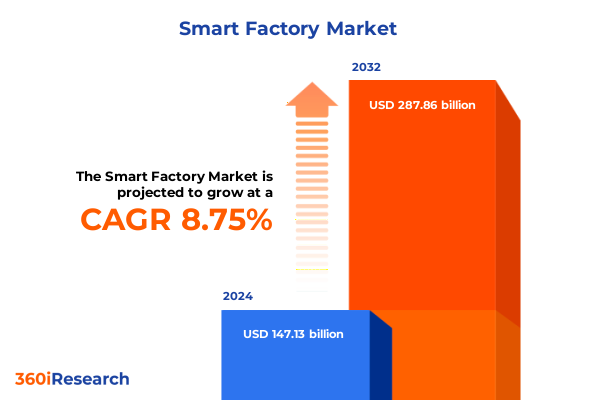

The Smart Factory Market size was estimated at USD 147.13 billion in 2024 and expected to reach USD 159.52 billion in 2025, at a CAGR of 8.75% to reach USD 287.86 billion by 2032.

Charting the Course of Smart Factory Evolution with a Comprehensive Overview of Emerging Technologies and Operational Paradigms

In today’s era of rapid digital transformation, manufacturing leaders face a pivotal moment in harnessing advanced technologies to redefine operational excellence and innovation. The convergence of cyber-physical systems, data analytics, and automation is reshaping factory floors into intelligent, interconnected environments capable of self-optimizing processes and enabling real-time decision making. Against a backdrop of increasing competitive pressures, evolving customer expectations, and global supply chain complexities, the smart factory paradigm offers a pathway to higher productivity, improved quality, and enhanced resilience.

This executive summary delivers an authoritative overview of the smart factory domain, emphasizing the strategic imperatives driving adoption and the critical enablers that underpin seamless integration. Throughout the report, readers will discover how equipment elements-ranging from CNC machines and industrial PCs with advanced control capabilities to precision sensors and autonomous robots-interact with sophisticated software suites encompassing analytics platforms, enterprise resource planning, manufacturing execution systems, and product lifecycle management solutions. Complementing these components, specialized services such as integration and deployment expertise and responsive maintenance and support models ensure that technological investments translate into measurable performance gains.

By illuminating key trends, transformative shifts, policy impacts, and segmentation insights across diverse applications and geographies, this summary equips decision makers with a concise yet comprehensive understanding of the forces shaping the future of manufacturing. As the foundation for deeper strategic planning, it sets the stage for exploring the nuanced facets of regional dynamics, leading industry players, and actionable recommendations that will follow.

Unveiling Transformational Shifts Reshaping Manufacturing through Artificial Intelligence Connectivity and Decentralized Production Models

The manufacturing landscape is undergoing unprecedented transformation driven by advances in artificial intelligence, connectivity, and simulation technologies. Smart factories are moving beyond siloed automation to embrace AI-powered predictive maintenance frameworks that reduce unplanned downtime and optimize resource utilization. Simultaneously, the integration of digital twins-virtual replicas of physical assets-enables continuous performance monitoring and scenario testing, allowing enterprises to simulate line reconfigurations or process improvements before implementation in the physical environment.

Cloud computing architectures have emerged as vital enablers, providing scalable data storage, advanced analytics capabilities, and platform-as-a-service offerings that facilitate rapid deployment of new applications while maintaining stringent security standards. At the same time, edge computing has gained traction for applications requiring ultra-low latency, ensuring that critical control processes remain resilient even amid network disruptions. Immersive technologies, including virtual and augmented reality, are transforming training protocols and remote collaboration, allowing technicians to visualize complex system interactions or receive guided repair instructions overlaid on equipment in real time.

Moreover, interoperability standards and open architectures are fostering a shift toward modular, plug-and-play production cells that can be reconfigured dynamically to address fluctuating demand patterns. This agility is amplified by data-driven insights derived from big data analytics engines that process streaming sensor inputs and historical performance records. By seamlessly combining these technological advances, manufacturers are transitioning to adaptive, self-optimizing facilities that balance efficiency with flexibility, setting the stage for a new era of mass customization and resilient supply chain networks.

