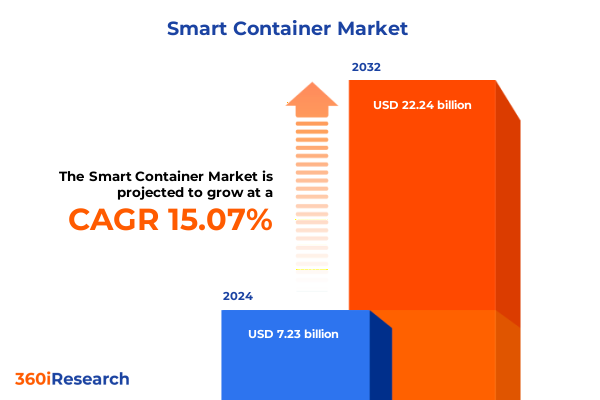

The Smart Container Market size was estimated at USD 8.23 billion in 2025 and expected to reach USD 9.38 billion in 2026, at a CAGR of 15.24% to reach USD 22.24 billion by 2032.

Unveiling the Strategic Importance of Smart Containers: Exploring Fundamental Innovations and Market Drivers Shaping Modern Supply Chains

The smart container paradigm represents a fundamental shift in how goods are tracked, monitored, and managed throughout the global supply chain. At its core, this technology integrates sensors, connectivity, and data analytics within standard shipping containers to provide real-time insights into location, temperature, humidity, and handling conditions. By leveraging advanced digital tools, companies gain visibility across end-to-end logistics processes, reduce pilferage, and ensure compliance with stringent regulatory requirements. This transparency not only enhances operational efficiency but also fosters proactive decision-making, allowing stakeholders to anticipate disruptions and optimize resource allocation.

As digital transformation continues to redefine the transportation and logistics sectors, smart containers are emerging as a critical component of modern supply chain strategies. The convergence of Internet of Things platforms, cloud computing, and satellite connectivity has enabled more robust tracking solutions that transcend traditional GPS limitations. This evolution coincides with growing customer expectations for faster delivery, stringent quality control in perishable goods, and heightened environmental accountability. Consequently, businesses must embrace these innovations to maintain competitiveness, drive cost reductions, and reinforce end-to-end supply chain resilience in a rapidly evolving market landscape.

Identifying Transformative Technological and Operational Shifts Redefining the Global Container Logistics and Supply Chain Ecosystem

Industrial stakeholders are witnessing transformative shifts driven by the convergence of digital technologies and sustainability imperatives. First, the proliferation of next-generation sensor technology and low-power wide-area networks has redefined data capture, enabling long-range, energy-efficient transmission that supports continuous monitoring in remote maritime corridors. In parallel, enhanced RFID and high-frequency tagging solutions have streamlined asset tracking within ports and warehouses, reducing manual scanning errors and accelerating throughput.

Operational practices are also undergoing rapid change as companies adopt cloud-based data platforms for real-time analytics and predictive modeling. Collaborative ecosystems, facilitated by shared digital ledgers and interoperable APIs, are enabling cross-enterprise visibility that transcends traditional silos. This shift is particularly pronounced in cold chain logistics, where regulatory compliance and product integrity hinge on precise temperature control. As regulatory frameworks tighten and sustainability goals become more ambitious, these technological and operational transformations will continue to drive adoption and reshape global container logistics.

Assessing the Ripple Effect of United States 2025 Tariff Measures on Container Logistics Costs, Regional Trade Flows, and Supply Chain Resilience

The imposition of tariffs on container components and associated technologies under the United States’ 2025 trade policy has generated significant reverberations throughout supply chain networks. Increased duties on sensor modules, microprocessors, and specialized materials have elevated acquisition costs, compelling companies to reevaluate sourcing strategies. In response, some manufacturers are nearshoring production to mitigate tariff burdens, while others are renegotiating supplier contracts to secure cost efficiencies amidst rising import expenses.

