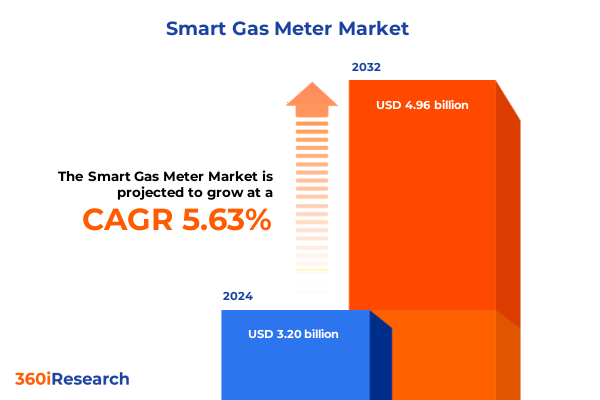

The Smart Gas Meter Market size was estimated at USD 3.95 billion in 2025 and expected to reach USD 4.28 billion in 2026, at a CAGR of 8.66% to reach USD 7.07 billion by 2032.

An Overview of Smart Gas Meter Adoption Trends Illuminating How Technological Innovation, Regulatory Evolution, and Utility Modernization Are Converging to Transform Gas Infrastructure

The landscape of gas metering is undergoing a profound shift as utilities and infrastructure stakeholders embrace the imperative of modernization. At the heart of this transition lies the smart gas meter, a device designed to provide granular consumption data, enhance operational visibility, and support broader digitalization efforts within the energy sector. As technological innovation accelerates, the traditional mechanical and electro-mechanical meters are giving way to solutions that integrate advanced sensors, two-way communication capabilities, and real-time analytics. This evolution is being propelled by a convergence of factors: aging networks in need of rehabilitation, regulatory mandates emphasizing efficiency and emissions reduction, and the rising demand for transparent billing and consumption insights.

The introduction of smart gas meters marks the beginning of a new era in utility management. By deploying intelligent metering infrastructure, service providers can detect leaks more promptly, respond to faults with greater agility, and optimize gas distribution through data-driven algorithms. Moreover, the interplay between meter design enhancements and software-enabled platforms is fostering closer collaboration between meter manufacturers, software vendors, and utilities. This collaborative ecosystem is critical in navigating the technical complexities of integration, ensuring cybersecurity resilience, and delivering seamless user experiences. As a result, stakeholders across the value chain are recognizing the potential of smart gas meters to deliver both cost savings and environmental benefits, setting the stage for widespread deployment and innovation in the years ahead.

Exploring the Radical Shifts Driving Smart Gas Meter Market Transformation Through Digitalization, Data Analytics, and Infrastructure Upgrades

Underpinning the smart gas meter revolution are transformative shifts that are reshaping the broader energy and utility landscape. Digitalization, once a peripheral consideration, has moved to the forefront as grid operators and gas distributors seek to enhance resiliency and optimize resource allocation. The integration of cloud-based platforms with edge computing capabilities enables continuous data collection and processing at unprecedented speeds. This, in turn, empowers predictive maintenance models that anticipate equipment degradation before it leads to service interruptions. In parallel, the maturation of machine learning algorithms has unlocked new avenues for pattern recognition, facilitating the early detection of anomalies and helping utilities mitigate risks associated with both operational failures and safety incidents.

Additionally, evolving regulatory frameworks are accelerating the adoption of advanced metering infrastructure. In many jurisdictions, performance-based rate structures reward utilities for reducing non-technical losses and improving service reliability, effectively tying revenue models to digital transformation outcomes. At the same time, consumer expectations are shifting as end users demand more transparency, control, and sustainability in their energy usage. This has prompted utilities to develop customer engagement portals that leverage the insights generated by smart gas meters to offer personalized conservation tips and dynamic pricing options. Viewed collectively, these transformative trends are not only redefining the technical parameters of gas metering but also fostering a more integrated, responsive, and customer-centric energy ecosystem.