Analyzing the Cascading Effects of 2025 United States Tariffs on Supply Chain Resilience and Cross-Border Manufacturing Collaborations

In 2025, the imposition of targeted tariffs on critical manufacturing inputs by the United States has reverberated across global supply chains, compelling manufacturers to reassess sourcing strategies and risk mitigation frameworks. Components such as precision sensors, advanced industrial PCs, and specialized robotics systems have experienced elevated import costs, encouraging many enterprises to explore localized assembly or alternative supplier partnerships. These strategic adjustments are not without complexity, as manufacturers navigate trade compliance, cross-border logistics constraints, and inventory optimization imperatives.

The cascading effects of tariff-driven cost pressures have catalyzed a broader emphasis on supply chain resilience and transparency. Digital platforms that integrate supplier performance metrics, compliance documentation, and real-time shipment tracking have become instrumental in maintaining operational continuity. Furthermore, the rise in procurement costs has intensified interest in software-driven process optimization tools that can deliver efficiency gains to offset higher input prices. Manufacturers are increasingly leveraging advanced analytics platforms and digital twins to model the financial impact of tariff scenarios and to identify process bottlenecks where technology adoption can yield rapid return on investment.

While short-term disruptions have challenged lean manufacturing philosophies, they have also accelerated the adoption of regionalized production strategies that prioritize proximity to end markets. By establishing local hubs equipped with modular smart factory cells, organizations can reduce exposure to cross-border friction, shorten lead times, and enhance responsiveness to evolving customer requirements. As the landscape continues to evolve, supply chain orchestration platforms and scenario-planning tools will remain key to balancing cost management with the agility needed to thrive under shifting trade policies.

Deriving Actionable Insights from Component Technology Connectivity Enterprise Size Deployment Application Area and End Use Segmentations

A nuanced understanding of market segmentation is essential to unlocking the full strategic potential of smart factory initiatives. From a components perspective, equipment represents a foundational pillar that encompasses CNC machines programmed for precision fabrication, industrial PCs and controllers that serve as the nerve center of automated systems, robotics platforms capable of both collaborative and high-speed operations, and a diverse array of sensors that provide the granular data necessary for closed-loop process control. Complementing hardware investments, specialized services such as integration and deployment ensure seamless orchestration of disparate technologies, while maintenance and support frameworks uphold system reliability and minimize operational downtime. The software dimension spans advanced analytics platforms that convert raw data into actionable insights, enterprise resource planning solutions that synchronize business processes, manufacturing execution systems that manage shop-floor workflows, and product lifecycle management suites that oversee design-to-retirement processes.

Technology segmentation reveals the critical role of big data analytics in driving predictive insights, cloud computing in facilitating scalable infrastructure, digital twins in enabling virtual prototyping and scenario analysis, and immersive realities that enhance workforce training and remote assistance. Examining connectivity options, wired networks such as Ethernet and fieldbus provide robust, deterministic communication channels, whereas wireless protocols-including Bluetooth BLE, Wi-Fi, WirelessHART, and Zigbee-unlock flexibility for mobile assets and distributed sensors.

Considering enterprise size, the distinction between large organizations with expansive, multi-site operations and small and medium enterprises underscores variations in investment horizons, integration complexity, and resource allocation. Deployment models further influence operational agility, with cloud-based implementations offering rapid scalability and remote management, and on-premises solutions providing greater data sovereignty and control. Application areas range from asset tracking that enhances visibility to process automation that drives throughput, energy management platforms that reduce operational costs, production planning systems that optimize scheduling, and quality inspection tools that ensure product conformance. Across end uses such as aerospace and defense, automotive, chemicals, energy and power, food and beverages, healthcare, logistics and warehousing, metal and machinery, oil and gas, pharmaceuticals, and semiconductor and electronics, the interplay of these segmentations dictates tailored technology roadmaps and investment strategies.

This comprehensive research report categorizes the Smart Factory market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Connectivity

- Enterprise Size

- Deployment

- Application Area

- End Use

Gaining Strategic Perspectives on Smart Factory Evolution across Americas Europe Middle East Africa and Asia Pacific Regions

Regional dynamics play an instrumental role in shaping smart factory adoption and innovation pathways. In the Americas, a mature industrial base is increasingly focused on retrofitting existing facilities with advanced automation, leveraging industrial robots and industrial PCs to enhance legacy production lines. Domestic policy incentives and infrastructure development initiatives have bolstered investments in data centers and edge computing nodes, facilitating hybrid cloud architectures that meet stringent data security requirements. Moreover, cross-border collaboration within North America has accelerated supply chain integration, with manufacturers partnering across the United States, Canada, and Mexico to develop interoperable systems and shared digital standards.

