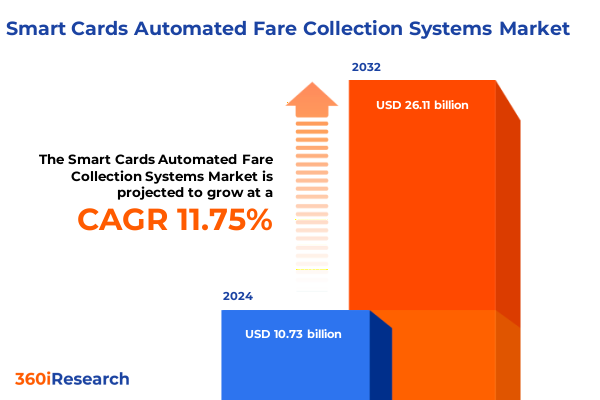

The Smart Cards Automated Fare Collection Systems Market size was estimated at USD 12.01 billion in 2025 and expected to reach USD 13.26 billion in 2026, at a CAGR of 11.73% to reach USD 26.11 billion by 2032.

Harnessing Advanced Smart Card Fare Collection Technologies to Streamline Transit Operations and Enhance Passenger Experience Across Urban Networks

The evolution of fare collection systems has entered a new era, propelled by the integration of advanced smart card technologies. Once limited to traditional magnetic stripe or paper-based tickets, transport networks are now adopting dynamic electronic fare media to address growing passenger expectations and operational demands. As urban centers strive to enhance service reliability and reduce costs, automated fare collection systems leveraging smart cards have become indispensable assets for transit authorities and operators.

In recent years, the convergence of secure microprocessor cards, contactless interfaces, and robust back office infrastructures has redefined how passengers access services. These systems not only accelerate boarding times and minimize queues but also provide real-time data analytics that empower agencies to forecast peak loads and optimize resource allocation. Moreover, enhanced encryption and security management capabilities guard against cloning and fraud, safeguarding revenue streams and reinforcing public trust in digital ticketing solutions.

Looking ahead, seamless integration with mobile wallets and open-loop EMV applications is set to blur the lines between closed-loop transit cards and bank-grade contactless payments. This progression underscores the critical role that smart card fare collection systems play in facilitating omnichannel experiences, where passengers enjoy frictionless travel across buses, metros, ferries, and rail without the need for separate ticketing media. Consequently, decision-makers must embrace these technological advancements to usher in a new standard of convenience, security, and efficiency across urban transportation networks.

Navigating the Technological and Regulatory Shifts Reshaping Smart Card Fare Collection for Modern Transportation Systems

The landscape of automated fare collection is undergoing transformative shifts driven by rapid technological innovation and evolving regulatory frameworks. Contactless communication standards such as NFC and RFID have matured significantly, enabling faster transaction speeds and broader ecosystem compatibility. At the same time, Bluetooth Low Energy (BLE) protocols are gaining traction to facilitate secure mobile ticketing, offering passengers an alternative to plastic cards and paving the way for device-agnostic fare media.

Simultaneously, policymakers are encouraging open-loop payment architectures, allowing the use of bank-issued credit and debit cards directly at fare gates and validators. This regulatory encouragement is redefining traditional procurement strategies, prompting transit agencies to modernize infrastructure and adopt flexible middleware platforms that bridge legacy systems with cloud-based service models. The resulting interoperability not only simplifies integration but also fosters greater inclusivity by accommodating a wider range of payment options.

Moreover, the rise of smart city initiatives is incentivizing the convergence of fare collection with broader urban mobility services, from parking management to access control. Municipal stakeholders are prioritizing data interoperability standards and API-driven ecosystems, accelerating the development of unified mobility-as-a-service (MaaS) platforms. Together, these developments are reshaping competitive dynamics, compelling vendors to deliver scalable, secure, and future-proof solutions capable of sustaining evolving passenger expectations.

