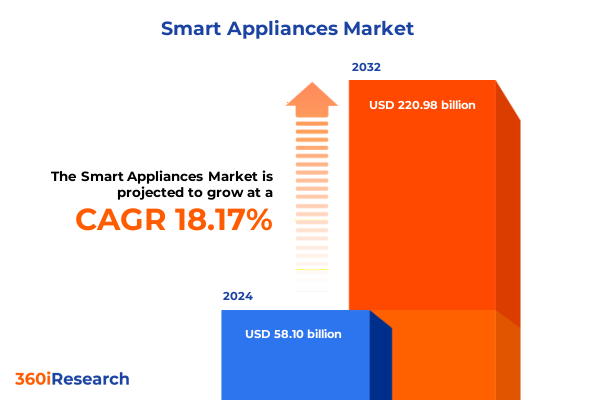

The Smart Appliances Market size was estimated at USD 68.21 billion in 2025 and expected to reach USD 80.19 billion in 2026, at a CAGR of 18.28% to reach USD 220.98 billion by 2032.

Exploring How Smart Appliances Are Revolutionizing Home Experiences Through Connectivity Intelligence and Sustainability Integration

The home is rapidly transforming from a collection of isolated appliances into an intelligent ecosystem that anticipates and adapts to the rhythms of daily life. Advances in connectivity, data analytics, and embedded intelligence are converging to create a new generation of smart appliances that optimize comfort, convenience, and energy efficiency without requiring constant user intervention. Today’s discerning consumers expect seamless integration across devices, intuitive voice and gesture controls, and personalized automation that can learn preferences over time. As homes become networked hubs of data generation, appliance manufacturers are under pressure to deliver products that not only perform their core functions but also integrate securely into broader platforms and ecosystems.

In response to these evolving expectations, industry stakeholders are investing heavily in artificial intelligence, Internet of Things frameworks, and sensor technologies that enable real-time monitoring and predictive maintenance. At the same time, global concerns around sustainability and rising energy costs are driving demand for appliances that optimize power usage, leverage renewable energy sources, and provide transparent feedback on environmental impact. This intersection of smart functionality and sustainable design marks a significant shift in how appliances are conceptualized, manufactured, and marketed. As the lines between traditional home appliances and consumer electronics continue to blur, the competitive landscape will reward those who can deliver intuitive user experiences underpinned by robust data security and interoperability.

Uncovering the Transformative Technological and Consumer Behavior Shifts Reshaping the Smart Appliances Ecosystem Globally

The last few years have witnessed a profound transformation in the smart appliances sector, driven by breakthroughs in artificial intelligence and the proliferation of connected sensors. Modern devices no longer rely on pre-programmed routines alone; instead, they leverage machine learning algorithms to anticipate user needs and adapt dynamically to changing conditions. For example, the latest generation of smart vacuums and air purifiers can map floor plans, identify high-traffic areas, and optimize cleaning cycles with minimal human input. Meanwhile, voice-activated assistants have evolved from simple command-execution platforms into contextual understanding engines that reduce friction and accelerate task completion.

Concurrently, interoperability standards such as the Matter protocol are unifying previously fragmented ecosystems, enabling appliances from competing brands to communicate seamlessly over common frameworks. This shift is reducing reliance on proprietary hubs and enhancing the consumer experience by simplifying setup and ensuring devices can share data securely across platforms. In addition, edge computing has begun to alleviate latency concerns by processing critical data locally, thereby improving responsiveness and safeguarding sensitive information. These technological strides are complemented by a growing emphasis on cybersecurity, with manufacturers integrating hardware-level encryption and blockchain-based trust chains to protect user data and preserve privacy.

At the same time, shifting consumer behaviors are catalyzing new product categories and service models. Wellness-oriented features, such as circadian lighting and advanced air quality monitoring, are gaining traction in health-conscious households. Furthermore, the rise of “invisible technology,” where devices blend into home aesthetics, reflects a growing desire for seamless integration rather than visible gadgetry. Together, these developments underscore a fundamental pivot: the smart appliances market is no longer defined solely by individual device capabilities but by holistic, data-driven experiences that anticipate and adapt to the unique needs of each household.

Assessing the Cumulative Impact of United States Tariff Measures on Smart Appliance Supply Chains Costs and Consumer Affordability in 2025

Since the introduction of broad-based import tariffs in mid-2018, smart appliance manufacturers have navigated an increasingly complex trade environment that has driven up component costs and disrupted established supply chains. Most notably, levies of up to 34 percent on sensors, thermostats, and other key electronic modules have compelled industry players to reevaluate sourcing strategies and absorb higher input costs, which are often passed through to consumers. These measures have also exacerbated parts shortages, as small production runs in alternative regions have struggled to meet sudden demand shifts while complying with varying tariff schedules.