Moreover, these fiscal adjustments have influenced regional trade flows as importers and exporters adjust to new cost structures. Ports on the Gulf and East Coasts are experiencing shifts in traffic patterns, with some shippers rerouting cargo through Free Trade Zone facilities to leverage duty deferrals. At the same time, logistics service providers are enhancing their value propositions by offering tariff advisory services and integrated customs compliance solutions. Collectively, these adaptive measures are fostering greater supply chain agility, ensuring that businesses can absorb tariff shocks while maintaining service levels and safeguarding profit margins.

Decoding Key Segmentation Insights: Holistic Analysis Across Container Types, Materials, Capacities, Technologies, Industries, and Applications

A holistic examination of container type segmentation reveals a diversity of form factors tailored to specific cargo requirements. From the ubiquitous dry container to purpose-built options such as flat rack and open top containers, each variant addresses distinct loading and handling scenarios. The refrigerated container segment, encompassing absorption cooling, compressor cooling, and thermoelectric cooling solutions, underscores the growing importance of temperature-sensitive supply chains, particularly in pharmaceuticals and perishables. Tank containers further illustrate the industry’s adaptability, facilitating the safe transport of bulk liquids and hazardous chemicals.

Material selection plays a critical role in container performance and lifecycle costs. Aluminum constructions offer lightweight durability that reduces fuel consumption, while composite materials deliver corrosion resistance and thermal insulation benefits. Steel remains the industry standard, prized for its strength and cost-effectiveness. Load capacity segmentation-focusing on Forty Foot Equivalent Units and Twenty Foot Equivalent Units-aligns with carrier optimization strategies and port handling equipment, ensuring compatibility with existing infrastructure.

Technological segmentation accentuates the role of connectivity platforms in driving operational intelligence. Cloud computing underpins scalable data storage and analytics, while global navigation satellite systems enhance positional accuracy. Within the Internet of Things domain, variations such as cellular, LPWAN, satellite, and Wi-Fi connectivity cater to diverse geographic and operational contexts. Radio frequency identification technologies-including high frequency, low frequency, and ultra-high frequency-enable automated gate operations and container-level inventory management.

Industry-specific segmentation highlights the adaptation of smart containers across automotive, chemicals, food and beverage, and pharmaceuticals. The chemicals sector bifurcates into petrochemicals and specialty chemicals, each demanding tailored monitoring for safety and compliance. Food and beverage segmentation-covering beverages, dairy, fresh produce, and meat-drives stringent temperature and humidity controls. Pharmaceuticals, encompassing biologics, medicines, and vaccines, necessitate validated cold chain solutions to preserve efficacy.

Application segmentation further delineates the business case for smart containers. Humidity monitoring safeguards hygroscopic goods, while location tracking optimizes routing and ETA accuracy. Shock detection protects fragile cargo, temperature monitoring maintains product integrity, and theft prevention reinforces asset security. Together, these layers of segmentation inform a nuanced understanding of market needs and solution viability.

This comprehensive research report categorizes the Smart Container market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Container Type

- Material

- Load Capacity

- Technology

- Industry

- Application

Key Regional Dynamics Illuminated: How the Americas, EMEA, and Asia-Pacific Regions Are Paving Distinct Pathways for Smart Container Adoption

Geographic dynamics play a pivotal role in shaping smart container adoption and operational priorities. In the Americas, robust infrastructure investments and advanced logistics ecosystems have facilitated early embracement of end-to-end visibility solutions. North American shippers prioritize regulatory compliance and cold chain integrity, while Latin American markets leverage cost-effective sensor deployments to enhance export competitiveness and combat cargo pilferage.

The Europe, Middle East & Africa region presents a complex tapestry of mature maritime hubs alongside emerging inland logistics corridors. European enterprises are accelerating digitization initiatives to meet stringent environmental directives and carbon reduction targets. In the Middle East, free zones and port authorities are partnering with technology providers to cultivate smart logistics corridors. Sub-Saharan Africa is witnessing pilot programs that leverage satellite connectivity and LPWAN networks to overcome infrastructural constraints and extend tracking capabilities into remote areas.

