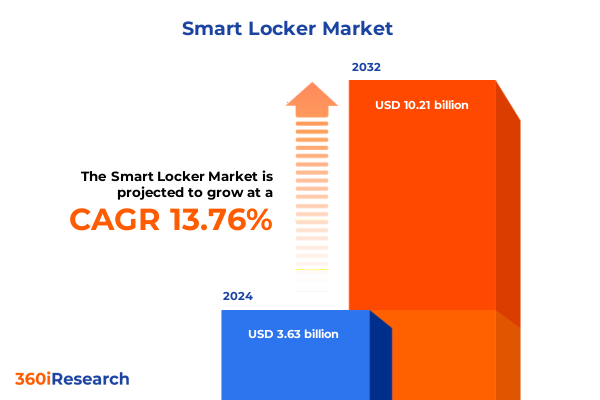

The Smart Locker Market size was estimated at USD 3.28 billion in 2025 and expected to reach USD 3.71 billion in 2026, at a CAGR of 13.53% to reach USD 7.97 billion by 2032.

Unlocking the Future of Parcel Management with Smart Lockers Empowering Contactless Delivery and Seamless Consumer Experiences in a Digital Age

Smart lockers have emerged as a critical enabler for modern parcel management, addressing the complexities of today’s dynamic logistics ecosystem. As consumers increasingly expect rapid, contactless delivery options, retailers and e-commerce providers are turning to automated locker networks to streamline last-mile operations. The U.S. Census Bureau reports that e-commerce sales accounted for 16.2 percent of total retail sales in the first quarter of 2025, marking a 6.1 percent increase from the same period in 2024, underscoring the sustained pivot toward online channels and the urgency for efficient delivery solutions. Moreover, digital commerce captured 17.9 percent of all retail transactions in the fourth quarter of 2024, reaffirming that e-commerce penetration is not a temporary spike but a structural shift in consumer behavior.

Against this backdrop, smart lockers offer a versatile, scalable approach to bridging the gap between centralized fulfillment centers and decentralized consumer locations. By integrating IoT sensors, cloud-based management platforms, and mobile app controls, these systems enable real-time monitoring of parcel status, temperature conditions, and secure access, cutting down delivery failures and returns. This seamless orchestration of hardware, software, and services positions smart lockers as a linchpin in evolving omni-channel strategies, empowering businesses to balance cost efficiency with superior customer experience.

Embracing Digital Transformation and Contactless Innovation Redefining the Smart Locker Landscape Across Retail Logistics and Last-Mile Delivery

The smart locker landscape has been reshaped by rapid digital transformation, with organizations converging on contactless innovation to meet evolving consumer expectations. Cloud-native platforms now underpin centralized locker management, enabling operators to deploy new units swiftly and update firmware remotely, while big data analytics optimize unit allocation based on real-time demand patterns. This shift toward an integrated, software-driven model is further propelled by mobile app ecosystems, which grant end users intuitive control over pickup and return processes. In 2024 alone, over 1.2 million smart locker units were deployed globally, up from 950,000 the previous year, reflecting a near 27 percent year-over-year surge in installations.

Simultaneously, IoT integration has elevated operational resilience by embedding predictive diagnostics and remote troubleshooting into locker networks. Nearly three-quarters of all units now support QR code or OTP-based access methods, significantly reducing reliance on manual interventions. The proliferation of temperature-controlled compartments, which grew by 34 percent year-over-year, has unlocked new verticals such as grocery, pharmaceutical deliveries, and meal-kit services, extending the utility of smart lockers beyond traditional parcel pickup to broad inventory management applications. As urbanization intensifies and delivery density escalates, these transformative shifts underscore the crucial role of intelligent automation and connectivity in redefining last-mile delivery paradigms.