In response, many leading brands have accelerated efforts to reshore or nearshore assembly operations, moving production from traditional Chinese hubs to Mexico, Southeast Asia, and other tariff-exempt zones. Although this geographic diversification offers a hedge against future tariff escalations, it has introduced new challenges related to workforce training, quality assurance, and logistics coordination. Additionally, disruptions to the global supply of specialty materials such as aluminum, steel, and printed circuit boards-each subject to its own duty rates-have further complicated manufacturing forecasts and extended lead times.

These cascading effects have also impacted research and development investment cycles. Companies facing margin compression have reallocated budgets toward compliance and supply chain risk mitigation, potentially delaying the rollout of next-generation products that incorporate advanced AI and IoT functionalities. As tariff landscapes remain unpredictable, strategic agility in sourcing and production planning will remain an imperative for sustaining long-term competitiveness and preserving price accessibility for end users.

Deriving Strategic Insights from Diverse Segmentation Criteria Spanning Appliance Types Technologies Connectivity Energy Sources and End Users

The smart appliances market encompasses a diverse array of product categories, each with unique performance requirements and consumer expectations. Home air conditioning and heating systems leverage advanced sensors and AI to modulate temperature and indoor air quality dynamically, whereas kitchen appliances such as smart ovens and coffee makers focus on culinary precision and intuitive user interfaces. Personal care devices, from app-enabled hair stylers to connected bathroom scales, illustrate how manufacturers are pushing intelligence into traditionally analog segments.

Underpinning these appliance types are core enabling technologies including artificial intelligence, machine learning, and voice-activated controls, which collectively drive the predictive capabilities that consumers now expect. The choice between wired and wireless connectivity options further determines the ease of installation and range of deployment scenarios, influencing adoption in retrofit applications versus new builds. Energy sourcing also varies, with solar-integrated refrigerators and battery-powered portable devices catering to off-grid and sustainability-focused consumers.

End-user segmentation highlights contrasting priorities between residential and commercial deployments. While homeowners emphasize convenience, aesthetic integration, and energy savings, hospitality and healthcare networks prioritize robustness, compliance with regulatory standards, and centralized fleet management. Finally, the rise of direct-to-consumer e-commerce channels complements traditional brick-and-mortar distribution, creating omnichannel ecosystems where digital marketplaces and in-store demonstrations jointly inform buyer decisions.

This comprehensive research report categorizes the Smart Appliances market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Appliance Type

- Technology

- Connectivity

- Energy Source

- End User

- Distribution Channel

Analyzing Regional Dynamics and Adoption Drivers across the Americas Europe Middle East Africa and Asia Pacific Smart Appliance Markets

In the Americas, smart appliance adoption is propelled by strong consumer demand for connected experiences and accessible financing options. Incentive programs and updated building codes in North America have accelerated the uptake of energy-efficient models, while large urban centers see rising interest in integrated home automation platforms that offer unified control across lighting, climate, and security.

Across Europe, Middle East, and Africa, regulatory mandates around energy labeling and eco-design have compelled manufacturers to enhance the power efficiency of smart refrigerators, dishwashers, and HVAC systems. The EU’s updated efficiency directives and the GCC’s focus on sustainable construction have both driven innovation in low-power sensor networks and demand-response features. In parallel, growing penetration of high-speed broadband and 5G networks in the region’s major economies has improved device interoperability and enabled remote diagnostics services.

Asia-Pacific distinguishes itself as both a major manufacturing hub and a rapidly maturing consumer market. China’s large installed base of smart appliances is complemented by aggressive product launches from local brands, while Japan and South Korea continue to push premium offerings with cutting-edge robotics and AI. Southeast Asia, buoyed by rising middle-class incomes, is witnessing a surge in entry-level smart devices that balance affordability with essential connectivity. These regional nuances highlight the importance of tailored product roadmaps and go-to-market strategies that respect local regulatory frameworks and consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Smart Appliances market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Competitive Landscape and Key Strategic Moves by Leading Smart Appliance Manufacturers Driving Innovation Partnerships and Market Expansion

Leading manufacturers are charting distinct pathways to differentiate their smart appliance portfolios. Samsung and LG have doubled down on proprietary AI platforms that optimize device interoperability within their branded ecosystems, offering features such as cross-device meal planning and coordinated energy draw for kitchen suites. Meanwhile, traditional appliance giants like Whirlpool and Electrolux are forging partnerships with technology firms to retrofit existing models with IoT modules, thereby expanding their serviceable installed bases.

New entrants are also reshaping competitive dynamics. Pure-play smart device companies, often backed by venture capital, specialize in niche categories-robotic vacuum cleaners, app-enabled air purifiers, and networked water sensors-and monetize via subscription-based data analytics and maintenance services. At the same time, consumer electronics firms such as Apple and Google are embedding home appliance controls into their operating systems and voice assistants, driving a platform-led approach that blurs the line between white goods and digital hardware.

Collaboration across the ecosystem has become increasingly common. Joint ventures between component suppliers, software developers, and utility providers aim to deliver turnkey energy management solutions that transcend individual devices. This collaborative ethos, combined with an emphasis on open standards, will continue to influence merger and acquisition activity as well as strategic alliances in pursuit of comprehensive smart home propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Appliances market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Dyson Direct Inc.

