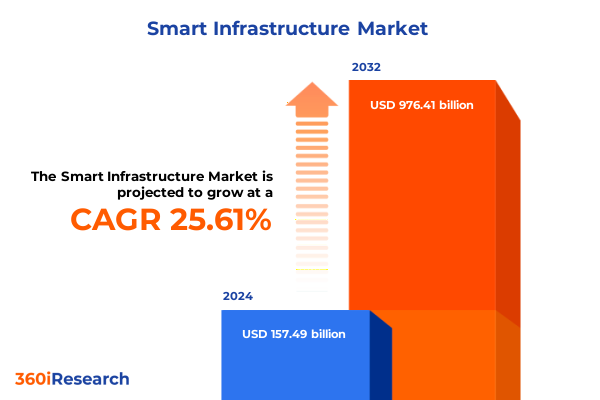

The Smart Infrastructure Market size was estimated at USD 197.66 billion in 2025 and expected to reach USD 248.08 billion in 2026, at a CAGR of 25.63% to reach USD 976.41 billion by 2032.

How Advanced Digital Technologies are Revolutionizing Infrastructure Operations through Real-Time Data, Automation, and Sustainable Resilience

The rapid convergence of Internet of Things devices, artificial intelligence, and high-bandwidth networks is ushering in a new era for infrastructure management, where digital twins, predictive analytics, and automation redefine traditional operations. Advanced building information modeling platforms now integrate real-time sensor data from cameras, controllers, meters, and environmental sensors to create dynamic digital replicas of physical assets. This shift enables seamless monitoring and proactive maintenance that reduce downtime and extend asset lifecycles by anticipating issues before they emerge.

Simultaneously, the pressing need for sustainable resilience has propelled significant investments in grid and energy infrastructure. In the United States, declining renewable energy costs, federal tax incentives, and rising power demands from AI-intensive data centers are driving a modernization wave in transmission and distribution networks. Federal initiatives under recent FERC orders now require long-term transmission plans from regional operators to accommodate distributed energy resources and ensure system reliability in the face of growing electrification trends.

With increased digitization comes heightened exposure to cyber-threats, prompting regulators and industry stakeholders to embed security protocols into every layer of system architecture. Government guidelines now emphasize ‘‘secure-by-design’’ principles alongside collaborative threat intelligence sharing to safeguard grids, water networks, and intelligent transportation systems from ransomware, supply chain attacks, and intrusions.

Moreover, next-generation construction methodologies, such as robotics, 3D printing, and modular fabrication, are being adopted at scale to accelerate project delivery, reduce material waste, and improve worker safety. By combining these methods with digital planning tools, infrastructure teams can execute complex projects with unprecedented speed and precision, ensuring both cost control and environmental responsibility in today’s fast-paced markets.

What Major Technological, Environmental, and Regulatory Forces are Driving the Transformative Shifts Reshaping Smart Infrastructure in 2025

The surge in generative AI applications is creating unprecedented power requirements, placing new strains on utilities and spurring accelerated investments in smart energy infrastructure. Tech giants are expanding data center footprints to train and host complex AI models, fueling an annual increase in electricity demand that industry analysts project at over 3% per year through 2028. This trend is compelling infrastructure stakeholders to upgrade grid capacity, deploy advanced energy storage systems, and integrate renewable resources to maintain reliable service delivery.

Digital twins and building information modeling platforms are transforming construction and asset management by providing real-time visibility into project progress and facility health. Through AI-driven simulations, infrastructure planners can optimize layout, schedule preventive maintenance interventions, and forecast resource needs with greater accuracy. These capabilities are reducing error rates, curbing cost overruns, and shortening project timelines across both public and private sector developments.

The decentralization of energy systems via microgrids and edge computing is empowering communities with localized control and enhancing resilience against large-scale disruptions. Microgrids paired with distributed solar, wind, and battery storage allow remote and underserved areas to maintain critical services independently of centralized utilities. This shift toward distributed control architectures also alleviates congestion on transmission corridors and supports efficient demand response programs.

