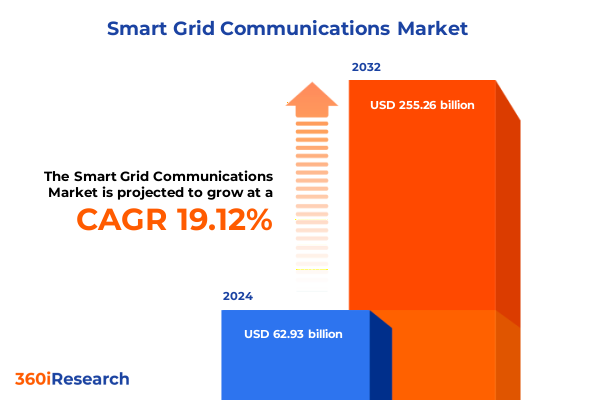

The Smart Grid Communications Market size was estimated at USD 75.12 billion in 2025 and expected to reach USD 88.45 billion in 2026, at a CAGR of 19.09% to reach USD 255.26 billion by 2032.

Setting the Stage for Next-Generation Smart Grid Communications as Digital Innovation, Renewable Integration, and Resilience Become Imperative Priorities

Smart grid communications have emerged at the forefront of digital transformation within the energy sector, redefining the ways utilities, regulators, and end-users interact with power infrastructure. Over recent years, an intricate tapestry of advanced sensors, bi-directional communication channels, and intelligent analytics platforms has evolved to facilitate unprecedented levels of grid visibility and control. As stakeholders pursue the twin imperatives of decarbonization and resilience, smart grid communications have become indispensable, enabling seamless integration of distributed renewable energy sources, real-time demand response mechanisms, and predictive maintenance routines that safeguard against disruptions.

Against the backdrop of mounting regulatory requirements and intensifying consumer expectations, the role of communications technologies has extended beyond mere data transmission. Today’s networks must offer robust cybersecurity safeguards, ensure interoperability across heterogeneous vendor ecosystems, and accommodate the high-throughput demands of electric vehicle charging infrastructure. Moreover, the proliferation of IoT-enabled devices at the edge, from advanced metering infrastructure to intelligent grid sensors, has reshaped traffic patterns and elevated the importance of network management strategies that can dynamically prioritize mission-critical operations.

As the smart grid communications landscape continues to mature, decision-makers must recognize that digital architecture is no longer ancillary but foundational to delivering reliable, efficient, and sustainable energy services. This executive summary sets the stage by outlining the transformative shifts, regulatory influences, segmentation insights, and regional dynamics that define the modern market. By synthesizing these elements, stakeholders will be equipped to navigate complexity and chart a forward-looking course in an era where communications form the very bedrock of grid modernization.

Unveiling the Paradigm-Shifting Advances That Are Redefining Connectivity, Intelligence, and Operational Efficiency in Modern Smart Grid Ecosystems

The smart grid communications ecosystem is undergoing seismic shifts driven by emerging technologies and evolving stakeholder demands. Foremost among these changes is the transition from centralized, supervisory control and data acquisition systems to distributed intelligence architectures. As edge computing capabilities become more sophisticated, distributed nodes can process and act upon data locally, reducing latency and enhancing grid stability. This shift, coupled with increasing adoption of artificial intelligence and machine learning algorithms, is transforming operational paradigms, from predictive maintenance to automated fault detection and self-healing networks.

Concurrently, the convergence of information and operational technologies has accelerated, leading to hybrid platforms that bridge traditional IT networks with operational technology protocols. This confluence has improved situational awareness across control centers while exposing new challenges around cybersecurity and data governance. To address these risks, industry leaders are embedding zero-trust frameworks and secure credential management directly into communication nodes and gateways.

