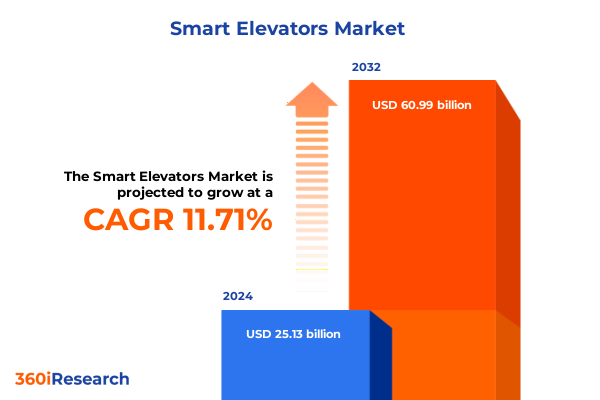

The Smart Elevators Market size was estimated at USD 28.00 billion in 2025 and expected to reach USD 31.20 billion in 2026, at a CAGR of 11.76% to reach USD 60.99 billion by 2032.

Unveiling the transformative journey of elevator technology driven by digital integration urban expansion and evolving safety and user experience demands

The rapid convergence of digital connectivity and urban expansion has propelled elevator systems from simple mechanical lifts into sophisticated, data-driven platforms at the heart of modern infrastructure. As cityscapes reach ever higher and passenger expectations evolve, elevator stakeholders are compelled to embrace innovations that deliver enhanced safety, efficiency, and seamless user engagement. Traditional lift designs are giving way to integrated solutions that leverage sensor networks, cloud analytics, and mobile interfaces, signaling a new era of vertical mobility.

In this dynamic environment, the smart elevator emerges as a critical enabler of operational excellence and occupant satisfaction. By embedding predictive maintenance algorithms, real-time performance monitoring, and intuitive control systems, building owners and operators can reduce downtime, optimize energy consumption, and deliver a superior travel experience. As this report unfolds, readers will gain a clear understanding of the foundational drivers reshaping the elevator landscape and the pivotal role of digital transformation in catalyzing the next generation of vertical transportation solutions.

Exploring how digitalization AI-powered analytics and sustainability imperatives are catalyzing unprecedented shifts in elevator system capabilities and design strategies

The elevator industry is undergoing a fundamental metamorphosis as digitalization, artificial intelligence, and sustainability imperatives redefine traditional benchmarks for performance and reliability. Connected sensors now capture vibration, temperature, and usage data around the clock, enabling machine learning models to predict component failures before they occur and recommend proactive interventions. These capabilities are accompanied by cloud-based platforms that aggregate fleet-level insights, empowering service providers to prioritize maintenance tasks and optimize resource allocation with unprecedented precision.

Concurrently, the push toward greener operations has introduced eco-friendly drive systems and energy-regenerative braking, reducing the carbon footprint of high-traffic buildings. Retrofit programs are accelerating the adoption of destination control and intelligent dispatch algorithms, which not only enhance throughput but also minimize passenger wait times. As this landscape shifts, stakeholders must adapt through strategic investments in digital infrastructure, partnerships with technology innovators, and workforce upskilling initiatives to maintain competitive advantage.

Assessing the compounding effects of 2025 United States tariff policies on elevator component supply chains pricing structures and strategic procurement decisions

In 2025, United States tariff policies have introduced a complex layer of cost considerations for elevator manufacturers and component suppliers. Duties imposed on steel, aluminum, and electronic subassemblies have driven up the landed price of key raw materials, creating ripple effects throughout procurement channels and maintenance budgets. As a result, original equipment manufacturers and their service networks are re-evaluating sourcing strategies to balance cost pressures with quality and delivery expectations.

In response to these cumulative impacts, industry leaders are diversifying their supplier base, exploring nearshoring options, and renegotiating long-term contracts to hedge against further rate fluctuations. Some have accelerated the integration of modular, standardized components to mitigate tariff-related volatility, while others are leveraging predictive analytics to optimize inventory levels and reduce capital tied up in parts. These adaptive strategies underscore the critical importance of supply chain resilience in an increasingly protectionist environment.