As the digital backbone of modern infrastructure expands, the imperative to secure critical assets has led to substantial cybersecurity investments. Organizations are deploying AI-based threat detection, blockchain-anchored identity management, and continuous monitoring frameworks to protect industrial control systems from increasingly sophisticated attacks. These measures are vital to ensure uninterrupted operation of transportation networks, water treatment facilities, and smart grids in an era of heightened geopolitical risk.

Assessing the Cumulative Consequences of the 2025 U.S. Tariff Hikes on Smart Infrastructure Supply Chains, Costs, and Project Delivery

The cumulative impact of Section 301 tariff expansions and new levies on Chinese imports has introduced material cost increases across multiple smart infrastructure hardware categories. In late 2024, the U.S. administration imposed a 100% duty on electric vehicles, increased solar cell tariffs to 50%, and doubled semiconductor duties to 50% effective January 1, 2025. These actions aim to bolster domestic manufacturing but have also heightened expenses for critical components such as batteries, sensors, and control modules supplied by Chinese manufacturers.

U.S. utility companies and integrators are navigating higher import costs for solar photovoltaic components, lithium-ion battery materials, and essential metals under Section 301, with proposed levies on $18 billion of Chinese goods set to intensify supply pressures. Analysis indicates that battery energy storage systems may face pronounced cost increases due to tariffs on lithium, cobalt, and graphite, while solar module pricing could see more modest impacts given current demand dynamics and existing domestic capacity.

In response, leading smart infrastructure suppliers have begun passing through tariff surcharges to end customers. For instance, in March 2025, one major building automation provider announced a 3.2% tariff surcharge across its product portfolio to offset increased costs on steel, aluminum, and critical components. These surcharges are applied to new orders but exempt legacy contracts and software subscriptions, reflecting a calibrated approach to limit customer disruption while preserving supplier margins.

To mitigate long-term risks, industry participants are pursuing diversified sourcing strategies, including expanding procurement from Mexico, within North America, and alternative Asian partners. Concurrently, policymakers and private stakeholders are accelerating domestic capacity building-supported by initiatives such as the U.S. Chips Act and planned incentives for battery manufacturing-to reduce import dependencies and enhance supply chain resilience in strategic smart infrastructure segments.

Key Differentiators within Component, Connectivity, Deployment, Application, and End User Segments that are Shaping the Smart Infrastructure Market’s Evolution

Within the component landscape, hardware remains the dominant value driver, fueled by strong demand for IP and thermal cameras, advanced microcontrollers, and high-precision flow meters across utilities and smart buildings. Motion, pressure, and temperature sensors embedded throughout assets enable real-time diagnostics. Meanwhile, services such as strategic consulting, systems integration, and preventive maintenance are growing rapidly as organizations seek end-to-end solutions. On the software side, analytics platforms that deliver predictive insights and cloud-native architectures for device management are pivotal for operating efficiency and cybersecurity compliance.

Connectivity options are evolving to meet diverse application needs. Short-range protocols like Bluetooth, Wi-Fi, and Zigbee lead in building automation and in-venue systems, while LPWAN technologies such as LoRaWAN and NB-IoT are increasingly adopted for wide-area monitoring in water and grid applications. The rollout of 5G cellular networks is unlocking ultra-low latency use cases in traffic management and autonomous vehicle corridors, enabling real-time control and high-density sensor deployments.

Cloud-based deployment models continue to dominate for centralized data processing and long-term storage, especially among municipal and commercial end users seeking scalability and remote access. However, the rise of edge data centers and enterprise on-premises solutions reflects a growing need for low-latency decision making and data sovereignty-particularly in mission-critical contexts like healthcare, transportation, and industrial automation.

Applications such as building automation, energy management, and smart lighting account for significant adoption, driven by sustainability mandates and operational cost reduction targets. Traffic and waste management systems are emerging strongly in urban environments, while water management platforms are gaining traction in regions facing scarcity and regulatory scrutiny. Commercial, government, and industrial end users lead deployments, with transportation and residential segments following as integration costs decline and user awareness increases.

