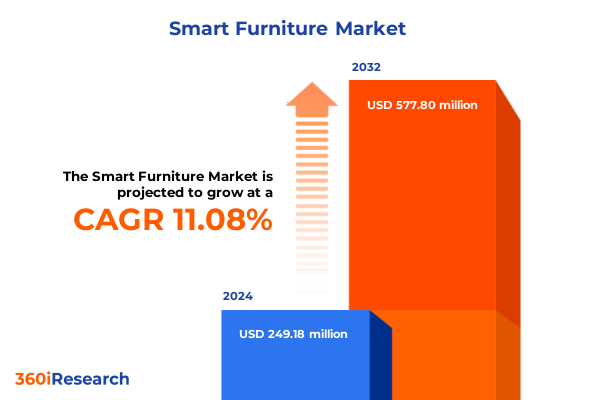

The Smart Furniture Market size was estimated at USD 276.60 million in 2025 and expected to reach USD 312.73 million in 2026, at a CAGR of 11.09% to reach USD 577.80 million by 2032.

Unveiling the Rise of Intelligent Furnishings That Are Redefining Comfort Connectivity and Convenience Across Workspaces and Homes

Smart furniture represents the convergence of traditional craftsmanship and cutting-edge technology, bringing intelligence and adaptability to everyday furnishings. As digital transformation reshapes how individuals interact with their environments, furniture has evolved beyond static fixtures into responsive, interconnected assets that support productivity, health, and convenience. From homes and offices to hospitality venues and healthcare facilities, smart furniture integrates sensors, connectivity, and AI-driven controls to deliver personalized experiences that align with user behaviors and preferences.

In this rapidly changing landscape, stakeholders across the value chain-from manufacturers and designers to distributors and end users-must navigate a complex web of technological innovation, material sourcing, and regulatory considerations. This executive summary illuminates the critical drivers, emerging trends, and strategic imperatives that are shaping the smart furniture market. Through an analysis of transformative shifts, tariff impacts, segmentation insights, and regional nuances, this overview equips decision-makers with the insights necessary to capitalize on opportunities and mitigate risks in this dynamic industry.

Exploring the Technological Evolution Sustainability Imperatives and Hybrid Work Demands Shaping the Future of Smart Furniture Design and Adoption Worldwide

The advent of AI-powered personalization has accelerated the transition of smart furniture from concept to mainstream adoption. Intelligent systems embedded within furniture products collect and analyze user data-ranging from posture and weight distribution to environmental conditions-to deliver customized adjustments in real time. This capability extends beyond static comfort settings, enabling predictive maintenance that alerts users to potential component failures and optimizes performance through continuous learning. Such adaptive designs create lasting value by enhancing user engagement and ensuring that furniture evolves alongside individual needs over time.

Concurrently, demand for sustainable, health-focused furnishing solutions is reshaping product development and procurement strategies. Manufacturers are leveraging eco-friendly materials such as low-VOC composites and responsibly sourced woods while embedding features that promote wellness, including sleep tracking in smart beds and vital sign monitoring in clinical chairs. The hybrid work model further amplifies the imperative for furniture that supports both productivity and well-being, as users seek versatile solutions that seamlessly transition between residential, educational, and professional settings.

Assessing the Cumulative Ripple Effects of 2025 United States Steel Aluminum and Technology Tariffs on Smart Furniture Supply Chains and Costs

In early 2025, the U.S. government enacted significant increases in Section 232 tariffs, elevating duties on steel and aluminum imports to 50 percent ad valorem. This measure, justified on national security grounds, has exerted upward pressure on the cost of metal-intensive components used in smart furniture production. Manufacturers reliant on imported tubing, castings, and structural elements face heightened input expenses, compelling a reallocation of resources toward domestic suppliers or the exploration of alternative materials to preserve margins and maintain competitive pricing.

Parallel to these changes, adjustments to Section 301 tariffs have targeted critical technology inputs. Effective January 1, 2025, the tariff rate for semiconductors classified under HTS headings 8541 and 8542 rose to 50 percent, affecting the procurement of sensors, integrated circuits, and connectivity modules. As these components are foundational to the intelligence and connectivity of smart furniture solutions, companies are accelerating efforts to diversify vendor networks, negotiate volume discounts, and enhance vertical integration to mitigate the cumulative cost impact of trade policy shifts.

Uncovering the Diverse End Users Distribution Channels Pricing Materials Technologies and Product Categories Driving Smart Furniture Market Dynamics

Segmentation by end user reveals a multidimensional market where commercial environments demand ergonomic smart desks and chairs that integrate health analytics, while educational institutions-from schools fostering collaborative learning spaces to universities equipping research labs-seek configurable setups that support both instruction and innovation. Healthcare facilities prioritize sensor-based beds and chairs that monitor patient vitals, driving efficiency in clinics and hospitals alike. Hospitality operators leverage smart tables and integrated charging solutions to elevate guest experiences across hotels and restaurants, and residential consumers adopt multifunctional wardrobes and tables that optimize living spaces.

