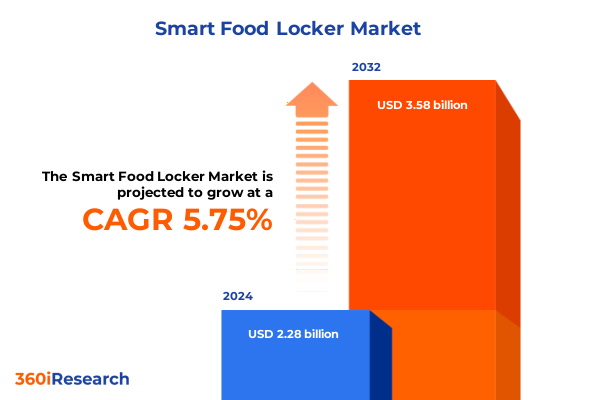

The Smart Food Locker Market size was estimated at USD 2.39 billion in 2025 and expected to reach USD 2.54 billion in 2026, at a CAGR of 5.91% to reach USD 3.58 billion by 2032.

Smart Food Locker Market Emerges as Essential Last-Mile Infrastructure Transforming Urban Consumer Food Access and Delivery Efficiency

The smart food locker market has emerged as a foundational element in modern urban delivery infrastructure, reshaping how consumers access meal kits, grocery orders, and prepared foods. Fueled by the convergence of digital ordering platforms and the increasing demand for contactless solutions, these automated modules have become instrumental in catering to time-pressed end users seeking seamless food retrieval experiences. As consumer expectations gravitate toward higher convenience, shorter delivery windows, and precise temperature control, the adoption of these lockers has accelerated across residential, commercial, and hospitality environments.

Moreover, the integration of smart technologies-ranging from IoT-enabled monitoring systems to mobile-app interfaces-has elevated operational efficiency for logistics providers and foodservice operators alike. With real-time status updates, remote diagnostics, and automated alerts, stakeholders gain unprecedented visibility into locker utilization and environmental conditions. Consequently, facility managers and delivery partners can proactively address maintenance issues and optimize routing algorithms, which in turn minimizes spoilage risks and enhances the reliability of last-mile distribution. Against this backdrop, the present analysis delves into market dynamics, tariff influences, segment-specific performance, and regional patterns, offering a comprehensive foundation for informed strategic planning and investment decisions.

Rapid Technological and Behavioral Shifts Reshaping the Dynamics of Smart Food Locker Adoption Across Diverse End-Use Sectors and Operational Models

A wave of transformative shifts is redefining the smart food locker industry, driven by advancements in refrigeration technologies and evolving consumer behaviors. Industrial innovations, such as energy-efficient compressors and advanced phase-change materials, have substantially reduced power consumption while extending the safe holding period for perishable items. In parallel, end users have embraced omnichannel ordering patterns, increasingly mixing grocery deliveries, meal subscription boxes, and on-demand restaurant orders within a single locker ecosystem. This convergence not only boosts utilization rates but also amplifies the value proposition of versatile locker deployments in mixed-use developments and corporate campuses.

Furthermore, the operational models underpinning locker networks have diversified to accommodate varying service expectations. Some providers have rolled out subscription-based managed services that cover installation, maintenance, and software support, whereas others offer self-service solutions with modular hardware that clients can integrate within existing facilities. These dual approaches cater to different risk appetites and resource allocations, thereby stimulating broader market penetration. As a result, the competitive landscape has intensified, with incumbents and new entrants forging strategic partnerships to bundle locker solutions with last-mile logistics, cold-chain monitoring, and data analytics. This dynamic environment sets the stage for ongoing product enhancements and business model experimentation.

Evolving Trade Policies and Tariffs in 2025 Trigger Cascading Effects on Cost Structures and Supply Chain Strategies for Smart Food Locker Manufacturers

In 2025, newly implemented tariffs by the United States government have altered cost structures across the smart food locker value chain, particularly affecting components sourced from international suppliers. Imposed under trade policy mandates targeting electronic control modules and climate-control units, these levies have elevated procurement expenses for compressor systems, sensors, and printed circuit board assemblies. Consequently, original equipment manufacturers and distributor networks have recalibrated pricing strategies, passing a portion of the added costs onto end users to preserve profit margins and fund ongoing research and development.

