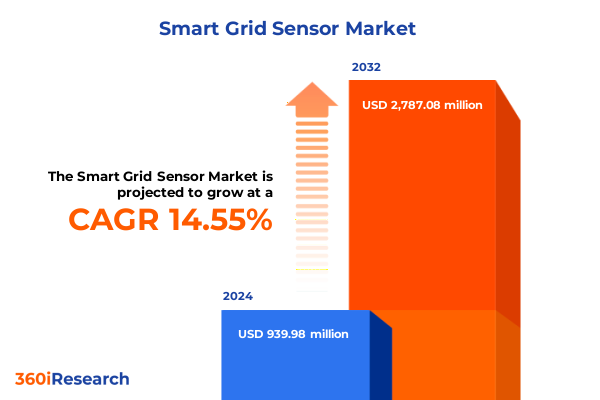

The Smart Grid Sensor Market size was estimated at USD 1.07 billion in 2025 and expected to reach USD 1.22 billion in 2026, at a CAGR of 14.61% to reach USD 2.78 billion by 2032.

Unveiling the Strategic Value of Smart Grid Sensor Technologies as Cornerstones of a Robust and Sustainable Energy Infrastructure Ecosystem

Smart grid sensor technologies have emerged as vital enablers of modern energy infrastructures, offering real-time visibility into power flows, asset health, and system performance. As utilities and grid operators navigate the complexity of distributed generation, electric vehicle integration, and fluctuating demand, the deployment of advanced sensing solutions enables more informed decision-making, reduces operational risks, and enhances overall grid reliability. In this context, smart sensors serve as the foundation for automated fault detection, demand response orchestration, and predictive maintenance strategies that drive efficiency and cost savings.

In recent years, regulatory imperatives and growing sustainability commitments have intensified pressure on energy stakeholders to pursue digital transformation initiatives. By embedding sensors at critical nodes-transformers, substations, distribution lines, and end-user connections-organizations can establish a robust data pipeline to advanced analytics platforms. This transformative approach aligns with broader industry trends toward decentralization and decarbonization, empowering utilities to seamlessly integrate renewable generation while maintaining stability within legacy networks.

Yet the journey toward a fully digitized grid presents its own set of challenges, including interoperability concerns, cybersecurity defenses, and capital allocation for large-scale rollouts. The success of sensor deployments hinges on striking a balance between technological sophistication and pragmatic integration, ensuring that each deployment yields measurable operational benefits. This introduction sets the stage for an in-depth exploration of the shifts, segmentation nuances, regional dynamics, and strategic imperatives shaping the future of smart grid sensor adoption.

Exploring the Revolutionary Technological and Market Dynamics Accelerating the Evolution of Next Generation Smart Grid Sensor Deployments

The landscape of smart grid sensors has undergone transformative shifts driven by convergence of edge computing, artificial intelligence, and pervasive connectivity. Edge analytics capabilities now enable sensors to process vast volumes of data locally, reducing latency and easing bandwidth constraints on communication networks. This evolution from centralized data aggregation to distributed intelligence marks a pivotal turn in how operators monitor and control grid assets, ushering in a new era of real-time operational insights.

Simultaneously, advances in miniaturization and low-power electronics have broadened the scope of sensor applications. Frequency, current, voltage, and temperature sensors now boast enhanced precision and reduced form factors, facilitating unobtrusive integration within existing infrastructure. The proliferation of wireless mesh networks and cellular IoT platforms has further accelerated deployments by offering flexible alternatives to fiber and power line communications, particularly in hard-to-reach or retrofit scenarios.

Regulatory frameworks and cybersecurity standards have kept pace with technological innovation, introducing stringent requirements for data integrity, privacy, and resilience. At the same time, the rise of prosumer models and electric vehicle charging demands has amplified the need for granular visibility across distribution networks, driving investment in advanced sensing solutions. These combined shifts are redefining the market’s trajectory, compelling stakeholders to adopt forward-looking strategies that prioritize interoperability, security, and scalability.

Assessing the Interplay Between United States Tariff Policies in 2025 and the Strategic Adaptation of Smart Grid Sensor Supply Chains

The imposition of targeted tariff measures by the United States in early 2025 has reshaped the competitive dynamics of the smart grid sensor supply chain, prompting a reassessment of procurement strategies and regional sourcing priorities. Manufacturers reliant on cross-border components have encountered increased input costs, leading to a recalibration of supplier portfolios and accelerated efforts to localize critical assembly operations. As a result, organizations are engaging in deeper collaborations with domestic integrators to mitigate risks associated with prolonged lead times and potential trade disputes.