Understanding Recent United States Tariff Measures Transforming the Supply Chain Dynamics of Smart Card Fare Collection Ecosystems

United States tariff measures enacted in recent years have introduced new cost variables into the supply chains supporting smart card automated fare collection systems. Imposed on imported components ranging from smart card semiconductors to card readers and middleware licenses, these duties have driven procurement teams to reassess vendor portfolios and diversify sourcing strategies. The cumulative impact has manifested in extended lead times, as manufacturers recalibrate production footprints to mitigate tariff exposure and ensure continuity of supply.

As a direct consequence, several technology providers have embarked on nearshoring initiatives, relocating assembly and testing operations to Mexico and other lower-tariff jurisdictions. This shift has not only alleviated some financial burdens but also enhanced agility through closer geographic proximity to end markets. However, the transition has necessitated investments in local infrastructure and workforce training, affecting deployment timelines and cost-to-market projections for project stakeholders.

In parallel, domestic manufacturers have ramped up capacity to capitalize on the reshoring trend, leveraging government incentives to establish high-security card fabrication and specialized back office software development centers. These emerging capabilities promise greater resilience against global trade volatility, yet the benefits will accrue over time as production scales and operational efficiencies are realized. For organizations engaged in planning large-scale fare collection upgrades, understanding these tariff-driven dynamics is essential for constructing realistic budgets and execution plans.

Unveiling Critical Segmentation Perspectives that Illuminate Diverse Applications Cards Components Technologies and Sales Channels

An in-depth examination of smart card fare collection markets reveals a multifaceted segmentation framework that influences deployment strategies and technology selection. When considering applications, access control encompasses both logical and physical access implementations, while event ticketing spans concerts, conferences, and sports venues. Parking management systems address off-street and on-street environments, and public transportation solutions cater to bus, ferry, metro, and rail services. Toll collection further divides into barrier tolling and open road tolling, each presenting unique transaction speed and operational resilience requirements.

Equally important is the differentiation by card type, where pure contact interfaces, contactless variants, and dual-interface cards serve distinct user interaction models and security profiles. Component segmentation highlights the role of back office systems in clearing and settlement as well as database management, contrasted with the deployment of fixed and mobile card readers. Middleware layers, comprising device management, host interfaces, and security management, integrate disparate hardware elements and enable service orchestration, while smart cards themselves range from simple memory cards to advanced microprocessor cards equipped with cryptographic engines.

Further classification by underlying technology showcases Bluetooth Low Energy’s emergence for mobile ticketing, NFC’s ubiquity for rapid tap-and-go transactions, and RFID’s proven reliability in high-throughput scenarios. Finally, sales channels influence go-to-market approaches, with direct engagements by original equipment manufacturers and system integrators complementing indirect partnerships through distributors and resellers, and online channels leveraging e-commerce platforms alongside manufacturer websites to reach diverse customer segments. Appreciating these layered segmentation insights enables decision-makers to tailor solutions that align precisely with operational priorities and user expectations.

This comprehensive research report categorizes the Smart Cards Automated Fare Collection Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Card Type

- Component

- Technology

- Application

- Sales Channel

Assessing Regional Variations in Adoption and Infrastructure Maturity Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping adoption curves and infrastructure investments across the smart card fare collection sector. In the Americas, transit operators prioritize modernization initiatives that support integrated multimodal ticketing and contactless bank card acceptance, driven by significant urbanization and passenger volume growth. North American agencies are increasingly piloting open-loop EMV systems to reduce reliance on proprietary media, whereas Latin American markets continue to expand contactless smart card deployments that address fare evasion and revenue protection challenges.

Across Europe, Middle East, and Africa, regulatory harmonization and interoperability standards govern system architectures, with European metropolitan networks leading in cross-border interoperability and mobile credentialing projects. Gulf Cooperation Council cities invest heavily in digital payment ecosystems as part of broader smart city agendas, while African transit authorities focus on cost-effective contactless solutions to improve financial transparency and support financial inclusion efforts in underbanked communities.