Asia-Pacific stands at the forefront of smart container innovation, driven by dense manufacturing clusters and expansive trade routes. East Asian economies are integrating advanced automation within port operations, while Southeast Asian nations are capitalizing on digital platforms to modernize legacy systems. Emerging markets in South Asia are exploring hybrid connectivity models that blend cellular and satellite technologies to achieve continuous monitoring across diverse terrains. Collectively, these regional nuances underscore the importance of tailored deployment strategies that reflect local priorities, regulatory landscapes, and infrastructure maturity.

This comprehensive research report examines key regions that drive the evolution of the Smart Container market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Driving Innovation and Competitive Differentiation in the Smart Container Arena

Leading logistics providers and specialized technology vendors are shaping the competitive landscape through strategic partnerships, product innovation, and service differentiation. Large-scale carriers are embedding sensor suites in owned fleets to guarantee end-to-end control, while third-party logistics firms are bundling smart container solutions with value-added services such as predictive maintenance and carbon footprint analytics. Technology incumbents are advancing platform interoperability to ensure seamless integration with enterprise resource planning and transportation management systems.

Emerging players are challenging traditional paradigms by introducing modular sensor kits and subscription-based connectivity models that lower entry barriers for small and medium-sized shippers. Collaborations between electronics manufacturers and software providers are driving the development of AI-powered anomaly detection algorithms, enabling proactive issue resolution before disruptions occur. Corporate ventures and accelerator programs are further accelerating innovation by funding proof-of-concept trials and cross-industry consortiums.

Across the board, competitive differentiation hinges on the ability to offer scalable, secure, and end-user-centric solutions. Firms that demonstrate robust data governance practices, including encryption, access controls, and compliance with regional privacy regulations, are gaining customer trust. As the ecosystem continues to mature, strategic alliances with telematics providers, port authorities, and customs agencies will become increasingly vital in delivering comprehensive, end-to-end smart container offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Container market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.P. Moller - Maersk A/S

- CMA CGM S.A.

- COSCO SHIPPING Lines Co., Ltd.

- Emerson Electric Co.

- Evergreen Marine Corporation (Taiwan) Ltd.

- Hapag-Lloyd AG

- Hyundai Merchant Marine Co., Ltd.

- Mediterranean Shipping Company S.A.

- Ocean Network Express Pte. Ltd.

- Orient Overseas Container Line Limited

- Sensitech Inc.

- SkyCell AG

- Smart Containers Group AG

- Yang Ming Marine Transport Corporation

Actionable Strategies for Industry Leaders to Capitalize on Smart Container Trends, Enhance Operational Agility, and Drive Sustainable Growth

Industry stakeholders should prioritize the integration of modular IoT sensor platforms that support multi-modal connectivity, ensuring continuous data streams across maritime, rail, and road segments. Strategic investments in advanced analytics capabilities can transform raw telemetry into actionable insights, enabling predictive maintenance schedules and dynamic route optimization that reduce dwell times and minimize downtime. To maximize return on technology expenditure, decision-makers are advised to pilot solutions in high-value corridors and verticals-such as pharmaceuticals and fresh produce-before scaling deployments broadly.

Collaboration with regulatory bodies and standards organizations is essential to navigate evolving compliance requirements, particularly in cold chain and hazardous materials transportation. Establishing clear data-sharing agreements with partners and customers fosters transparency and builds confidence in shared digital platforms. Sustainability goals can be advanced by selecting lightweight materials and energy-efficient cooling technologies that contribute to carbon reduction targets while preserving container performance.

Finally, organizations should cultivate cross-functional governance structures that align IT, operations, and commercial teams around shared objectives. By creating a centralized command center for logistics intelligence, companies can accelerate decision cycles and establish clear accountability mechanisms. In doing so, leaders will position themselves to respond to emerging market disruptions, capture new revenue opportunities, and achieve long-term operational resilience.

