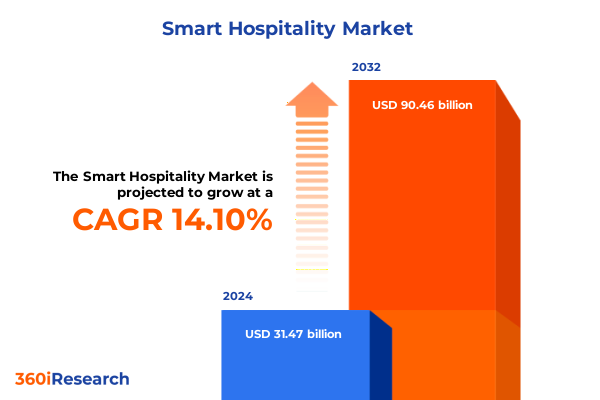

The Smart Hospitality Market size was estimated at USD 35.70 billion in 2025 and expected to reach USD 40.50 billion in 2026, at a CAGR of 14.20% to reach USD 90.46 billion by 2032.

Discover how cutting-edge technologies and data-driven strategies are reshaping modern hospitality into immersive, personalized guest experiences

The hospitality industry stands at a pivotal crossroads where guest expectations, operational complexity, and digital innovation converge to create an unprecedented landscape of opportunity. Rapid advances in sensor networks, data analytics, and artificial intelligence have enabled properties to transcend traditional service models, offering intuitive environments that anticipate needs before they arise. As connectivity becomes woven into every touchpoint, from check-in kiosks to in-room controls, stakeholders must navigate an ecosystem that demands agility, security, and an unwavering focus on personalized experiences.

Against this backdrop, industry leaders are reevaluating business models and technology investments to maintain relevance in a market that prizes speed of adoption as much as quality of service. The introduction of cloud-native platforms and edge computing capabilities has accelerated the delivery of real-time insights, yet also introduced new considerations around data sovereignty, interoperability, and cost management. Consequently, decision-makers are tasked with aligning long-term strategic priorities-such as sustainability, labor optimization, and brand differentiation-with a rapidly evolving suite of digital solutions.

Explore the seismic industry shifts driven by artificial intelligence, IoT connectivity, sustainability imperatives, and evolving guest expectations in hospitality

Innovation in hospitality is no longer confined to standalone guestroom enhancements; rather, it permeates every facet of operational delivery, reshaping workflows and revenue streams alike. Artificial intelligence and machine learning algorithms enable predictive maintenance for HVAC systems, minimizing downtime and energy consumption, while blockchain applications are being explored to secure guest identities and streamline loyalty program interactions. Simultaneously, the proliferation of Internet of Things sensors has created an omnipresent network of data points that feed advanced analytics engines, empowering staff to respond to service anomalies in real time.

Moreover, sustainability imperatives have become a decisive influence on both brand reputation and regulatory compliance, prompting hoteliers to invest in energy management platforms and waste-reduction initiatives. Digitalization has also fostered new guest engagement channels-from chatbots that handle basic inquiries to augmented reality experiences that enrich on-property exploration. As workforce dynamics shift, training programs increasingly leverage virtual simulations to upskill employees, ensuring consistency across multi-brand portfolios. Collectively, these developments signal a transformative era where technology serves as the catalyst for heightened guest satisfaction and operational excellence.

Understand the ripple effects of 2025 United States tariffs on smart hospitality ecosystems, supply chains, technology costs, and strategic sourcing decisions

The introduction of new United States trade tariffs in early 2025 has created a ripple effect across the hospitality technology landscape, particularly in areas reliant on imported hardware components. Providers of controllers, sensors, and network infrastructure have faced elevated manufacturing costs, compelling many to reevaluate sourcing strategies and reinforce supply chain resilience. As tariffs increased import duties on key electronics, system integrators began diversifying their vendor base to include domestic manufacturers and near-shore suppliers, thereby mitigating exposure to price volatility and potential delivery delays.

In parallel, cloud service providers have absorbed portions of these cost pressures, leading to revisions in subscription models and contract terms. Hospitality groups, in turn, have negotiated bulk purchasing agreements and longer-term commitments to lock in favorable pricing. Additionally, the tariff environment has accelerated the adoption of software-driven optimization, as asset monitoring and predictive maintenance solutions reduce reliance on frequent hardware replacements. Looking ahead, stakeholders anticipate that continuous dialogue with regulatory bodies and participation in industry coalitions will be essential to manage future trade shifts and maintain technology momentum.