In the Asia-Pacific region, high-density urban corridors in East and Southeast Asia embrace next-generation validators supporting dual-interface cards and mobile tickets, leveraging local semiconductor manufacturing capabilities. Australia and New Zealand continue to evolve legacy systems toward account-based ticketing, integrating cloud-based back office services. Emerging markets in South Asia invest in pilot projects to upgrade magnetic stripe installations, underscoring the importance of scalable, low-cost technologies in regions with limited transit infrastructure budgets.

This comprehensive research report examines key regions that drive the evolution of the Smart Cards Automated Fare Collection Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Advancements in Smart Card Fare Collection Solutions and Services

Industry leaders and specialized innovators are driving the competitive landscape of smart card fare collection systems through differentiated product portfolios and strategic alliances. Major semiconductor vendors provide secure microcontrollers and memory modules that underpin both physical cards and embedded mobile secure elements. Hardware manufacturers offer a broad range of fixed and mobile readers optimized for high-volume transit applications, while specialized middleware providers deliver modular platforms that facilitate rapid integration with third-party fare payment services.

Consulting and integration service providers are emerging as essential partners for transit agencies seeking end-to-end project delivery, combining systems engineering expertise with domain-specific best practices. These integrators often form joint ventures with original equipment manufacturers to co-develop turnkey solutions that encompass hardware provisioning, software customization, and ongoing maintenance. Meanwhile, back office system vendors focus on delivering robust clearing and settlement engines, equipped with advanced data analytics and fraud detection capabilities, to support complex fare policies and real-time reporting requirements.

Collaborative partnerships between card issuers, mobile network operators, and financial institutions are accelerating the rollout of mobile-first fare products, integrating device management services and host interface protocols. In addition, standards bodies and industry consortia continue to influence roadmaps, ensuring that emerging technologies align with security management frameworks and interoperability mandates essential for large-scale deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Cards Automated Fare Collection Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Card Systems Ltd.

- Advantech Co., Ltd.

- Atos SE

- Aurionpro Solutions Ltd.

- Conduent Incorporated

- Cubic Transportation Systems, Inc.

- Giesecke+Devrient GmbH

- Hitachi, Ltd.

- IDEMIA Group

- Indra Sistemas, S.A.

- INIT Innovations in Transportation GmbH

- Kapsch TrafficCom AG

- LECIP Holdings Corporation

- Masabi Ltd

- NXP Semiconductors N.V.

- Omron Corporation

- Scheidt & Bachmann GmbH

- Siemens Mobility GmbH

- Thales S.A.

- Vix Technology Pty Ltd

Implementing Strategic Roadmaps and Technology Investments to Future Proof Smart Card Fare Collection Infrastructure and Operations

To navigate the complexities of modern fare collection environments, industry stakeholders should adopt strategic roadmaps that prioritize open standards and modular architectures. Investments in scalable cloud-based back office platforms enhance agility, enabling rapid introduction of new fare products and seamless integration with third-party mobility services. At the same time, strengthening supply chain resilience through diversified manufacturing and distribution partnerships mitigates tariff-related risks and reduces lead times for critical components.

Embracing mobile credentialing and contactless bank payment acceptance not only addresses evolving passenger preferences but also reduces the operational burden of physical media management. By implementing robust device management and security management middleware, organizations can enforce consistent encryption protocols and software updates across heterogeneous fleets of readers and smart cards. Furthermore, aligning procurement strategies with sustainability goals-such as utilizing recyclable card substrates and energy-efficient hardware-demonstrates corporate responsibility and responds to growing stakeholder demands for environmentally conscious solutions.

Finally, forging strategic alliances with system integrators and financial institutions can unlock new revenue streams and expedite market entry for innovative fare products. Collaborative proof-of-concept initiatives, anchored by quantifiable performance metrics, support data-driven decision-making and facilitate the adoption of next-generation capabilities that future proof fare collection operations.

