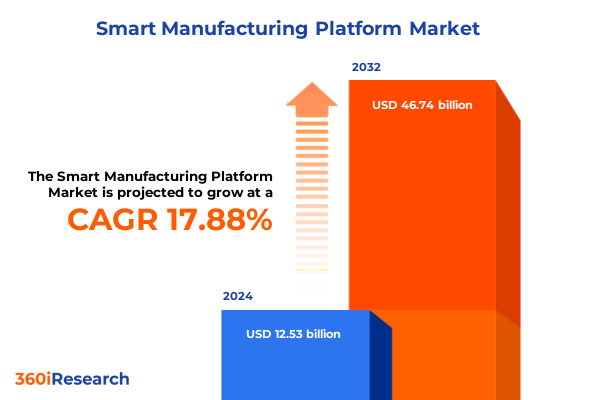

The Smart Manufacturing Platform Market size was estimated at USD 14.75 billion in 2025 and expected to reach USD 17.38 billion in 2026, at a CAGR of 17.90% to reach USD 46.74 billion by 2032.

Emerging Opportunities and Core Challenges Shaping the Future of Smart Manufacturing Platforms Amid Rapid Technological and Operational Transformation

The global manufacturing landscape is undergoing a profound digital metamorphosis driven by advances in connectivity, data analytics, and automation technologies. As organizations strive to remain competitive, smart manufacturing platforms have emerged as cornerstone solutions that integrate hardware, software, and services to enhance visibility, agility, and efficiency across operations. These platforms unify data from sensors, controllers, and connectivity devices, enabling real-time monitoring of equipment, predictive maintenance algorithms, and adaptive process control. Transitioning from traditional, siloed production lines to interconnected ecosystems, manufacturers can harness actionable insights to reduce downtime, optimize resource utilization, and respond swiftly to shifting market demands.

In parallel, escalating pressures related to sustainability, labor challenges, and supply chain disruptions underscore the urgency for digital transformation. Stakeholders from the boardroom to the shop floor recognize the strategic value of platforms that deliver end-to-end integration-from analytics and application software to cloud-native or hybrid deployment models. This growing consensus has accelerated platform adoption, promoting not only operational excellence but also innovation. By leveraging advanced technologies such as artificial intelligence, digital twins, and edge computing, manufacturers are reinventing workflows, improving product quality, and reducing energy consumption. This foundational shift sets the stage for a new era in which data-driven decision-making and adaptive manufacturing become essential drivers of growth and resilience.

How Converging Technologies and Industry 4.0 Adoption Are Redefining Operational Paradigms and Driving Innovation in Manufacturing Ecosystems

The advent of Industry 4.0 has catalyzed a wave of innovation, reshaping manufacturing paradigms through the convergence of Internet of Things devices, cloud computing, and artificial intelligence. Smart sensors embedded in machinery now capture high-frequency vibration, temperature, and throughput data, feeding advanced analytics engines that predict maintenance needs and flag anomalies before they escalate into costly downtime. Meanwhile, digital twin models replicate physical assets in virtual environments, enabling scenario testing and fine-tuning of process parameters without disrupting production. These transformative technologies are not isolated trends; they interact synergistically to enhance responsiveness, flexibility, and operational intelligence.

Moreover, the rollout of 5G networks and the expansion of edge computing infrastructure have further accelerated real-time data processing and decision-making closer to the source. As a result, manufacturers can deploy latency-sensitive applications-such as autonomous guided vehicles and collaborative robots-with greater reliability. Simultaneously, software platforms are evolving from standalone solutions toward modular architectures that support open APIs and interoperability standards. This shift encourages cross-vendor ecosystems, fostering collaboration between traditional industrial conglomerates, software innovators, and emerging technology startups. In sum, the interplay of these converging forces is redefining the capabilities of smart manufacturing platforms and unlocking new production efficiencies.

Assessing the Comprehensive Impact of the 2025 United States Tariff Regime on Smart Manufacturing Platforms and Supply Chain Economics

In 2025, the cumulative impact of new and existing United States tariffs has reverberated across supply chains, influencing costs, sourcing strategies, and technology investments within smart manufacturing ecosystems. The continuation of Section 301 duties on select imported components, including precision sensors, advanced controllers, and connectivity modules, has elevated input costs for hardware segments. Manufacturers reliant on foreign-sourced devices have faced margin compression, prompting many to re-engineer product architectures or seek alternative suppliers. In turn, stakeholder dialogues around reshoring and nearshoring have gained momentum as organizations weigh the trade-offs between cost, quality, and geopolitical risk.

Beyond hardware, tariffs applied to electronics and semiconductor supply chains have indirectly affected software and integration services. Elevated component prices have delayed certain upgrade projects, while service providers have adapted by bundling maintenance agreements and offering flexible financing. As a countermeasure, some industry leaders have increased investments in in-house manufacturing capabilities, leveraging automation to offset labor and tariff pressures. Regulatory shifts have spurred collaborative ventures aimed at localizing production of critical components, enhancing supply chain traceability and resilience. Consequently, while short-term disruptions have tested budgets and project timelines, the broader trajectory indicates a strategic pivot toward diversified sourcing, localized manufacturing hubs, and more robust risk management frameworks.

