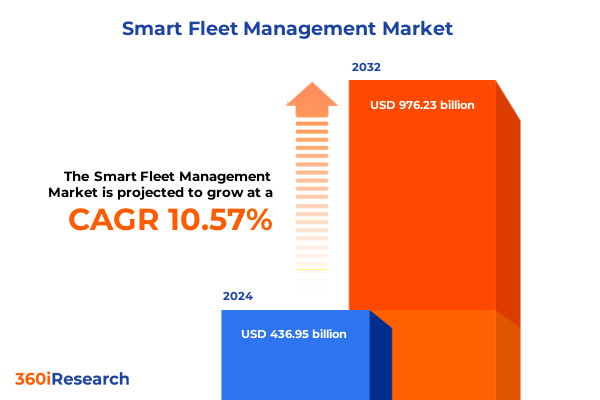

The Smart Fleet Management Market size was estimated at USD 482.80 billion in 2025 and expected to reach USD 530.88 billion in 2026, at a CAGR of 10.58% to reach USD 976.23 billion by 2032.

Unveiling the Strategic Imperative of Smart Fleet Management in Modern Logistics Ecosystems to Drive Operational Excellence and Competitive Advantage

In today’s fast-paced transportation environment, organizations are under intense pressure to optimize logistics operations while simultaneously reducing costs and enhancing safety. Smart fleet management has emerged as a strategic imperative, leveraging next-generation telematics, advanced analytics, and connectivity solutions to transform traditional vehicle oversight into a data-driven, predictive discipline. Fuel efficiency, route optimization, driver performance, and maintenance forecasting are no longer disparate initiatives but integral parts of a cohesive ecosystem that delivers real-time visibility and actionable intelligence.

This executive summary distills the most critical themes shaping the smart fleet management landscape. It offers a cohesive narrative on technological innovation, regulatory influence, segmentation dynamics, and regional variations, while also highlighting the cumulative impact of new tariff regimes. By synthesizing these multilayered factors, decision-makers will gain clarity on current challenges, emergent opportunities, and strategic imperatives that underpin sustainable growth and competitive differentiation.

As this analysis unfolds, it will lay the foundation for subsequent sections that explore technological shifts, policy developments, granular segmentation insights, regional nuances, and industry best practices. Through this lens, executives can align investments with evolving market demands and secure an optimal trajectory for their fleet operations.

Mapping the Transformative Technological and Regulatory Shifts Reshaping Smart Fleet Management Strategies in a Rapidly Evolving Transportation Sector

The smart fleet management sector has undergone profound transformation in recent years, driven by the convergence of ubiquitous connectivity, artificial intelligence, and stringent regulatory requirements. The advent of cellular IoT modules and the proliferation of edge computing have enabled on-board devices to process and transmit vast data volumes, empowering fleets with unparalleled situational awareness. Simultaneously, machine learning algorithms have evolved to deliver predictive maintenance models that anticipate component wear and reduce unplanned downtime.

Regulatory bodies are also reshaping industry imperatives, with emissions standards and driver hours-of-service mandates accelerating the adoption of telematics for compliance reporting. Regions that offer incentives for lowering carbon footprints have seen fleets embrace electrification alongside hybrid powertrains, further intertwining sustainability with operational resilience. Transitioning from reactive to prescriptive operational models, fleet operators now deploy advanced driver assistance features, risk scoring systems, and real-time safety alerts to minimize incidents and safeguard assets.

Together, technological advancements and regulatory frameworks are redefining the competitive landscape, compelling stakeholders to reassess legacy architectures and invest in modular, future-ready platforms. This paradigm shift underscores the need for continuous innovation and strategic agility, themes that resonate throughout the remainder of this report.

