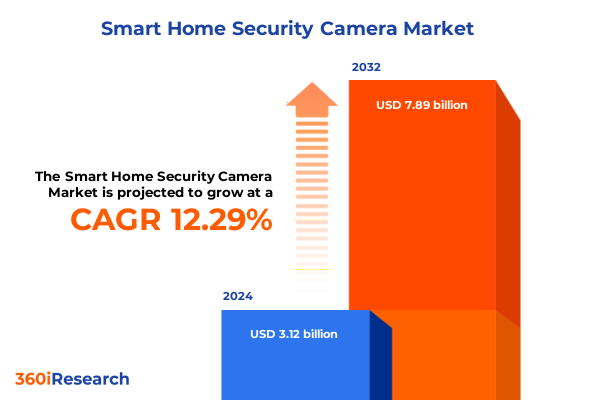

The Smart Home Security Camera Market size was estimated at USD 3.12 billion in 2024 and expected to reach USD 3.49 billion in 2025, at a CAGR of 12.29% to reach USD 7.89 billion by 2032.

Setting the Stage for Smart Home Security Cameras by Exploring the Industry Evolution and Emerging Consumer Expectations and Shifting Market Dynamics

In recent years, the smart home security camera sector has undergone a dramatic transformation driven by the convergence of consumer demand for safety and the rapid advancement of connected technologies. As households embrace the concept of the intelligent home, security solutions have evolved from standalone recording devices into sophisticated, interconnected systems capable of real-time video analytics and remote monitoring. This shift reflects broader societal concerns around personal safety, property protection, and the desire for actionable insights powered by artificial intelligence.

Furthermore, the proliferation of high-speed wireless networks and affordable sensor technology has lowered barriers to entry, enabling a diverse array of market participants to develop and deliver innovative camera solutions. Today’s users expect seamless interoperability with other smart home devices, intuitive mobile applications, and subscription models that offer extended storage, advanced motion detection, and automated alerts. Against this backdrop of heightened expectations, manufacturers and service providers are challenged to balance features such as privacy safeguards, data security, and ease of installation. As a result, the smart home security camera market has become a dynamic battleground where technological prowess and consumer experience intersect.

Unveiling Fundamental Technological and Behavioral Shifts Redefining the Smart Home Security Camera Ecosystem and Driving New Opportunities

Over the past few years, several transformative shifts have redefined the competitive landscape for home security cameras. First, the integration of artificial intelligence and computer vision capabilities has enabled devices to distinguish between people, pets, and objects with unprecedented accuracy. This has fostered the development of context-aware alerting systems that reduce false positives and enhance user trust in automated monitoring.

Concurrently, edge computing architectures have gained prominence, allowing critical analytics to run directly on the device rather than relying exclusively on cloud infrastructure. This not only accelerates response times but also mitigates privacy concerns by keeping sensitive data within the home network. Alongside these hardware and software innovations, the emergence of unified IoT platforms has led to greater interoperability, enabling cameras to cooperate with door locks, lighting systems, and voice assistants for holistic security management.

Finally, changing consumer behavior has driven service providers toward subscription-based models that offer continuous firmware updates, cloud-based storage, and advanced analytics. Consumers now seek not just hardware, but a comprehensive security ecosystem that evolves with their needs. Taken together, these shifts underscore the industry’s progression toward smarter, more integrated, and user-centric security solutions.

Analyzing the Far Reaching Consequences of Recent Tariffs Imposed by the United States on Smart Home Security Camera Components

Recent policy actions in the United States have introduced a new set of challenges for manufacturers and importers of smart home security cameras. In mid-2025, increased import duties were applied to a broad range of electronic components used in camera modules, image sensors, and processing chips. These levies have led many original equipment manufacturers to reassess their global supply chains and explore alternative sourcing strategies.

In response, several key players in the industry have begun shifting production out of traditional manufacturing hubs, expanding assembly operations in Southeast Asia and Latin America to mitigate cost pressures. Moreover, the imposition of these duties has prompted increased cooperation between hardware vendors and component suppliers to localize critical subassemblies domestically. Such efforts aim not only to avoid tariff impacts but also to comply with evolving regulatory requirements around data security and technology transfer.

Although these measures have introduced short-term cost challenges, they have also spurred innovation in component design and raised awareness of supply chain resilience. Moving forward, companies that proactively adapt to this altered tariff landscape are likely to secure a strategic advantage by ensuring continuity of supply and preserving competitive pricing without compromising on feature sets.

Revealing Key Drivers through Insights into Connectivity Installation End User Distribution Channel Price Range and Resolution Segmentation

The market’s heterogeneity is best understood by examining multiple layers of segmentation that drive performance and adoption. Connectivity options span both wired and wireless architectures, with the former focusing primarily on Ethernet reliability while the latter offers sub-options such as Bluetooth for short-range pairing, Wi-Fi for broad coverage, and Zigbee or Z-Wave for low-power mesh networking. This variety underscores the need to align product specifications with installation environments and intended use cases.

