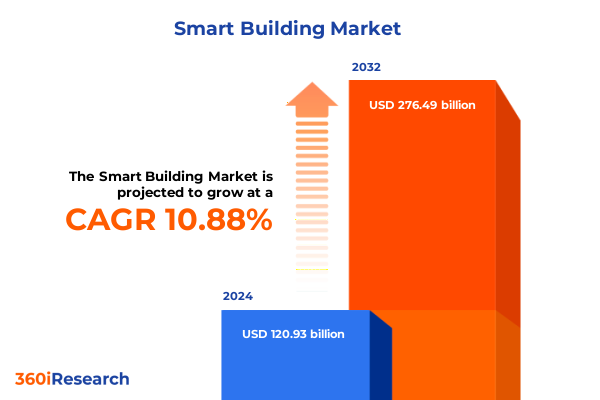

The Smart Building Market size was estimated at USD 131.99 billion in 2025 and expected to reach USD 144.06 billion in 2026, at a CAGR of 11.14% to reach USD 276.49 billion by 2032.

Setting the Stage for a New Era of Intelligent and Sustainable Building Infrastructure Fueled by Digital Innovation and Environmental Imperatives

In recent years, the convergence of digital technologies, environmental mandates, and stakeholder expectations has fundamentally redefined the architecture, management, and performance of built environments. Smart building ecosystems now rely on an intricate web of sensors, connectivity modules, and analytics engines to deliver operational efficiencies and align with corporate sustainability targets. From large-scale commercial offices to multifamily residences, facility managers are increasingly leveraging IoT-driven platforms to automate climate control, optimize lighting, and monitor energy consumption in real time.

The imperative for environmentally responsible design has accelerated adoption of green building practices, with major regulatory frameworks and incentive programs guiding the deployment of advanced automation systems. Meanwhile, evolving occupant expectations for healthy, adaptive spaces are pushing providers to integrate wellness-focused technologies, such as circadian lighting and enhanced air quality controls, into unified management platforms. As these trends converge, smart buildings emerge not only as operational assets but also as strategic enablers of resilience, productivity, and sustainability.

Exploring the Profound Technological and Operational Shifts That Are Revolutionizing How Buildings Are Designed, Managed, Secured, and Experienced Worldwide

The integration of artificial intelligence and machine learning is revolutionizing conventional building management by enabling predictive maintenance across critical infrastructure. Advanced HVAC control systems now analyze occupancy statistics and weather forecasts to adapt temperature and humidity settings proactively, reducing energy use and preventing unplanned equipment downtime.

Concurrently, the rise of cloud-native platforms and edge computing architectures has unlocked new levels of responsiveness and scalability in smart building operations. By distributing data processing workloads closer to sensors and control nodes, organizations can achieve sub-second latency for safety-critical applications such as elevator dispatch optimization and real-time security monitoring.

Accelerating environmental mandates are driving adoption of sustainable materials and energy management solutions. Innovative building envelopes incorporating phase change materials and adaptive facades help moderate thermal loads, while embedded energy harvesting technologies and advanced insulation systems contribute to marked reductions in carbon footprints and compliance with stringent decarbonization targets.

As occupants and organizations place greater emphasis on health and well-being, smart buildings are embedding wellness technologies directly into system architectures. From circadian lighting that supports natural sleep-wake cycles to AI-enabled air filtration systems that continuously monitor and purify indoor air quality, building ecosystems are evolving to prioritize occupant comfort, productivity, and safety at every level of service delivery.

With the increasing interconnectivity of devices and control systems, cybersecurity has become a paramount concern for stakeholders overseeing smart infrastructure. Recent industry research indicates that over a quarter of businesses encountered attacks on operational systems within the past year, underscoring the need for zero-trust frameworks and standardized security certifications that validate device resilience against emerging threats.