This comprehensive research report categorizes the Smart Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity

- Deployment

- Application

- End User

How North America, EMEA, and Asia-Pacific Regions are Leveraging Policy, Innovation, and Investment to Advance Smart Infrastructure Goals

In the Americas, substantial federal funding streams and regulatory support are elevating smart infrastructure projects to critical national priorities. The Infrastructure Investment and Jobs Act has allocated billions toward grid hardening, electric vehicle charging networks, and bridge monitoring systems. Combined with falling costs for renewable energy and growing corporate sustainability commitments, the region’s advanced economies are pioneering integrated projects that unite clean generation, digital controls, and advanced analytics to meet ambitious decarbonization goals.

Europe, the Middle East, and Africa are leveraging a mix of legislative frameworks and private capital to accelerate digital and green transitions. The European Union’s NIS2 cybersecurity directive and the Digital Europe Programme are catalyzing investments in secure IoT architectures, AI-driven energy management, and resilient transportation networks. In the Gulf Cooperation Council states, sovereign wealth-backed projects focus on smart water management and solar-powered microgrids to safeguard communities against climate risks and support rapid urban growth.

Asia-Pacific markets are at the forefront of large-scale 5G rollouts, digital twin pilots, and infrastructure virtualization initiatives. China’s national smart city framework, India’s smart city mission, and Australia’s renewable integration targets are driving demand for advanced monitoring and control solutions. Local manufacturing hubs and government-led R&D programs are also enhancing capacity for critical components, positioning the region as both a major consumer and increasingly influential producer of smart infrastructure technologies.

This comprehensive research report examines key regions that drive the evolution of the Smart Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Initiatives, Partnerships, and Innovations from Industry Leaders Driving Competitive Dynamics in the Smart Infrastructure Sector

ABB has capitalized on booming demand from AI data center operators and utilities by ramping up its energy-efficient electrification offerings. In Q2 2025, the company recorded its highest quarterly order intake ever, driven by a 37% surge in U.S. orders for data center products. ABB’s leadership in medium-voltage UPS systems and circuit breakers has also led to significant contract wins, reflecting strong customer confidence in its predictive maintenance and arc flash detection capabilities.

Schneider Electric is reinforcing its North American footprint with a planned investment exceeding $700 million through 2027 to bolster domestic manufacturing of switchgear, power distribution products, and data center solutions. This commitment accompanies a strategic partnership with Nvidia to co-develop AI-optimized energy management and cooling platforms capable of cutting data center cooling energy usage by 20% and reducing deployment time by 30%. Such alliances underscore Schneider’s dual focus on operational excellence and sustainability.

Siemens Smart Infrastructure continues to outpace peers by more than doubling its digital business revenue to €1.7 billion ahead of schedule and achieving a 12% year-on-year sales increase in its SI division. Recent Q2 results reaffirm a 6-9% revenue growth target backed by robust orders in electrification and smart building automation, while strategic acquisitions and product launches such as the SENTRON ECPD circuit protection device and the blueGIS medium-voltage portfolio have fortified its market leadership.

Honeywell has strengthened its building automation position through an AI-powered Connected Solutions platform that integrates disparate facility systems into a unified interface, enabling predictive maintenance and real-time energy optimization. Partnerships with Verizon for 5G-enabled smart meters and with Google to bake generative AI into industrial data workflows further illustrate Honeywell’s commitment to converging connectivity, analytics, and security in smart infrastructure environments.

Johnson Controls has leveraged its OpenBlue smart building suite and advanced cooling technologies to capture growth in AI-driven data center deployments. By raising its 2025 profit forecast and relaunching digital services such as its Connected Sprinkler predictive-maintenance offering, Johnson Controls has demonstrated sustained demand for its liquid-cooling systems, fire safety, and integrated building management platforms across commercial and industrial segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Accenture PLC

- Amazon Web Services, Inc.

