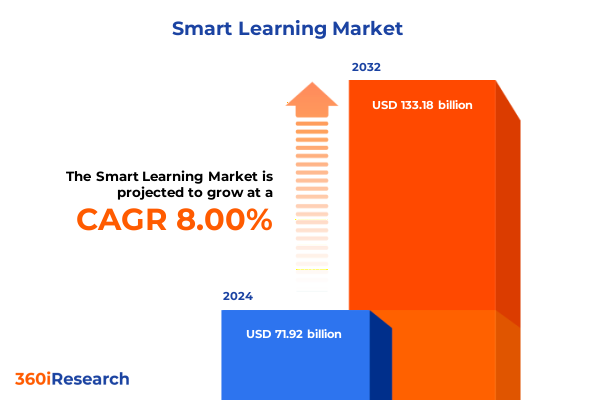

The Smart Learning Market size was estimated at USD 76.89 billion in 2025 and expected to reach USD 82.20 billion in 2026, at a CAGR of 8.16% to reach USD 133.18 billion by 2032.

Exploring the Convergence of Adaptive Technologies and User-Centric Strategies Redefining the Future of Smart Learning Experiences

The digital education landscape is undergoing a profound metamorphosis driven by advances in artificial intelligence, immersive technologies, and shifting user expectations. This executive summary introduces a framework for understanding how adaptive learning platforms, virtual classroom solutions, and robust hardware ecosystems converge to create highly personalized learning experiences. Amidst increasing demands for remote and hybrid education models, stakeholders are prioritizing scalable, secure, and data-driven tools that can address diverse learner profiles from K–12 students to corporate professionals.

In this context, leaders in academia, enterprise training, and government initiatives are seeking integrated offerings that combine interactive whiteboards, tablets, authoring tools, and comprehensive consulting services. This report unpacks the critical drivers shaping adoption curves, highlights pivotal regulatory shifts, and examines the competitive dynamics among global solution providers. By contextualizing transformative technological trends against recent trade developments, the introduction sets the stage for an in-depth exploration of segmentation insights, regional nuances, and actionable recommendations designed to empower decision-makers in a rapidly evolving smart learning market.

Unveiling the Rapid Emergence of Immersive Technologies and Data-Driven Platforms Transforming Digital Learning Landscapes

Over the past few years, digital learning has evolved from simple content delivery platforms to multifaceted ecosystems that harness artificial intelligence, analytics, and immersive reality. Today’s learners expect seamless integration across devices and modalities, where real-time data-driven feedback adapts instruction on the fly. As a result, organizations are prioritizing investments in virtual classroom platforms that offer synchronous and asynchronous learning, underpinning flexible delivery models that cater to varied schedules and geographies.

Meanwhile, the rise of augmented reality and virtual reality headsets has introduced immersive simulations that replicate hands-on training environments for technical skills development. These experiences are complemented by analytics tools that monitor engagement metrics and learning outcomes, enabling continuous optimization of content and pedagogical approaches. Consequently, the smart learning landscape is experiencing a radical shift toward end-to-end solutions that unify hardware, software, and services, creating cohesive pathways for learner success and operational efficiency.

Analyzing 2025 Tariff-Driven Supply Chain Realignments and Their Pronounced Effects on Smart Learning Technology Costs

In 2025, the imposition of tariffs on key electronic components imported from select regions has reverberated across the smart learning supply chain. Increased duties on tablets, interactive whiteboards, and VR headset modules have translated into higher procurement costs for hardware manufacturers and their enterprise customers. These elevated expenses have created pressure points on profit margins and prompted a reevaluation of sourcing strategies, with many providers exploring localized assembly or diversified supplier networks to mitigate the impact of trade policy shifts.

Additionally, the ripple effects of tariff-induced cost inflation have extended to software and service pricing as vendors seek to preserve margin thresholds. Training and support contracts are being renegotiated, and consulting engagements now often include clauses addressing potential future trade fluctuations. Despite these challenges, certain organizations have turned tariffs into opportunities by emphasizing total cost of ownership reductions through cloud-based delivery models and SaaS licensing, ultimately delivering more predictable budgeting outcomes for end users.

Delving into Multifaceted Segmentation Dynamics That Illuminate Nuanced Opportunities Across Components Applications and User Profiles

By examining component categories, we observe that hardware solutions such as interactive whiteboards, tablets, and VR headsets form the foundation of immersive learning environments, while complementary services in consulting, implementation, and training & support bridge technological capabilities with pedagogical expertise. On the software front, an ecosystem of authoring tools, learning management systems, and virtual classroom platforms underpins content creation and delivery, ensuring a cohesive user experience.