Assessing the Far-Reaching Consequences of the Latest 2025 United States Tariff Actions on Building Automation, Hardware, and Industry Supply Chains

In mid-2025, U.S. construction and infrastructure sectors are contending with a renewed wave of protectionist measures, as proposed tariff levies of up to 50% on steel, aluminum, and copper aim to shield domestic producers but risk adding as much as 10% to material expenses for building projects, depending on project scale and geographic location.

The smart building component supply chain, heavily reliant on global manufacturing hubs, faces acute disruption from recent tariff expansions, including a 125% levy on select Chinese imports. This has compelled several manufacturers to reassess offshore production strategies, raising the specter of increased product prices and dampened sales promotions at a time when affordability already challenges mass adoption.

Major industry suppliers have begun passing these costs directly to customers, as evidenced by a recent announcement of a 3.2% surcharge on building automation, fire safety, security, HVAC, and energy management products, implemented to offset new tariff burdens and maintain operational continuity.

Builders and developers report that, on average, material suppliers have raised their prices by over 6%, contributing to an estimated increase of nearly $11,000 in per-unit construction costs. Such surges exacerbate project budget scrutiny and may compel stakeholders to explore alternative sourcing strategies or design modifications to preserve margin targets.

Beyond immediate cost pressures, the protracted uncertainty surrounding tariff policy has disrupted R&D timelines and innovation roadmaps, as firms reallocate development budgets to manage procurement volatility. These conditions have sparked interest in reshoring or nearshoring manufacturing operations, though higher labor and logistics costs may neutralize anticipated efficiencies in the medium term.

Uncovering Segmentation Insights That Illuminate How Diverse Components, Applications, Deployments, and Connectivity Models Shape the Smart Building Market

Analyzing the market through a component lens reveals distinct growth vectors anchored in hardware, services, and solutions. Hardware segment evolution is driven by advances in actuators that deliver precise motion control, next-generation control systems that integrate multi-protocol architectures, and sensor networks that capture granular environmental data. Concurrently, service offerings-from expert consulting engagements that guide digital roadmaps to holistic support and maintenance agreements, and full-scale system integration and deployment projects-are becoming indispensable for executing complex rollouts. On the solutions front, comprehensive building automation ecosystems encompass modular facility management software, advanced fire safety systems, and intelligent elevator controls, while energy management platforms unify monitoring, HVAC control, and smart lighting, and infrastructure management suites integrate access control, emergency communications, intrusion detection, and surveillance into cohesive security networks.

The dichotomy between new construction and retrofit projects also shapes solution design and investment decisions. In greenfield developments, stakeholders can embed IoT frameworks and cloud architectures from project inception, whereas retrofit initiatives demand tailored integration approaches that harmonize existing building systems with modern automation technologies, balancing performance gains against installation complexity.

Connectivity preferences underscore the importance of network topology in smart building deployments. Wired installations continue to anchor mission-critical backbones, delivering deterministic performance and robust security guarantees, while wireless modalities-particularly Bluetooth, Wi-Fi, and Zigbee protocols-are gaining traction for their ease of deployment, scalability, and support for mobile and occupant-centric applications.

Application segments reflect the nuanced needs of commercial, industrial, and residential end users. Within commercial environments-spanning educational campuses, healthcare facilities, hospitality venues, corporate offices, and retail complexes-there is a pronounced emphasis on occupant experience, uptime, and compliance. Industrial settings such as factories, manufacturing plants, and distribution warehouses prioritize operational continuity, predictive maintenance, and energy optimization. Meanwhile, residential settings, from apartment complexes and multifamily dwellings to bespoke smart homes, increasingly adopt integrated HVAC, lighting, and security suites designed for seamless user engagement and remote management.

Finally, deployment models oscillate between cloud-based platforms that offer rapid scalability, centralized updates, and advanced analytics capabilities, and on-premises solutions that appeal to organizations with stringent data sovereignty requirements or limited network connectivity, highlighting an ongoing trade-off between operational agility and control.

