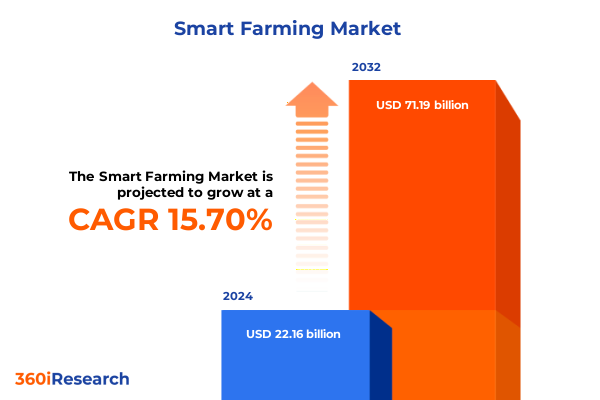

The Smart Farming Market size was estimated at USD 25.65 billion in 2025 and expected to reach USD 29.42 billion in 2026, at a CAGR of 15.69% to reach USD 71.19 billion by 2032.

Laying the Groundwork for a Data-Driven Revolution that Elevates Agricultural Productivity and Sustainability in the Modern Smart Farming Era

The evolution of agriculture into an intelligent, data-driven ecosystem marks a pivotal moment in human history, transforming traditional practices into precision-driven operations that maximize yield and conserve resources. As environmental pressures intensify and global food demand continues to rise, farm operators and agri-tech companies are rallying around smart farming innovations that integrate digital sensors, advanced analytics, and automation. This introduction frames the broader narrative, situating smart farming not merely as a collection of isolated technologies but as an interconnected system designed to enhance decision making at every stage of the agricultural value chain.

Throughout this executive summary, we dissect the key forces shaping smart farming, emphasizing the convergence of hardware, software, and service components, and highlighting how they collectively empower farmers to adopt a more proactive stance toward crop management, resource allocation, and supply chain optimization. We introduce the primary segments, from Crop Monitoring and Variable Rate Application to Farm Management Software and Climate Control, illustrating how each pillar contributes to a holistic agricultural strategy. By clarifying the technological and operational contexts, this introduction sets the stage for a deeper exploration of transformative shifts, regulatory impacts, segmentation insights, and regional dynamics in subsequent sections, ensuring that stakeholders gain a clear and actionable understanding of the smart farming landscape.

How Emerging Technologies and Evolving Farm Practices Are Dramatically Reshaping the Agricultural Landscape in the Smart Farming Domain

The agricultural sector is experiencing a profound metamorphosis as emerging technologies and novel farming approaches redefine the boundaries of what is possible. Precision farming techniques leverage real-time sensor data to drive adaptive irrigation, fertilization, and pest management strategies, transforming reactive interventions into anticipatory orchestration of field activities. Simultaneously, the integration of drone and satellite imaging has introduced a new paradigm in Crop Monitoring, enabling farmers to detect stress indicators and disease patterns at a granular level across vast acreages.

Moreover, Software platforms that consolidate data from Controllers, Sensors, and Actuators are empowering stakeholders with intuitive dashboards and predictive analytics. This convergence of technologies is further augmented by specialized Services ranging from Consulting on digital transformation roadmaps to Support and Maintenance packages that ensure system uptime during critical seasons. In parallel, Livestock Monitoring systems are evolving to encompass Behavior Monitoring and Health Monitoring, offering precision insights into feed optimization and disease prevention. These shifts collectively underscore a transition from intuition-based decisions toward evidence-based strategies, accelerating adoption of Variable Rate Application and Yield Mapping to maximize both productivity and environmental stewardship. As the landscape continues to evolve, agility in integrating these diverse technologies becomes the key differentiator between leading and lagging operations.

Assessing the Multifaceted Consequences of 2025 U.S. Agricultural Tariffs on Smart Farming Supply Chains and Technology Adoption Rates

In 2025, the introduction of new U.S. tariffs on agricultural equipment and technology components sent ripples through the global smart farming ecosystem, compelling manufacturers and service providers to reassess supply chain configurations and pricing strategies. Hardware segments, particularly high-precision Sensors and Actuators, experienced increased input costs as import duties were applied to key electronic components. This prompted several providers to explore domestic manufacturing partnerships and alternative suppliers in order to mitigate cost inflation and maintain competitive positioning.

At the same time, the Services domain encountered indirect effects as rising hardware expenses influenced the pricing of Support and Maintenance contracts, while Consulting firms adjusted their engagement models to account for longer lead times and greater logistical complexity. On the Software front, Data Analytics Software developers faced pressure to justify subscription fees amid broader concerns over overall technology expenditures. Across Crop Types such as Corn, Rice, and Wheat, farm operators weighed the benefits of precision irrigation against higher equipment acquisition costs, recalibrating their capital allocation toward farm management platforms that promised near-term efficiency gains.