Installation contexts range from indoor applications, where discreet form factors and aesthetic integration matter most, to outdoor use cases that demand ruggedized enclosures and weatherproof performance. End users encompass commercial venues requiring scalable multi-camera deployments, industrial facilities with stringent safety protocols, and residential customers prioritizing ease of use and remote accessibility. Distribution channels further influence market dynamics, as offline sales via mass merchandisers and specialty retailers coexist alongside online platforms, dominated by e-commerce models offering direct-to-consumer delivery and digital bundling opportunities.

Price tiers extend from economy lines designed for budget-conscious buyers to premium offerings that integrate advanced analytics and high-end materials. Finally, resolution remains a critical differentiator, segmented into high-definition options, full HD standards, and ultra-high 4K and above categories. By weaving these dimensions together, stakeholders can pinpoint specific value propositions and tailor go-to-market approaches that resonate with target segments.

This comprehensive research report categorizes the Smart Home Security Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity

- Resolution

- Power Source

- Storage Type

- Installation Type

- Application

- End User

- Distribution Channel

Highlighting Regional Dynamics That Shape Demand and Innovation Trajectories across the Americas Europe Middle East Africa and Asia Pacific Camera Markets

Regional dynamics play a pivotal role in shaping the evolution of smart home security cameras around the world. In the Americas, early adoption has been propelled by high disposable incomes, widespread broadband penetration, and consumer willingness to invest in home safety. This region continues to lead in demand for integrated solutions that blend video analytics with smart home automation frameworks.

Across Europe, the Middle East, and Africa, diverse regulatory environments and varied infrastructure maturity levels have created a mix of opportunities and challenges. Privacy regulations in certain European countries have spurred demand for edge-based processing, while dynamic growth in the Middle East has attracted international brands through high-end commercial and residential projects. African markets, though currently nascent, exhibit strong potential where infrastructure is being upgraded to support smart city and security initiatives.

In the Asia-Pacific region, rapid urbanization, government-driven smart home programs, and cost-competitive manufacturing hubs have converged to make it one of the fastest changing markets for home security cameras. Domestic players have leveraged local supply chain advantages, while global vendors have focused on partnerships to accelerate regional service offerings. Navigating these regional nuances is essential for manufacturers seeking sustained growth and competitive differentiation.

This comprehensive research report examines key regions that drive the evolution of the Smart Home Security Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Approaches and Competitive Positioning of Leading Manufacturers in the Smart Home Security Camera Industry

Leading players in this space have adopted distinct strategies to maintain momentum in a crowded marketplace. Some global vendors have doubled down on platform ecosystems, integrating their camera offerings with broader smart home services to encourage customer stickiness and recurring revenue. Others have focused on hardware differentiation, rapidly rolling out new models with proprietary sensor technologies and specialized optics to address niche applications such as low-light surveillance or license plate recognition.

Strategic partnerships have also become a hallmark of competitive positioning, with alliances between camera manufacturers and cybersecurity firms ensuring robust end-to-end encryption and threat detection capabilities. Simultaneously, select companies have invested heavily in direct-to-consumer channels, fostering brand loyalty through seamless online onboarding experiences and subscription plans that bundle cloud storage and premium analytics.

Meanwhile, regional incumbents continue to defend their home markets by capitalizing on local manufacturing efficiencies and government relationships. These firms often excel at delivering cost-effective solutions tailored to unique regulatory landscapes. By analyzing these varied approaches, industry participants can glean best practices and adapt their own strategies to navigate both global trends and regional particularities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Home Security Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc

- Anker Technology (SG) Pte., Ltd

- Aqara LLC

- Arlo Technologies, Inc.

- D-Link Corporation

- Google LLC by Alphabet Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hanwha Corporation

- Hi-Focus Digital Technology Co., Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd

- Koninklijke Philips N.V.

- LG Innotek Co., Ltd.

- Panasonic Holdings Corporation

- Reolink Innovation Limited

- Robert Bosch GmbH

- Shenzhen Enster Electronics Co., Ltd.

- Shenzhen LS VISION Technology Co., Ltd.

- SimpliSafe, Inc.

- Swann Communications U.S.A. Inc.

- TP-Link Systems Inc.

- Vivint LLC by NRG Energy, Inc.

- VIVOTEK Inc. by Delta Electronics, Inc.

- Wyze Labs Inc.

- Xiaomi Corporation

- Xthings Inc.

- Zhejiang Dahua Technology Co., Ltd.

- Zhejiang Uniview Technologies Co.,Ltd.

- ZKTECO CO., LTD.

- Zmodo Technology Corporation Ltd.