Examining the Cumulative Effect of 2025 United States Tariff Adjustments on Supply Chain Dynamics and Cost Structures within the Smart Fleet Management Industry

As the United States implemented its updated tariff schedule in early 2025, hardware components critical to telematics and fleet-monitoring solutions experienced significant cost fluctuations. Devices such as in-vehicle cameras, onboard diagnostics units, and telematics control modules faced import duties that elevated procurement expenses, prompting OEMs and service providers to reassess sourcing strategies. In certain cases, upward of a ten percent duty increase on key electronic subassemblies compelled fleets to explore alternative suppliers or negotiate long-term fixed-price agreements to mitigate margin erosion.

The ripple effects extended beyond hardware. Professional services engagements, including system integration and custom analytics development, saw contractual repricing as labor rates were recalibrated to offset rising equipment costs. Meanwhile, cloud infrastructure expenditures were indirectly influenced by shifts in data center utilization patterns, as some providers relocated compute resources closer to manufacturing hubs to reduce cross-border traffic and associated tariff exposure.

To navigate this evolving landscape, many market participants have adopted dual-sourcing models and are increasingly evaluating nearshore and onshore production facilities. This strategic diversification not only alleviates tariff pressures but also reinforces supply chain resilience. As tariffs remain a critical variable in procurement optimization, stakeholders must continually calibrate their cost models and supply chain footprints to maintain competitive pricing and service delivery standards.

Illuminating Critical Segmentation Insights by Integrating Component Application Deployment Mode Connectivity Type and Vehicle Type Perspectives for Deeper Market Understanding

An integrated component perspective reveals that hardware forms the foundational layer of smart fleet solutions, encompassing devices such as in-vehicle cameras that capture real-time road conditions, onboard diagnostics sensors that monitor engine health, telematics control units that aggregate critical performance metrics, and transport management units that facilitate centralized orchestration. Managed services and professional services ensure these hardware investments translate into ongoing value through remote monitoring, system upgrades, and bespoke analytics development. Above this tier, software modules deliver essential functionality-driver behavior management that incentivizes safe and eco-conscious driving, fleet tracking that provides end-to-end visibility, fuel management that detects inefficiencies and potential theft, route optimization that adapts to real-time traffic flows, safety and compliance frameworks that automate regulatory reporting, and comprehensive vehicle diagnostics and maintenance workflows.

From an application standpoint, solutions extend across behavioral analytics, where eco-driving and performance-scoring algorithms refine driver profiles while risk management dashboards guide targeted training initiatives. Fuel optimization suites rest on advanced efficiency analytics and theft-monitoring alerts, whereas safety and compliance tools leverage accident reconstruction algorithms and regulatory compliance engines to minimize liability. Decision-makers benefit from a unified view that aligns operational priorities with business outcomes, combining predictive alerts with historical trend analysis.

Deployment flexibility is paramount, as organizations evaluate cloud-based platforms for rapid scalability and reduced infrastructure overhead against on-premise installations that provide greater control over data residency and security. Connectivity architectures vary accordingly, spanning Bluetooth and Wi-Fi for short-range data exchanges, cellular networks for ubiquitous coverage, radio frequency networks in remote environments, and satellite communications in areas devoid of terrestrial infrastructure. Finally, the distinct requirements of heavy commercial vehicles, light commercial vehicles, and passenger cars shape adoption curves, with heavy fleets prioritizing ruggedized hardware and high-throughput telematics, light fleets balancing cost sensitivity with essential tracking capabilities, and passenger car deployments focusing on safety, convenience, and compliance applications.

This comprehensive research report categorizes the Smart Fleet Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment Mode

- Connectivity Type

- Vehicle Type

Analyzing Regional Nuances Across Americas, Europe Middle East & Africa, and Asia-Pacific to Highlight Divergent Adoption Patterns and Growth Drivers in Smart Fleet Management

Regional dynamics play an instrumental role in shaping the direction and pace of smart fleet management adoption. In the Americas, high freight volumes, expansive highway networks, and robust e-commerce penetration underpin strong demand for real-time tracking, route optimization, and fuel management solutions. Market leaders in this region leverage telematics insights to negotiate favorable insurance premiums and to streamline last-mile delivery operations in densely populated urban corridors.

