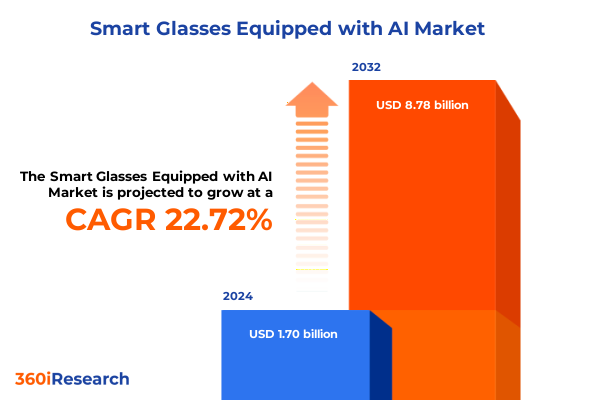

The Smart Glasses Equipped with AI Market size was estimated at USD 2.07 billion in 2025 and expected to reach USD 2.53 billion in 2026, at a CAGR of 22.88% to reach USD 8.78 billion by 2032.

Pioneering a New Frontier in Wearable Intelligence Through Seamless Integration of AI and Augmented Reality

The convergence of artificial intelligence and wearable display technology has ushered in a new era where smart glasses are transforming the way individuals interact with digital and physical environments. By integrating onboard AI processors, advanced sensors, and high-definition optical displays, these devices are not only enhancing user experiences but also enabling entirely new modes of communication, collaboration, and productivity. As remote work, telemedicine, and immersive entertainment gain widespread traction, the evolution of smart glasses stands at the forefront of the next wave of digital innovation, promising to bridge the gap between real-world contexts and data-driven insights.

Within enterprise and consumer segments alike, smart glasses are redefining traditional paradigms. In professional settings, they facilitate hands-free access to real-time information, remote assistance for field technicians, and dynamic visualization of complex data sets. For individual users, AI-powered ocular displays are unlocking personalized navigation, contextual notifications, and immersive augmented reality (AR) experiences that seamlessly coexist with daily routines. This transformative potential underscores a broader shift toward intelligent wearables that not only display content but proactively adapt to user behaviors and environmental cues.

How Cutting-Edge Display Innovations Coupled with Cross-Industry Alliances Are Transforming AI-Infused Smart Glasses

Over the past years, a series of technological breakthroughs and strategic collaborations have catalyzed dramatic transformations in the smart glasses market. Improvements in micro-LED displays and miniaturized optics have significantly enhanced clarity and comfort, while innovations in edge AI chipsets have enabled real-time computer vision and natural language processing directly within the wearer’s field of sight. Meanwhile, the proliferation of 5G networks, alongside low-latency connectivity standards, has dissolved previous constraints on data transmission, empowering developers to create bandwidth-intensive AR applications that were once relegated to high-performance desktop systems.

Furthermore, partnerships between hardware manufacturers and software developers have accelerated the maturation of the AI eyewear ecosystem. Major cloud platform providers now offer optimized development kits for spatial computing, while niche startups are experimenting with gesture recognition, eye-tracking, and haptic feedback modules designed to complement core display technologies. This synergistic innovation cycle is reshaping competitive dynamics, enabling new entrants to challenge legacy players by focusing on specialized use cases such as remote surgical assistance, advanced training simulations, and context-aware advertising. As these shifts continue to unfold, the market landscape is evolving into a vibrant environment where agility and cross-industry alliances determine sustainable leadership.

Assessing the Multifaceted Influence of United States Tariff Measures on Smart Glasses Supply Chains in 2025

The United States government’s imposition of tariffs on select electronic components and finished wearable products in early 2025 has introduced a layer of complexity to global supply chains. While the measures aimed to protect domestic manufacturing capabilities, they have inadvertently driven up the landed cost of critical modules such as micro-optics, sensor arrays, and high-performance processors sourced from key Asian markets. These changes have prompted original equipment manufacturers (OEMs) to reassess vendor strategies, leading to localized assembly initiatives and strategic stockpiling of inventory to mitigate potential disruptions.

At the same time, tariffs have catalyzed a renewed focus on supply chain resilience, with industry leaders investing in secondary sourcing arrangements and exploring co-manufacturing partnerships closer to consumption hubs. In parallel, software developers and service integrators are adapting their pricing models to absorb incremental cost pressures, often shifting toward subscription-based offerings to distribute expenses across multi-year contracts. Although the immediate impact has increased production outlays, the tariff environment has also accelerated efforts to diversify inputs, standardize component designs, and drive collaborative research aimed at more cost-effective, domestically sourced alternatives.

Unveiling Core Market Dynamics Through Comprehensive Application, Distribution, Component, and Device-Type Perspectives

Analyzing the market through the lens of application reveals a clear bifurcation between consumer-oriented use cases and enterprise-grade deployments. On the consumer front, lifestyle applications such as immersive gaming, social media overlays, and fitness coaching benefit from form-factor advancements and intuitive AR experiences. Enterprise applications, in contrast, extend across domains including financial services, where real-time data visualization supports trading floor decisions; education, where interactive overlays enrich remote and in-class instruction; healthcare, which leverages hands-free diagnostics and surgical guidance; manufacturing, where on-site troubleshooting is streamlined with contextual overlays; and retail, where sales associates utilize intelligent search and guided customer interactions.