Assessing the Aggregate Effects of 2025 US Tariffs on Smart Gas Meter Supply Chains, Component Costs, and Industry Collaboration Models

The introduction of new tariffs in 2025 has introduced a complex layer of considerations for stakeholders in the smart gas meter supply chain. While aimed at levelling the playing field for domestic manufacturing and promoting strategic industry partnerships, the tariffs have also influenced the cost dynamics of key meter components. Suppliers dependent on imported diaphragm assemblies, microelectromechanical sensors, and specialized communication modules have had to reassess their procurement strategies. As a result, some manufacturers have accelerated the localization of critical parts or explored alternative material compositions to maintain competitive pricing structures without compromising product performance or reliability.

Concurrently, heavier duties on certain imported elements have encouraged a strategic reconfiguration of logistics networks. Stakeholders have undertaken scenario planning to identify resilient sourcing corridors, mitigate exposure to trade policy fluctuations, and secure buffer inventories. This has led to closer collaboration between meter producers and component suppliers, fostering long-term agreements that provide greater price certainty and supply continuity. From a broader perspective, the tariffs have underscored the strategic value of supply chain transparency and risk management, prompting technology-enabled tracking systems that capture provenance data and support compliance efforts. Ultimately, while the 2025 tariff adjustments have presented challenges, they have also catalyzed a wave of innovation in procurement, manufacturing, and collaboration models that will endure beyond the immediate policy environment.

Uncovering Deep-Dive Perspectives on Market Diversity Across Device Types, Communication Protocols, Installation Approaches, and End-User Applications

Understanding the smart gas meter market requires a nuanced look at how various segments interact and drive demand across different contexts. When examining the device type, the choice between smart diaphragm gas meters and smart ultrasonic gas meters often hinges on accuracy requirements and operational environments, with ultrasonic variants gaining traction in settings that demand higher precision and minimal maintenance. Transitioning to the realm of technology type, the decision between Advanced Metering Infrastructure and Automated Meter Reading reflects how stakeholders balance investment in two-way communications against the need for scalable, retrofit-friendly solutions. These infrastructure decisions further interlink with installation considerations, where the contrast between new installations and retrofit projects influences project timelines, cost structures, and stakeholder coordination.

Moreover, communication type-be it wired or wireless-plays a pivotal role in determining the agility of deployment and the resilience of data transmission, especially in areas with challenging terrain or dense urban environments. From an application standpoint, the deployment spectrum encompasses billing accuracy, comprehensive consumption monitoring, and proactive leakage detection, each driving unique data requirements and analytics use cases. Finally, evaluating the end user dimension between commercial, industrial, and residential consumers helps reveal how usage patterns, regulatory obligations, and service expectations shape product specifications and service offerings. By integrating these segmentation lenses, decision-makers can more effectively align product roadmaps and deployment strategies with the specific needs of each market segment, ensuring that technology investments deliver tangible operational and customer benefits.

This comprehensive research report categorizes the Smart Gas Meter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Meter Type

- Gas Type

- Component

- Communication Type

- Application

- Installation Type

- End User

- Distribution Channel

Mapping Regional Dynamics in Smart Gas Meter Deployment Across the Americas, Europe Middle East Africa, and Fast-Growing Asia-Pacific Markets

Regional dynamics exert a profound influence on how smart gas meter solutions are adopted and scaled. In the Americas, utilities are balancing modernization imperatives with the need to upgrade aging infrastructure and address regulatory mandates aimed at curbing methane emissions. This environment has catalyzed pilot projects that leverage wireless communication technologies to minimize installation disruption, as well as initiatives to integrate gas data with broader smart grid platforms. In contrast, Europe, Middle East, and Africa regions present a mosaic of regulatory regimes and infrastructure maturity levels. Here, standardized metering protocols and interoperability requirements are driving harmonized approaches, particularly in the European Union, while emerging markets in the Middle East and Africa are leapfrogging legacy systems by embracing wireless mesh networks and solar-powered metering solutions.