- Electrolux AB

- Godrej Enterprises Group

- Gree Electric Appliances Inc. of Zhuhai

- Haier Group Corporation

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Koninklijke Philips N.V.

- LG Electronics U.S.A. Inc.

- Midea Group Co., Ltd.

- Miele & Cie. KG

- Netatmo S.A.

- Panasonic Corporation

- Rinnai Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Siemens AG

- Sony Corporation

- V-ZUG Ltd.

- Vestel Ticaret A.Ş

- Voltas Limited

- Whirlpool Corporation

- Xiaomi Corporation

Formulating Actionable Strategies and Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in the Smart Appliances Sector

To capitalize on the intelligent home revolution, industry leaders should prioritize modular architecture in both hardware and software design, enabling rapid feature deployment and simplified maintenance updates. Embracing open interoperability standards will not only expand addressable markets but also reduce development costs associated with supporting multiple proprietary protocols.

Companies must also cultivate supply chain resilience by diversifying production footprints and forging strategic alliances with component vendors in tariff-friendly jurisdictions. Investing in advanced analytics for demand forecasting and dynamic inventory optimization will help mitigate the impact of trade uncertainties and parts shortages. Moreover, allocating R&D budgets toward energy harvesting sensors and low-power computing will address both consumer demand for sustainability and regulatory pressures around energy efficiency.

Building strong after-sales ecosystems-through subscription-driven maintenance services, predictive diagnostics, and integrated customer support platforms-can generate recurring revenue streams and reinforce brand loyalty. Finally, as data privacy concerns intensify, implementing transparent data governance frameworks and end-to-end encryption will differentiate brands that prioritize consumer trust.

Detailing Robust Research Methodology and Data Triangulation Approaches Underpinning the Smart Appliances Market Analysis with Expert Validation

This analysis is underpinned by a rigorous multi-phase research framework that integrates both primary and secondary data sources. In the first phase, structured interviews were conducted with senior executives from leading appliance manufacturers, IoT platform providers, and regulatory bodies to capture firsthand perspectives on market dynamics, technology roadmaps, and policy influences.

Complementing these qualitative insights, a comprehensive review of trade publications, patent filings, and industry reports was performed to map historical trends and validate emerging themes. Data triangulation techniques were applied to reconcile disparate information sets, ensuring consistency across forecast assumptions and competitive benchmarks.

Quantitative data points, such as shipment volumes, adoption rates, and technology penetration metrics, were synthesized from publicly available databases and proprietary industry subscriptions. All data inputs underwent a thorough validation process with an expert advisory panel comprising academic researchers, supply chain analysts, and field technicians. This methodological approach balances depth of insight with empirical rigor, providing stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Appliances market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Appliances Market, by Appliance Type

- Smart Appliances Market, by Technology

- Smart Appliances Market, by Connectivity

- Smart Appliances Market, by Energy Source

- Smart Appliances Market, by End User

- Smart Appliances Market, by Distribution Channel

- Smart Appliances Market, by Region

- Smart Appliances Market, by Group

- Smart Appliances Market, by Country

- United States Smart Appliances Market

- China Smart Appliances Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing Key Conclusions and Future Outlook for Stakeholders Navigating the Evolving Smart Appliances Industry Landscape

The convergence of AI, IoT, and sustainability imperatives is redefining the boundaries of the smart appliances industry. Manufacturers that can deliver intuitive, interoperable, and energy-efficient solutions will capture leadership positions in a market increasingly driven by platform value and integrated service offerings. Tariff-induced supply chain disruptions underscore the critical importance of strategic sourcing and adaptability, while regional variances in consumer behavior and regulatory landscapes call for customized go-to-market approaches.

As competition intensifies, the ability to harness data for predictive maintenance, personalized automation, and seamless user experiences will become a key differentiator. Collaboration between legacy appliance firms, technology innovators, and utilities will further shape the ecosystem, as will the adoption of common standards that simplify integration. Stakeholders who align their product strategies with evolving energy mandates and consumer expectations will unlock new revenue streams and foster lasting brand engagement.

Ultimately, the smart appliances market represents a dynamic intersection of hardware, software, and services. By leveraging the insights presented in this report, industry participants can chart a path toward sustainable growth and enduring customer value.

Engaging with Ketan Rohom Associate Director to Secure Comprehensive Market Intelligence and Strategic Insights in the Smart Appliances Report

For personalized guidance on how these insights can translate into strategic advantage, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will unlock a tailored discussion on the report’s findings, enabling you to align your product development, supply chain decisions, and go-to-market strategies with the most current market intelligence.

Seize this opportunity to deepen your competitive edge by acquiring the comprehensive smart appliances market research report. Connect with Ketan to explore licensing options, enterprise subscriptions, or bespoke data packages that meet your organization’s specific needs. Elevate your decision-making with unparalleled insights and ensure you stay at the forefront of industry innovation.

- How big is the Smart Appliances Market?

- What is the Smart Appliances Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?