Unveiling Critical Insights Across Components Applications Industries and Deployment Modes to Illuminate Market Segmentation Dynamics

A nuanced examination of market segmentation reveals distinct opportunities across component, application, end-user, and deployment vectors. When evaluating hardware, services, and software offerings, one observes that connectivity devices, controllers, and sensors anchor the physical infrastructure layer, while consulting, integration, and support and maintenance services drive implementation and continuous operation. Concurrently, analytics, application, and platform software underpin data visualization, process orchestration, and scalable ecosystem integration, respectively. Together, these component categories form the backbone of a holistic smart manufacturing strategy.

Diving deeper into application areas illuminates where value realization is most pronounced. Asset tracking initiatives deliver granular visibility into equipment utilization across global operations, whereas inventory management solutions optimize stock levels and material flows to reduce carrying costs. Predictive maintenance algorithms enhance asset reliability by forecasting component wear and failure, while process control systems enforce consistency and throughput targets. Production monitoring modules provide real-time dashboards, and quality management applications ensure compliance with stringent industry standards. Each application exerts unique performance requirements, fueling tailored platform configurations and integration roadmaps.

From an industry standpoint, aerospace and defense manufacturers demand rigorous certification and traceability, automotive producers focus on high-volume, just-in-time workflows, and chemical and electronics firms prioritize precise process control and yield optimization. The food and beverage sector emphasizes perishable item tracking and sanitation compliance, oil and gas companies require remote asset supervision in harsh environments, and pharmaceutical producers enforce stringent quality and validation protocols. Lastly, deployment preferences span cloud infrastructure for scalability and ease of access, hybrid models balancing latency and security, and on-premise installations for maximum control. These segmentation dimensions, when analyzed collectively, underpin strategic platform design and market positioning.

This comprehensive research report categorizes the Smart Manufacturing Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- End User Industry

- Deployment Mode

Evaluating Regional Performance Variations Across Americas Europe Middle East Africa and Asia Pacific to Highlight Growth Drivers and Barriers

Regional dynamics play a pivotal role in shaping the adoption trajectory and investment climate for smart manufacturing platforms. In the Americas, leading economies have witnessed robust demand for digital transformation fueled by government incentives, tax credits, and workforce upskilling initiatives. North American manufacturers are piloting collaborative robotics and advanced analytics in sectors ranging from automotive to food and beverage, with nearshore reshoring projects gaining traction as firms seek supply chain continuity. Latin American markets, though at an earlier stage, are rapidly embracing cloud-based deployments to overcome infrastructure constraints and leverage pay-as-you-grow models.

In Europe, the Middle East, and Africa, regulatory frameworks such as the European Union’s Digital Compass and Industry 4.0 initiative have accelerated platform deployments across Germany, France, and the United Kingdom. Middle Eastern nations are investing heavily in smart city infrastructure, integrating manufacturing corridors with broader digital ecosystems. Meanwhile, African manufacturers are exploring hybrid deployment models to bridge connectivity gaps, coupling edge computing with intermittent cloud synchronization. Demand in this combined region reflects a mix of mature industrial hubs and emerging markets, each presenting unique adoption curves and partnership opportunities.

The Asia-Pacific region continues to lead in volume, driven by established electronics, automotive, and pharmaceuticals clusters in China, Japan, South Korea, and Southeast Asia. Government-backed modernization programs and strategic initiatives like China’s Made in China 2025 have bolstered domestic platform providers and incentivized cross-border partnerships. Cloud deployment remains dominant in markets with reliable data infrastructure, while on-premise and hybrid solutions persist in areas with data sovereignty concerns or limited network coverage. Across APAC, international vendors collaborate with local integrators to address language, regulatory, and operational nuances, ensuring platform scalability and compliance.

This comprehensive research report examines key regions that drive the evolution of the Smart Manufacturing Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Pioneering Innovations in Manufacturing Platforms by Highlighting Strategic Partnerships Market Positioning and Technological Edge

Leading providers in the smart manufacturing platform space are distinguished by their ability to integrate comprehensive hardware portfolios with robust software stacks and value-added services. Traditional automation giants have expanded cloud-native offerings, incorporating digital twin capabilities and advanced analytics to complement their legacy controllers and drive broader ecosystem engagement. New-media technology firms, leveraging expertise in cloud computing and artificial intelligence, have entered the market with platforms that emphasize rapid deployment, open API ecosystems, and modular service offerings. Meanwhile, specialist software companies focus on deep vertical solutions, delivering turnkey applications for predictive maintenance, quality management, and production scheduling.

Strategic alliances and joint ventures have accelerated solution development and market penetration. Collaborations between edge computing pioneers and industrial equipment manufacturers yield integrated appliances that simplify on-premise deployments. Partnerships involving consulting and systems integration firms enable seamless end-to-end transformation projects, combining change management expertise with technical implementation. Further, many vendors are strengthening their support and maintenance portfolios through subscription-based models, embedding remote monitoring and continuous improvement services. Innovation roadmaps emphasize interoperability, with demonstrations at major industry trade shows underscoring cross-vendor data exchange, cybersecurity solutions, and adaptive machine learning frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Manufacturing Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Amazon Web Services, Inc.

