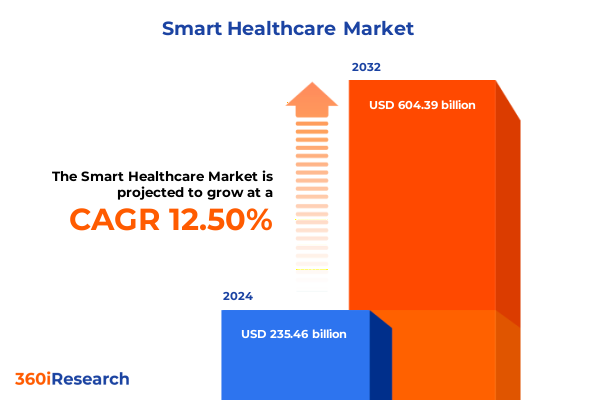

The Smart Healthcare Market size was estimated at USD 124.52 billion in 2025 and expected to reach USD 140.84 billion in 2026, at a CAGR of 13.53% to reach USD 302.85 billion by 2032.

Pioneering the Smart Healthcare Revolution with Patient-Centric Technologies Hubspotting Key Drivers Shaping Tomorrow’s Clinical and Operational Outcomes

The convergence of cutting-edge technologies and patient-centric care models is catalyzing an unprecedented transformation across healthcare ecosystems worldwide. At the heart of this revolution lies a shift from traditional, reactive treatment paradigms toward proactive, preventive interventions enabled by data-driven insights. By integrating intelligent devices, advanced analytics, and seamless clinical workflows, providers and payers are striving to deliver personalized experiences that not only improve outcomes but also optimize operational efficiencies. This report offers executives a comprehensive introduction to the foundational drivers redefining the way care is delivered, monitored, and managed across acute, ambulatory, and home-based settings.

In recent years, strategic alliances between technology companies, biopharmaceutical firms, and health systems have accelerated the commercialization of solutions that once existed solely in academic research labs. These partnerships underscore a collective commitment to harnessing digital tools to tackle some of the industry’s most daunting challenges, including rising chronic disease burdens, workforce shortages, and the imperatives of value-based reimbursement frameworks. Consequently, decision makers must consider both the clinical efficacy and economic viability of emerging innovations to ensure they can respond nimbly to shifting regulatory requirements, patient expectations, and reimbursement landscapes. This introduction sets the stage for a deep dive into the transformative shifts and key insights that define today’s Smart Healthcare market.

Unveiling the Transformative Shifts Disrupting Healthcare Delivery from Artificial Intelligence to Interoperability Innovations Redefining Care Pathways

A wave of digital health breakthroughs is reshaping the contours of care delivery, enabling stakeholders to move beyond siloed systems and toward an integrated, interoperable future. Artificial intelligence capabilities are augmenting clinical decision making through predictive diagnostics, automated image interpretation, and personalized treatment regimens, while machine learning algorithms refine these insights over time. Simultaneously, the proliferation of Internet of Things–enabled devices-from implantable sensors that continuously monitor physiological parameters to wearable patches that transmit real-time data-empowers both clinicians and patients with unprecedented visibility into health status.

Equally transformative is the emergence of robust interoperability standards and secure data exchange platforms that facilitate seamless collaboration among disparate systems. Blockchain pilots are enhancing data provenance and integrity, addressing long-standing concerns around privacy and consent. Meanwhile, telehealth and remote patient monitoring solutions have matured far beyond their initial iterations, delivering comprehensive care in virtual settings that rival in-person interventions. Taken together, these shifts underscore a new reality in which technology platforms operate as dynamic ecosystems rather than isolated tools, forging a connective tissue that realigns incentives, streamlines workflows, and ultimately delivers value across the continuum of care.

Assessing the Cumulative Repercussions of 2025 United States Tariffs on Smart Healthcare Supply Chains, Cost Structures, Innovation, and Global Market Dynamics

In early 2025, the United States government introduced a series of tariffs targeting specific components and subassemblies imported for use in healthcare devices and digital platforms. These measures, while aimed at bolstering domestic manufacturing, have introduced notable cost pressures across the Smart Healthcare supply chain. Medical device manufacturers, particularly those reliant on precision components for diagnostic imaging and vital monitoring equipment, have reported escalated import expenses that are partially passed on to providers and ultimately affect reimbursement models.

Beyond direct cost implications, the tariffs have prompted a reevaluation of global procurement strategies, spurring firms to consider nearshoring or onshoring production to mitigate exposure to future trade policy volatility. However, such shifts require significant capital investment and carry inherent risks related to talent availability, regulatory compliance, and scale-up timelines. Innovation pipelines have also felt the ripple effects, as R&D initiatives dependent on specialized sensors and semiconductor technologies contend with longer lead times and supply disruptions. While some organizations view these developments as an impetus to accelerate in-house capabilities, the collective impact thus far underscores the need for agile sourcing strategies and collaborative partnerships that can navigate an increasingly complex trade environment.