Illustrating a Robust Multi-Methodology Research Framework Integrating Primary Interviews, Secondary Sources, and Data Triage for Insight Validity

This research framework combines rigorous primary research with comprehensive secondary data analysis to ensure the validity and reliability of insights. Primary research includes in-depth interviews with senior executives across carriers, port authorities, technology suppliers, and end-user organizations. These qualitative engagements provide firsthand perspectives on adoption drivers, pain points, and strategic priorities. Complementing these interviews, structured surveys captured quantitative data on deployment timelines, technology preferences, and investment plans across diverse market segments.

Secondary research sources encompass industry white papers, regulatory filings, technology vendor publications, and trade association reports. Through systematic data triangulation, conflicting information is reconciled and key trends are validated against multiple reference points. A proprietary database of shipment records and customs documents underpins analysis of regional trade flows and tariff impacts. Advanced analytical techniques, including cluster analysis and scenario modeling, are applied to distill segmentation insights and forecast the implications of emerging technologies.

Throughout the study, rigorous quality control measures are enforced at every stage. Findings are peer-reviewed by domain experts and cross-checked for consistency against external benchmarks. As a result, the final report delivers a robust, evidence-based foundation for strategic decision-making, ensuring that stakeholders have access to reliable, actionable intelligence that guides investment, deployment, and partnership strategies in the evolving smart container market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Container market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Container Market, by Container Type

- Smart Container Market, by Material

- Smart Container Market, by Load Capacity

- Smart Container Market, by Technology

- Smart Container Market, by Industry

- Smart Container Market, by Application

- Smart Container Market, by Region

- Smart Container Market, by Group

- Smart Container Market, by Country

- United States Smart Container Market

- China Smart Container Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesis of Critical Findings and Strategic Imperatives Consolidating the Executive Synopsis of the Smart Container Market Landscape

The converging forces of digital transformation, evolving trade policies, and escalating customer expectations position smart containers as a critical enabler of supply chain excellence. By integrating advanced sensor technologies, multi-modal connectivity, and data analytics, stakeholders can achieve unprecedented visibility, compliance, and operational efficiency. The cumulative impact of recent tariff measures underscores the need for agile sourcing strategies and adaptive logistics models that safeguard profitability while preserving service levels.

Segmentation analysis reveals targeted opportunities across container types, materials, technologies, and vertical applications, illuminating pathways for tailored value propositions. Regional dynamics further emphasize the importance of context-specific deployment strategies that account for infrastructure maturity, regulatory environments, and trade flows. Competitive landscapes are being reshaped by alliances between logistics incumbents and technology innovators, driving modular solution offerings that cater to both large enterprises and SMEs.

Ultimately, organizations that embrace a data-driven, collaborative approach to smart container adoption will realize tangible benefits in operational resilience, cost efficiency, and market responsiveness. The insights presented in this summary provide a strategic roadmap for navigating the complexities of modern container logistics and unlocking new avenues for growth in an increasingly interconnected global economy.

Engage with Ketan Rohom to Unlock In-Depth Smart Container Market Research Insights and Propel Your Supply Chain Innovation Journey

As you navigate the complexities of modern container logistics and seek to capitalize on real-time visibility, operational resilience, and efficiency gains, the decision to acquire comprehensive market research can define your competitive edge. By partnering with Ketan Rohom, Associate Director, Sales & Marketing, you gain direct access to an exhaustive analysis of technological innovations, regional dynamics, and segmentation insights that empower strategic decisions.

Engaging with Ketan Rohom ensures that your organization receives a tailored briefing on the latest findings, exclusive executive discussions, and customized data packages that align with your unique requirements. His expertise facilitates swift onboarding to the report’s granular data, interactive dashboards, and actionable recommendations designed to streamline implementation roadmaps. Reach out today to secure your copy and embark on a transformative journey that optimizes your supply chain performance, mitigates tariff impacts, and strengthens your market positioning.

Unlock the full potential of smart container solutions by connecting with Ketan Rohom and propel your organization toward a future defined by enhanced visibility, sustainable innovation, and operational excellence.

- How big is the Smart Container Market?

- What is the Smart Container Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?