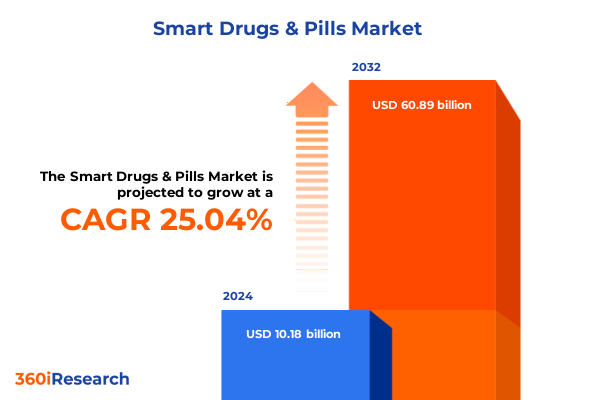

The Smart Drugs & Pills Market size was estimated at USD 12.69 billion in 2025 and expected to reach USD 15.59 billion in 2026, at a CAGR of 25.10% to reach USD 60.89 billion by 2032.

Unveiling the Adaptive Evolution of Cognitive Performance Enhancers Amid Technological Progress and Shifting Consumer Demands Worldwide

Contemporary society has witnessed a significant evolution in the pursuit of cognitive optimization, driven by rapid technological progress, intensified competition in academic and professional arenas, and heightened awareness of holistic wellness. This multifaceted landscape has propelled smart drugs and pills into the spotlight as viable avenues for enhancing mental acuity, sustaining focus, and supporting long-term neurological health. Innovations in formulation science and the convergence of dietary, botanical, and synthetic approaches have expanded the repertoire of solutions available to consumers seeking targeted cognitive benefits.

Moreover, demographic shifts have underscored the rising importance of memory support and age-related cognitive preservation, as an aging population seeks safe and effective interventions. Younger segments, including students and professionals, have likewise gravitated toward precision-engineered compounds capable of bolstering attention, accelerating information recall, and stabilizing mood under stress. These cross-generational demand drivers, combined with a proliferation of digital wellness platforms and direct-to-consumer channels, have transformed what was once a niche discipline into a burgeoning domain within the broader health and wellness industry.

Consequently, stakeholders are now navigating a dynamic ecosystem where regulatory frameworks, scientific validation, and consumer trust converge. This introduction lays the groundwork for examining the transformative shifts reshaping the market, the external forces influencing supply and cost structures, and the segmentation strategies that inform product development and go-to-market planning.

Charting the Crucial Paradigm Shifts That Have Redefined Cognitive Health and Elevated Consumer Expectations in the Smart Drug Sphere

The last decade has witnessed pivotal paradigm shifts redefining the smart drugs and pills landscape, with innovation cycles accelerating and interdisciplinary collaborations propelling new product categories. Early research into single-molecule compounds has given way to integrated formulations that combine micronutrients, adaptogenic botanicals, and targeted synthetic nootropics, delivering synergistic benefits in cognitive performance and resilience. In parallel, breakthroughs in neurobiology and pharmacokinetics have enabled precision dosing strategies, ensuring optimal bioavailability and minimizing adverse effects.

Simultaneously, consumer perceptions have evolved from viewing cognitive enhancement as an extraordinary intervention to embracing it as a routine aspect of holistic health regimens. This cultural shift has been catalyzed by enhanced transparency in clinical studies, open-access scientific publications, and the democratization of nutritional genomics. Furthermore, digital platforms that track biometrics and deliver personalized insights have bridged the gap between laboratory findings and real-world applications, elevating expectations for efficacy, safety, and ethical marketing.

These transformative forces have collectively fostered a new competitive dynamic, compelling legacy pharmaceutical entities to diversify their portfolios and prompting niche innovators to pursue rigorous validation pathways. As these currents converge, they are forging an ecosystem characterized by rapid product lifecycle iterations, heightened regulatory scrutiny, and an ever-intensifying quest for demonstrable outcomes in cognitive health and performance.