Assessing the Cumulative Impact of 2025 US Tariffs on Smart Locker Ecosystem from Manufacturing to Consumer Pricing and Supply Chain Strategies

The wave of U.S. tariffs instituted in 2025 has had a compounding effect on the smart locker ecosystem, reshaping manufacturing strategies, supply chain architectures, and end-user pricing. A blanket 10 percent duty on all imports, coupled with levies up to 50 percent on targeted goods, has disrupted established supplier relationships and squeezed profit margins, prompting many manufacturers to reengineer production footprints. In particular, Chinese components now attract cumulative duties exceeding 145 percent, driving immediate cost increases and forcing technology vendors to reevaluate offshore tooling and assembly processes.

These trade measures have not only elevated direct hardware expenses but have also cascaded into broader R&D realignments. With rising tariffs on semiconductors and sensor modules, companies have diverted budget from innovation pipelines to absorb import surcharges, delaying new feature rollouts and software updates. Consequently, some enterprises have accelerated near-shoring initiatives, relocating critical assembly to Mexico and Southeast Asia to mitigate exposure. However, such shifts incur higher labor expenditures and ramp-up timelines, creating transitional friction that may translate into higher consumer prices.

For logistics providers and facility operators, these cumulative tariff impacts have underscored the importance of supply chain agility. Many are engaging in dual-sourcing strategies, stockpiling key components, and renegotiating contracts to secure tariff-exempt origin certifications. While these adaptations strive to contain cost inflation, the mid-term outlook suggests an ongoing period of price volatility, emphasizing the need for strategic procurement planning and agile operations to preserve margin integrity.

Deep Dive into Strategic Segmentation Unveiling End User Verticals Product Types Applications Connectivity Deployment and Sales Channel Dynamics

A nuanced segmentation framework reveals the multifaceted dynamics driving smart locker adoption across diverse market pillars. From an end-user perspective, e-commerce platforms harness B2B and B2C locker networks to optimize hub-and-spoke delivery, whereas hospitality providers and transportation hubs integrate automated parcel solutions to enhance guest convenience and passenger service. Retailers tailor locker deployments within department stores, hypermarkets, and specialty boutiques to facilitate in-store pickup and returns, while logistics service providers collaborate on temperature-controlled lockers and asset tracking deployments. In parallel, the product portfolio spans automated parcel lockers, intelligent vending solutions, retail-integrated lockers, and luggage-dedicated cabinets designed to meet specialized security and throughput requirements.

Application-driven segmentation further underscores key use cases: inventory management systems leverage sensor-enabled lockers for real-time stock monitoring and asset traceability, while last-mile delivery scenarios employ home-delivery modules or centralized pick-up networks. Contactless parcel delivery and in-store fulfillment processes are increasingly automated, and optimized returns management flows enable seamless in-store or locker-based return drop-offs. This intricate web of offerings is supported by a robust mix of hardware, software, and service components-ranging from modular cabinets, secure doors, and precision sensors to analytics platforms, integration middleware, and consulting services-underscoring the criticality of end-to-end lifecycle support.

Connectivity remains a cornerstone of system performance, with BLE, GSM, RFID, and Wi-Fi interfaces ensuring consistent device outreach and cloud synchronization. Moreover, deployment modes span public cloud services, private and hybrid clouds, as well as on-premise installations within edge data centers to accommodate latency-sensitive applications. Indoor and outdoor installation footprints navigate commercial, residential, parking-lot, and street-side environments, while direct sales, distributor partnerships, system integrators, and e-commerce platforms shape the commercial ecosystem’s go-to-market latitude.

This comprehensive research report categorizes the Smart Locker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Locker Type

- Component

- Connectivity Type

- Authentication Method

- Locker Size

- Power Source

- Sales Channel

- Installation Environment

- End User

Comprehensive Regional Dynamics Shaping Smart Locker Adoption Trends in the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional contours of smart locker demand reveal distinct growth trajectories and adoption patterns. In the Americas, the United States leads with highly developed e-commerce infrastructure, robust last-mile logistics frameworks, and favorable regulatory support for contactless solutions. Retailers and logistics providers in North America are capitalizing on sophisticated cold-chain requirements and integrated mobile platforms, with key metropolitan corridors exhibiting dense locker networks that alleviate urban delivery congestion and reduce carbon footprints.