Detailing Rigorous Research Methodological Frameworks Leveraging Qualitative and Quantitative Approaches to Ensure Data Integrity

The insights presented in this report are grounded in a rigorous methodological framework combining both qualitative and quantitative approaches. Primary research involved in-depth interviews with executives from transit authorities, technology vendors, system integrators, and financial institutions across key regions. These conversations illuminated deployment challenges, technology preferences, and strategic priorities directly from market participants responsible for fare collection modernization.

Secondary research encompassed a comprehensive review of technical whitepapers, open industry standards documentation, regulatory filings, and case study literature relating to contactless, contact, and dual-interface smart card implementations. Data integrity was ensured through triangulation, cross-editing vendor-provided specifications with independent validation from third-party laboratory test reports and compliance certifications. Moreover, competitive landscape analysis integrated publicly available financial disclosures, press releases, and product catalogs to map partnership networks and emerging technology roadmaps.

The combined use of primary and secondary sources enables a nuanced understanding of market dynamics while minimizing bias. Statistical analyses of adoption trends and technology penetration were conducted using validated data models, ensuring that the conclusions and recommendations reflect real-world usage patterns and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Cards Automated Fare Collection Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Cards Automated Fare Collection Systems Market, by Card Type

- Smart Cards Automated Fare Collection Systems Market, by Component

- Smart Cards Automated Fare Collection Systems Market, by Technology

- Smart Cards Automated Fare Collection Systems Market, by Application

- Smart Cards Automated Fare Collection Systems Market, by Sales Channel

- Smart Cards Automated Fare Collection Systems Market, by Region

- Smart Cards Automated Fare Collection Systems Market, by Group

- Smart Cards Automated Fare Collection Systems Market, by Country

- United States Smart Cards Automated Fare Collection Systems Market

- China Smart Cards Automated Fare Collection Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Key Insights and Strategic Imperatives That Poise Smart Card Fare Collection Systems for Sustained Growth and Innovation

Bringing together the diverse findings on technological innovation, regulatory initiatives, and regional market dynamics reveals a cohesive narrative: smart card automated fare collection systems stand at the nexus of convenience, security, and operational excellence. The rapid evolution of contactless interfaces, open-loop payment acceptance, and cloud-based back office infrastructure underscores the imperative for transit agencies to modernize existing frameworks and embrace interoperable solutions.

Tariff-driven supply chain shifts highlight the need for resilient procurement strategies and localized manufacturing capabilities. At the same time, detailed segmentation insights demonstrate that success hinges on understanding application-specific requirements, choosing the optimal card types and underlying components, and aligning sales channel strategies with customer purchasing behaviors. Regional analyses further emphasize that tailored deployment plans, sensitive to local regulatory and infrastructure landscapes, yield the greatest benefits in terms of ridership growth and revenue protection.

Ultimately, organizations that integrate these strategic insights-by adopting open standards, investing in scalable architectures, and forging collaborative partnerships-will be well positioned to deliver superior passenger experiences, maximize operational efficiencies, and capture new mobility revenue streams. The path forward requires deliberate planning, informed by the evidence and frameworks synthesized in this report.

Connect with Associate Director of Sales and Marketing to Secure the Comprehensive Smart Card Fare Collection Market Research Report

Elevating organizational performance demands data-backed insights and tailored guidance to navigate complex market dynamics. Engaging with the associate director of Sales and Marketing offers a seamless channel to obtain a comprehensive exploration of the competitive landscape, technological innovations, and regulatory shifts driving the smart card automated fare collection domain. By connecting directly with this seasoned professional, stakeholders gain privileged access to in-depth analysis, rich case studies, and expert recommendations designed to inform strategic decision-making and accelerate time to value. Reach out today to secure your copy of the in-depth research report and unlock the intelligence necessary to outpace competitors, optimize operational efficiencies, and capitalize on emerging opportunities within the smart card fare collection ecosystem.

- How big is the Smart Cards Automated Fare Collection Systems Market?

- What is the Smart Cards Automated Fare Collection Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?