Meanwhile, in the Asia-Pacific, rapid urbanization and population growth are generating robust demand for scalable, high-precision metering. Market participants are investing in firmware platforms capable of supporting complex tariff structures and real-time analytics to address the needs of industrial clusters and densely populated urban centers. Furthermore, government-driven smart city programs are fostering public–private collaborations that incentivize large-scale deployments. Across all regions, the interplay between local regulatory frameworks, infrastructure readiness, and digital innovation strategies is shaping unique adoption curves, underscoring the importance of region-specific deployment models and partner ecosystems to maximize the impact of smart gas meter technologies.

This comprehensive research report examines key regions that drive the evolution of the Smart Gas Meter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Competitive Landscape of Smart Gas Meter Development and Strategic Industry Partnerships

A small cohort of technology leaders is driving the evolution of the smart gas meter market through strategic investments in research, strategic acquisitions, and collaborative partnerships. These companies are leveraging their expertise in sensor design, communication modules, and software analytics to develop comprehensive metering solutions that address diverse utility challenges. By forging alliances with telecommunications providers and IoT platform vendors, these innovators are ensuring seamless data integration and robust cybersecurity frameworks. Their product roadmaps emphasize scalable architectures that support both standalone meter deployments and fully integrated grid modernization initiatives.

In addition to product innovation, leading firms are differentiating themselves through service offerings that include predictive maintenance analytics and consultancy on regulatory compliance. Some organizations have established global centers of excellence that coordinate cross-regional deployment strategies, ensuring that lessons learned in one geography can be rapidly adapted to another. Collaborative R&D initiatives with academic institutions and standardization bodies are further enhancing interoperability and driving industry-wide best practices. As these key market participants extend their reach into emerging markets, they are also investing in local manufacturing and talent development programs to strengthen supply chain resilience and accelerate technology transfer. This multi-dimensional approach positions them not only as meter suppliers but as comprehensive solution providers that can support utilities throughout the entire digital transformation journey.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Gas Meter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adya Smart Metering Pvt Ltd.

- Aichi Tokei Denki Co., Ltd.

- Apator Group

- Badger Meter, Inc.

- Cavagna Group

- CHINT Group Corporation

- Chongqing Shancheng Gas Equipment Co., Ltd.

- Cubic Sensor and Instrument Co., Ltd.

- Diehl Stiftung & Co. KG

- Fujitsu Limited

- Genus Power Infrastructures Ltd.

- Honeywell International, Inc.

- Hubbell Incorporated

- Itron Inc.

- Kimpex Flow Pvt. Ltd.

- Landis+Gyr AG by Toshiba Corporation

- Osaki Electric Co., Ltd.

- Pietro Fiorentini S.p.a.

- Semtech Corporation

- Siemens AG

- Silicon Laboratories, Inc

- Sopan

- Tata Communications Limited

- Xylem Inc.

- ZENNER International GmbH & Co. KG

Strategic Imperatives for Industry Leaders to Drive Adoption, Optimize Infrastructure Investments, and Foster Collaborative Ecosystem Growth

To capitalize on the momentum of smart gas meter adoption, industry leaders should adopt a strategic framework that balances technological innovation with operational pragmatism. First, prioritizing end-to-end integration of metering data with enterprise asset management systems will unlock insights that drive process optimization and reduce downtime. In parallel, forging strategic partnerships with communication service providers can streamline network deployment and ensure reliable data transmission, particularly in challenging geographies. Additionally, utility operators should embrace agile pilot programs to validate advanced sensor technologies and data analytics applications before committing to large-scale rollouts.