Distribution channel segmentation highlights the coexistence of direct sales, offline retail, and online platforms in shaping market access. Brand websites serve as a showcase for flagship solutions, while marketplaces aggregate a broad range of options for price-sensitive buyers. Traditional brick-and-mortar outlets continue to play a vital role by offering tactile engagement and expert consultations. These channels interact dynamically, as omnichannel strategies emerge to deliver seamless customer journeys across digital and physical touchpoints.

Price range and material dimensions intersect to define product breadth and depth. Economy offerings leverage cost-effective plastics and composites to democratize basic smart features, while mid-range and premium tiers integrate engineered woods, glass, and metal alloys-ranging from aluminum to steel-to balance durability with aesthetics. Luxury solutions further incorporate solid wood, high-grade metals, and bespoke finishes. Material choices underpin not only visual appeal and longevity but also the integration of technology, as certain substrates better accommodate embedded sensors and wiring.

Technological segmentation underscores the proliferation of AI-powered, Bluetooth-enabled, IoT-enabled, sensor-based, voice-controlled, and Wi-Fi-enabled functionalities. Within the IoT segment, devices communicate over Bluetooth, Wi-Fi, and Zigbee protocols to facilitate interoperability and remote management. Finally, product type differentiation-encompassing smart beds, chairs, desks, tables, and wardrobes-illustrates the specialization of applications, as each category evolves to meet distinct ergonomic, spatial, and lifestyle requirements.

This comprehensive research report categorizes the Smart Furniture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Technology

- Distribution Channel

- End User

Analyzing Regional Adoption Patterns Regulatory Influences and Technological Uptake Across Americas Europe Middle East Africa and Asia Pacific

In the Americas, North America stands at the forefront of smart furniture adoption, driven by high disposable incomes, robust R&D investment, and widespread consumer acceptance of connected home and office solutions. Corporations in the United States and Canada are upgrading workspaces with height-adjustable desks and health-monitoring chairs, while residential markets integrate smart beds and lighting tables that sync with broader home automation ecosystems. This region benefits from a well-established technological infrastructure and favorable procurement cycles in commercial and hospitality sectors.

Within Europe, stringent environmental regulations such as the EU Ecodesign for Sustainable Products Regulation have accelerated the adoption of eco-certified smart furniture that complies with durability and traceability standards. Manufacturers and importers in the European Union, Middle East, and Africa are responding to countermeasures against U.S. tariffs and local sustainability mandates by prioritizing recyclable materials, green certifications, and energy-efficient designs. Simultaneously, Gulf Cooperation Council countries are investing in smart hospitality and residential projects that leverage IoT-enabled tables and voice-controlled lighting solutions to align with smart city initiatives.

Asia-Pacific is emerging as a powerhouse for both production and consumption of smart furniture, fueled by rapid urbanization, rising disposable incomes, and strong government support for technological innovation. Countries such as China, Japan, South Korea, and India are integrating smart beds and AI-driven ergonomic chairs into healthcare and residential applications, while manufacturing hubs in Vietnam and Indonesia benefit from competitive costs and favorable trade diversification strategies. The region’s growth is underpinned by expanding IoT ecosystems and consumer appetite for multifunctional, space-saving solutions.

This comprehensive research report examines key regions that drive the evolution of the Smart Furniture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Innovations Collaborations and Strategic Moves by Leading Manufacturers Shaping Competitiveness in the Smart Furniture Sector

Leading industry participants are advancing market dynamics through continuous innovation, partnerships, and strategic investments. Inter IKEA Systems BV and Herman Miller Inc. have launched modular smart seating solutions with integrated sensor arrays for posture correction, while Steelcase Inc. expanded its intelligent desk portfolio to include voice-activated controls and environmental monitoring. Meanwhile, emerging specialists such as Sobro and Sleep Number Corporation are gaining traction with sleep-tracking smart beds, and companies like Krini Furniture and Hi-Interiors are blending sustainable materials with IoT-enabled features to address regional demands. Established design engineering firms including Desktronik LLC and Nitz Engineering continue to enrich product roadmaps through collaboration with technology providers and system integrators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Furniture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ATLASIO

- BDI Furniture Ltd.

- Burovision, Inc.

- Desktronic

- Eight Sleep, Inc.

- Ekornes AS

- Ergotron, Inc.

- Harworth Group plc

- HENAN K-HOME STEEL STRUCTURE CO.,LTD

- Herman Miller, Inc.

- Hi-Interiors Srl

- Hill-Rom Holdings, Inc.

- HomeMore

- Human Touch, LLC

- Inter Ikea Systems B.V.

- Jinhua Wanrong Sanitary Ware Co., Ltd.

- LAKDI Furniture & Design Co.

- Milano Smart Living

- Mindawe Furniture Limited

- Modoola Limited

- Nitz engineering Srl

- ORI Systems

- PARAMOUNT BED CO., LTD

- Sedus

- SKF Decor Pvt. Ltd.