Despite these headwinds, some industry participants have leveraged localized manufacturing and regional supply partnerships to mitigate tariff burdens. By shifting assembly operations closer to end markets and sourcing critical hardware domestically, companies have preserved competitive positioning while maintaining service quality. Moreover, the expanded utilization of standardized components and cross-functional platforms has generated economies of scale, partly offsetting the increased unit costs. Accordingly, this tariff-driven environment has prompted a strategic reevaluation of procurement policies, supplier diversification, and inventory management practices, reinforcing the importance of supply chain agility in sustaining growth and profitability.

In-Depth Segmentation Analysis Reveals Critical Insights into Temperature, End User, Channel, Payment, Deployment, and Service Models Driving Market Dynamics

A nuanced segmentation analysis reveals the distinct roles played by environmental controls, user profiles, sales channels, payment preferences, installation formats, and service delivery models in shaping market performance. When examining temperature parameters, ambient lockers cater to nonperishable items and high-traffic environments, whereas refrigerated variants-divided into chilled and frozen options-address perishable grocery components and meal kits requiring specific thermal regimes. This differentiation influences both hardware complexity and lifecycle costs, as climate-controlled systems demand advanced insulation and digital monitoring capabilities.

Turning to end users, hospitality settings leverage locker solutions to streamline banquet service and room-service deliveries, while office buildings integrate smart lockers into employee food programs. Residential complexes use communal modules to facilitate grocery pickups, and retail stores embed lockers within storefronts to extend operating hours. These distinct applications drive product customization in terms of capacity, security features, and user interface design. Along the distribution axis, offline strategies span direct sales agreements and distributor partnerships, enabling broad physical coverage, while online channels utilize e-commerce portals and original equipment manufacturer websites to reach digital-first buyers.

In the realm of payment, the coexistence of card, cash, and mobile options underscores the need for adaptable transaction systems that accommodate diverse consumer demographics. Deployment modes further diversify offerings: free-standing units provide standalone placement flexibility, whereas wall-mounted lockers suit space-constrained venues. Finally, the choice between managed service and self-service models defines the scope of vendor involvement, with fully managed arrangements encompassing installation, upkeep, and software updates, contrasted by self-service packages that grant clients full operational control.

This comprehensive research report categorizes the Smart Food Locker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Locker Temperature

- Payment Method

- Deployment Mode

- Service Model

- End User

- Distribution Channel

Regional Variations and Growth Drivers Highlight How the Americas, EMEA, and Asia-Pacific Markets Each Offer Distinct Opportunities and Challenges

Regional developments in the smart food locker industry underscore the interplay between consumer demand patterns, regulatory frameworks, and infrastructure maturity across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, urbanization trends and well-established grocery e-commerce platforms have spurred rapid deployment of smart lockers in metropolitan areas. Stakeholders in North America are capitalizing on partnerships with last-mile logistics firms to meet rising consumer expectations for same-day and contactless delivery options, while Latin American markets explore locker networks to circumvent urban traffic congestion and expand access in high-density neighborhoods.

Meanwhile, Europe, Middle East & Africa exhibit a diverse spectrum of growth trajectories shaped by varying regulatory environments and logistical capacities. Western European countries emphasize green energy integration and sustainability certifications, prompting locker vendors to innovate with solar-powered modules and eco-friendly refrigerants. In contrast, emerging economies in the region focus on building reliable postal and courier infrastructures, leveraging public-private collaborations to extend smart locker services into secondary cities. Across the Gulf Cooperation Council and North Africa, large-scale real estate developments incorporate lockers as part of smart city initiatives.

