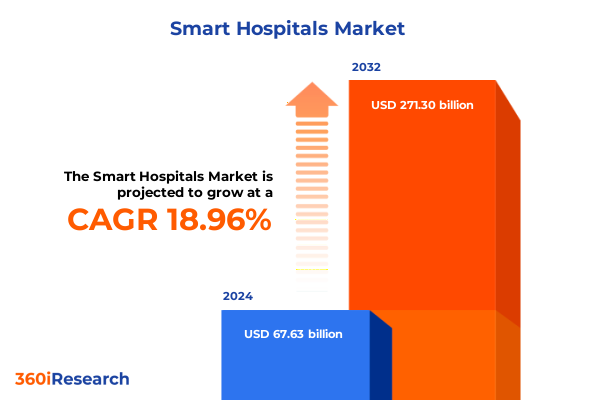

The Smart Hospitals Market size was estimated at USD 79.62 billion in 2025 and expected to reach USD 93.88 billion in 2026, at a CAGR of 19.14% to reach USD 271.30 billion by 2032.

Understanding the Rise of Smart Hospitals as the Convergence of Technology, Patient-Centric Care, and Efficiency in Modern Healthcare

In recent years, healthcare systems worldwide have confronted unprecedented challenges that compel a fundamental reimagining of the traditional hospital model. Rapid advancements in digital technologies, rising patient expectations for personalized care, and mounting operational pressures have driven institutions to pursue integrated solutions that seamlessly unite clinical, administrative, and infrastructural functions into unified digital ecosystems. Initially driven by discrete pilots of artificial intelligence–enabled diagnostics or standalone Internet of Things deployments, the vision for smart hospitals now embraces holistic strategies that align technology with broader organizational transformation.

Key Transformative Shifts Redefining Smart Hospital Infrastructure Through AI, IoT, Robotics, and Data-Driven Clinical and Operational Models

The convergence of artificial intelligence, Internet of Medical Things (IoMT) networks, robotics, and immersive telemedicine capabilities is reshaping how hospitals deliver and optimize care. AI algorithms now support predictive diagnostics and decision support, scanning complex imaging data to flag early signs of sepsis and expedite critical interventions. Simultaneously, IoMT ecosystems compose an interconnected fabric of smart sensors, wearables, and asset trackers that enable continuous monitoring of patient vitals and real-time localization of equipment. These technologies not only enhance clinical precision but also foster new models of preventive care and streamlined workflows.

Assessing the Cumulative Impact of New United States Tariffs on Smart Hospital Technologies, Devices, Infrastructure, and Supply Chains

The introduction of broad-based U.S. tariffs in early 2025 has reverberated across the supply chains underpinning smart hospital deployments. Newly applied duties, including a baseline 10% import tax on most technology components and elevated levies on network hardware, cloud infrastructure, and certain medical devices, have increased acquisition costs for hospitals and technology vendors alike. Cloud service subscriptions and software licensing fees have risen as providers pass through heightened infrastructure expenses to end users, with nearly four in ten health IT executives forecasting a substantial uptick in digital transformation budgets to offset these shifts.

Unveiling Critical Segmentation Insights Across Components, Technologies, Applications, and End Users for Comprehensive Smart Hospital Evaluation

A granular examination of market segmentation reveals differentiated dynamics across multiple dimensions. Component analysis indicates that infrastructure hardware investments-from data center racks and networking switches to bedside monitoring terminals-continue to dominate capital allocations, while specialized medical devices such as smart infusion pumps and AI-empowered imaging systems drive incremental value. Support and maintenance services are increasingly bundled with integration and consulting offerings, ensuring that complex solutions perform reliably over time without placing undue burdens on internal IT teams. On the software front, electronic health record platforms, health information management suites, and picture archiving and communication systems form the core digital backbone that harmonizes disparate data streams.

From a technology standpoint, the ascendancy of AI and machine learning is bifurcated into computer vision, which automates image analysis, natural language processing for clinical documentation, and predictive modeling that forecasts patient deterioration. Big data analytics practices range from descriptive insights that inform retrospective performance reviews to prescriptive analytics that recommend optimized staffing levels or supply inventories. Hybrid, private, and public cloud architectures offer flexible deployment pathways, while IoT implementations encompass asset tracking, environmental sensing, and patient wearables. Robotics solutions subdivide into service robots for logistics tasks, robotic surgical platforms, and autonomous transport robots that navigate corridors with medical payloads.