Revealing critical insights across elevator market segments from type and technology to service building height and control systems shaping strategic priorities

A nuanced examination of elevator market segments reveals distinct dynamics that demand tailored strategies. Freight and passenger categories each carry unique performance and safety requirements, with heavy and light freight lifts optimized for cargo throughput, while passenger units are differentiated by speed tiers-high, mid, and low-to serve varying building profiles. Understanding these distinctions is fundamental for manufacturers and integrators seeking to align product portfolios with end-user expectations.

Technology choices further shape competitive positioning, as hydraulic systems maintain relevance in low-rise contexts, while traction geared and gearless drives-with their fixed-speed, VVVF, induction, and permanent magnet variants-address the spectrum of efficiency, noise, and maintenance criteria. Application sectors such as commercial, healthcare, industrial, residential, and retail each introduce specialized demands, from the controlled environment of hospitals to the robust handling needs of manufacturing and warehousing operations. Service envelopes extend beyond new installations into full and partial modernization offerings that prolong asset life and unlock performance gains.

Building height classifications-low, mid, and high rise-drive equipment specification and regulatory compliance, with up-to-five-floor structures favoring simpler drive architectures and over-25-floor towers necessitating advanced control logic and high-capacity designs. Finally, control systems bifurcate into conventional collective or selective schemes and destination control platforms, which are increasingly enhanced by smartphone integration and touchscreen interfaces to streamline boarding flows and personalize passenger journeys.

This comprehensive research report categorizes the Smart Elevators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Elevator Type

- Technology

- Service Type

- Building Height

- Control System

- Application

Highlighting regional dynamics across the Americas EMEA and Asia-Pacific that influence elevator market expansion regulatory frameworks and adoption patterns

Regional patterns of smart elevator adoption reflect divergent economic trajectories, regulatory frameworks, and infrastructure maturity across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, retrofit initiatives are driving modernization demand in legacy urban cores, while green building imperatives encourage the integration of energy-regenerative drives and advanced dispatch algorithms to curtail operational costs and carbon emissions.

Across Europe Middle East & Africa, stringent safety standards and heritage preservation considerations shape solution design, prompting manufacturers to develop compact, low-noise systems that respect architectural constraints. Incentives for sustainable construction in Gulf Cooperation Council states and EU climate directives in Western Europe further accelerate investments in predictive maintenance and digital service platforms. Meanwhile, rapid urbanization in Asia-Pacific is fueling unprecedented new installations in high-rise residential and commercial towers, with local players collaborating on IoT-enabled lifts and AI-driven analytics to meet surging capacity requirements and diverse regulatory regimes.

This comprehensive research report examines key regions that drive the evolution of the Smart Elevators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading elevator industry players strategic initiatives innovation pipelines and competitive positioning driving market leadership and differentiation

Leading industry players are cementing their competitive edge by forging strategic alliances, expanding digital service offerings, and channeling R&D resources into next-generation drive technologies. Partnerships with IoT specialists and software providers underpin the development of holistic monitoring platforms that deliver real-time diagnostics and remote troubleshooting capabilities. Concurrently, investments in additive manufacturing and modular component design are reducing lead times and enabling rapid customization for unique architectural projects.

Innovation pipelines emphasize sustainable materials and energy efficiency, with several companies unveiling carbon-neutral elevator cabins and AI-based traffic management systems that adapt dynamically to building usage patterns. At the same time, market frontrunners are augmenting their global footprints through targeted acquisitions and joint ventures, ensuring access to emerging markets and after-sales service networks. These multifaceted strategies underscore the imperative for continuous reinvention in a landscape where technological prowess and operational agility drive long-term success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Elevators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AVIRE Ltd. by Halma PLC

- Brivo Systems LLC

- Emerald Elevators

- Fujitec Co., Ltd.

- HID Global Corporation by ASSA ABLOY AB

- Hitachi, Ltd.

- Honeywell International Inc.

- Hyundai Elevator Co., Ltd.

- International Business Machines Corporation

- Kambar Technologies

- Kintronics, Inc.