Across Europe, the Middle East, and Africa, locker adoption is closely tied to postal modernization programs, parcel service expansions, and retail omnichannel strategies. EMEA markets are witnessing accelerated deployment within metropolitan transit stations and airport terminals, where passenger convenience aligns with security protocols. In Western Europe, regulatory emphasis on digital sovereignty and data privacy has catalyzed on-premise and private cloud locker solutions, whereas Middle Eastern logistics hubs leverage smart lockers to accommodate rapidly growing e-commerce penetration.

In the Asia-Pacific region, rapid urbanization and high smartphone penetration have created fertile ground for locker networks across residential complexes and university campuses. Emerging markets such as China and India are experimenting with solar-powered and AI-driven locker pods to navigate power constraints and traffic management challenges. Globally, North America accounts for roughly 38 percent of smart locker market share, followed by Asia-Pacific at 32 percent and Europe at 20 percent, with Middle East & Africa representing the balance, underscoring the truly global nature of this infrastructure revolution.

This comprehensive research report examines key regions that drive the evolution of the Smart Locker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Shaping Innovation and Competitive Strategies in the Global Smart Locker Market Landscape

Several leading incumbents and innovative challengers are shaping the competitive smart locker landscape. Amazon, with its expansive Hub Locker network, is reinforcing last-mile capabilities through a planned $15 billion warehouse and logistics facility expansion, signaling a deeper integration of locker nodes within its urban and rural delivery ecosystems. In parallel, InPost continues to solidify its European stronghold, recently acquiring Spain’s Sending delivery firm to enhance its Iberian Peninsula presence and planning to add over 1,000 additional locker sites by year-end to meet surging consumer demand.

InPost’s broad network, which exceeded 46,900 automated parcel machines at the close of 2024, delivered more than 1.09 billion parcels, achieving a 22 percent year-over-year increase in volumes, and demonstrating market resilience across Poland, the UK, and France as it extended its cross-border offerings. Other notable players include Quadient, which leverages postal service partnerships to embed lockers within retail points of sale; Cleveron, an Estonian innovator advancing robotic pick-and-place locker mechanisms; Luxer One, targeting the multifamily residential sector; and ASSA ABLOY, bolstering security features through biometric access integration. These companies collectively drive continuous improvements in operational uptime, software-defined capabilities, and omnichannel user journeys.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Locker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Pitney Bowes Inc.

- ASSA ABLOY Inc.

- Ricoh Company, Ltd.

- KEBA Group AG

- SALTO Systems SL

- SwipBox International A/S

- Bell and Howell, LLC

- Parcel Pending LLC by Quadient

- Meridian Kiosks

- Godrej & Boyce Mfg. Co. Ltd.

- LockTec GmbH

- Hollman Inc.

- TZ Limited

- Florence Corporation by Gibraltar Industries

- AirLocker, Inc.

- Package Nexus

- Bradford Systems

- Click n Collect Pty Ltd

- Fonzel Malaysia Sdn Bhd

- Kargopark

- Machan International Co., Ltd.

- MobiiKey Technologies Private Limited

- Ozone Secutech

- ParcelPort Solutions Inc.

- Shenzhen Zhilai Sci and Tech Co Ltd

- Smart Lockers MVK

- Smart Lockers, Inc.

- Smiota

- Snaile Inc.

Actionable Recommendations Guiding Industry Leaders to Optimize Smart Locker Deployments and Drive Sustainable Growth

To maximize the strategic value of smart locker investments, industry leaders should first align deployment objectives with customer journey mapping, ensuring that locker locations and functionalities resonate with distinct audience segments. By leveraging predictive analytics, operators can forecast locker utilization patterns and optimize unit density in high-traffic zones, thereby reducing dwell times and enhancing throughput. Concurrently, integrating lockers within broader ecosystem platforms-such as mobile commerce apps, digital wallets, and loyalty schemes-can further elevate user engagement and drive repeat utilization.