Shifting to Asia-Pacific, diminishing hardware costs and a robust manufacturing base have enabled rapid scaling of both ambient and refrigerated lockers. East Asian markets, driven by high-density urban hubs and advanced digital payment ecosystems, display early adoption rates, while Southeast Asia and Oceania witness pilot projects targeting university campuses and suburban retail centers. In each subregion, localized partnerships with logistics providers and payment platform aggregators prove instrumental in accelerating deployment and achieving broad consumer engagement.

This comprehensive research report examines key regions that drive the evolution of the Smart Food Locker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Company Strategies and Competitive Landscape Highlight Key Players’ Innovations, Collaborations, and Differentiation Tactics in Smart Food Locker Solutions

Leading corporations and innovative newcomers are actively sculpting the competitive landscape through strategic investments, merger-and-acquisition activities, and technology collaborations. Prominent locker manufacturers have expanded their portfolios by securing partnerships with refrigeration specialists, thereby integrating high-efficiency cooling technology into modular cabinet designs. Concurrently, autonomous locker network operators have forged alliances with meal kit providers and grocery players to ensure consistent utilization and data-driven consumer insights.

Moreover, several companies have pursued vertical integration strategies, incorporating end-to-end solutions that blend hardware provisioning with route optimization software and analytics platforms. This holistic approach enables clients to monitor delivery performance metrics, temperature variance logs, and user satisfaction indicators via unified dashboards. At the same time, niche players focusing exclusively on self-service lockers have differentiated themselves by offering lightweight, compact units that appeal to small-scale retailers and microfulfillment centers. These targeted innovations underscore the role of specialization in addressing diverse market segments.

In addition to product-led initiatives, vendor ecosystems are evolving through collaborative pilot programs with technology startups exploring AI-driven demand forecasting and blockchain-based supply chain transparency. Such experiments aim to refine inventory replenishment schedules, reduce shrinkage, and enhance consumer trust through traceable cold-chain records. Collectively, these company-level maneuvers illustrate a market in which agility, technological prowess, and partnership acumen converge to define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Food Locker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apex Supply Chain Technologies, Inc.

- Apudos Ltd.

- Bell and Howell, LLC

- Cleveron OÜ

- Cole Kepro International, LLC

- InPost S.A.

- KEBA AG

- LockTec GmbH

- Luxer Corporation

- Panasonic Holdings Corporation

- Parcel Pending LLC

- Schneider Electric SE

- Smiota Inc.

- StrongPoint ASA

- TZ Limited

Strategic Roadmap for Industry Leaders to Optimize Operations, Enhance Customer Engagement, and Capitalize on Emerging Smart Food Locker Market Opportunities

Industry leaders must adopt a multi-faceted roadmap that balances technological investment, operational excellence, and customer-centric innovation. Firstly, enhancing modular design frameworks and leveraging open API architectures will accelerate integration with third-party delivery platforms and payment providers. By fostering an ecosystem of interoperable solutions, companies can reduce implementation friction and cater to a wider range of use cases without escalating development timelines.

Secondly, optimizing lifecycle management through predictive maintenance capabilities will minimize downtime and extend equipment longevity. Deploying advanced sensor networks and machine learning algorithms to anticipate component failures allows maintenance teams to perform targeted interventions, thereby reducing service disruptions and total cost of ownership. In tandem, refining installation and commissioning protocols through standardized training programs will streamline field deployments and ensure consistent user experiences across geographies.

Lastly, strengthening stakeholder engagement via data-driven customer success initiatives will reinforce competitive positioning. Analyzing usage patterns and feedback loops enables companies to tailor locker configurations, temperature setpoints, and service tiers to specific client needs. Coupled with strategic partnerships spanning logistics, real estate development, and foodservice brands, this focus on collaborative value creation will unlock new revenue streams and cement market leadership.

Robust Research Methodology Outlines Comprehensive Approaches to Data Collection, Analysis Techniques, and Validation Standards Ensuring Reliable Insights

This research employs a rigorous, mixed-methods framework to ensure robust and reliable insights into the smart food locker landscape. Primary data collection encompasses in-depth interviews with C-level executives, operations managers, and supply chain directors across hardware vendors, logistics providers, end-user organizations, and ecosystem partners. These qualitative conversations provide contextual understanding of pain points, strategic priorities, and innovation roadmaps.