Analyzing the Comprehensive Effects of the 2025 United States Tariff Measures on Supply Chains, Cost Structures, and Market Dynamics in Cognitive Supplements

In early 2025, the United States implemented a series of tariffs targeting key raw materials and intermediates essential to cognitive supplement production, including certain botanical extracts and synthetic nootropic precursors. These measures have reverberated across global supply chains, as manufacturers recalibrate sourcing strategies to mitigate cost escalations and ensure uninterrupted product flows. Whereas direct procurement from traditional suppliers in Asia-Pacific once delivered predictable lead times, rising levies have compelled firms to explore alternative origins and invest in domestic processing capabilities.

Consequently, production stakeholders are absorbing incremental expenses tied to import duties, logistical adjustments, and inventory re-engineering. These shifts have underscored the importance of resilient supplier diversification strategies, encouraging partnerships with regional extraction facilities and contract manufacturers capable of localizing key inputs. Moreover, the tariff landscape has accelerated internal efforts to streamline formulation footprints, favoring compounds with stable supply histories and lower tariff classifications.

On a broader scale, cost pressures have sparked innovation in green chemistry and circular production models, as companies seek to develop in-house synthesis routes and leverage biotechnological platforms. These advancements not only offset rising tariffs but also align with consumer preferences for sustainable, ethically sourced ingredients. As the year unfolds, decision-makers must continue monitoring tariff trajectories and evolving trade negotiations to maintain competitive positioning in a marketplace where agility and supply chain visibility have become strategic imperatives.

Decoding the Complex Multidimensional Segmentation Framework Driving Consumer Adoption and Product Differentiation in Cognitive Enhancement Solutions

The market’s nuanced segmentation framework underpins the strategic endeavors of product developers and marketers, guiding resource allocation and innovation priorities. Based on product type, the industry encompasses dietary supplements - spanning foundational multivitamins, essential omega-3 fatty acids, and the B-complex family of nutrients - as well as natural nootropics like Bacopa Monnieri, Ginkgo Biloba, and Rhodiola Rosea. In parallel, prescription smart drugs extend into amphetamine derivatives, which include dexamphetamine, lisdexamfetamine, and mixed amphetamine salts, alongside cholinergics such as alpha GPC and citicoline, and racetam compounds including oxiracetam, phenylpiracetam, and piracetam. Synthetic nootropics mirror this racetam class, further diversifying the palette of high-potency, lab-engineered cognitive enhancers.

Form considerations play a critical role in user adoption, with capsules, liquids, powders, soft gels, and tablets each offering distinct advantages in terms of onset speed, dosage precision, and consumer convenience. Moreover, the application spectrum ranges from core cognitive enhancement and targeted focus and attention support to specialized memory bolstering, mood stabilization, and sleep enhancement protocols. Distribution channels are equally stratified, as direct sales operations leverage personalized outreach, online retail platforms harness omnichannel synergies, pharmacies deliver professional credibility, and specialty stores curate niche brand experiences.

End-user profiles reveal diverse motivations: elderly consumers prioritize memory support and neuroprotection; professionals seek sustainable focus and mental endurance; recreational users value mood and energy modulation; and students pursue amplified concentration and accelerated learning capacity. This multifaceted segmentation matrix drives tailored product positioning, personalized marketing narratives, and differentiated channels designed to meet the precise needs of each cohort.

This comprehensive research report categorizes the Smart Drugs & Pills market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- End User

- Distribution Channel

Comparative Examination of Regional Growth Drivers, Regulatory Landscapes, and Consumer Behaviors Across Key Global Markets for Cognitive Enhancers

Global demand for cognitive enhancers manifests distinct regional nuances, propelled by demographic trends, regulatory regimes, and cultural attitudes toward supplementation. In the Americas, widespread consumer awareness and established direct-to-consumer channels sustain robust demand, while progressive labeling requirements reinforce product transparency and foster greater trust. Conversely, Europe, Middle East & Africa exhibit a mosaic of regulatory stances: rigorous approval pathways in Western Europe contrast with emerging markets that prioritize rapid product launches, creating opportunities for nimble local innovators.