- AT&T Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- General Electric Company

- Hitachi Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Johnson Controls International plc

- Legrand SA

- Microsoft Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

Strategic Imperatives and Actionable Steps Industry Leaders Must Take to Capitalize on Smart Infrastructure Opportunities and Mitigate Risks

Leverage digital twin and AI-driven analytics as foundational elements of your infrastructure strategy to enable scenario modeling, risk mitigation, and continuous performance optimization. Embedding these capabilities early in planning and procurement phases will yield exponential returns in asset reliability and operational efficiency.

Prioritize cybersecurity by adopting secure-by-design methodologies and participating in cross-industry threat intelligence consortia. Align with emerging regulatory frameworks, such as the European NIS2 directive and the U.S. National Cybersecurity Strategy, to ensure that resilience measures are both proactive and compliant with global standards.

Mitigate tariff-driven supply risks by diversifying procurement channels, increasing domestic sourcing commitments, and exploring alternative regional partnerships. Engage with public policy stakeholders to advocate for balanced trade measures that protect strategic industries while preserving the cost-competitiveness of critical infrastructure components.

Formulate cross-sector collaborations that blend public investment with private innovation. Leverage federal incentives such as the U.S. CHIPS Act and IIJA grants to co-fund pilot projects in smart energy, transportation, and water management, thereby accelerating deployment and validating new business models under real-world conditions.

Comprehensive Approach Combining Primary Research, Secondary Data Analysis, Expert Validation, and Quality Control to Ensure Robust Market Insights

This study employed a hybrid research approach combining primary and secondary methodologies. Primary research included in-depth interviews with senior executives, technical experts, and end users across North America, EMEA, and Asia-Pacific to capture real-time perspectives on investment priorities and technology adoption.

Secondary research encompassed an extensive review of government publications, regulatory filings, industry white papers, and authoritative news sources. Data triangulation techniques were applied to reconcile disparate information streams and validate emerging trends.

The segmentation framework covered components, connectivity, deployment, applications, and end users, ensuring comprehensive coverage of market dynamics. Quantitative analysis applied statistical modeling and scenario forecasting to assess the impact of external variables such as tariffs, regulatory changes, and macroeconomic factors.

A multi-stage quality assurance process, including peer reviews, data consistency checks, and expert validation panels, was implemented to guarantee the accuracy and reliability of findings. All proprietary assumptions and methodologies are fully documented in the report’s annex.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Infrastructure Market, by Component

- Smart Infrastructure Market, by Connectivity

- Smart Infrastructure Market, by Deployment

- Smart Infrastructure Market, by Application

- Smart Infrastructure Market, by End User

- Smart Infrastructure Market, by Region

- Smart Infrastructure Market, by Group

- Smart Infrastructure Market, by Country

- United States Smart Infrastructure Market

- China Smart Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4770 ]

Concluding Perspectives on the Strategic Importance of Smart Infrastructure Investments to Foster Sustainable, Resilient, and Data-Driven Urban Environments

As cities and industries worldwide embrace digital transformation, smart infrastructure emerges as the linchpin for sustainable growth, operational resilience, and climate adaptation. The interplay of advanced analytics, edge computing, and modular construction methodologies has created a fertile environment for innovation that spans energy, transportation, water, and public safety domains.

Industry leaders must remain agile in navigating evolving regulatory landscapes, supply chain complexities, and cybersecurity imperatives. By harnessing the power of data-driven decision making and pursuing collaborative pilot projects, organizations can reduce risk, accelerate time to value, and unlock new revenue streams.

Ultimately, the strategic integration of smart infrastructure solutions fosters urban environments that are not only more efficient but also more empathetic to societal needs, delivering safer, greener, and more inclusive spaces for communities to thrive.

Engage with 360iResearch to Gain Exclusive Smart Infrastructure Market Intelligence and Drive Strategic Decision Making with Expert Guidance

To explore these insights in greater depth and secure the competitive intelligence vital for strategic planning, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expert guidance will help you align your roadmap with emerging opportunities in smart infrastructure, whether you’re refining your innovation pipeline, optimizing supply networks, or defining your next investment priority. Purchase the comprehensive market research report today to arm your leadership team with the forward-looking analysis and actionable data required to stay at the forefront of this rapidly evolving sector.

- How big is the Smart Infrastructure Market?

- What is the Smart Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?