Supply chain agility remains paramount in the face of tariff-driven cost pressures. Leaders are advised to diversify component sourcing, secure origin certifications, and establish dual-sourcing arrangements to mitigate tariff exposure. Investing in modular hardware architectures and firmware-over-the-air capabilities ensures future-proofing against regulatory shifts, while rigorous lifecycle management protocols can extend asset longevity and reduce total cost of ownership.

Finally, forging strategic partnerships with last-mile service providers, real estate developers, and public transit authorities can broaden locker network footprints and unlock new revenue streams. By co-creating tailored solutions-such as temperature-controlled modules for grocery and pharmaceutical applications-organizations can tap emerging verticals and sustain growth momentum.

Robust Research Methodology Integrating Primary and Secondary Data Sources for In-Depth Smart Locker Market Analysis

This study employed a comprehensive, hybrid research methodology that integrates both secondary and primary data collection to ensure rigorous market analysis. The secondary research phase involved reviewing trade publications, government reports, company press releases, and industry white papers to establish foundational insights into e-commerce growth dynamics, tariff developments, and technology adoption patterns. Key sources included government statistical releases, reputable news wire agencies, and open-source technical documentation.

The primary research component comprised in-depth interviews with senior executives, product managers, and logistics operators across key regions, providing qualitative validation and contextual nuance to secondary findings. Insights gleaned from these interviews informed the refinement of segmentation criteria, enabling the delineation of end user categories, product typologies, application usage scenarios, and technology stacks.

Data triangulation was applied through quantitative modeling, cross-referencing shipment volumes, installation counts, and tariff rate schedules. This triangulated approach, combined with iterative validation workshops, underpinned the development of actionable segmentation matrices and regional outlooks. The resulting framework offers a robust foundation for strategic decision-making and scenario planning within the smart locker domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Locker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Locker Market, by Locker Type

- Smart Locker Market, by Component

- Smart Locker Market, by Connectivity Type

- Smart Locker Market, by Authentication Method

- Smart Locker Market, by Locker Size

- Smart Locker Market, by Power Source

- Smart Locker Market, by Sales Channel

- Smart Locker Market, by Installation Environment

- Smart Locker Market, by End User

- Smart Locker Market, by Region

- Smart Locker Market, by Group

- Smart Locker Market, by Country

- United States Smart Locker Market

- China Smart Locker Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3657 ]

Conclusion Synthesizing Smart Locker Market Insights to Inform Strategic Decision-Making and Future Growth Trajectories

Smart lockers have rapidly transitioned from a niche innovation to a cornerstone of modern logistics and retail operations, driven by accelerating e-commerce demand, urbanization trends, and consumer appetite for contactless experiences. The convergence of IoT, cloud computing, and advanced analytics has redefined locker capabilities, enabling proactive diagnostics, seamless integrations, and frictionless user journeys. At the same time, geopolitical shifts such as U.S. tariffs on imported components have underscored the criticality of supply chain diversification and agile procurement frameworks.

Segmentation analyses reveal that end user adoption spans diverse sectors-from e-commerce and hospitality to transportation and retail-with tailored solutions permeating each vertical. Regional dynamics highlight robust growth in North America and Asia-Pacific, balanced by evolving infrastructure investments in EMEA markets. Leading companies are investing heavily in network expansion, technology differentiation, and strategic partnerships, signaling a maturing competitive landscape.

In this environment, success hinges on aligning deployment strategies with broader digital transformation initiatives, prioritizing data-driven location planning, and adopting modular, scalable technologies. By synthesizing these insights, decision-makers can chart informed paths forward, anticipate emerging market shifts, and unlock new opportunities within the rapidly evolving smart locker ecosystem.

Ready to Elevate Your Market Strategy Connect with Ketan Rohom to Access Comprehensive Smart Locker Market Research Insights

To explore how these insights can translate into competitive advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who can provide tailored guidance on leveraging comprehensive smart locker intelligence. Whether you are refining your go-to-market strategy or seeking to benchmark against industry best practices, Ketan Rohom is ready to help you obtain the full research report and unlock the detailed analysis that will power your next phase of growth.

- How big is the Smart Locker Market?

- What is the Smart Locker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?