Proposing Actionable Strategies to Enhance Market Penetration Bolster Product Differentiation and Strengthen Supply Chain Resilience within Smart Security

Industry leaders are encouraged to pursue a multifaceted approach that balances technological innovation with operational resilience. Prioritizing investments in machine learning capabilities and computer vision algorithms will sharpen product differentiation, enabling more accurate detection of security events and reducing user fatigue from false alerts. At the same time, strengthening partnerships across the component supply chain can preempt disruption from policy shifts or geopolitical tensions.

Enhancing data privacy measures is equally crucial; embedding advanced encryption and localized storage options will not only satisfy regulatory requirements but also foster consumer trust. To capture emerging opportunities, manufacturers should explore modular hardware architectures that allow end users to upgrade specific functionalities without replacing entire units. This strategy not only extends product lifecycles but also creates upsell pathways for service add-ons and premium analytics packages.

Finally, broadening distribution networks through strategic alliances with telecom operators, energy providers, and smart home integrators can expand reach while diversifying revenue streams. By weaving these recommendations into both new product development and go-to-market planning, companies can position themselves to thrive amid evolving customer needs and market conditions.

Detailing Rigorous Research Methods Employed to Gather Proprietary Data and Analyze Trends Shaping the Smart Home Security Camera Ecosystem

This study employs a rigorous research framework combining both primary and secondary methodologies. Primary data was gathered through structured interviews with industry executives, technical experts, and channel partners to capture firsthand insights on innovation trajectories and deployment challenges. These qualitative inputs were complemented by follow-up discussions to validate key technical assumptions and strategic priorities.

Secondary research involved an extensive review of publicly available information, including corporate filings, regulatory filings, patent databases, and technology whitepapers. Trade journals, industry associations, and global standards bodies provided additional context around evolving interoperability protocols and cybersecurity benchmarks. Triangulation of these data sources ensured robustness of the findings and mitigated potential biases.

Quantitative analysis was conducted by synthesizing component cost structures, pricing differentials, and service subscription models to identify prevailing value drivers. Trend mapping techniques were applied to track historical developments and project potential inflection points in technology adoption. Throughout the research process, quality control measures were implemented to verify data accuracy and ensure the study’s conclusions deliver reliable guidance for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Home Security Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Home Security Camera Market, by Product Type

- Smart Home Security Camera Market, by Connectivity

- Smart Home Security Camera Market, by Resolution

- Smart Home Security Camera Market, by Power Source

- Smart Home Security Camera Market, by Storage Type

- Smart Home Security Camera Market, by Installation Type

- Smart Home Security Camera Market, by Application

- Smart Home Security Camera Market, by End User

- Smart Home Security Camera Market, by Distribution Channel

- Smart Home Security Camera Market, by Region

- Smart Home Security Camera Market, by Group

- Smart Home Security Camera Market, by Country

- United States Smart Home Security Camera Market

- China Smart Home Security Camera Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2544 ]

Summarizing Key Findings and Outlining the Path Forward for Stakeholders Navigating the Evolving Smart Home Security Camera Landscape

In summary, the smart home security camera landscape stands at the nexus of rapid technological innovation, evolving consumer expectations, and shifting regulatory frameworks. Artificial intelligence and edge computing have emerged as core pillars that differentiate leading offerings, while changing tariff regimes have underscored the importance of supply chain agility. Segmentation analysis reveals that performance drivers vary significantly across connectivity, installation context, end-user profiles, distribution channels, price tiers, and resolution categories.

Regional insights highlight distinct growth pathways in the Americas, EMEA, and Asia-Pacific, each reflecting unique demand drivers and regulatory conditions. Competitive positioning continues to evolve as global incumbents refine platform strategies and regional specialists leverage local advantages. By synthesizing these insights, industry participants gain a holistic view of the forces shaping near-term opportunities and long-term challenges.

Armed with this intelligence, stakeholders-from device manufacturers to service providers-are better equipped to navigate a market defined by continuous innovation, heightened security requirements, and dynamic consumer preferences. The path forward demands a strategic blend of technological leadership, operational resilience, and customer-centric business models.

Engage with Ketan Rohom to Access In Depth Market Analysis Insights and Secure Your Comprehensive Smart Home Security Camera Report Today

To secure unparalleled insights into the smart home security camera market and obtain the full suite of data, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engage with him to discuss how this detailed research can support strategic planning, competitive analysis, and product development. Taking this step will equip your organization with the intelligence needed to navigate emerging threats, capitalize on evolving trends, and achieve a sustainable competitive edge. Get in touch today to explore flexible report packages, custom add-on services, and expert briefing options designed to accelerate your decision-making process and deliver measurable value across your business functions.

- How big is the Smart Home Security Camera Market?

- What is the Smart Home Security Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?