Unraveling Key Market Segmentation Insights Spanning Components, Delivery Modes, Applications, and End Users to Illuminate Diverse Smart Healthcare Ecosystems

A nuanced understanding of market segmentation reveals the multifaceted nature of Smart Healthcare adoption and investment priorities. Within the component landscape, devices such as diagnostic imaging tools-including computed tomography, magnetic resonance imaging, and ultrasound systems-remain core to clinical workflows, yet a parallel surge in vital monitoring hardware, encompassing implantable devices, noninvasive monitors, and wearable technologies, is driving continuous patient engagement. Service offerings further encompass strategic consulting, precision installation and deployment, and comprehensive support and maintenance programs designed to optimize long-term system performance. On the software front, the rise of integrated platforms for electronic health records, advanced healthcare analytics, and management software underscores the imperative for streamlined data orchestration across increasingly complex care networks.

The delivery mode dimension highlights a growing preference for cloud-based deployments, with hybrid and private cloud options gaining traction among organizations seeking to balance scalability with data governance. Public cloud solutions continue to deliver cost efficiencies and rapid provisioning, especially in greenfield environments. From an application standpoint, healthcare analytics solutions lead investment, leveraging predictive modeling to inform population health initiatives, while mHealth applications-spanning both chronic disease management and fitness and wellness programs-extend care beyond clinical gates. Remote patient monitoring rounds out this view by offering continuous oversight of at-risk populations. End users in this ecosystem include ambulatory care facilities, specialized diagnostic centers, and the expanding home healthcare segment, which supports both elderly care and postoperative care. Hospitals and clinics, segmented into private and public institutions, remain anchor adopters, driving large-scale rollouts and integration efforts across their digital infrastructures.

This comprehensive research report categorizes the Smart Healthcare market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Delivery Mode

- Application

- End User

Delving into Key Regional Dynamics across the Americas, Europe Middle East Africa, and Asia Pacific to Highlight Distinct Growth Drivers and Adoption Trends

Regional dynamics play a central role in shaping Smart Healthcare trajectories, as each geographic cluster contends with unique demographic pressures, regulatory frameworks, and funding models. In the Americas, the United States leads through robust venture capital investment and a mature reimbursement landscape that increasingly rewards value-based care, while Canada and select Latin American markets exhibit growing interest in digital therapeutics and telehealth solutions amid physician shortages. Regulatory initiatives aimed at data interoperability and patient access are further driving adoption, particularly in regions with established healthcare infrastructures.

In Europe, Middle East, and Africa, European Union mandates around device approval and data protection have fostered rigorous compliance standards, catalyzing demand for secure, interoperable platforms. Middle Eastern healthcare systems are investing heavily in smart hospital projects, leveraging public-private partnerships to pilot advanced monitoring and analytics solutions. Across Africa, nascent digital health ecosystems are emerging to address accessibility gaps, with mobile health initiatives bridging rural care divides. Meanwhile, the Asia-Pacific region represents a mosaic of innovation pathways: advanced economies like Japan and South Korea focus on aging-population wearable technologies and robotics, while China’s aggressive digital health policy landscape accelerates large-scale deployments. In markets such as India and Southeast Asia, rapid urbanization and expanding internet connectivity underpin a burgeoning appetite for telemedicine and remote diagnostic services.

This comprehensive research report examines key regions that drive the evolution of the Smart Healthcare market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Approaches of Leading Companies Shaping the Smart Healthcare Landscape with Innovative Solutions, Partnerships, and Competitive Positioning

Leading organizations across the Smart Healthcare ecosystem are deploying a variety of strategic approaches to cement their competitive positions. Global conglomerates with established footprints in diagnostic imaging and therapeutic devices have intensified their focus on digital solutions, launching integrated platforms that combine hardware, software, and services under unified operating models. These players are also forging cross-industry partnerships with cloud providers and analytics firms to enhance platform scalability and feature richness. Mid-tier device manufacturers, recognizing the value of end-to-end service delivery, are building robust support and maintenance networks, while simultaneously investing in subscription-based software offerings to secure recurring revenue streams.

Software and analytics companies are doubling down on open-architecture, API-driven models to facilitate seamless integration with electronic health records and device ecosystems. By offering modular solutions tailored to population health, chronic disease management, and postoperative monitoring, these vendors are addressing the need for specialized capabilities within broader digital health strategies. Moreover, innovative startups are carving out niches in high-growth segments-such as AI-enabled diagnostics, tele-ICU services, and blockchain-backed data exchange-prompting larger incumbents to pursue acquisitions and joint development agreements. As competitive intensity escalates, the ability to deliver holistic, interoperable solutions through collaborative ecosystems will distinguish market leaders from fast-followers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Healthcare market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- GE HealthCare Technologies, Inc.

- Siemens AG

- Medtronic plc

- IBM Corporation

- Koninklijke Philips N.V.

- Cisco Systems, Inc.

- Apple Inc.