Unveil the nuanced segmentation that spans applications from asset tracking to personalized marketing, technologies from AI to IoT, and diverse deployment models

The modern hospitality market is characterized by a layered structure of applications, technologies, deployment models, end-user segments, and component types, each influencing strategic priorities. Application-wise, property operators deploy solutions for asset monitoring and tracking, which subdivides into environmental monitoring to maintain optimal guestroom conditions and equipment tracking to ensure operational uptime. Energy management capabilities address HVAC optimization and smart lighting control to enhance efficiency, while guest management platforms orchestrate arrival, in-stay, and departure processes. Personalized marketing functions harness AI-driven promotions alongside loyalty program management to deepen guest engagement, and security and surveillance systems protect assets and data integrity.

On the technology front, innovations span from Artificial Intelligence and Machine Learning-supported by natural language processing and predictive modeling-to Blockchain applications like identity management and smart contract execution. Cloud Computing architectures, available as private or public models, underpin scalable deployments, whereas data analytics offerings deliver both predictive and real-time insights. The Internet of Things ecosystem facilitates sensor networks and telemetry solutions that generate actionable operational intelligence. Deployment choices between cloud and on-premise models determine integration complexity and data control considerations. End users such as cruises, hotels, resorts, and serviced apartments exhibit unique technology adoption curves shaped by property size, guest demographics, and regulatory environments. Component categories include hardware-namely controllers and sensors-services spanning managed and professional engagements, and software delivered on-premise or as a service.

This comprehensive research report categorizes the Smart Hospitality market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Deployment Type

- Application

- End User

Delve into how regional dynamics across the Americas, Europe-Middle East-Africa, and Asia-Pacific shape demand, innovation adoption, and partnership models in hospitality

Regional market dynamics are driven by distinct regulatory frameworks, infrastructure maturity, and customer expectations across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, emphasis on guest personalization and sustainability has fueled investments in energy management platforms and AI-driven guest services. The regulatory landscape in North America, with stringent data protection and climate initiatives, has further incentivized property owners to adopt end-to-end digital solutions that enhance visibility and compliance.

Across Europe, Middle East & Africa, diverse market maturity levels have led to a dual focus: legacy properties in established destinations are retrofitting smart systems to remain competitive, while new developments in emerging tourism hubs leverage integrated IoT architectures from inception. Data privacy regulations such as the GDPR and region-specific initiatives around carbon neutrality continue to shape procurement priorities. Meanwhile, strategic partnerships between hospitality chains and telecom operators in the Middle East have accelerated 5G-enabled service enhancements.

Asia-Pacific stands out with its rapid technology adoption rates, driven by digital-native travelers and government incentives for smart city initiatives. Leading hotel brands in this region are piloting robotics for contactless services and exploring advanced analytics to optimize yield management. Cross-border collaborations between technology startups and established hospitality groups are further enriching the ecosystem, underscoring the region’s role as both an innovation testbed and a demand hotspot.

This comprehensive research report examines key regions that drive the evolution of the Smart Hospitality market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain insights into how leading technology providers, system integrators, and emerging startups are positioning themselves in the competitive smart hospitality arena

Global and regional technology providers are engaging in a multifaceted approach to capture value in the smart hospitality arena. Established players with comprehensive portfolios integrate hardware, software, and services, enabling turnkey deployments that streamline vendor management and accelerate time to value. These organizations leverage strategic alliances with telecommunications firms, cloud platform vendors, and property management system providers to extend their ecosystem reach and facilitate seamless interoperability.

Concurrently, specialized startups are focusing on niche innovations-such as AI-driven guest sentiment analysis, low-power sensor mesh networks, and blockchain-enabled loyalty exchanges-to differentiate their offerings. Through venture funding and co-development partnerships, these agile entrants are gaining traction, particularly with boutique hotel operators seeking bespoke guest experiences. System integrators occupy a critical role by customizing multi-vendor solutions to align with each client’s unique operational and brand requirements, ensuring cohesive user interfaces and optimized data flows.

Additionally, hardware manufacturers are embedding intelligence at the device level, enabling edge-based analytics that alleviate network congestion and enhance data privacy. Service providers are expanding their portfolios to include managed security operations, professional services for system integration, and ongoing performance benchmarking, thereby transforming one-time technology sales into long-term customer engagements and recurring revenue models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Hospitality market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 24Online Pte. Ltd.

- Agilysys, Inc.

- Amadeus IT Group, S.A.

- Amazon.com, Inc.

- ASSA ABLOY AB

- Canary Technologies Corp

- Cendyn Group, Inc.

- Cisco Systems, Inc.

- Dormakaba AG

- GAO Tek Inc.

- Google, LLC by Alphabet Inc.

- Guestline Limited

- HotelSmarters by inoRain LLC

- Infor, Inc. by Koch Industries

- International Business Machines Corporation

- KIOT Pvt. Ltd.