In response to escalating tariffs, several sensor producers have initiated dual-sourcing agreements across North American, European, and Asia-Pacific manufacturing hubs. This diversification not only cushions against policy volatility but also enhances responsiveness to regional customization requirements, such as strict cybersecurity mandates and interoperability standards. Furthermore, incentives introduced under recent infrastructure legislation have spurred investment in localized production capabilities, bolstering resilience against future tariff escalations.

While these strategic shifts introduce near-term cost pressures, they also unlock opportunities for innovation in design for manufacturability and regional service offerings. Companies adept at navigating the new trade landscape are forging partnerships with component vendors to drive mutual cost efficiencies, while also exploring modular architectures that facilitate swift upgrades and expansions. Ultimately, the cumulative impact of 2025 tariff policies is positioning the ecosystem to favor agile, vertically integrated players capable of delivering end-to-end solutions across diverse operating environments.

Illuminating In-Depth Market Segmentation Insights That Reveal Critical Adoption Drivers Across Sensor Types Connectivity Installation and End User Applications

Sensor type segmentation reveals distinct growth trajectories influenced by the unique data requirements of system operators. Current sensors have surged in importance for real-time fault detection and load balancing, while frequency sensors play a critical role in maintaining grid stability amid growing renewable penetration. Temperature sensors offer predictive maintenance insights, detecting thermal anomalies in transformers and switchgear before failures occur, and voltage sensors deliver precise voltage profiling essential for optimizing power quality and reducing losses. Each sensor type contributes specialized insights that collectively enhance operational resilience and visibility.

Connectivity technology choices are equally pivotal, with wired and wireless solutions addressing varied deployment scenarios. Ethernet and fiber optic connections are preferred for high-throughput, low-latency requirements within substations and control centers, while power line communication enables data transmission across existing conductors without additional cabling. Wireless approaches such as cellular networks and RF mesh systems provide scalable coverage for wide area monitoring, particularly in rural or retrofit contexts where trenching costs or physical access constraints pose challenges. Beyond connectivity, installation type influences project roadmaps; new installations enable seamless integration of the latest sensor architectures, whereas retrofit projects demand compatibility with legacy equipment and minimal disruption to live networks.

Application segmentation underscores the diverse use cases that drive investment decisions. Asset management teams leverage sensors to extend equipment lifecycles and prioritize maintenance activities, whereas demand response programs depend on granular consumption data to modulate load in real time. Distribution automation initiatives harness sensor feedback for automated switching and voltage regulation, and grid monitoring functions rely on continuous data streams to detect anomalies and coordinate outage management efforts. End users across commercial, industrial, residential, and utility segments exhibit varying adoption patterns, with utilities driving large-scale deployments, while commercial and industrial enterprises pilot advanced analytics to achieve energy efficiency goals. These segmentation insights illuminate where stakeholders can focus resources to capture maximum operational and financial impact.

This comprehensive research report categorizes the Smart Grid Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Power Line Type

- Measurement Parameter

- Installation Type

- Distribution Channel

- End-User

- Application

Uncovering Strategic Regional Insights That Highlight Unique Drivers and Challenges in the Americas EMEA and Asia Pacific Smart Grid Sensor Landscapes

In the Americas, utilities and municipalities are at the forefront of modernizing distribution networks, spurred by federal and state initiatives that incentivize grid hardening and resilience enhancements. Urban centers have become testbeds for cutting-edge sensor rollouts, leveraging both wired and wireless architectures to support electrification goals and manage ever-increasing load variability from electric vehicles. Meanwhile, rural cooperatives prioritize cost-effective communications solutions such as RF mesh to deliver real-time data without extensive infrastructure investment.

The Europe, Middle East, and Africa region presents a complex landscape marked by advanced regulatory frameworks and a diverse array of infrastructure maturity levels. In Western Europe, stringent grid codes and ambitious carbon reduction targets have driven aggressive adoption of frequency and voltage sensors to maintain system stability amid high renewable penetration. In contrast, emerging markets across the Middle East and Africa are gradually implementing foundational monitoring solutions to enhance grid reliability, often partnering with global technology providers to bridge expertise gaps and develop local capabilities.