This comprehensive research report categorizes the Smart Building market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity

- Deployment

- Building Type

- Application

- End-User

Revealing Key Regional Dynamics and Growth Opportunities Across the Americas, Europe Middle East & Africa, and the Asia-Pacific Smart Building Ecosystems

In the Americas, innovation is driven by robust government incentives and a vast base of early adopters seeking to decarbonize building portfolios. The United States leads with landmark policies such as the Inflation Reduction Act spurring investment in energy management solutions, while Canada’s stringent building codes are catalyzing demand for next-generation automation and sensor networks.

Across Europe, Middle East, and Africa, diverse market dynamics are at play. European Union regulations on energy performance and carbon reporting have positioned the region as a global incubator for sustainable building technologies, with Germany and the Nordic countries at the forefront. In the Middle East, high-profile infrastructure projects in the Gulf Cooperation Council nations are integrating AI-powered smart city initiatives, and in Africa emerging economies are beginning to incorporate automation in commercial and institutional developments despite nascent market maturity.

The Asia-Pacific region is experiencing rapid adoption, with established markets like Japan and Australia embracing digital twins and IoT ecosystems, and China driving scale through government-led smart city programs. Southeast Asian economies actively pursue modernization of legacy building stocks through public-private partnerships, while South Korea’s focus on 5G-enabled infrastructure and India’s push for affordable urban housing are shaping distinct trajectories in smart building deployment.

This comprehensive research report examines key regions that drive the evolution of the Smart Building market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations from Leading Global Players Driving Transformational Change in the Smart Building Industry

Honeywell’s recent financial performance underscores its strategic emphasis on building automation as a core growth engine. With second-quarter 2025 revenues exceeding projections and year-over-year expansion in building automation segment orders, the organization’s planned corporate restructuring aims to sharpen its focus on automation, aerospace, and advanced materials and to accelerate delivery of its new Advanced Control for Buildings platform that combines cybersecurity, machine learning, and network-agnostic connectivity.

Johnson Controls continues to refine its OpenBlue digital ecosystem and legacy Metasys portfolio under new leadership, as evidenced by raised profit forecasts and a leadership transition that highlights the company’s increasing integration of AI-driven analytics within its HVAC and security infrastructure offerings. Strategic divestitures of non-core assets have streamlined operations and enabled focused investment in cloud-native and edge-enabled building management solutions.

Siemens Smart Infrastructure has responded to market demand by raising mid-term profit margin targets for its Smart Infrastructure business and doubling digital revenue ahead of schedule, leveraging its Building X platform, Wireless Plug and Play Automation Bundles, and a series of strategic acquisitions to fortify its position in electrification, decarbonization, and data-center infrastructure. Partnerships with cloud leaders like Microsoft enhance IoT interoperability and drive standardized adoption of open protocols.

Beyond the legacy giants, a cadre of specialized technology providers and startups are carving niche opportunities in space-optimization analytics, AI-based occupancy sensing, and blockchain-enabled energy trading, challenging incumbents with focused innovation and collaborative business models that emphasize rapid prototyping and customizable integration services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Building market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aquicore, Inc. by Information Grid Ltd.

- Arup Group Ltd.

- Cisco Systems, Inc.

- CohesionIB, Inc.

- EcoEnergy Insights by Carrier Global Corporation

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Development LP

- Hitachi, Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Infineon Technologies AG

- Intel Corporation

- International Business Machines Corporation

- Johnson Controls International PLC

- KMC Controls, Inc.

- L&T Technology Services Limited

- Legrand S.A.

- Metrikus Limited

- Microsoft Corporation

- Mitsubishi Corporation

- Mode Green Integrated Building Technology

- mySmart Pty Ltd.

- Nippon Telegraph and Telephone Corporation

- PointGrab Inc.

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG

- Verdigris Technologies, Inc.

- Verizon Communications Inc.