Despite these challenges, some agile enterprises leveraged tariff-induced market disruptions to differentiate through localized production, rapid deployment of turnkey systems, and enhanced remote support offerings. The cumulative impact of these policy changes has thus acted as both a catalyst for supply chain innovation and a stress test for existing business models, underscoring the importance of adaptive strategies in navigating evolving regulatory landscapes.

Unveiling Strategic Segmentation Insights That Decode the Complex Interplay of Components Crop Types Applications and Farm Scales

Delving into the component-based segmentation, it becomes evident that Hardware-including Controllers and Sensors-serves as the foundational layer upon which data flows, while Software components such as Farm Management Software translate that data into actionable insights. Services, encompassing both Consulting and Support & Maintenance, play a critical role in ensuring system integration and sustained operational performance. This tripartite structure reveals how each segment contributes uniquely to the overall value proposition of smart farming solutions.

Turning to Crop Type segmentation, distinctions between Cereals & Grains like wheat and rice versus Fruits & Vegetables such as tomatoes and potatoes illustrate varied technology adoption patterns, driven by differences in crop cycle lengths, yield sensitivities, and landscape heterogeneity. Oilseeds & Pulses, including soybean and chickpea, present another set of specialized requirements for nutrient monitoring and yield mapping, further emphasizing the need for tailored application modules within broader platforms.

Application-level segmentation sheds light on the diverse suite of use cases that stakeholders prioritize. From Drone Imaging in Crop Monitoring to Pest Management in Greenhouse Monitoring, each application area demands specific sensor types, analytics capabilities, and service frameworks. Similarly, Precision Farming projections around Variable Rate Application intersect with Soil Monitoring techniques like Moisture and Nutrient Monitoring to optimize input utilization at the field level. Finally, Farm Size segmentation underscores how Large Farms pursue enterprise-grade, fully integrated systems, whereas Small and Medium Farms often scale solutions in modular fashions, underscoring the importance of flexible deployment options.

This comprehensive research report categorizes the Smart Farming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Crop Type

- Application

- Farm Size

Dissecting Regional Dynamics and Growth Drivers Across the Americas EMEA and AsiaPacific to Illuminate Smart Farming Trajectories

Regional nuances in smart farming adoption reveal that the Americas continue to capitalize on vast arable lands and well-established precision agriculture infrastructure, with farm operators increasingly deploying Variable Rate Application and satellite-based imaging to optimize input usage across expansive fields. In contrast, Europe, Middle East & Africa are characterized by a patchwork of regulatory frameworks, climatic conditions, and crop portfolios, driving multipronged investments in Climate Control, Pest Management, and Soil Monitoring technologies that address both high-value specialty crops and staple grains.

Meanwhile, Asia-Pacific markets stand at the intersection of rapid technological modernization and diverse agricultural traditions, with emerging economies embracing Farm Management Software and Data Analytics Software to enhance food security amid urbanization pressures. These regional dynamics underscore the importance of customizing go-to-market strategies and service delivery models to local operational contexts, whether that requires multi-lingual user interfaces, regional support centers, or compliance with varying data privacy regulations. By delineating these geographic insights, stakeholders can identify optimal entry points and partnership frameworks, crafting region-specific value propositions that resonate with local growers and agribusinesses.

This comprehensive research report examines key regions that drive the evolution of the Smart Farming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Differentiators and Innovation Strategies of Market Leading Players Driving Smart Farming Advancements

Leading players in the smart farming ecosystem distinguish themselves through differentiated hardware portfolios, integrated software suites, and comprehensive service offerings. Some technology providers focus on advancing sensor accuracy and actuator responsiveness to deliver real-time adaptive control, while others prioritize platform interoperability, enabling seamless data exchange between Controllers, Data Analytics Software, and third-party solutions. Certain consultancies have carved out niche specialties in digital transformation roadmaps for specific crop types, leveraging deep agronomic expertise to recommend optimal sensor placements and imaging schedules.

Additionally, software innovators differentiate through advanced machine learning algorithms that forecast yield outcomes or detect plant stress ahead of visible symptoms, delivering prescriptive recommendations via intuitive dashboards. Service-oriented firms, on the other hand, invest heavily in remote monitoring capabilities, ensuring that firmware updates and system calibrations occur with minimal downtime. Across Farm Sizes, leading companies offer scalable solutions that accommodate the needs of large enterprises as well as cost-effective modules for smallholder operations, thereby capturing a broader addressable market without diluting their premium service tiers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Farming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afimilk Ltd.

- AGCO Corporation

- Allflex

- BouMatic

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- DeLaval

- Farmers Edge Inc.

- GEA Group AG

- Kubota Corporation

- Kubota Corporation

- Kuhn S.A.

- Lely Industries N.V.