Asia-Pacific exemplifies a dual momentum of rapid urbanization and expansive rural electrification. In developed markets such as Japan and Australia, utilities are deploying sophisticated sensor networks integrated with AI-driven analytics to optimize distributed energy resources. Concurrently, countries in Southeast Asia and South Asia prioritize scalable, low-cost sensor deployments to accelerate rural grid connectivity and support large-scale renewable integration. This dynamic regional mosaic underscores the importance of tailoring solutions to local policy drivers, infrastructure constraints, and cost sensitivities.

This comprehensive research report examines key regions that drive the evolution of the Smart Grid Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Market Leading Companies Driving Innovation Strategic Collaborations and Competitive Dynamics in the Smart Grid Sensor Sector

Leading industrial conglomerates and specialized sensor manufacturers are driving innovation through strategic collaborations, M&A activities, and targeted R&D investments. Established players have expanded their portfolios by acquiring niche sensor startups, integrating advanced MEMS technologies and edge AI capabilities to differentiate their offerings. At the same time, technology firms traditionally focused on networking and cybersecurity are entering the smart grid sensor domain, leveraging their communication expertise to develop integrated hardware-software bundles that prioritize end-to-end data security and device management.

Competitive dynamics have also intensified around the development of open standards and interoperability frameworks. Several consortia and industry alliances have emerged, advocating for common communication protocols and data schemas to reduce integration complexity and accelerate multi-vendor deployments. This collaborative approach is reshaping how companies position themselves, with a growing emphasis on platform-agnostic solutions that enable seamless integration into existing SCADA and utility management systems.

Furthermore, the entrance of cloud service providers and analytics specialists into the market is driving sensor OEMs to forge partnerships that extend beyond hardware supply. By offering data-as-a-service models and predictive insights subscriptions, these hybrid alliances are unlocking recurring revenue opportunities and fostering deeper customer engagement. As a result, smart grid sensor market competition is evolving from component sales toward comprehensive digital service ecosystems that deliver continuous value and strengthen vendor-customer relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Grid Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ABB Ltd

- Analog Devices, Inc.

- Anritsu Corporation

- Arteche Lantegi Elkartea SA

- Cisco Systems, Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- GIPRO GmbH by PREIS group

- Heimdall Power AS

- Honeywell International Inc.

- Hubbell Incorporated

- Itron, Inc.

- Kamstrup A/S

- LEM International SA

- Littelfuse, Inc.

- Megger group

- Mitsubishi Electric Corporation

- Networked Energy Services Corporation

- NXP Semiconductors N.V.

- Oracle Corporation

- QinetiQ Limited

- Radiant Enterprises

- Schneider Electric SE

- Sentient Energy, Inc.

- Siemens AG

- Tantalus

- Toshiba Corporation

- Trilliant Holdings Inc.

- Ubicquia, Inc.

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Maximizing Efficiency Resilience and Scalability of Smart Grid Sensor Networks

Industry leaders should prioritize the deployment of edge analytics capabilities within sensor nodes to minimize data transmission volumes and enhance real-time responsiveness. By embedding intelligent processing at the network edge, operators can filter noise, execute local control loops, and trigger automated responses without relying exclusively on centralized systems. This approach not only reduces operational latency but also strengthens resilience against communication outages and cyber disruptions.

To mitigate supply chain uncertainties, companies must adopt a diversified sourcing strategy that balances component procurement across multiple geographic regions. Strategic partnerships with regional manufacturers can streamline logistics, decrease lead times, and ensure compliance with emerging tariff policies. Simultaneously, developing modular sensor architectures that accommodate interchangeable communication modules-whether Ethernet, fiber optic, cellular, or RF mesh-will future-proof deployments against evolving connectivity standards and network protocols.

Collaboration with utility customers to implement pilot programs and interoperability testing is essential for refining end-to-end solutions. Early engagement fosters mutual understanding of site-specific requirements, regulatory landscapes, and integration touchpoints. Moreover, industry stakeholders should actively contribute to consortium-driven standards development, aligning product roadmaps with open communication frameworks that simplify large-scale rollouts. By embracing these combined strategies, market participants can accelerate adoption, reduce implementation risk, and deliver measurable operational impact.