- Wipro Limited

Delivering Actionable Recommendations on Resilient Technology Adoption, Cybersecurity Enhancement, and Sustainability Strategies to Guide Industry Leaders

To maintain competitive advantage, organizations should prioritize deployment of integrated AI-powered building management platforms that unify HVAC, lighting, and security controls, enabling predictive maintenance and dynamic energy optimization that have been shown to reduce operational costs by up to 30% in pilot deployments.

Given the escalating frequency of cyber incidents targeting building infrastructure, adopting a zero-trust security framework and leveraging emerging certification schemes, such as the U.S. Cyber Trust Mark, can significantly mitigate exposure and ensure continuous compliance with evolving regulatory benchmarks.

To buffer against future tariff or geopolitical disruptions, decision-makers should diversify their supply chain geography by sourcing critical components across multiple regions and exploring nearshoring options while maintaining flexible contractual structures that accommodate shifting trade policies.

Stakeholders must align technology roadmaps with prevailing sustainability incentives and ESG mandates by integrating connectivity-based decarbonization tools and lifecycle analytics, ensuring optimal qualification for federal and state rebate programs and unlocking long-term value creation.

A successful digital transformation depends on equipping facility teams with skills in data analytics, cybersecurity, and IoT integration. Organizations should establish cross-functional governance structures and invest in targeted training programs that foster collaboration between IT, operations, and sustainability departments, mirroring best practices observed in companies deploying connected technologies for emissions management.

Detailing a Robust Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Triangulation to Ensure Rigor and Credibility

Our research methodology combined rigorous secondary research with extensive primary validation to ensure depth, accuracy, and objectivity. We conducted a thorough review of publicly available data, including government regulations, industry association publications, and reputable news sources, to build a comprehensive foundation of market context. This was supplemented by analysis of technical white papers and product launch announcements to capture emerging technology trends and vendor strategies.

To validate and enrich these insights, we conducted structured interviews with senior executives, facilities managers, and solution providers across multiple geographies. Responses were synthesized using a triangulation approach, cross-referencing quantitative data with qualitative feedback to identify consistent patterns and actionable findings. Finally, we applied a defined segmentation framework-covering component, building type, connectivity, application, and deployment-to organize insights and maintain clarity in our analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Building market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Building Market, by Component

- Smart Building Market, by Connectivity

- Smart Building Market, by Deployment

- Smart Building Market, by Building Type

- Smart Building Market, by Application

- Smart Building Market, by End-User

- Smart Building Market, by Region

- Smart Building Market, by Group

- Smart Building Market, by Country

- United States Smart Building Market

- China Smart Building Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Perspectives on How Digital Innovation, Sustainability Imperatives, and Regulatory Dynamics Are Shaping the Future of Smart Building Ecosystems

As the smart building industry evolves, the interplay of digital innovation, environmental stewardship, and regulatory imperatives is set to redefine the future of built environments. Organizations that master the convergence of AI-driven automation, sustainable materials, and cybersecurity resilience will secure a competitive edge and meet the demands of increasingly sophisticated stakeholders.

Looking ahead, market success will hinge on adaptive strategies that integrate emerging technologies, leverage regional incentives, and fortify global supply chains against geopolitical disruptions. By embracing a holistic approach that balances agility with governance and fosters collaboration across functional and geographic boundaries, industry leaders can architect a future where smart buildings not only operate more efficiently but also contribute to broader societal and environmental goals.

Reach Out to Ketan Rohom to Access This Comprehensive Smart Building Research Report and Propel Your Organization’s Strategic Decision-Making Forward

To access the full suite of in-depth analyses, proprietary data models, and expert insights presented in this smart building market research report, reach out directly to Ketan Rohom. Leveraging his role as Associate Director of Sales & Marketing and his deep understanding of industry needs, Ketan can guide you through tailored licensing options, enterprise subscriptions, and bespoke consulting packages. Connect with Ketan to secure your organization’s strategic advantage and accelerate informed decision-making with this comprehensive resource.

- How big is the Smart Building Market?

- What is the Smart Building Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?