will drive value creation in distinct market niches. Meanwhile, regional dynamics-from the resource-rich Americas to the rapidly industrializing Asia-Pacific-demand tailored solutions that address local logistical, environmental, and economic considerations.

As industry participants refine their competitive postures, strategic partnerships, joint ventures, and targeted acquisitions will be essential to assemble end-to-end capabilities. The synthesis of these elements points to a future where small scale LNG plays a central role in energy diversification, decarbonization, and supply security. This conclusion should galvanize decision-makers to embrace a holistic, data-driven approach and to invest in the capabilities that will differentiate them in an increasingly competitive landscape.

Engaging Directly with Ketan Rohom for Tailored Small Scale LNG Insights and Exclusive Access to In-Depth Market Research Deliverables

Unlock the full depth of this comprehensive market research by contacting Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By partnering directly with Ketan, you can access bespoke data sets, customized insights, and tailored consulting services designed to address your unique challenges in small scale LNG. Whether you’re looking to benchmark your strategic roadmap, evaluate emerging markets, or refine your investment thesis, this exclusive engagement will equip you with actionable intelligence and practical frameworks. Reach out today to secure your organization’s competitive edge and translate these insights into measurable outcomes.

- How big is the Small Scale LNG Market?

- What is the Small Scale LNG Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?