Application-driven segmentation underscores the pivotal roles of equipment tracking, inpatient and remote patient monitoring, security and surveillance systems, telemedicine frameworks, and end-to-end workflow orchestration platforms that coordinate communication, scheduling, and task management. Each application layer weaves together hardware, software, and services to address specific operational or clinical challenges.

End user classification further delineates adoption patterns, as ambulatory surgery centers and diagnostic clinics prioritize rapid outpatient workflows, general and specialist clinics focus on patient experience and referral management, and hospitals-both private and public-evaluate scalable integration of high-acuity care models with enterprise-wide digital command centers.

This comprehensive research report categorizes the Smart Hospitals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

Highlighting Key Regional Insights and Strategic Variances Shaping Smart Hospital Adoption Trends in the Americas, EMEA, and Asia-Pacific

Regional divergences in smart hospital adoption underscore distinct strategic priorities and investment climates across the Americas, EMEA, and Asia-Pacific. In the Americas, a robust venture capital ecosystem and sizable healthcare IT budgets have fueled early deployments of AI-driven command centers and remote patient monitoring networks. North American providers leverage strong broadband coverage and progressive reimbursement frameworks to pilot novel telehealth modalities and predictive analytics platforms. Across Latin America, public-private partnerships are emerging to bridge infrastructural gaps and extend connected healthcare services beyond urban centers.

In Europe, the Middle East, and Africa, regulatory emphasis on data privacy and security shapes integration approaches, with many EU hospitals prioritizing on-premises or private cloud implementations to comply with GDPR mandates. Governments in the Gulf Cooperation Council are channeling sovereign wealth funds into 5G-powered hospital campuses, while African health ministries explore solar-supported Internet of Things initiatives to bolster rural outreach. Cross-border collaboration on medical device compliance and cybersecurity standards further harmonizes adoption roadmaps within the region.

Asia-Pacific’s diverse markets are orchestrating national strategies to catalyze digital health transformation. South Korea’s completion of a nationwide 5G network has enabled flagship smart hospital initiatives featuring AI-enhanced care rooms and 5G-powered robotic surgery demonstrations. China and Japan are accelerating integration of IoT and cloud platforms to support their large aging populations. Meanwhile, Southeast Asian countries are piloting telemedicine networks and electronic health records as foundational blocks for future smart hospital expansions.

This comprehensive research report examines key regions that drive the evolution of the Smart Hospitals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation and Collaboration in the Smart Hospital Ecosystem Through Technology Integration and Strategic Partnerships

Technology vendors and healthcare providers are forging partnerships that drive the evolution of smart hospital solutions. Cisco’s collaboration with a leading medical imaging company to merge real-time location system data with enterprise Wi-Fi infrastructure illustrates how asset and patient tracking can be unified into a single management console for enhanced visibility and utilization control. This integrated platform reduces over-provisioning of both equipment and personnel while streamlining admission and discharge processes through intelligent workflow triggers.

In South Korea, a strategic consortium comprising a major telecom operator, a renowned medical center, and a global technology firm has constructed one of the world’s first enterprise-dedicated 5G smart hospitals. Through this initiative, high-definition surgical video streams, AI-powered in-patient voice assistants, and autonomous delivery robots operate seamlessly over ultra-low latency networks, enabling new models of remote collaboration and digital training.

Major medical device manufacturers continue to invest in subscription-based software services that extend the lifecycle of critical imaging and monitoring equipment. By embedding AI modules into CT and MRI systems, these firms provide continuous algorithm upgrades and predictive diagnostics capabilities, ensuring that clinicians have access to the latest innovations without wholesale hardware replacements.

Leading medical robotics companies remain vulnerable to global trade dynamics, yet they sustain momentum through diversified supply chain strategies and localized manufacturing partnerships. Even amidst elevated import duties, the imperative for precision surgical tools and automated care assistants maintains growth trajectories. Health systems that integrate these advanced devices with digital command platforms report measurable gains in procedural throughput and patient safety outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Hospitals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Ascom Holding AG

- Baxter International Inc.