Furthermore, the expansion of ubiquitous wireless connectivity, particularly with the rollout of 5G, has unlocked new use cases for wide area network deployments. Utilities are leveraging high-bandwidth, low-latency links to support advanced substation automation, granular demand response programs, and remote asset monitoring. In parallel, the emergence of open standards, such as IEC 61850 and IEEE 2030.5, is fostering multi-vendor interoperability and reducing integration costs. Taken together, these transformative shifts are reshaping expectations around reliability, flexibility, and cost-efficiency, laying the groundwork for a resilient and intelligent grid capable of meeting future energy demands.

Examining How 2025 Tariff Adjustments on Imported Grid Components and Technologies Are Reshaping Cost Structures, Supply Chains, and Strategic Sourcing Decisions

The imposition of new tariffs on imported grid communication components and technologies in 2025 has introduced a complex set of cost pressures and strategic considerations for market participants. By targeting hardware imports such as communication nodes, routers, and smart meters, these measures have disrupted traditional sourcing models, prompting a reevaluation of supplier relationships and procurement strategies. As a result, many utilities and integrators are accelerating efforts to diversify their supply chains, seeking alternative vendors in regions with favorable trade agreements or local manufacturing incentives to offset increased duties.

In addition, the tariff regime has heightened the appeal of in-country value creation, spurring collaborative partnerships between equipment manufacturers and domestic fabrication facilities. This shift not only mitigates the impact of import duties but also strengthens regional resilience by shortening lead times and reducing logistical complexities. At the same time, software and services providers have leveraged the tariff-induced hardware cost escalation to reinforce their value propositions, emphasizing remote diagnostic tools, performance optimization frameworks, and cloud-based network management solutions that can prolong asset lifecycles and defer capital expenditures.

Moreover, project timelines have been influenced by the need to account for tariff-related contingencies. Deployment schedules are increasingly aligned with tariff review cycles to capitalize on potential reprieves or adjustments. Consequently, procurement teams are building greater flexibility into contracts, embedding clauses that allow for renegotiation or indexation of prices tied to tariff fluctuations. Through these adaptive measures, stakeholders are demonstrating agility in navigating policy-driven market disruptions, safeguarding project viability while preserving long-term modernization objectives.

Deriving Strategic Insights from Component, Network, Technology, Application, and End-User Segmentation to Illuminate Opportunities and Guide Investment Priorities

A nuanced understanding of market segmentation offers critical guidance for stakeholders seeking to align product development, investment, and deployment strategies with evolving demand profiles. Component segmentation reveals that the hardware layer forms the backbone of smart grid communications, encompassing communication nodes, gateways, modems, routers and switches, and smart meters. Complementing this infrastructure, network management software and utility data analytics platforms deliver the intelligence necessary for real-time monitoring, predictive analytics, and operational control.

Examining network type segmentation illuminates the role of connectivity tiers in fulfilling diverse application requirements. At the premise level, home area networks leverage protocols such as Bluetooth, Wi-Fi, Wi-Sun, and Zigbee to facilitate end-user engagement and localized energy management. For broader community coverage, neighborhood area networks employ power line communication and RF mesh technologies, enabling mid-tier data aggregation. Meanwhile, wide area networks utilize 5G cellular, fiber optic, and microwave links to ensure secure, high-bandwidth transmission across dispersed grid assets.

When analyzed through the lens of communication technology segmentation, wired and wireless solutions emerge as complementary enablers. Wired approaches deliver deterministic performance and cyber-hardened resilience for mission-critical installations, whereas wireless methodologies offer rapid scalability and flexibility in dynamic environments. Application segmentation further highlights six core use cases-demand response, distribution automation, energy management, electric vehicle charging management, outage management, and smart metering-each carrying distinct performance and reliability requisites. Finally, end-user segmentation underscores the importance of tailoring offerings for commercial, industrial, and residential consumers, as each cohort exhibits unique consumption patterns, regulatory frameworks, and service expectations.

This comprehensive research report categorizes the Smart Grid Communications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Network Type

- Communication Technology

- Application

- End-User

Navigating Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Identify Growth Drivers, Policy Landscapes, and Infrastructure Variations

Regional dynamics play a pivotal role in shaping smart grid communications deployment and innovation trajectories. In the Americas, supportive regulatory frameworks and incentive schemes have accelerated the adoption of advanced metering infrastructure and distribution automation projects. Utility companies in North America are piloting private 5G networks for substation connectivity, while Latin American markets demonstrate growing interest in solar-plus-storage microgrids that rely on robust communication backbones to manage bi-directional power flows.

