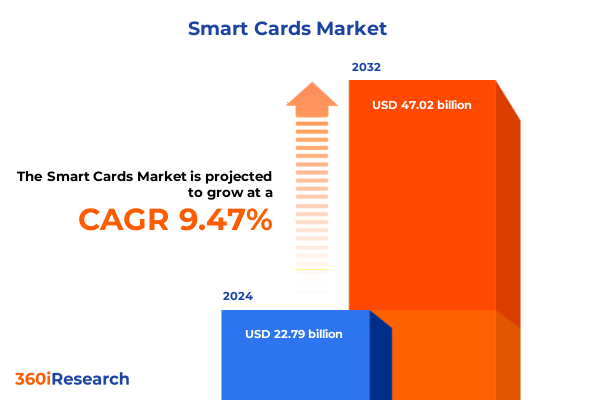

The Smart Cards Market size was estimated at USD 24.95 billion in 2025 and expected to reach USD 27.21 billion in 2026, at a CAGR of 9.47% to reach USD 47.02 billion by 2032.

Establishing the Pivotal Role of Smart Cards in Enhancing Secure Digital Transactions and Identity Management Ecosystems Across Industries

Smart cards have evolved from simple memory cards to highly sophisticated secure elements that underpin modern digital ecosystems. As these technology-driven credentials become integral to everything from payment solutions to national identification programs, their role in safeguarding sensitive information and enabling trusted interactions has never been more critical. Stakeholders across financial services, government agencies, telecommunications providers, and transportation networks are increasingly relying on smart cards to deliver seamless authentication, protect against fraud, and comply with stringent regulatory requirements.

In today’s dynamic environment, decision-makers must navigate a landscape shaped by rapid technological advancements, shifting regulatory regimes, and complex global supply chains. This executive summary provides a concise yet comprehensive overview of the transformative forces at play, the implications of recent United States tariffs, detailed segmentation and regional analyses, competitive intelligence on leading solution providers, and actionable recommendations for industry leaders. It sets the stage for deeper exploration in the full report, offering a clear framework to drive strategic planning and investment decisions in the smart card domain.

Unraveling the Technological and Market Evolution Driving Next Generation Smart Card Adoption and Integration Across Diverse Sectors Globally

Over the past several years, the smart card industry has undergone a profound metamorphosis, driven by the convergence of contact and contactless technologies and the rise of dual interface solutions that accommodate both encrypted chip access and near-field communication. This shift has unlocked new use cases, such as mobile wallet integration and secure IoT authentication, transforming cards from single-function devices into multi-application platforms. In parallel, advances in secure element hardware have enabled the embedding of biometric sensors, while cryptographic accelerators facilitate on-card encryption and blockchain-based identity verification, elevating the security posture of smart card–enabled systems.

Moreover, the proliferation of digital services has intensified demand for versatile form factors that support memory-only credentials for low-risk applications and microprocessor-based chips for high-assurance environments. These technological shifts have converged with evolving consumer expectations for frictionless experiences, prompting solution providers to innovate across operating systems-from standardized Java Card environments and Multos architectures to custom proprietary stacks tailored for niche applications. Collectively, these changes are redefining how issuers, integrators, and enterprises approach smart card deployment, ushering in a new era of secure, interoperable, and user-centric credential management.

Analyzing the Ripple Effects of 2025 United States Tariff Policies on Smart Card Supply Chains Component Costs and Industry Competitiveness Landscape

In early 2025, the United States expanded its tariff regime to include a broader range of semiconductor components and secure element microchips commonly used in smart cards. These measures, implemented under new Section 301 actions, have introduced additional import duties on both memory-only chipsets and more sophisticated microprocessor units. Consequently, suppliers sourcing from key manufacturing hubs have faced elevated input costs, prompting many to reassess their global procurement strategies and supply chain configurations.

The cumulative effect of these tariff adjustments has been an upward pressure on card module pricing, compelling issuers and solution integrators to absorb or pass on costs to end users. Some market participants have accelerated efforts to localize production through partnerships with domestic foundries, while others are diversifying their component portfolios by engaging alternative suppliers in tariff-exempt jurisdictions. Additionally, several industry associations have initiated dialogue with policymakers to seek temporary exemptions for security-critical hardware, arguing that over-burdensome duties could undermine national cybersecurity objectives. As a result, market dynamics in 2025 reflect a tension between cost containment imperatives and the imperative to maintain the highest levels of on-card security.