- Cerner Corporation

- Cisco Systems Inc.

- Drägerwerk AG & Co. KGaA

- Epic Systems Corporation

- Fresenius SE & Co. KGaA

- GE Healthcare

- Getinge AB

- Google LLC

- Hill-Rom Holdings Inc.

- Honeywell International Inc.

- IBM Corporation

- Johnson Controls International plc

- Masimo Corporation

- McKesson Corporation

- Microsoft Corporation

- Nihon Kohden Corporation

- Oracle Corporation

- Philips Healthcare

- Schneider Electric SE

- Stryker Corporation

Actionable Recommendations for Industry Leaders to Accelerate Smart Hospital Adoption Through Investment, Collaboration, and Technology-Driven Strategies

To accelerate smart hospital transformations, organizations should prioritize investments in modular infrastructures that support scalability and iterative upgrades. By adopting open standards and interoperable APIs, hospitals can integrate new applications without overhauling core systems, reducing both deployment timelines and total cost of ownership. Cultivating cross-industry alliances-linking healthcare providers with technology disruptors, telecom carriers, and academic research centers-enables shared innovation while distributing the risks associated with early-stage experimentation. Additionally, leveraging government incentive programs for digital health and domestic manufacturing can offset external cost pressures and support internal ROI calculations. Equally important is fostering clinical and IT leadership alignment; structured governance frameworks that assign joint accountability for project outcomes ensure that technology deployments deliver genuine clinical value and operational efficiency.

Comprehensive Research Methodology Outlining Data Sources, Analytical Frameworks, and Expert Validation Processes Underpinning the Smart Hospital Insights

This analysis synthesizes insights drawn from a comprehensive literature review, proprietary interviews with healthcare IT executives, consultations with technology vendors, and evaluation of regulatory filings. Secondary research encompassed peer-reviewed journals, reputable industry periodicals, and government publications on trade and healthcare policy. Primary research involved structured interviews with senior hospital CIOs, chief medical officers, and heads of patient experience. Quantitative data were triangulated against anonymized survey findings from supply chain and biomedical engineering departments. Analytical rigor was maintained through cross-validation of qualitative themes and quantitative trends, ensuring robust conclusions that reflect real-world implementation nuances.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Hospitals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Hospitals Market, by Component

- Smart Hospitals Market, by Technology

- Smart Hospitals Market, by Application

- Smart Hospitals Market, by End User

- Smart Hospitals Market, by Region

- Smart Hospitals Market, by Group

- Smart Hospitals Market, by Country

- United States Smart Hospitals Market

- China Smart Hospitals Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Concluding Perspectives Emphasizing the Strategic Imperatives and Future-Ready Potential of Smart Hospitals in Transforming Healthcare Delivery Worldwide

The smart hospital ecosystem embodies a convergence of disruptive technologies that fundamentally reframe how healthcare is delivered and experienced. By weaving together AI, IoT, robotics, and advanced analytics within unified digital frameworks, institutions can transcend legacy constraints and harness data-driven models that anticipate needs, optimize resources, and amplify clinical impact. Strategic navigation of tariff headwinds, segmentation dynamics, and regional policy environments will differentiate leaders from laggards. Through targeted investments in interoperable platforms, strategic partnerships, and governance structures that align clinical and operational objectives, the promise of smarter, more resilient hospitals can be fully realized worldwide.

Connect with Ketan Rohom to Secure Your Custom Market Insights Report and Empower Data-Driven Decisions in the Smart Hospital Domain

To receive a tailored market research report that equips your organization with the latest insights on emerging technologies, strategic partnerships, and regulatory developments in the smart hospital sector, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, he can guide you through report customization options, offer detailed sample chapters, and coordinate enterprise licensing. Engaging Ketan ensures you gain a competitive edge with actionable intelligence on hardware, software, services, and regional dynamics shaping the future of connected healthcare environments.

- How big is the Smart Hospitals Market?

- What is the Smart Hospitals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?