The Europe, Middle East and Africa region is characterized by a diverse policy landscape and a broad spectrum of grid modernization maturity. Europe’s aggressive decarbonization targets have catalyzed large-scale grid digitization programs, with cross-border interoperability standards facilitating pan-European energy exchanges. The Middle East is investing in smart city pilots that integrate smart grid communications with urban infrastructure, leveraging public–private partnerships to fund next-generation networks. Meanwhile, select African markets are adopting leapfrog strategies, deploying wireless mesh and hybrid power line communication systems to overcome legacy grid constraints and extend service to rural and underserved communities.

Across Asia-Pacific, rapid urbanization and electrification trends are driving demand for both high-throughput backbone connectivity and flexible edge solutions. China’s fiber-to-the-substation initiatives and spectrum allocations for private networks are enabling massive deployments, whereas Southeast Asian nations prioritize cost-effective RF mesh and power line communication models to address budgetary and terrain challenges. Japan and South Korea continue to lead in intelligent substation automation and cybersecurity integration, forging blueprints for regional harmonization of smart grid communication frameworks.

This comprehensive research report examines key regions that drive the evolution of the Smart Grid Communications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation, Partnership Strategies, and Competitive Positioning in the Evolving Smart Grid Communications Market

The competitive landscape of smart grid communications is shaped by companies that blend deep domain expertise with innovative technology portfolios. Leading equipment providers are focused on expanding their hardware footprints through modular, software-defined substation devices and multi-protocol gateways that accommodate evolving network topologies. Simultaneously, software specialists are differentiating through advanced analytics engines, digital twins, and AI-driven orchestration platforms that unify data streams from sensors, meters, and control systems.

Partnership ecosystems have become a hallmark of market leadership, as component manufacturers, network operators, and system integrators collaborate to deliver turnkey solutions. These alliances often span hardware provisioning, communications infrastructure, security services, and lifecycle management offerings. Additionally, smaller, agile technology firms are making inroads by targeting niche application segments, such as EV charging management and predictive outage analytics, prompting incumbents to accelerate internal innovation and open up their platforms through developer-friendly APIs.

To maintain competitive positioning, companies are investing heavily in research and development, particularly in areas such as secure edge computing, quantum-safe encryption techniques, and interoperability middleware. They are also exploring as-a-service business models to lower adoption barriers, offering subscription-based access to firmware updates, security patches, and analytics dashboards. Through these strategic initiatives, market participants are strengthening their value propositions and fostering long-term customer relationships in a rapidly evolving environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Grid Communications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aclara Technologies LLC

- Cisco Systems, Inc.

- Eaton Corporation plc

- Echelon Corporation

- Ericsson AB

- Fujitsu Limited

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Itron, Inc.

- Landis+Gyr Group AG

- Mitsubishi Electric Corporation

- Nokia Corporation

- Oracle Corporation

- S&C Electric Company

- Schneider Electric SE

- Siemens AG

- Silver Spring Networks

- Toshiba Corporation

- Trilliant Holdings Inc.

- ZTE Corporation

Translating Market Intelligence into Actionable Strategies for Stakeholders to Accelerate Adoption, Optimize Architectures, and Enhance Value Propositions

Actionable strategies emerge from a careful synthesis of market intelligence, stakeholder feedback, and technology roadmaps. Industry leaders should prioritize the deployment of interoperable, modular communication architectures that can evolve alongside emerging standards. By embracing open interfaces and adhering to recognized protocols, utilities and solution providers will reduce integration costs, accelerate time to market, and facilitate competitive sourcing.