Within application domains, corporate training has emerged as a critical driver, leveraging adaptive learning and predictive analytics to accelerate workforce upskilling. The government and defense segment is bifurcated between military training, which demands high-fidelity simulators, and public sector education, where resource allocation must balance efficacy and budget constraints. In higher education, institutions are integrating smart devices and analytics to personalize student pathways, while K–12 education increasingly relies on gamified modules to engage younger learners.

From an end user perspective, academic institutions and enterprises represent large-scale deployments requiring robust integration and support services, whereas individual learners, whether engaging in instructor-led live sessions or self-paced modules, demand intuitive platforms that offer flexibility and autonomy. Deployment mode choices range from cloud-based environments-encompassing community, private, and public cloud infrastructures-to hybrid and on-premises installations, each presenting unique scalability and security trade-offs.

Content typologies span assessment tools, digital textbooks, interactive modules, and video formats, with live streaming and pre-recorded video enabling diverse pedagogical strategies. Technological innovations in AI & ML feature prominently through adaptive learning, chatbots, and predictive analytics, while AR & VR deliver immersive scenarios and IoT sensors track hands-on skill acquisition. Pricing models including freemium, one-time licensing, pay-as-you-go, and subscription structures cater to different budgetary frameworks. Delivery modes oscillate between asynchronous learning via recorded lectures and self-paced modules, blended learning that combines on-site and digital sessions, and synchronous learning that mirrors real-time classroom interactions.

This comprehensive research report categorizes the Smart Learning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Content Type

- Technology

- Pricing Model

- Delivery Mode

- Application

- End User

- Deployment Mode

Unraveling Regional Variances in Regulatory Landscapes and Technological Adoption Impacting Smart Learning Strategies Globally

Across the Americas, widespread digitization efforts in both education and corporate sectors have fueled strong demand for scalable cloud-based learning solutions. North American institutions are at the forefront of adopting advanced analytics and AI capabilities, while Latin American markets are emphasizing cost-effective deployment modes and mobile-first learning to accommodate diverse infrastructure landscapes.

In Europe, Middle East & Africa, stringent data privacy regulations and multilingual requirements have shaped the customization of platforms, prompting vendors to enhance localized content and compliance features. Western Europe continues to lead in immersive technology adoption, whereas emerging markets in the Middle East and Africa are increasingly partnering with global providers to bridge skill gaps in critical sectors like energy and defense.

The Asia-Pacific region remains a hotbed of growth, driven by government-led digital education initiatives and substantial investments in smart classroom hardware. Countries such as China, India, and South Korea are integrating AR & VR into vocational training programs, while Southeast Asian nations prioritize mobile-accessible microlearning modules to address large student populations. This regional diversity underscores the importance of hybrid strategies that balance global best practices with tailored local solutions.

This comprehensive research report examines key regions that drive the evolution of the Smart Learning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Diverse Competitive Strategies Demonstrating How Leading Providers Are Shaping Holistic Smart Learning Ecosystems

Key players in the smart learning market have diversified their portfolios to deliver end-to-end solutions. Leading technology firms have expanded cloud-based LMS offerings, embedding adaptive learning engines and predictive analytics to stay competitive. Hardware manufacturers have forged partnerships with software vendors to provide packaged classroom solutions featuring interactive whiteboards, tablets, and VR headsets.

Service providers specializing in consulting and implementation have carved out niche expertise in sectors such as defense and corporate training, offering tailored programs that align with stringent performance standards. Meanwhile, emerging startups are challenging incumbents by introducing lightweight, mobile-first platforms that leverage AI-driven chatbots and microlearning modules to engage individual learners.

Collaborations between established enterprises and regional resellers have become a hallmark strategy, enabling efficient market penetration across diverse geographies. This collaborative ecosystem fosters innovation through co-development initiatives, pilot programs for AR & VR content, and integrated support models that streamline deployments and enhance learning outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Learning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2U, Inc.

- Apple Inc.

- Chegg, Inc.

- Coursera, Inc.

- Duolingo, Inc.

- Google LLC

- John Wiley & Sons, Inc.

- Microsoft Corporation

- New Oriental Education & Technology Group, Inc.

- Pearson plc

- Stride, Inc.