Secondary research comprises a thorough review of industry whitepapers, corporate disclosures, patent filings, and trade association publications to assemble data on technological advancements, tariff regulations, and regional deployment trends. Additionally, a proprietary database of deployment case studies offers granular visibility into locker utilization metrics, service response times, and energy consumption profiles. This database is continuously updated through partnerships with select pilot program operators.

Quantitative analysis integrates cross-sectional data on installation counts, user interactions, and transaction volumes, which are triangulated with interview insights to validate emerging patterns. Furthermore, supply chain cost modeling incorporates tariff schedules, component pricing indices, and logistics rate benchmarks to assess the financial impact of trade policy changes. Quality control is enforced through a multi-tier review process involving subject matter experts and data analysts, guaranteeing consistency, accuracy, and relevance of all findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Food Locker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Food Locker Market, by Locker Temperature

- Smart Food Locker Market, by Payment Method

- Smart Food Locker Market, by Deployment Mode

- Smart Food Locker Market, by Service Model

- Smart Food Locker Market, by End User

- Smart Food Locker Market, by Distribution Channel

- Smart Food Locker Market, by Region

- Smart Food Locker Market, by Group

- Smart Food Locker Market, by Country

- United States Smart Food Locker Market

- China Smart Food Locker Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesis of Findings Underscores Opportunities, Risks, and Emerging Trends Guiding Stakeholders Toward Informed Decision-Making in Smart Food Lockers

In synthesizing the in-depth analysis, several key takeaways emerge that guide stakeholders toward informed action. The convergence of consumer demand for convenience, coupled with technological enhancements in refrigeration and IoT connectivity, underpins substantial growth potential for smart food lockers. Nonetheless, evolving tariff regimes and supply chain constraints necessitate agile procurement strategies and supplier diversification to safeguard cost efficiencies.

Segmentation nuances highlight that temperature-controlled modules warrant differentiated design and service commitments compared to ambient-only units, while remarkable variations in end-user preferences underscore the importance of tailored offerings for hospitality, corporate, residential, and retail contexts. Regionally, market trajectories diverge based on infrastructure maturity, regulatory environments, and consumer adoption patterns, suggesting that localized go-to-market approaches will yield higher engagement and utilization rates.

Ultimately, companies that pursue partnerships across the foodservice ecosystem, standardize modular technology frameworks, and embrace predictive maintenance will secure a lasting competitive edge. By integrating data-driven insights into customer success initiatives, stakeholders can fine-tune locker configurations and service models to unlock operational efficiencies and elevate user satisfaction. These combined strategies chart a clear path toward scalable growth and sustainable profitability in the rapidly evolving smart food locker domain.

Empowering Stakeholders with Expert Support and Tailored Insights for Procurement of Comprehensive Smart Food Locker Market Intelligence

I invite industry leaders and decision-makers seeking authoritative market intelligence on smart food locker solutions to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, for personalized guidance on acquiring a comprehensive market research report. His deep understanding of the smart locker ecosystem and extensive experience in food delivery infrastructure ensures that your specific strategic needs will be addressed with precision. Engage in a consultative dialogue to explore detailed insights, tailored recommendations, and customized service options designed to support your organization’s market entry or expansion objectives.

By reaching out to Ketan, you gain access to an exclusive suite of analytical tools, executive interviews, and proprietary data that empower your team to make informed investments and operational decisions. This collaboration extends beyond mere data delivery, offering ongoing support to help you interpret findings, adapt strategies in real time, and secure a competitive advantage. Schedule a one-on-one consultation today to discover how our insights can accelerate your business growth and solidify your position in the rapidly evolving smart food locker marketplace. Take the next step toward market leadership by contacting Ketan Rohom and unlocking the full potential of our research expertise

- How big is the Smart Food Locker Market?

- What is the Smart Food Locker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?