Asia-Pacific’s accelerating health consciousness and growing middle-class demographics have catalyzed exponential growth in both natural nootropics and synthetic formulations, with leading economies advancing clinical research collaborations and botanical standardization initiatives. In addition, regional manufacturing hubs continue to refine extraction and synthesis technologies, yielding cost efficiencies that reverberate through global supply chains. These developments coexist with evolving consumer preferences, as wellness platforms integrate cognitive health into broader lifestyle ecosystems and mobile applications deliver personalized supplementation regimes.

Together, these regional insights illuminate the interplay between regulatory environments, consumer sophistication, and supply chain agility. Strategic entrants and established incumbents alike must navigate a patchwork of compliance requirements, distribution norms, and cultural expectations to capitalize on localized growth drivers and to deliver compelling value propositions in each market cluster.

This comprehensive research report examines key regions that drive the evolution of the Smart Drugs & Pills market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Initiatives, Product Innovations, and Competitive Landscapes Shaped by Leading Players in the Smart Drugs and Cognitive Supplements Sector

Leading players in the smart drugs and cognitive supplements arena are deploying a spectrum of strategic initiatives to secure competitive advantages. Many have significantly invested in research partnerships with academic institutions and contract research organizations to generate robust clinical evidence, thereby elevating product credibility and differentiation. Concurrently, top-tier manufacturers are expanding their intellectual property portfolios, securing patents for novel formulation technologies, proprietary delivery systems, and optimized compound combinations that enhance bioavailability.

Furthermore, collaboration with technology firms has enabled advanced data analytics and digital engagement platforms, empowering end users to track cognitive metrics and to receive personalized dosing recommendations. In the distribution domain, key companies have forged alliances with specialty retailers and telehealth providers, integrating consultative services that augment the consumer experience and foster recurring revenue streams. Concurrently, vertical integration strategies - from raw material sourcing to finished goods manufacturing - are enabling improved cost controls and tighter quality assurance protocols.

This blend of innovation, partnership, and integration underscores the evolving competitive landscape, where agility and regulatory foresight are as critical as formulation expertise. Organizations that harness these strategic levers are well positioned to navigate shifting trade policies, to anticipate emerging consumer demands, and to sustain leadership in a market characterized by rapid iteration and nuanced differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Drugs & Pills market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- CapsoVision Inc.

- Check-Cap Ltd.

- Given Imaging Ltd.

- IntroMedic Co. Ltd.

- Jinshan Science & Technology

- Medimetrics S.A. de C.V.

- Medtronic plc

- Microchips Biotech Inc.

- Olympus Corporation

- Otsuka Pharmaceutical Co. Ltd.

- Pentax Medical

- Philips Healthcare

- Proteus Digital Health Inc.

- RF Co. Ltd.

- Siemens Healthineers AG

- SmartPill Corporation

- Synectics Medical Ltd.

- Teleflex Incorporated

- VitalConnect Inc.

- Zoll Medical Corporation

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Regulatory, Supply, and Consumer Trends in Smart Drug Market

To excel in today’s dynamic environment, industry leaders must embrace holistic strategies that span innovation, regulatory intelligence, and consumer engagement. First, prioritizing investment in clinical validation and transparent efficacy studies will bolster trust and differentiate offerings, particularly as regulatory bodies intensify scrutiny on cognitive enhancement claims. In tandem, forging cross-sector alliances - whether with nutrigenomic specialists or digital health platforms - can yield integrated solutions that resonate with tech-savvy and health-conscious segments.

Moreover, supply chain resilience must remain a cornerstone of strategic planning. Diversifying supplier networks for critical plant extracts and synthetic precursors, while exploring near-shoring opportunities, will mitigate tariff impacts and logistical disruptions. Complementing this, adopting sustainable production methodologies and obtaining eco-certifications will appeal to environmentally conscious consumers and preempt emerging regulatory standards.

On the marketing front, crafting personalized experiences through targeted content, educational webinars, and interactive digital tools can deepen brand loyalty and facilitate premium positioning. Finally, leaders should implement agile scenario-planning frameworks that monitor geopolitical developments, tariff adjustments, and evolving regulatory directives, ensuring that strategic pivots can be executed swiftly. By aligning R&D, operations, and market engagement around these imperatives, organizations will be poised to capture emerging growth waves and sustain long-term competitiveness.