- Oracle Corporation

- Abbott Laboratories

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Veradigm LLC

- AirStrip Technologies, Inc.

- AT&T Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- CitiusTech, Inc.

- Dexcom, Inc.

- eClinicalWorks, LLC

- Epic Systems Corporation

- Honeywell International Inc.

- Innovaccer Inc.

- Masimo Corporation

- McKesson Corporation

- Olympus Corporation

- Omnicell, Inc.

- Securitas Healthcare LLC

- Teladoc Health, Inc.

Proposing Actionable Strategic Recommendations for Industry Leaders to Capitalize on Smart Healthcare Opportunities, Enhance Efficiency, and Drive Growth

To capitalize on the momentum underpinning Smart Healthcare adoption, industry leaders should prioritize the development of interoperable, end-to-end platforms that unify patient data across devices, software applications, and care settings. Investing in artificial intelligence and machine learning capabilities can unlock predictive insights that drive preventive care models, reducing avoidable hospitalizations and optimizing resource allocation. At the same time, organizations must reassess their sourcing strategies to mitigate supply chain vulnerabilities exposed by recent trade policy shifts, exploring collaborative manufacturing partnerships and diversified procurement channels.

Furthermore, leaders should adopt a patient-centric mindset when designing service offerings, emphasizing ease of use, data security, and seamless integration into everyday routines. Collaborative frameworks with payers, providers, and regulatory bodies will accelerate reimbursement approvals and pave the way for broader market access. Equally, embedding robust cybersecurity protocols and compliance safeguards into every solution component will foster provider confidence and ensure alignment with evolving data privacy mandates. By aligning innovation roadmaps with clear business objectives and forging cross-sector alliances, stakeholders can not only navigate uncertainty but also drive sustainable, outcome-oriented growth in Smart Healthcare.

Detailing the Rigorous Research Methodology Combining Primary Stakeholder Interviews, Secondary Data, and Analytical Frameworks to Ensure Robust Insights

This research leverages a multi-layered methodology grounded in both qualitative and quantitative analysis. Primary research involved structured interviews with a diverse array of stakeholders, including healthcare providers, technology vendors, payers, and regulatory authorities, to capture real-world perspectives on adoption barriers and success factors. Secondary research drew upon publicly available information from peer-reviewed journals, government and industry reports, corporate filings, and reputable institutional websites to establish baseline market dynamics and corroborate primary findings.

To ensure the robustness of insights, data triangulation techniques were applied, synthesizing information across multiple sources and validating key trends through triangulated cross-checks. Analytical frameworks-including SWOT analyses, PESTEL evaluations, and use-case mapping-were utilized to systematically assess market drivers, restraints, and emerging opportunities. This rigorous approach underpins the credibility of the conclusions presented, providing decision makers with a transparent and defensible foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Healthcare market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Healthcare Market, by Component

- Smart Healthcare Market, by Delivery Mode

- Smart Healthcare Market, by Application

- Smart Healthcare Market, by End User

- Smart Healthcare Market, by Region

- Smart Healthcare Market, by Group

- Smart Healthcare Market, by Country

- United States Smart Healthcare Market

- China Smart Healthcare Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Critical Takeaways from Smart Healthcare Evolution to Empower Decision Makers with Actionable Insights for Future-Proofing Clinical Ecosystems

The evolution of Smart Healthcare represents a pivotal opportunity for organizations willing to embrace data-driven, patient-focused paradigms. From the transformative potential of AI-enabled diagnostics to the efficiencies unlocked by cloud-based interoperability, the industry stands at the cusp of a new era marked by personalized, predictive, and participatory care. As trade policies and regulatory frameworks continue to shift, stakeholders must cultivate agility, fostering collaborative ecosystems that can withstand external shocks while continuing to innovate.

Ultimately, success in this landscape will hinge on the ability to integrate cutting-edge technologies with focused service offerings, aligned with clear reimbursement pathways and grounded in data security best practices. By synthesizing the insights and recommendations outlined within this report, executives are equipped to chart a course that not only anticipates future challenges but also capitalizes on the vast potential of Smart Healthcare to enhance patient outcomes, streamline operations, and secure competitive advantage.

Engage with Ketan Rohom to Unlock Smart Healthcare Research Insights That Drive Strategic Decisions and Secure Your Access to Market Intelligence

As you look to navigate the nuances of an ever-evolving Smart Healthcare landscape and capitalize on emerging opportunities, engaging directly with Ketan Rohom opens the door to unparalleled market clarity. With a proven track record in guiding organizations through complex research findings and translating insights into strategic initiatives, Ketan can provide tailored recommendations that align with your business priorities. Whether you seek deeper analysis of component dynamics, region-specific growth drivers, or bespoke competitive intelligence, this conversation will ensure you secure the actionable intelligence needed to outpace competitors. Reach out today to unlock comprehensive Smart Healthcare research insights that drive strategic decisions and secure your access to market intelligence.

- How big is the Smart Healthcare Market?

- What is the Smart Healthcare Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?