Defining Rigorous Research Methodology and Analytical Frameworks Underpinning the Insights and Conclusions of the Smart Grid Sensor Market Study

This study synthesizes insights derived from a multifaceted research framework that blends primary and secondary methodologies to ensure comprehensive market coverage. In the primary research phase, structured interviews were conducted with a cross section of utility executives, sensor OEM engineers, system integrators, and regulatory experts. These dialogues illuminated current deployment challenges, technology selection criteria, and regional policy influences, providing qualitative depth to each segment analysis.

Secondary research encompassed an extensive examination of public regulatory filings, industry white papers, technical specifications, and technology roadmaps published by leading standard-setting bodies. Market literature and archival data were reviewed to trace historical adoption patterns and identify recurring themes in communication protocol evolution. This dual approach facilitated data triangulation, validating trends observed in interviews against documented regulatory and technological developments.

Quantitative analysis involved mapping the segmentation framework across sensor types, connectivity technologies, installation modalities, application domains, and end user verticals. Each segmentation category was analyzed for deployment drivers and adoption barriers without projecting market sizing or share. Analytical rigor was maintained through iterative validation with domain experts, ensuring that the research outputs accurately reflect the practical realities of stakeholders in the smart grid sensor ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Grid Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Grid Sensor Market, by Sensor Type

- Smart Grid Sensor Market, by Power Line Type

- Smart Grid Sensor Market, by Measurement Parameter

- Smart Grid Sensor Market, by Installation Type

- Smart Grid Sensor Market, by Distribution Channel

- Smart Grid Sensor Market, by End-User

- Smart Grid Sensor Market, by Application

- Smart Grid Sensor Market, by Region

- Smart Grid Sensor Market, by Group

- Smart Grid Sensor Market, by Country

- United States Smart Grid Sensor Market

- China Smart Grid Sensor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Consolidating Critical Findings and Strategic Implications to Illustrate the Path Forward for Smart Grid Sensor Deployment and Industry Collaboration

The convergence of advanced sensor technologies, robust connectivity options, and supportive policy frameworks is driving a fundamental shift in how grid operators manage complexity, resilience, and sustainability. Key findings reveal that modular sensor design, edge analytics, and diversified supply chains are the principal enablers of rapid deployment, while regional variations underscore the necessity for tailored solutions that align with local regulatory, infrastructure, and cost considerations.

Looking ahead, the competitive landscape will be shaped by vendors that embrace open standards, foster collaborative ecosystems, and offer comprehensive hardware-software-services portfolios. Utilities and end-user organizations that integrate sensors into holistic grid modernization initiatives will be better positioned to capture operational efficiencies, reduce outage durations, and navigate the dual imperatives of decarbonization and digital transformation. By synthesizing segmentation insights, tariff impacts, and regional nuances, stakeholders can chart a clear path for strategic investments and partnerships that advance the collective objective of a resilient, intelligent, and sustainable energy infrastructure.

Engaging Directly with Ketan Rohom for Exclusive Access to Comprehensive Smart Grid Sensor Market Research to Propel Strategic Growth Initiatives

Engaging directly with Ketan Rohom provides an unparalleled gateway to strategic intelligence tailored for decision-makers seeking to fortify their competitive edge in the dynamic smart grid sensor domain.

By initiating a conversation with the Associate Director of Sales & Marketing, readers gain exclusive visibility into the comprehensive research methodologies, detailed segmentation analyses, and region-specific insights that underpin every recommendation in this report. Collaborating directly with this experienced professional ensures that your organization can translate market intelligence into actionable tactics, rapidly respond to evolving tariff landscapes, and adopt best-in-class sensor technologies to maximize grid resilience.

Securing this report through a direct dialogue equips stakeholders with the confidence to navigate supply chain complexities, harness emerging connectivity innovations, and align investment priorities with the most promising application verticals. A brief strategic discussion with Ketan Rohom will illuminate customized solutions for integrating advanced sensors across commercial, industrial, residential, and utility environments, enabling teams to preemptively address regulatory shifts and technology disruptions.

Don’t miss this opportunity to transform data-driven insights into decisive action. Reach out to arrange a personalized consultation and obtain your copy of the smart grid sensor market research report-your essential resource for shaping next-generation energy infrastructure strategies.

- How big is the Smart Grid Sensor Market?

- What is the Smart Grid Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?