- Sleep Number Corporation

- Smartfurniture GmbH

- SmartLiving Furniture

- Sobro LLC

- Spectral Audio Möbel GmbH

- Steelcase Inc.

- Tabula Sense

- Tempur Sealy International Inc.

- Terson Solutions, Inc.

- X-Chair, Inc.

Implementing Strategic Initiatives for Innovation Supply Chain Resilience and Sustainability to Secure Competitive Advantage in the Smart Furniture Industry

Industry leaders should prioritize the integration of advanced AI capabilities to deliver deeper personalization and predictive maintenance, fostering long-term customer loyalty and recurring revenue streams. By collaborating with technology partners and investing in machine learning platforms, manufacturers can differentiate their offerings and anticipate emerging user preferences.

Supply chain resilience is critical in an era of shifting trade policies. Companies must diversify sourcing strategies by qualifying multiple suppliers across geographies, negotiating flexible contracts, and exploring alternative materials to mitigate the impact of tariffs and logistics disruptions. Vertical integration of key components such as sensors and controllers can further buffer cost volatility.

Sustainability must be embedded at every stage of product development. Leaders should accelerate the adoption of eco-certified materials, establish circular design principles for disassembly and recycling, and implement transparent lifecycle disclosures. These measures enhance regulatory compliance, reduce environmental footprints, and resonate with eco-conscious consumers.

Omnichannel go-to-market strategies will capture a broader customer base and streamline purchasing journeys. By aligning direct sales, online marketplaces, and offline retail experiences, brands can deliver cohesive digital demonstrations, expert consultations, and post-purchase support, ensuring consistent value perception across touchpoints.

Finally, strategic partnerships with hospitality, education, and healthcare providers will unlock new applications and revenue models. Co-creating tailored solutions that integrate with facility management systems and electronic health records can position smart furniture as an essential component of institutional digital transformation initiatives.

Detailing the Comprehensive Multistage Primary Secondary and Analytical Methodologies Underpinning Our Smart Furniture Market Analysis

Our research methodology combines rigorous secondary research with targeted primary validation to ensure robust, objective insights. The process began with a comprehensive review of industry publications, government regulations, white papers, and credible news sources to map market developments, tariff changes, and technological breakthroughs.

Building on this foundation, we conducted in-depth interviews with senior executives at key manufacturers, distributors, and end users across diverse regions. These conversations provided qualitative context, enabling us to gauge sentiment around supply chain adaptations, product innovation, and regional adoption patterns.

Data triangulation was employed to reconcile findings from multiple sources, ensuring consistency and reliability. Quantitative datasets-including trade statistics, corporate financial disclosures, and patent filings-were cross-referenced against expert interviews and policy announcements. We further validated emerging trends through peer benchmarking and scenario analysis, assessing potential impacts of regulatory shifts and technology rollouts.

Finally, periodic expert workshops were convened to test preliminary conclusions, refine segmentation frameworks, and prioritize strategic imperatives. This iterative approach underpins the accuracy and relevance of our analysis and supports actionable recommendations for industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Furniture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Furniture Market, by Product Type

- Smart Furniture Market, by Material

- Smart Furniture Market, by Technology

- Smart Furniture Market, by Distribution Channel

- Smart Furniture Market, by End User

- Smart Furniture Market, by Region

- Smart Furniture Market, by Group

- Smart Furniture Market, by Country

- United States Smart Furniture Market

- China Smart Furniture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings to Illuminate Future Trajectories and Strategic Imperatives in the Evolving Smart Furniture Ecosystem

The smart furniture market is at an inflection point where technological innovation intersects with shifting trade landscapes, evolving consumer preferences, and heightened sustainability expectations. As AI, IoT, and sensor integration redefine product capabilities, market participants must balance cost pressures from tariff adjustments with investments in supply chain adaptability and eco-friendly design principles.

Looking forward, success will hinge on the ability to anticipate user behaviors, forge strategic alliances across technology and service sectors, and embed circular economy practices to meet stringent environmental standards. Companies that master the art of delivering personalized experiences at scale, while ensuring regulatory compliance and operational resilience, will emerge as the next generation of market leaders. These imperatives chart a clear path for navigating the complexities and capturing the opportunities inherent in the evolving smart furniture ecosystem.

Seize the Opportunity to Transform Decision Making with Our In-Depth Smart Furniture Market Research Report Contact Ketan Rohom Today

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to leverage unmatched insights and strategic foresight. His expertise in smart furniture market intelligence ensures you receive tailored guidance aligned with your business objectives. Act now to equip your decision-making process with deep, actionable data and gain a competitive edge in an industry defined by rapid technological evolution and shifting trade dynamics. Reach out today to secure your copy of the comprehensive smart furniture market research report and transform your strategic initiatives.

- How big is the Smart Furniture Market?

- What is the Smart Furniture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?