- Levotel Technologies Pvt. Ltd.

- Matrix Comsec Private Limited

- Mews Systems Ltd

- MOKOSmart Technology Ltd.

- Onity, Inc.

- Oracle Corporation

- POND IoT Solutions Pvt. Ltd.

- Sabre Corporation

- Shiji Information Technology Co., Ltd.

- Siemens AG

- StayNTouch, Inc.

Leverage practical, forward-looking strategies that hospitality leaders can adopt to harness technology investments, enhance guest loyalty, and drive operational agility

Industry leaders should prioritize interoperability by selecting solutions that adhere to open APIs and global standards, thereby avoiding vendor lock-in and facilitating seamless integrations. Furthermore, forging strategic partnerships with local telecommunication carriers and cloud platform vendors can accelerate rollout timelines and improve service reliability. In parallel, establishing a clear data governance framework will ensure compliance with evolving privacy regulations and build guest trust through transparent data practices.

Investment in workforce enablement is equally essential; deploying immersive training programs that harness virtual and augmented reality simulations can rapidly upskill staff on new system functionalities, while fostering a culture of continuous improvement. Additionally, sustainability goals should be embedded in technology roadmaps, leveraging smart lighting and HVAC optimization platforms to reduce carbon footprints and operational expenses. Lastly, implementing agile procurement strategies-such as subscription-based models and flexible licensing-will allow organizations to scale capabilities in step with guest demand and market volatility.

Learn about the rigorous mixed-methodology approach combining primary stakeholder interviews, secondary data triangulation, and expert validation behind this research

This research adopts a mixed-methodology approach to ensure robust and reliable insights. Primary data was collected through in-depth interviews with key stakeholders, including property executives, technology vendors, and industry consultants, providing first-hand perspectives on adoption drivers, barriers, and future roadmaps. These qualitative findings were complemented by secondary research, drawing on peer-reviewed journals, industry white papers, regulatory reports, and publicly available corporate disclosures to validate emerging trends and corroborate quantitative observations.

To triangulate results, data points were cross-referenced across multiple sources and subjected to consistency checks. Expert validation workshops were conducted with independent advisors and domain specialists to refine assumptions and identify potential blind spots. Additionally, the research team employed scenario-based analysis to assess the impact of external factors-such as trade policy shifts and cybersecurity threats-on technology uptake. Collectively, this rigorous methodology ensures comprehensive coverage of the smart hospitality ecosystem and delivers actionable insights with high confidence levels.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Hospitality market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Hospitality Market, by Component

- Smart Hospitality Market, by Technology Type

- Smart Hospitality Market, by Deployment Type

- Smart Hospitality Market, by Application

- Smart Hospitality Market, by End User

- Smart Hospitality Market, by Region

- Smart Hospitality Market, by Group

- Smart Hospitality Market, by Country

- United States Smart Hospitality Market

- China Smart Hospitality Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarize the transformative potential of smart hospitality innovations and outline the critical next steps for stakeholders to capitalize on emerging opportunities

As the hospitality sector continues to embrace digital transformation, the convergence of advanced technologies will redefine both guest experiences and operational paradigms. Predictive analytics and AI-driven automation promise to elevate service personalization while optimizing resource allocation, and IoT-enabled visibility will drive proactive maintenance and sustainability initiatives. Simultaneously, a well-executed tariff mitigation strategy can safeguard supply chain continuity and cost efficiency, preserving the momentum of innovation.

Looking forward, stakeholders must remain agile, continually reassessing their technology portfolios against evolving industry standards, regulatory requirements, and consumer preferences. The insights presented herein offer a strategic roadmap for navigating the complexities of smart hospitality, highlighting where investments can deliver the greatest impact. By fostering cross-functional collaboration-between IT, operations, marketing, and procurement-organizations can unlock the full potential of their digital ecosystems and secure a competitive edge in a rapidly changing marketplace.

Take the next decisive step by engaging with Ketan Rohom to access the comprehensive smart hospitality market report and drive strategic growth today

We invite you to partner with Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to the full smart hospitality market research report and unlock the strategic intelligence your organization needs. By reaching out directly, you will receive tailored guidance on leveraging these insights to refine your technology roadmap, optimize procurement strategies, and enhance guest engagement initiatives. Collaborate with an expert who understands both the nuances of modern hospitality challenges and the innovative solutions that drive industry leadership. Take this opportunity to equip your team with actionable data and foresight, ensuring you stay ahead of competitive pressures and regulatory shifts. Connect today and transform your strategic vision into measurable business outcomes with the support of a dedicated research partner.

- How big is the Smart Hospitality Market?

- What is the Smart Hospitality Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?