Europe, the Middle East, and Africa present a multifaceted landscape where established manufacturing hubs in Western Europe prioritize sustainability and circular economy principles. Here, digital twins and predictive analytics are applied to reduce resource consumption and carbon footprints within chemical, automotive, and aerospace sectors. Simultaneously, emerging markets in the Middle East are accelerating diversification efforts by investing in smart factory greenfield projects, often anchored by free-zone initiatives and public-private partnerships. In Africa, pilot deployments of low-cost wireless sensor networks and energy management solutions are demonstrating the potential for incremental efficiency gains in mining, logistics, and food processing operations.

Across Asia-Pacific, rapid urbanization and burgeoning consumer markets are driving high levels of automation investment. Japan and South Korea lead in robotics innovation and smart sensor integration, while China’s emphasis on digital sovereignty has fostered the development of domestic cloud platforms and manufacturing execution systems. Southeast Asian economies are positioning themselves as regional assembly hubs, integrating modular automation cells that can accommodate fluctuating order volumes. By understanding these region-specific drivers and regulatory environments, industry stakeholders can craft localized strategies that leverage existing infrastructure and address cultural and logistical nuances.

This comprehensive research report examines key regions that drive the evolution of the Smart Factory market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Organizations Driving Innovation Collaboration and Competitive Advantage in the Smart Factory Ecosystem

The competitive landscape of the smart factory ecosystem is characterized by a blend of legacy automation leaders and innovative technology entrants. Established industrial automation providers have augmented their portfolios with AI-driven software modules, expanding beyond traditional hardware to offer end-to-end integrated solutions. These incumbents often leverage extensive global service networks and deep industry expertise to deliver comprehensive deployment and maintenance programs.

Concurrently, specialized software vendors are disrupting the status quo by introducing cloud-native analytics platforms and modular digital twin frameworks that enable rapid pilot projects and iterative scaling. Their platforms typically prioritize interoperability through open APIs and microservices architectures, allowing manufacturers to integrate new capabilities without overhauling existing systems. Connectivity specialists, including industrial networking pioneers and wireless protocol innovators, are collaborating to optimize data pipelines and ensure the reliability of real-time communication.

Additionally, emerging challengers in areas such as augmented reality, cybersecurity for industrial control systems, and analytics-as-a-service are forging strategic partnerships with both equipment manufacturers and systems integrators. These collaborations enable the bundling of hardware, software, and services into cohesive offerings, reducing complexity for end users. As the ecosystem continues to evolve, organizations that combine domain expertise with agile development processes and robust partner networks are poised to lead the next phase of smart factory innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Factory market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- ABB Ltd.

- Andea sp. z o.o.

- Cisco Systems, Inc.

- Cognex Corporation

- Emerson Electric Co.

- Epicor Software Corporation

- Fanuc Corporation

- Fruitcore Robotics GmbH

- Fujitsu Limited

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- HP Inc.

- International Business Machines Corporation

- KUKA AG by Midea Group

- Microsoft Corporation

- Mitsubishi Electric Corporation

- NVIDIA Corporation

- Oracle Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- Stratasys Ltd.

- TE Connectivity Ltd.

- Telefonaktiebolaget LM Ericsson

- Texas Instruments Incorporated

- Ubisense Ltd.

- Yokogawa Electric Corporation

Actionable Strategic Recommendations to Accelerate Digital Transformation Enhance Productivity and Foster Sustainable Smart Factory Growth

To capitalize on the transformative potential of smart factory technologies, leaders should begin by articulating a clear digital vision that aligns with core business objectives and operational pain points. Engaging cross-functional teams early in the process ensures that technology roadmaps are grounded in practical use cases, facilitating stakeholder buy-in and reducing resistance during implementation. It is imperative to prioritize pilot projects that demonstrate quick wins-such as predictive maintenance for critical assets or automated quality inspection-so that the organization can gain confidence and refine governance models before scaling.