Furthermore, leveraging modular platform architectures will enable stakeholders to customize solutions for diverse segments-whether prioritizing billing accuracy in residential areas or real-time leakage detection in industrial zones-without extensive redesign efforts. To mitigate supply chain risks, companies are advised to diversify component sourcing and invest in digital provenance solutions that enhance visibility and compliance. Investing in customer engagement initiatives, such as interactive portals and mobile applications, can also strengthen relationships with end users by providing actionable insights and fostering energy conservation behaviors. By executing on these recommendations, industry leaders can navigate the complexities of technology integration, regulatory compliance, and operational scale-up while maximizing the value derived from smart gas meter deployments.

Elucidating the Comprehensive Research Framework Combining Rigorous Primary Interviews, Expert Validation, and Detailed Data Triangulation Techniques

This research leverages a robust multi-method approach that begins with an extensive review of industry publications, technical whitepapers, and regulatory filings to establish a comprehensive secondary data foundation. Following this, detailed primary interviews were conducted with executives, R&D leaders, and regulatory specialists across utilities, meter manufacturers, and technology providers. These conversations provided granular insights into deployment challenges, technology preferences, and strategic priorities.

The collected data were systematically triangulated through comparative analyses, correlating supply chain trends with policy developments and technology roadmaps. Advanced data validation techniques, including consistency checks and outlier detection, were employed to ensure the reliability of qualitative findings. Expert workshops were then convened to test preliminary hypotheses and refine thematic frameworks, leading to the identification of critical success factors and sector-specific best practices. Finally, the synthesis of these research streams yielded a detailed, actionable view of the smart gas meter ecosystem, grounded in empirical evidence and stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Gas Meter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Gas Meter Market, by Meter Type

- Smart Gas Meter Market, by Gas Type

- Smart Gas Meter Market, by Component

- Smart Gas Meter Market, by Communication Type

- Smart Gas Meter Market, by Application

- Smart Gas Meter Market, by Installation Type

- Smart Gas Meter Market, by End User

- Smart Gas Meter Market, by Distribution Channel

- Smart Gas Meter Market, by Region

- Smart Gas Meter Market, by Group

- Smart Gas Meter Market, by Country

- United States Smart Gas Meter Market

- China Smart Gas Meter Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Drawing Meaningful Conclusions on Smart Gas Meter Market Trajectories, Emergent Opportunities, and Long-Term Transformation Pathways

As the utility sector navigates the twin imperatives of sustainability and digital transformation, smart gas meters have emerged as a cornerstone technology capable of delivering operational efficiency, regulatory compliance, and enhanced customer engagement. The market is characterized by rapid innovation in sensor accuracy, communication protocols, and analytics platforms, supported by a collaborative ecosystem of manufacturers, software vendors, and service providers. Regulatory frameworks and policy incentives continue to guide deployment strategies, while regional dynamics shape distinct adoption trajectories.

In this context, stakeholders who embrace strategic partnerships, diversify their supply chains, and prioritize data integration will be best positioned to capture value and accelerate network modernization. The cumulative impact of evolving tariffs, advanced metering infrastructure initiatives, and emerging use cases underscores the need for agile, evidence-based decision-making. By synthesizing insights across segments and regions, this report illuminates the pathways through which smart gas meter solutions will drive the next wave of transformation in gas distribution networks. With this comprehensive understanding, industry participants can confidently navigate uncertainties and harness the full potential of intelligent metering.

Engage with Associate Director Ketan Rohom to Secure the In-Depth Smart Gas Meter Market Research Report and Accelerate Strategic Decision-Making

Ready to elevate your strategic roadmap with authoritative insights on smart gas meter advancements and market dynamics? Connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to access the comprehensive research report. His expertise will guide you through critical findings, detailed analyses, and tailored recommendations designed to inform procurement, partnerships, and investment decisions. Engage with Ketan today to unlock privileged access to in-depth data, expert commentary, and curated guidance that will empower your organization to lead in the rapidly evolving smart gas meter landscape. Secure your copy now to gain a competitive edge and chart a clear trajectory for future growth and innovation.

- How big is the Smart Gas Meter Market?

- What is the Smart Gas Meter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?