Conversely, Europe Middle East & Africa reflects a tapestry of regulatory environments, with stringent greenhouse gas targets driving electrification pilots and compliance tracking, while emerging economies in North Africa adopt turnkey solutions to enhance highway safety and cargo security. Fleet operators across this region often engage managed services providers to navigate complex cross-border regulations and to implement multilingual dashboard interfaces that accommodate diverse operational standards.

In Asia-Pacific, surging vehicle ownership, infrastructural upgrades, and government initiatives to modernize logistics corridors have catalyzed fleets to invest in integrated platforms. Compact urban centers in Southeast Asia demand agile route-planning tools to negotiate congestion, while vast territories in Australia and New Zealand prioritize satellite-based communications to maintain connectivity. Across these regions, the interplay between regulatory rigor and commercial incentives accelerates fleet modernization, fostering a competitive environment ripe for innovative solution providers.

This comprehensive research report examines key regions that drive the evolution of the Smart Fleet Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Reveal Strategic Partnerships Competitive Differentiators and Innovation Trajectories Driving the Smart Fleet Management Ecosystem

Key industry participants continue to expand their value propositions through targeted partnerships, product portfolio enhancements, and strategic acquisitions. Established providers of telematics hardware and software are deepening integrations with cloud hyperscalers to deliver scalable analytics services, while specialist managed-service firms are embedding artificial intelligence capabilities into their offerings to predict maintenance needs and optimize driver behavior. Emerging disruptors, particularly those originating from the enterprise IoT and analytics sectors, are introducing modular solutions designed for rapid deployment, often incorporating open APIs that facilitate seamless integration with enterprise resource planning and transportation management systems.

Collaborations between fleet OEMs and technology vendors have given rise to factory-fit telematics installations, streamlining procurement and maintenance processes through warranty-aligned data-sharing agreements. At the same time, innovators in satellite communications are partnering with fleet management platforms to extend visibility in remote regions, opening new vertical opportunities in mining and energy logistics. This blended ecosystem of hardware manufacturers, software developers, connectivity providers, and service organizations underscores the importance of interoperability, data security, and scalability as differentiating factors in an increasingly crowded market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Fleet Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Azuga, Inc

- Bridgestone Corporation

- Continental AG

- Fleet Complete

- Geotab Inc

- Gurtam UAB

- Hitachi Ltd

- IBM Corporation

- Inseego Corp

- Lytx Inc

- MiX Telematics Ltd

- Omnitracs LLC

- PowerFleet Inc

- Robert Bosch GmbH

- Samsara Inc

- Teletrac Navman Ltd

- TomTom N.V

- Trimble Inc

- Verizon Communications Inc

- Zonar Systems Inc

Offering Actionable Strategic Recommendations to Empower Industry Leaders to Optimize Investments Enhance Operational Efficiency and Capitalize on Emerging Smart Fleet Opportunities

To capitalize on emerging opportunities and mitigate market volatility, industry leaders should prioritize investments in integrated, cloud-native platforms that support modular feature expansion without disrupting core operations. By adopting predictive analytics and machine learning frameworks, fleet operators can transition from reactive maintenance schedules to proactive asset management, reducing downtime and optimizing total cost of ownership. Diversifying hardware supply chains through regional sourcing partnerships will help stabilize input costs and protect against tariff fluctuations.

Securing data across distributed endpoints is critical; therefore, leaders must enforce robust cybersecurity protocols that encompass device authentication, encryption standards, and real-time threat monitoring. Strategic alliances with connectivity providers, including cellular carriers and satellite operators, can ensure uninterrupted coverage in both urban and remote environments. Furthermore, aligning technology roadmaps with evolving emissions regulations and electrification incentives will enable fleets to position themselves as sustainability champions, thereby enhancing brand reputation and unlocking new funding streams.