Considering distribution channels, traditional brick-and-mortar outlets continue to play an important role in enabling users to experience device ergonomics and display fidelity firsthand, with direct sales, authorized resellers, and specialty technology stores providing personalized demonstrations. Conversely, online channels-encompassing official company storefronts, major e-commerce platforms, and third-party marketplaces-offer scalable reach and flexible fulfillment options, catering to price-sensitive buyers and enterprise procurement teams seeking streamlined bulk ordering and integrated support packages.

Differentiation across core components underscores strategic opportunities for manufacturers. Hardware segments such as power management systems, high-resolution optics, advanced processors, and multi-modal sensors serve as critical enablers of immersive AR performance. Service offerings including strategic consulting, post-deployment maintenance, and systems integration facilitate seamless enterprise adoption. Meanwhile, software layers-from specialized applications to middleware frameworks and native operating systems-dictate user experience, interoperability, and developer engagement.

Device typology further refines market positioning. Optical see-through variants-enabled by retinal projection and waveguide technologies-offer transparent overlays that preserve situational awareness, favored in industrial and field service contexts. Video see-through designs, available in binocular and monocular configurations, leverage camera feeds processed with advanced AI algorithms to blend digital content with live video streams, ideal for immersive consumer entertainment and remote collaboration.

This comprehensive research report categorizes the Smart Glasses Equipped with AI market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Type

- User Interaction Mode

- Connectivity

- Operating System

- Use Case

- End User

- Distribution Channel

Examining Adoption Trends and Regulatory Frameworks Across the Americas, EMEA, and Asia-Pacific Smart Glasses Markets

Regional analysis uncovers significant variations in adoption rates, regulatory frameworks, and innovation hubs that define smart glasses proliferation globally. In the Americas, mature technology ecosystems coupled with robust venture capital investment have fostered rapid commercialization, particularly within North America’s technology corridors. Regulatory clarity and strong IP protection further incentivize research partnerships and pilot deployments across sectors such as logistics, healthcare, and immersive media.

Within Europe, the Middle East, and Africa, the trajectory is characterized by harmonization efforts and regional alliances aiming to streamline certification processes and data privacy standards. Europe’s integration of smart glasses into Industry 4.0 initiatives highlights an emphasis on interoperability and cybersecurity, whereas Middle Eastern markets are leveraging AR for tourism and hospitality enhancements. Meanwhile, Africa’s emerging economies present high-growth potential, fueled by mobile-first enterprises adopting cost-effective, cloud-powered AR solutions for education and remote assistance.

The Asia-Pacific region remains at the forefront of manufacturing excellence and consumer adoption. Leading East Asian economies contribute significant production capacity and component innovation, while tech-savvy populations in Southeast Asia drive strong consumer demand for immersive gaming and social networking applications. Cross-border collaborations between local OEMs and global cloud providers accelerate the development of AI-optimized eyewear, creating a vibrant ecosystem where hardware affordability and software localization coalesce.

This comprehensive research report examines key regions that drive the evolution of the Smart Glasses Equipped with AI market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Leading Technology Providers and Emerging Innovators Are Shaping Competitive Dynamics in AI-Driven Smart Glasses

A handful of influential companies are shaping the trajectory of AI-enabled smart glasses through strategic investments, R&D breakthroughs, and ecosystem partnerships. Major technology providers are leveraging deep learning accelerators and proprietary optical modules to differentiate their offerings in both consumer and enterprise verticals. Meanwhile, specialist manufacturers are carving out niche positions by focusing on lightweight form factors, robust battery performance, and integration of advanced biometric sensors.

Strategic alliances between these companies and leading cloud platform operators underscore a broader trend toward open developer ecosystems and interoperable AR toolkits. Collaborative ventures with telecommunications providers are also emerging to embed smart glasses into next-generation connectivity frameworks, particularly in regions rolling out 5G and edge computing services. At the same time, a competitive landscape of emerging startups is advancing novel use cases-from remote inspection drones to AI-driven translation overlays-challenging incumbents to accelerate innovation cycles.

Mergers and acquisitions have amplified these dynamics, enabling established vendors to absorb specialized capabilities and expand their solution portfolios rapidly. Concurrently, partnerships with academic institutions and research consortia are facilitating cutting-edge studies in human-machine interaction, ergonomics, and AI safety, driving continuous improvements in device usability and reliability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Glasses Equipped with AI market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Apple Inc.

- Brilliant Labs Private Limited

- EssilorLuxottica Group

- Even Realities Limited

- Google LLC

- Halliday AI Glasses

- Huawei Technologies Co., Ltd.

- Lenovo Group Limited

- LUCYD EYEWEAR

- Magic Leap, Inc.