Outlining a Robust and Transparent Research Methodology Incorporating Primary Interviews, Secondary Data Validation, and Rigorous Analytical Frameworks for Market Intelligence

The research underpinning this analysis employs a rigorous, multi-method framework designed to ensure reliability, transparency, and actionable insight. Primary research comprised in-depth interviews with senior executives across formulation development, supply chain management, and regulatory affairs, coupled with expert consultations involving neurologists, pharmacologists, and nutrition scientists. These qualitative inputs were triangulated with secondary sources, including peer-reviewed journals, policy publications, and trade association reports, to validate emerging trends and to contextualize regulatory developments.

Quantitative analyses leveraged proprietary databases to map global trade flows of botanical extracts and synthetic precursors, while survey instruments captured end-user preferences and purchasing behaviors across key demographic segments. Data integrity was maintained through stringent validation protocols, including cross-source comparisons, outlier analysis, and methodological peer reviews. Further, thematic coding of qualitative feedback enabled the extraction of nuanced consumer insights and strategic considerations, which informed scenario-planning exercises and sensitivity assessments.

Together, these methodological pillars ensure that the findings presented herein are grounded in empirical evidence, reflective of stakeholder perspectives, and adaptable to evolving market conditions. This transparent approach equips decision-makers with a robust intelligence foundation, facilitating informed strategy development and risk-mitigation planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Drugs & Pills market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Drugs & Pills Market, by Product Type

- Smart Drugs & Pills Market, by Form

- Smart Drugs & Pills Market, by Application

- Smart Drugs & Pills Market, by End User

- Smart Drugs & Pills Market, by Distribution Channel

- Smart Drugs & Pills Market, by Region

- Smart Drugs & Pills Market, by Group

- Smart Drugs & Pills Market, by Country

- United States Smart Drugs & Pills Market

- China Smart Drugs & Pills Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Future Outlook to Empower Stakeholders with Insights Pivotal for Strategic Decision-making in Cognitive Performance Markets

This executive summary has illuminated the dynamic forces reshaping the smart drugs and pills sector, from paradigm-shifting innovations in cognitive enhancement to the supply chain disruptions stemming from recent tariff measures. The layered segmentation analysis has underscored the diversity of product types, forms, applications, distribution channels, and end-user cohorts, each driving unique requirements for formulation, marketing, and regulatory compliance. Regional insights further highlighted how market maturity, regulatory stringency, and consumer sophistication vary across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Moreover, the strategic initiatives of key players reveal a landscape where clinical validation, digital engagement, and vertical integration converge as essential competitive levers. Actionable recommendations focused on research investment, supply chain diversification, sustainable manufacturing, personalized marketing, and agile scenario planning provide a roadmap for navigating uncertainties and capitalizing on emerging opportunities.

Ultimately, stakeholders equipped with this intelligence will possess the clarity and foresight necessary to refine product portfolios, optimize operational resilience, and engage consumers in meaningful ways. The convergence of scientific rigor, strategic alignment, and ethical stewardship will define the future of cognitive performance solutions, empowering organizations to deliver measurable value and to foster lasting consumer trust.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence That Drives Growth and Informs Strategic Initiatives in Cognitive Enhancement Domain

Ready to transform your strategic approach to cognitive enhancement markets? Reach out to Ketan Rohom, the seasoned Associate Director for Sales & Marketing, and gain immediate access to the comprehensive market research report packed with actionable intelligence on emerging consumer trends, regulatory implications, and competitive dynamics. With expert guidance tailored to your organization’s unique priorities, you’ll secure the insights necessary to optimize product portfolios, expand distribution channels, and capture untapped growth opportunities in the smart drugs and pills sector. Engage today to ensure your strategies are informed by rigorous analysis and to elevate your decision-making with real-time clarity on the forces shaping the future of cognitive performance solutions

- How big is the Smart Drugs & Pills Market?

- What is the Smart Drugs & Pills Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?