Deriving Strategic Intelligence from Technology Application End User and Operating System Segmentation to Navigate Smart Card Market Complexities

A nuanced understanding of technology segmentation reveals that smart card deployments vary significantly by interface type. Contact cards continue to thrive in environments needing straightforward memory storage, while microprocessor-based contact modules underpin more security-demanding applications. Meanwhile, the rise of contactless credentials, leveraging both RFID protocols for physical access control and NFC standards for secure payment and mobile interactions, illustrates the diversity of deployment scenarios. Dual interface modules, which unify contact and contactless functionalities, are emerging as a premium offering for issuers seeking maximum flexibility.

Examining application segmentation shows that identification remains foundational, with driver licenses, employee badges, healthcare credentials, and national identity schemes all requiring tailored security models. Network security use cases, such as secure network access and enterprise authentication, rely heavily on programmable chips capable of advanced cryptographic operations. The payments domain continues to be dominated by credit, debit, and prepaid offerings, each demanding compliance with global standards like EMV. From an end-user perspective, banking institutions leverage smart cards to mitigate fraud, government agencies deploy them for citizen ID programs, telecom operators utilize embedded SIMs for subscriber management, and transportation authorities implement them for fare collection and access control.

Operating system choices further differentiate market approaches. Java Card remains the de facto standard for multi-application environments due to its portability and robust developer ecosystem. Multos offers high‐assurance security features favored by governments and large enterprises. Proprietary OS platforms provide customizability for companies prioritizing unique security architectures or specialized functionality. Together, these segmentation insights underscore the complexity of the smart card market and highlight the need for solution strategies that align technology capabilities with specific application and user requirements.

This comprehensive research report categorizes the Smart Cards market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Application

- End User

Interpreting Key Dynamics Shaping Smart Card Deployment and Uptake Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics in the Americas are shaped by ongoing EMV migration programs and the expansion of contactless payment infrastructure across both mature and emerging markets. In North America, increasing issuance of dual interface cards is driven by integration with digital wallets and mobile device ecosystems, while Latin American governments are deploying secure national ID cards to bolster public services and streamline social welfare distribution.

Within Europe, the Middle East, and Africa, regulatory harmonization efforts are advancing the adoption of digital identity frameworks that leverage multi-protocol smart cards. High interoperability standards in Western Europe support cross-border travel documents and unified payment schemes, whereas Middle Eastern nations are investing heavily in contactless transport ticketing systems. In Africa, pilot projects for biometric-enabled national IDs are accelerating, underpinned by partnerships between international technology providers and local governments.

The Asia-Pacific region exhibits the highest growth velocity, driven by widespread acceptance of mobile payment platforms that complement RFID and NFC-based smart card solutions. Markets in East Asia have pioneered embedded SIM deployments for cellular IoT, while Southeast Asian transportation networks increasingly rely on interoperable smart card ticketing. Governments across the region are also initiating large-scale e-health identity programs, underscoring the versatility of smart cards as a secure credential across both public and private sectors.

This comprehensive research report examines key regions that drive the evolution of the Smart Cards market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leading Smart Card Manufacturers and Solution Providers to Highlight Differentiated Strategies Partnerships and Technological Innovations

Leading smart card manufacturers and solution providers are differentiating through innovation in secure element design, strategic partnerships, and vertical integration across the value chain. One prominent player has focused on advancing multi-application chip architectures that support biometric authentication and on-card blockchain key management, thereby enabling new identity as a service offerings. Another global supplier has pursued strategic alliances with mobile network operators to embed secure elements within eSIM platforms, catalyzing growth in cellular IoT security.

Several semiconductor firms are strengthening their competitive positions by expanding wafer fabrication capabilities in regions less affected by tariff constraints, ensuring supply continuity for memory and microprocessor modules. Concurrently, system integrators are constructing end-to-end solutions that combine hardware, middleware, and cloud-based credential management platforms, offering comprehensive identity, access management, and payment suites. A few niche vendors maintain leadership in proprietary operating systems optimized for high-security government applications, securing long-term contracts for national ID and passport programs. Overall, these company-level strategies reflect a dual emphasis on technological differentiation and supply chain resilience to meet the diverse requirements of global smart card stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Cards market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atos SE

- CPI Card Group Inc.

- Eastcompeace Technology Co., Ltd.