Investments in cybersecurity must extend beyond perimeter defenses to encompass end-to-end encryption, identity management, and continuous threat monitoring. Embedding secure elements at the hardware level, combined with zero-trust network segmentation, will protect critical grid functions against increasingly sophisticated cyber threats. In parallel, adopting edge computing frameworks that distribute processing workloads closer to the source will enhance response times, alleviate network congestion, and support advanced analytics for fault detection and demand forecasting.

Furthermore, forging cross-industry partnerships can unlock new revenue streams and innovation pathways. Collaborations with telecommunications operators, cloud service providers, and electric vehicle charging network companies can yield integrated offerings that address holistic energy management challenges. Finally, stakeholders should engage proactively with regulators and standard-setting bodies to shape policies that incentivize digital investments, streamline certification processes, and encourage sustainable business models.

Detailing a Robust Research Methodology Incorporating Systematic Data Collection, Triangulation Techniques, and Stakeholder Validation to Ensure Analytical Rigor

This analysis is grounded in a comprehensive research framework designed to ensure validity, reliability, and relevance. The methodology commenced with an extensive desk review of technical standards, regulatory filings, vendor white papers, and industry association publications. This initial phase established a contextual foundation and identified prevailing trends and emerging disruptions.

Subsequently, primary data was collected through structured interviews and consultations with a cross-section of stakeholders, including utility executives, technology providers, integrators, and regulatory experts. These interactions provided nuanced perspectives on deployment challenges, procurement priorities, and innovation drivers. To mitigate potential biases, insights were triangulated against publicly available case studies, pilot project reports, and market intelligence databases.

Quantitative and qualitative information underwent rigorous validation via data triangulation techniques, ensuring consistency across multiple sources. Expert review panels were engaged at critical junctures to challenge assumptions, refine segmentation frameworks, and endorse key findings. Throughout the process, confidentiality agreements safeguarded proprietary insights, enabling candid dialogue and preserving the integrity of the research.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Grid Communications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Grid Communications Market, by Component

- Smart Grid Communications Market, by Network Type

- Smart Grid Communications Market, by Communication Technology

- Smart Grid Communications Market, by Application

- Smart Grid Communications Market, by End-User

- Smart Grid Communications Market, by Region

- Smart Grid Communications Market, by Group

- Smart Grid Communications Market, by Country

- United States Smart Grid Communications Market

- China Smart Grid Communications Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Present a Cohesive Perspective on the Trajectory, Challenges, and Strategic Imperatives of Smart Grid Communications

In summary, smart grid communications stand at the confluence of digital innovation, regulatory evolution, and shifting energy imperatives. The combined forces of distributed intelligence, advanced analytics, and next-generation connectivity are reshaping the grid into a dynamic, responsive ecosystem. While tariff-induced supply chain adaptations and regional diversity add layers of complexity, they also drive agility and localized innovation.

Segment-specific insights underscore the need for tailored solutions across hardware, software, networks, applications, and end-users, while regional analyses reveal divergent pathways to modernization. Market leaders are leveraging partnerships, cybersecurity best practices, and flexible business models to stay ahead of the curve. By integrating these findings, stakeholders can devise robust strategies that balance reliability, cost-efficiency, and sustainability.

Ultimately, the trajectory of smart grid communications will be defined by collaborative efforts between utilities, technology vendors, regulators, and end-users. Those who act decisively, prioritizing open standards, resilient architectures, and proactive policy engagement, will be best positioned to harness the full potential of the digital grid revolution.

Engage with Ketan Rohom to Unlock Comprehensive Smart Grid Communications Insights and Secure Access to Tailored Market Research Deliverables

To explore deeper strategic implications and gain a competitive edge through a nuanced understanding of evolving grid communication dynamics, we invite you to connect directly with Ketan Rohom (Associate Director, Sales & Marketing). His expertise in tailoring market intelligence to precise stakeholder needs will ensure you derive maximum value from this report’s actionable findings. Engage now to discuss customized deliverables, clarify insights on emerging opportunities, and secure access to the comprehensive research package that will empower your organization to lead in the rapidly transforming arena of smart grid communications

- How big is the Smart Grid Communications Market?

- What is the Smart Grid Communications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?