- PrecisionHawk Inc.

- Raven Industries, Inc.

- SDF S.p.A.

- Topcon Corporation

- Trimble Inc.

- Yanmar Co., Ltd.

Strategic Imperatives and Tactical Roadmaps for Industry Leaders to Capitalize on Smart Farming Opportunities and Navigate Disruptions

Industry leaders must prioritize the development of fully integrated ecosystems that combine hardware robustness, software intelligence, and responsive services to remain ahead of the curve. This entails forging strategic partnerships with sensor manufacturers and cloud platform providers to streamline data flows and reduce time to value for end users. In parallel, organizations should invest in modular solution architectures that allow farm operators of varied scales to adopt core functionalities first and scale up to advanced applications over time.

To navigate ongoing regulatory shifts and tariff uncertainties, firms are advised to diversify their manufacturing footprints, exploring co-location strategies in key agricultural regions. Cultivating local reseller and service partner networks will also enhance customer support capabilities, ensure rapid deployment, and foster community-based knowledge sharing. Moreover, technology providers should allocate resources toward continuous algorithm refinement, leveraging field trial data from diverse crop types to improve prediction accuracy and extend application relevance. Finally, a proactive approach to thought leadership-publishing case studies, hosting workshops, and engaging in pilot projects-will underscore credibility, accelerate market education, and drive adoption among innovative growers.

Detailed Explanation of Rigorous Qualitative and Quantitative Research Methodology Employed for Comprehensive Smart Farming Market Analysis

This research employs a hybrid approach, combining qualitative interviews with agronomists, farm managers, and industry executives alongside quantitative surveys of technology usage patterns across varied crop types and geographies. Primary data collection involved structured consultations to capture insights into sensor deployment challenges, software integration experiences, and service engagement preferences. Secondary research encompassed a comprehensive review of scientific publications, patent filings, and regulatory documents to contextualize technological advancements and policy impacts.

Data validation protocols included cross-referencing survey responses with field deployment case studies and financial disclosures where available, ensuring that the compiled insights reflect operational realities rather than theoretical projections. Market participation metrics were triangulated through firm-level analyses, enabling the delineation of competitive positioning and innovation focus areas. The methodology also integrated geo-spatial analysis to map regional adoption density, correlating climatic variables with application uptake. This rigorous, multi-layered approach underpins the robustness of findings presented in this executive summary, delivering an authoritative perspective for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Farming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Farming Market, by Component

- Smart Farming Market, by Crop Type

- Smart Farming Market, by Application

- Smart Farming Market, by Farm Size

- Smart Farming Market, by Region

- Smart Farming Market, by Group

- Smart Farming Market, by Country

- United States Smart Farming Market

- China Smart Farming Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Core Findings and Forward Looking Perspectives to Chart Future Pathways in Smart Farming Evolution

The evolving convergence of hardware, software, and services in agriculture signifies a watershed moment for food production, resource management, and sustainability. Our analysis has illuminated how precision technologies-from Drone Imaging to Predictive Analytics Software-have shifted farming paradigms toward data-driven decision making, yielding both environmental and economic benefits. The 2025 tariff landscape, while introducing cost pressures, has simultaneously spurred supply chain reconfiguration and local manufacturing innovation, reinforcing the sector’s resilience.

Segmentation insights reveal distinct adoption patterns that hinge upon component type, crop variety, application focus, and farm size, underscoring the necessity for tailored solution architectures. Regional dynamics further accentuate the importance of customizing offerings to local regulatory frameworks, climatic contexts, and growth priorities. Competitive analysis shows that market-leading companies excel by integrating advanced machine learning, delivering end-to-end service support, and enabling flexible deployment models.

Looking forward, the industry is poised to embrace next-generation innovations such as autonomous field robotics and edge-based analytics, driving even greater precision and operational efficiency. Stakeholders armed with the insights and recommendations presented here will be well positioned to navigate the complexity of the smart farming landscape, capitalizing on technological advances while mitigating emerging risks.

Connect Directly with Ketan Rohom to Secure Tailored Access to the Complete Smart Farming Market Research Insights and Drive Informed Strategic Decision Making

To explore the full breadth of insights on precision agriculture, advanced sensor integration, and strategic market positioning, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will ensure that you gain customized guidance on how these insights translate into actionable strategies tailored to your organization’s needs. By engaging with Ketan Rohom, you will also receive priority access to exclusive data deep dives, supplementary analyses, and private briefings designed to inform high-impact decisions. Whether you represent a technology provider, an agricultural cooperative, or a leading farm operation, this direct engagement will empower you to align your investments, partnerships, and innovation roadmaps with the latest developments in smart farming. Reach out today to unlock the complete market research report and position your organization at the forefront of the agricultural revolution.

- How big is the Smart Farming Market?

- What is the Smart Farming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?