Finally, fostering a culture of continuous improvement through regular performance reviews, driver training initiatives, and cross-functional stakeholder collaboration will empower organizations to extract maximum value from their smart fleet investments. Establishing governance frameworks that measure key performance indicators and iterate on deployment strategies will sustain long-term competitive advantage.

Detailing Rigorous Research Methodology Employed to Ensure Data Integrity Analytical Rigor and Comprehensive Insights for Smart Fleet Management Stakeholders

The research underpinning this analysis combined primary insights from structured interviews with fleet managers, telematics solution architects, regulatory specialists, and procurement executives. These discussions employed semi-structured questionnaires to capture nuanced perspectives on technology adoption barriers, total cost considerations, and emerging use cases. Complementing this primary data, surveys were distributed to a representative sample of fleet operators across diverse vehicle types and geographies to quantify adoption rates, satisfaction levels, and planned investment cycles.

Secondary research sources included public financial disclosures of leading technology vendors, government and regulatory filings related to emissions standards and trade policies, industry white papers on IoT deployments, and regional logistics reports. Data points were validated through a triangulation methodology that cross-referenced stakeholder interviews, survey results, and proprietary thematic analysis. Quantitative models were developed using statistical regression techniques to identify correlations between segmentation variables, regional dynamics, and tariff impacts, while qualitative insights were derived via thematic coding of interview transcripts.

To ensure analytical rigor, all findings underwent peer review by subject-matter experts specializing in transportation economics, data security, and cloud computing. Rigorous quality checks, including data integrity audits and consistency reviews, were conducted prior to finalizing the report’s insights and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Fleet Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Fleet Management Market, by Component

- Smart Fleet Management Market, by Application

- Smart Fleet Management Market, by Deployment Mode

- Smart Fleet Management Market, by Connectivity Type

- Smart Fleet Management Market, by Vehicle Type

- Smart Fleet Management Market, by Region

- Smart Fleet Management Market, by Group

- Smart Fleet Management Market, by Country

- United States Smart Fleet Management Market

- China Smart Fleet Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights Synthesizing Key Findings and Articulating the Strategic Imperatives for Sustainable Competitive Advantage in Smart Fleet Management

Smart fleet management stands at the nexus of technology innovation, regulatory evolution, and shifting market demands. This analysis underscores the transformative potential unlocked by advanced telematics devices, predictive analytics, and integrated software platforms, all of which converge to deliver heightened operational visibility, safety enhancements, and cost efficiencies. The interplay of increased tariffs, complex regional dynamics, and robust segmentation perspectives highlights that strategic agility and supply chain resilience are paramount for sustained competitive advantage.

As organizations navigate this multidimensional landscape, the ability to align technology investments with both compliance requirements and performance objectives will define market leaders. The insights detailed herein offer a comprehensive blueprint for executives to prioritize initiatives, allocate resources effectively, and capitalize on emerging opportunities. By adopting the recommendations and methodologies presented, stakeholders can confidently steer their fleets toward a future characterized by innovation, sustainability, and enduring profitability.

Inspiring Immediate Engagement with Ketan Rohom Associate Director Sales Marketing to Access the Full Market Research Report on Smart Fleet Management

To access comprehensive analysis, detailed insights, and proprietary data essential for informed decision-making in smart fleet management, we encourage you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By reaching out, you can explore personalized engagement options, obtain sample chapters, and secure early access to critical strategic findings that will provide your organization with a first-mover advantage. This report affords unparalleled depth into emerging opportunities, competitive intelligence, and actionable guidance, enabling you to shape transformative fleet strategies. Engage today with Ketan Rohom to discuss how this market research can be tailored to your unique business challenges and drive impactful outcomes in the rapidly evolving smart fleet landscape

- How big is the Smart Fleet Management Market?

- What is the Smart Fleet Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?