- Meta Platforms, Inc.

- Noise by Nexxbase Marketing Pvt. Ltd.

- Orcam, Inc.

- RealWear, Inc.

- Rokid

- Seiko Epson Corp.

- Snap Inc.

- Solos Technology Limited

- TCL King Electrical Appliance (Huizhou) Co.,LTD.

- Vuzix Corporation

- XREAL, Inc.

Strategic Imperatives for Innovating Hardware, Diversifying Supply Chains, and Cultivating Ecosystem Partnerships

Industry leaders must prioritize a holistic approach that encompasses technological innovation, supply chain resilience, and market education. Investing in modular hardware architectures will enable rapid integration of next-generation optics, sensors, and AI accelerators, ensuring product roadmaps remain responsive to evolving use cases. Establishing diversified procurement channels-both domestically and internationally-will mitigate risk associated with tariff fluctuations and geopolitical uncertainties.

Equally important is the cultivation of strategic partnerships with software developers, system integrators, and cloud platform operators. By fostering open APIs and developer communities, companies can accelerate application innovation and expand ecosystem offerings across enterprise and consumer domains. A focus on user-centric design, informed by extensive usability testing and human factors research, will further differentiate products in increasingly crowded markets.

To drive adoption, organizations should implement targeted educational initiatives and pilot programs that demonstrate tangible ROI for enterprise stakeholders. Thought leadership content, immersive demos, and training workshops will be critical to overcoming skepticism and navigating complex procurement processes. By pursuing these recommendations, industry participants can secure a leadership position in the fast-growing arena of AI-enabled smart eyewear.

Leveraging Multisource Data Integration and Proprietary Modeling to Provide Robust Insights Across Smart Glasses Technology Dimensions

This analysis is grounded in a robust research methodology that integrates primary interviews with industry executives, technology architects, and end-users across key geographies. These insights are complemented by secondary sources, including patent filings, company financial disclosures, and regulatory databases. Data triangulation ensures that findings are corroborated through independent validation, while proprietary modeling techniques synthesize qualitative inputs with technology roadmaps and connectivity trends.

Additionally, targeted surveys and focus groups provided a granular understanding of user preferences, ergonomics requirements, and perceived barriers to adoption. Coverage extends across hardware specifications, service offerings, software platforms, and device typologies, ensuring a multidimensional perspective. Regional assessments were informed by on-the-ground experts and local regulatory analyses to capture market nuances. The resulting research framework delivers actionable intelligence designed to guide strategic planning and investment decisions in the evolving smart glasses landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Glasses Equipped with AI market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Glasses Equipped with AI Market, by Display Type

- Smart Glasses Equipped with AI Market, by User Interaction Mode

- Smart Glasses Equipped with AI Market, by Connectivity

- Smart Glasses Equipped with AI Market, by Operating System

- Smart Glasses Equipped with AI Market, by Use Case

- Smart Glasses Equipped with AI Market, by End User

- Smart Glasses Equipped with AI Market, by Distribution Channel

- Smart Glasses Equipped with AI Market, by Region

- Smart Glasses Equipped with AI Market, by Group

- Smart Glasses Equipped with AI Market, by Country

- United States Smart Glasses Equipped with AI Market

- China Smart Glasses Equipped with AI Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3021 ]

Synthesizing Progress in AI-Powered Wearables to Define Strategic Pathways and Forecast Industry Maturation Trends

The integration of artificial intelligence within smart glasses represents a paradigm shift, transforming these wearables from passive display devices into intelligent assistants capable of contextual awareness and proactive engagement. Technological advancements in optics, sensor fusion, and edge computing, combined with evolving regulatory environments and supply chain strategies, are defining the contours of a rapidly maturing market.

Segmentation insights underscore the diversity of applications-from enterprise sectors such as finance, healthcare, and manufacturing to consumer domains like gaming and social media. Regional variations highlight the importance of tailored strategies that account for local regulations, infrastructure readiness, and cultural preferences. Competitive analysis reveals a dynamic ecosystem where established technology giants and agile startups alike are vying for leadership through differentiated offerings and ecosystem partnerships.

As the landscape continues to evolve, the path forward will be shaped by the industry’s ability to innovate modular architectures, establish resilient supply chains, and foster open development communities. For decision-makers, this moment represents an opportunity to align strategic priorities with emerging trends, ensuring sustained growth and value creation in the era of AI-driven smart eyewear.

Unlock unparalleled intelligence with our detailed research report on AI-driven smart glasses by connecting with Ketan Rohom for your personalized purchase

To explore the comprehensive insights and strategic guidance contained in this in-depth market research report on smart glasses equipped with AI, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage with Ketan to secure your copy of the full analysis, leveraging expert perspectives and proprietary data to inform your next steps in this rapidly evolving technology landscape. Don’t miss the opportunity to gain a competitive advantage through actionable intelligence tailored to your business objectives.

- How big is the Smart Glasses Equipped with AI Market?

- What is the Smart Glasses Equipped with AI Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?