- Gemalto N.V.

- Giesecke+Devrient GmbH

- HID Global Corporation

- IDEMIA

- Infineon Technologies AG

- Inteligensa

- Kona I Co., Ltd.

- Morpho

- NXP Semiconductors N.V.

- Oberthur Technologies

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Thales Group

- Toshiba Corporation

- Watchdata Technologies

Defining Actionable Strategic Imperatives for Industry Stakeholders to Capitalize on Smart Card Market Opportunities and Mitigate Emerging Regulatory Technical Risks

Industry leaders should prioritize diversification of their supply base to mitigate tariff-related cost fluctuations while ensuring uninterrupted access to critical chipsets. Engaging alternative manufacturing sites and forging alliances with regional foundries will help stabilize component pricing and strengthen resilience against policy shifts. Equally important is active participation in international standards bodies to influence emerging NFC and RFID protocols, ensuring interoperability and reducing integration risks for end users.

Organizations must also accelerate investment in dual interface and biometric-capable modules to address escalating demand for seamless yet secure authentication across physical and digital channels. By developing modular operating environments-whether based on Java Card, Multos, or proprietary frameworks-issuers can streamline application deployment and future proof their credential portfolios. Finally, establishing collaborative partnerships with cloud identity providers and mobile wallet platforms will enhance value propositions, enabling a holistic ecosystem where smart cards, mobile devices, and backend services coalesce into unified identity, payment, and access management solutions.

Outlining Rigorous Research Approaches Data Collection Techniques and Analytical Frameworks Employed to Ensure Robust Smart Card Market Intelligence Findings

This research synthesizes insights derived from a multi-pronged methodology combining extensive secondary research with targeted primary interviews. The secondary component encompassed a thorough review of industry publications, regulatory filings, patent databases, and technical white papers to map out technology trends, tariff policy developments, and competitive benchmarks. Primary data was collected through structured interviews with C-level executives, product managers, and technical specialists from leading card manufacturers, system integrators, and end-user organizations across key regions.

Data triangulation techniques were applied to validate findings and reconcile discrepancies across sources, ensuring the accuracy and reliability of the analysis. Segmentation frameworks were developed through iterative workshops with subject matter experts, aligning technology, application, end-user, and operating system categorizations with real-world deployment scenarios. Quality assurance protocols included peer reviews by independent analysts and validation checks against publicly available case studies and pilot project results. This rigorous approach underpins the credibility of the report’s conclusions and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Cards market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Cards Market, by Technology

- Smart Cards Market, by Application

- Smart Cards Market, by End User

- Smart Cards Market, by Region

- Smart Cards Market, by Group

- Smart Cards Market, by Country

- United States Smart Cards Market

- China Smart Cards Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Takeaways to Illuminate the Future Trajectory and Value Creation Potential of Smart Card Technologies and Ecosystems

In summary, the smart card industry stands at the intersection of heightened security demands, evolving user expectations, and fluctuating trade policies. Technological advances in dual interface modules, embedded biometrics, and secure operating environments are unlocking novel applications across payments, identity management, network security, and beyond. However, the imposition of new tariffs in 2025 has introduced cost pressures that are reshaping supply chain strategies and driving a renewed focus on regional manufacturing and procurement resilience.

By leveraging detailed segmentation insights, tapping into diverse regional growth drivers, and studying leading companies’ strategic maneuvers, stakeholders can chart pathways to value creation in this complex ecosystem. The actionable recommendations outlined herein provide a roadmap for balancing innovation, security, interoperability, and cost efficiency, thereby ensuring that smart cards remain a lynchpin technology in the global digital transformation journey.

Partner with Ketan Rohom to Secure Comprehensive Smart Card Market Intelligence and Empower Data Driven Decisions Through Customized Research Engagements

I invite you to connect with Ketan Rohom to explore how a tailored smart card market intelligence engagement can accelerate your strategic vision. By partnering directly with our Associate Director of Sales & Marketing, you gain access to exclusive insights that go beyond standard reports, incorporating bespoke analysis aligned with your operational priorities. This engagement will empower your organization with actionable data, competitive benchmarking, and scenario planning tools designed to inform every phase of your product roadmap and market entry strategy. Reach out to schedule a personalized consultation and secure a comprehensive research package that will position your team at the forefront of smart card innovation and adoption.

- How big is the Smart Cards Market?

- What is the Smart Cards Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?