- TAL Education Group

- Udemy, Inc.

Empowering Market Leaders to Orchestrate Agile Cloud Architectures and Strategic Alliances for Next-Generation Learning Experiences

Industry leaders seeking to maintain an edge should prioritize strategic investments in cloud-native architectures that support both synchronous and asynchronous delivery modes, ensuring reliable scalability and secure data management. Embracing API-driven integrations between LMS platforms, analytics engines, and immersive hardware will unlock seamless user experiences and facilitate rapid innovation.

Furthermore, organizations should cultivate partnerships with regional experts to navigate local regulations, language requirements, and infrastructure considerations. By establishing modular pricing models-ranging from freemium to subscription tiers-vendors can lower entry barriers and encourage adoption among diverse customer segments. Simultaneously, embedding AI-driven personalization engines and chatbot support will enhance learner engagement and provide actionable insights for content optimization.

Finally, decision-makers must build cross-functional teams that align technology, pedagogy, and operational expertise, fostering agile methodologies that accelerate pilot deployments and iterative improvements. This approach will enable swift adaptation to evolving market dynamics and position organizations as leaders in delivering impactful, future-ready learning solutions.

Illustrating a Rigorous Mixed-Methods Research Strategy That Integrates Quantitative Surveys Qualitative Interviews and Data Triangulation

This research was conducted through a mixed-methods approach, beginning with an extensive review of publicly available white papers, industry reports, and academic publications to map out foundational trends in AI, AR/VR, and IoT-enabled learning. Primary insights were gathered via interviews with senior executives from leading hardware manufacturers, software developers, service consultancies, and end-user organizations across North America, Europe, and Asia-Pacific.

Quantitative data was collected through surveys targeting technology decision-makers in education and enterprise training departments, supplemented with usage analytics from select platform providers. Data triangulation was achieved by cross-referencing tariff impact analyses with customs and trade databases, ensuring a comprehensive understanding of cost pressures and supply chain adaptations. All findings were validated through expert panel reviews to maintain methodological rigor and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Learning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Learning Market, by Component

- Smart Learning Market, by Content Type

- Smart Learning Market, by Technology

- Smart Learning Market, by Pricing Model

- Smart Learning Market, by Delivery Mode

- Smart Learning Market, by Application

- Smart Learning Market, by End User

- Smart Learning Market, by Deployment Mode

- Smart Learning Market, by Region

- Smart Learning Market, by Group

- Smart Learning Market, by Country

- United States Smart Learning Market

- China Smart Learning Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2862 ]

Synthesizing Market Drivers and Strategic Imperatives That Will Propel Future Growth and Innovation in Smart Learning Ecosystems

In summary, the smart learning market stands at an inflection point, driven by the convergence of immersive technologies, data-driven platforms, and evolving user demands. While 2025 tariffs have introduced cost challenges, they have also catalyzed supply chain diversification and innovative pricing strategies. Segmentation insights reveal a rich tapestry of opportunities across components, applications, end users, deployment modes, content types, technologies, pricing models, and delivery formats.

Regional analysis underscores the necessity of tailored approaches that address regulatory, infrastructural, and cultural nuances, while competitive dynamics highlight the importance of collaboration and co-development. By adopting agile cloud architectures, forging strategic alliances, and embedding AI-powered personalization, organizations can differentiate their offerings and deliver transformative learning experiences. Ultimately, this report provides a roadmap for stakeholders seeking to navigate complexity and drive impactful growth in the future of smart learning.

Unlock Strategic Growth in Smart Learning Markets by Partnering with Ketan Rohom for Exclusive Report Access and Tailored Intelligence

As you prepare to leverage deep insights from this comprehensive smart learning market research report, now is the moment to secure your copy and work directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan Rohom brings a wealth of expertise and can guide you through tailored purchase options, customized data packages, and timely support to meet your strategic goals and budget considerations. By contacting him, you will gain streamlined access to actionable intelligence covering emerging technologies, segmentation strategies, competitive landscapes, and regional dynamics.

Investing in this report empowers your organization with an end-to-end understanding of the forces reshaping digital learning experiences. Engage with Ketan to explore how you can accelerate innovation in your product roadmap, strengthen partnerships with technology providers, and refine your go-to-market strategies. Don’t miss this opportunity to transform insights into impact-connect with Ketan Rohom today and chart a course toward leadership in the fast-evolving smart learning ecosystem.

- How big is the Smart Learning Market?

- What is the Smart Learning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?