- Emerson Electric Co.

- Fujitsu Limited

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- International Business Machines Corporation

- Microsoft Corporation

- PTC Inc.

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

Delivering Actionable Strategic Recommendations to Empower Industry Leaders Optimize Operations Accelerate Innovation and Drive Sustainable Growth in Manufacturing

Industry leaders should prioritize investments in modular, open architectures that facilitate seamless integration with existing systems and third-party applications. By adopting interoperable standards and leveraging edge-to-cloud frameworks, organizations can scale pilot projects into enterprise-wide deployments with minimal disruption. Furthermore, aligning digital transformation initiatives with workforce development programs ensures that employees acquire the skills needed to manage automated systems, interpret analytics, and drive continuous improvement. Strong change management practices, supported by executive sponsorship, are essential to cultivate a culture of data-driven decision-making.

In parallel, decision-makers must embed cybersecurity and data governance into platform rollouts from the outset. Implementing zero-trust security models and end-to-end encryption protects sensitive operational data while complying with evolving regulatory requirements. To mitigate geopolitical and tariff-related risks, companies should diversify supply chains through strategic partnerships, regional manufacturing hubs, and in-house component production where feasible. Finally, a focus on sustainability-optimizing energy usage, reducing waste, and enabling circular economy principles-can unlock both cost savings and brand value. Organizations that execute on these recommendations will not only enhance resilience but also position themselves as leaders in the next generation of smart manufacturing.

Detailing Rigorous Research Methodology Combining Primary Secondary Data Collection and Advanced Analytical Frameworks to Ensure Robust Insights

This report synthesizes insights from a rigorous research methodology combining primary and secondary sources. Primary research entailed in-depth interviews with executives, technology architects, and operational managers across diverse manufacturing sectors, providing first-hand perspectives on platform evaluation criteria, deployment challenges, and emerging use cases. Secondary research drew on industry publications, white papers, government policy documents, and company disclosures to validate market dynamics and triangulate quantitative trends.

Analytical frameworks underpinning this study include comparative technology benchmarking, SWOT analysis, and convergence mapping to assess vendor capabilities and ecosystem synergies. Data collection was supplemented by case study reviews, showcasing best-in-class implementations across segments such as predictive maintenance, inventory management, and process control. The research team employed a layered approach to ensure data integrity, cross-verifying information with multiple stakeholder interviews and public disclosures. This methodology ensures that the findings presented are both actionable and reflective of the most current industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Manufacturing Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Manufacturing Platform Market, by Component

- Smart Manufacturing Platform Market, by Application

- Smart Manufacturing Platform Market, by End User Industry

- Smart Manufacturing Platform Market, by Deployment Mode

- Smart Manufacturing Platform Market, by Region

- Smart Manufacturing Platform Market, by Group

- Smart Manufacturing Platform Market, by Country

- United States Smart Manufacturing Platform Market

- China Smart Manufacturing Platform Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Key Findings and Synthesizing Critical Conclusions to Provide a Compelling Perspective on Smart Manufacturing Market Evolution

The comprehensive exploration of smart manufacturing platforms underscores a market defined by accelerating technological convergence, evolving regulatory landscapes, and shifting supply chain paradigms. Key findings reveal that integrated hardware-software-service models drive the most significant value, particularly when combined with open, modular architectures that support rapid scalability. Tariff-induced cost pressures have catalyzed regional diversification and localized production initiatives, reinforcing the importance of flexible deployment modes and resilient sourcing strategies.

Segmentation analysis highlights distinct value propositions across components, applications, industries, and deployment preferences, indicating that successful platform adoption hinges on aligning solution portfolios with specific operational priorities. Regional insights demonstrate that while developed markets lead in innovation and scale, emerging economies are leveraging cloud and hybrid models to leapfrog infrastructure barriers. Leading vendors differentiate themselves through strategic partnerships, deep vertical expertise, and continuous investment in interoperability and security.

In closing, organizations that embrace these insights-by fostering cross-functional collaboration, embedding robust risk management, and committing to workforce transformation-will be best positioned to capture competitive advantage. The shift toward smart manufacturing represents not just a technological upgrade, but a fundamental reimagining of how products are designed, produced, and brought to market.

Act Now to Secure Comprehensive Market Intelligence and Partner with Ketan Rohom for Customized Sales Marketing Insights to Propel Smart Manufacturing Success

To explore the full depth of insights, secure this specialized market intelligence report today and collaborate directly with Ketan Rohom, Associate Director of Sales & Marketing, to tailor findings to your strategic objectives and accelerate the adoption of smart manufacturing solutions across your organization. His expertise will guide you through actionable data, competitive benchmarks, and strategic pathways to elevate operational excellence and capture emerging opportunities in this dynamic landscape.

- How big is the Smart Manufacturing Platform Market?

- What is the Smart Manufacturing Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?