Data governance and cybersecurity frameworks must be established in tandem with infrastructure deployments. By defining data ownership, access controls, and encryption standards upfront, manufacturers can mitigate risk and comply with evolving regulatory requirements. Adopting a hybrid architecture that balances edge and cloud deployments enables organizations to optimize latency-sensitive applications onsite while leveraging cloud-based analytics for more complex workloads.

Investment in workforce upskilling is equally essential. Combining immersive training technologies with mentorship programs empowers employees to engage with new systems and contribute to continuous improvement initiatives. Furthermore, forging collaborative partnerships-whether with technology vendors, academic institutions, or industry consortia-accelerates knowledge transfer and fosters innovation. By systematically monitoring key performance indicators and iterating on deployment strategies, industry leaders can ensure that smart factory initiatives deliver sustainable operational and financial benefits.

Detailing Rigorous Research Methodology Data Collection Analytical Framework and Validation Processes Underpinning the Smart Factory Report

This report rests on a rigorous research methodology incorporating both qualitative and quantitative approaches. Primary data were collected through structured interviews with senior manufacturing executives, technology vendor leaders, and systems integrators across key regions. These conversations provided firsthand perspectives on technology adoption drivers, integration challenges, and strategic priorities.

Complementing primary research, secondary sources-including industry white papers, regulatory publications, and peer-reviewed journals-were analyzed to contextualize findings and validate emerging trends. A robust analytical framework was developed to segment the ecosystem by components, technologies, connectivity, enterprise size, deployment models, application areas, and end-use industries, ensuring that insights are both comprehensive and nuanced. Triangulation techniques were employed to cross-verify data points and maintain the integrity of conclusions.

To enhance transparency and reproducibility, detailed appendices outline the data collection instruments, sampling criteria, and validation processes. Peer review sessions with independent experts further refined the report’s analytical rigor, ensuring that the strategic recommendations and key insights are grounded in empirical evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Factory market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Factory Market, by Component

- Smart Factory Market, by Technology

- Smart Factory Market, by Connectivity

- Smart Factory Market, by Enterprise Size

- Smart Factory Market, by Deployment

- Smart Factory Market, by Application Area

- Smart Factory Market, by End Use

- Smart Factory Market, by Region

- Smart Factory Market, by Group

- Smart Factory Market, by Country

- United States Smart Factory Market

- China Smart Factory Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Summarizing Key Findings Strategic Implications Operational Best Practices and Future Directions for Stakeholders in the Smart Factory Landscape

Through a careful synthesis of technological developments, policy impacts, segmentation dynamics, regional drivers, and competitive landscapes, several critical findings emerge. Smart factories are evolving into adaptive, decentralized production environments powered by AI, digital twins, and advanced connectivity protocols. Trade policy shifts, such as the 2025 United States tariffs, have highlighted the necessity for resilient supply chain strategies and localized manufacturing hubs.

Segmentation analysis underscores the importance of tailoring component selection, deployment models, and software architectures to enterprise size and specific application requirements. Regional insights reveal distinct investment priorities and regulatory landscapes across the Americas, Europe Middle East and Africa, and Asia Pacific, informing market entry and partnership decisions. Competitive profiling highlights a collaborative ecosystem in which established automation leaders, software disruptors, and niche specialists converge to deliver integrated solutions.

Looking ahead, stakeholders should focus on establishing robust data governance, leveraging hybrid cloud-edge architectures, and investing in workforce capabilities to fully realize smart factory potential. By embracing a strategic, data-driven approach and fostering cross-industry collaborations, organizations will be well positioned to navigate industry complexities, drive continuous improvement, and capture value from next-generation manufacturing innovations.

Encouraging Engagement and Guiding Decision Makers to Secure the Comprehensive Smart Factory Market Research Report Today

To explore the depths of smart factory transformation and secure a comprehensive resource tailored to your strategic objectives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By obtaining the full research report, decision makers can harness detailed analyses, actionable recommendations, and rigorous methodological insights to guide investment decisions, technology roadmaps, and ecosystem partnerships. Engage with Ketan to customize the scope of your research, arrange a tailored briefing, and ensure that your organization captures the full potential of digital transformation in manufacturing. Connect today to unlock unparalleled expertise and strategic foresight that will drive operational excellence and competitive differentiation.

- How big is the Smart Factory Market?

- What is the Smart Factory Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?