- Kisi Incorporated

- Kone Corporation

- Matrix Comsec Pvt Ltd.

- Mitsubishi Electric Corporation

- Nidec Corporation

- Openpath Security Inc. by Motorola Solutions, Inc.

- Otis Worldwide Corporation

- Pepperl+Fuchs SE

- Robert Bosch GmbH

- Robustel

- Schindler Holding Ltd.

- Sick AG

- Siemens AG

- Sigma Elevator Company

- Spectra Technovision Pvt. Ltd.

- Swiftlane, Inc.

- Taoping Inc.

- Thames Valley Controls Ltd. by VANTAGE ELEVATION, LLC

- Thyssenkrupp AG

- TK Elevator GmbH

- Toshiba Corporation

- ZKTeco Co., Ltd

Strategic guidance for elevator industry decision makers to leverage technology integration supply chain resilience and customer-centric services effectively

Industry leaders must prioritize the deployment of scalable IoT architectures to harness the full potential of data-driven maintenance and performance optimization. Integrating machine learning tools with existing service platforms will enable more accurate fault detection, minimize unplanned downtime, and reduce lifecycle costs. Simultaneously, executives should evaluate nearshoring and multi-sourcing strategies to bolster supply chain resilience, thereby mitigating exposure to trade policy shifts and component shortages.

Further, organizations should accelerate the adoption of modular modernization packages that deliver expedited upgrade cycles and tangible ROI for building owners. Emphasis on user-centric control systems, including smartphone-based access and intuitive touchscreen interfaces, will enhance passenger satisfaction and differentiate service offerings. By forging cross-industry partnerships and upskilling technical teams, stakeholders can cultivate a culture of continuous innovation that anticipates regulatory changes and evolving customer expectations.

Outlining the comprehensive research framework combining primary interviews secondary references and quantitative analysis ensuring robust market intelligence

The foundation of this analysis is a mixed-methods research framework that integrates primary and secondary data sources to ensure comprehensive market coverage. Primary insights were gathered through in-depth interviews with C-level executives, field service engineers, and procurement specialists across manufacturing, installation, and maintenance domains. These qualitative discussions provided nuanced perspectives on technology adoption, regulatory influences, and competitive dynamics.

Secondary research encompassed a systematic review of industry white papers, technical standards, financial disclosures, and peer-reviewed publications. Quantitative data were extracted from U.S. and international trade statistics, import-export databases, and patent filings to identify supply chain trends and innovation hotspots. Triangulation of these inputs through robust data validation protocols reinforced the reliability of key findings and reinforced the strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Elevators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Elevators Market, by Elevator Type

- Smart Elevators Market, by Technology

- Smart Elevators Market, by Service Type

- Smart Elevators Market, by Building Height

- Smart Elevators Market, by Control System

- Smart Elevators Market, by Application

- Smart Elevators Market, by Region

- Smart Elevators Market, by Group

- Smart Elevators Market, by Country

- United States Smart Elevators Market

- China Smart Elevators Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Synthesizing key findings and strategic implications to underscore the transformative trajectory of the smart elevator sector in current market contexts

This report has captured the pivotal forces driving the evolution of the smart elevator sector, from the integration of digital ecosystems to the strategic implications of evolving trade policies. By examining granular segmentation dynamics, regional particularities, and the maneuvers of leading corporations, stakeholders are equipped with the insights needed to navigate complexity and capitalize on emerging opportunities.

Ultimately, the fusion of advanced control systems, data-driven maintenance, and sustainable design principles is redefining the value proposition of vertical transportation. Organizations that embrace these transformative trends through informed investment and collaborative innovation will emerge as the architects of future urban mobility landscapes.

Engaging with Associate Director Sales & Marketing Ketan Rohom to secure exclusive insights through the comprehensive smart elevator market research report

Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure unparalleled access to the comprehensive smart elevator market research report and gain the strategic intelligence needed to stay ahead of industry evolution. Reach out today to explore tailored insights, unlock competitive advantages, and drive the next phase of innovation and growth within your organization.

- How big is the Smart Elevators Market?

- What is the Smart Elevators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?