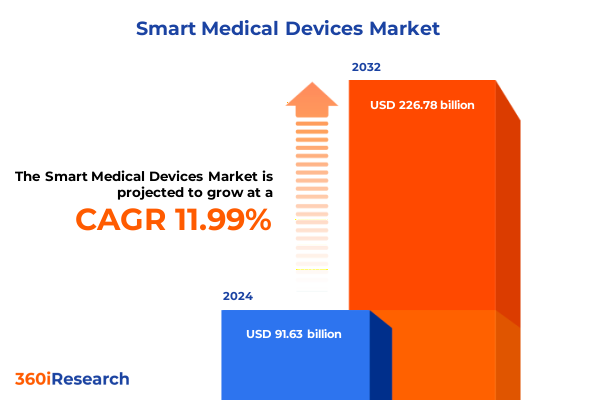

The Smart Medical Devices Market size was estimated at USD 101.34 billion in 2025 and expected to reach USD 112.08 billion in 2026, at a CAGR of 12.19% to reach USD 226.78 billion by 2032.

How Smart Medical Devices Are Revolutionizing Patient Care Through Connectivity, AI, and Personalized Real-Time Monitoring in the Era of Digital Health and Global Aging

Smart medical devices represent a transformative leap in the delivery of healthcare, converging sensor technology, data analytics, and artificial intelligence to elevate patient outcomes. As global populations age and the prevalence of chronic conditions rises, the demand for remote monitoring, real-time diagnostics, and personalized therapeutic interventions continues to intensify. Wearable patches track vital signs and biochemical markers at the point of care, while portable handheld ultrasound units extend imaging capabilities beyond traditional clinical settings. Stationary bedside systems now interoperate with cloud-based analytics platforms, enabling clinicians to predict patient deterioration with unprecedented accuracy. Therapeutic devices-from smart hearing aids to connected inhalers-offer nuanced control over treatment regimens, enhancing adherence and improving quality of life. Interoperability standards and regulatory frameworks have matured in parallel, fostering an ecosystem where devices seamlessly integrate into electronic health record systems and telehealth platforms.

Amid these advancements, patient empowerment has become a central theme: consumers now actively participate in their own care through intuitive interfaces and mobile health applications that provide actionable insights. Healthcare providers, in turn, leverage aggregated device data to refine clinical pathways and optimize resource allocation. This convergence of technology, regulation, and patient-centric design underpins the emergence of a truly connected healthcare environment, setting the stage for the following analysis of the landscape’s most pressing shifts and strategic considerations.

Major Technological, Regulatory, and Patient-Centric Shifts Are Driving the Next Wave of Innovation in Connected Medical Solutions

The smart medical device landscape is undergoing rapid transformation propelled by advancements in connectivity, edge computing, and regulatory support for digital health. 5G networks and low-power wide-area protocols have vastly expanded the range and reliability of remote patient monitoring, enabling continuous data streams from wearable monitors and sensor-based patches directly into cloud analytics. These real-time feeds support predictive algorithms that alert caregivers to early signs of cardiac distress or respiratory compromise. In parallel, the maturation of artificial intelligence frameworks-fueled by more robust computing at the device edge-has accelerated the evolution of diagnostic imaging, with deep-learning algorithms enhancing image reconstruction to reduce scan times and radiation exposure while improving diagnostic accuracy.

Regulatory bodies have recognized the imperative of mitigating cybersecurity risks in this connected ecosystem. In June 2025, the U.S. Food and Drug Administration released its updated "Cybersecurity in Medical Devices: Quality System Considerations and Content of Premarket Submissions" guidance, which establishes clear requirements for software bill of materials, vulnerability management, and secure product development frameworks to ensure patient safety and data integrity in premarket submissions. Earlier in 2025, the FDA identified specific vulnerabilities in certain patient monitors that could be accessed by unauthorized actors, underscoring the critical need for embedded security across the product lifecycle.

Amid these technological and regulatory shifts, patient-centric care models have gained prominence. Remote monitoring platforms are being integrated into value-based reimbursement schemes that reward outcomes over procedure volume. Collaborative partnerships between device manufacturers and digital health platforms have streamlined care transitions from hospital to home, reducing readmissions and enhancing patient engagement. This confluence of innovation, policy, and clinical transformation is reshaping how medical devices are developed, regulated, and deployed across care settings.

Assessing the Cumulative Effects of 2025 United States Tariffs on Medical Device Costs, Supply Chains, and Industry Innovation

Throughout 2025, a series of tariffs implemented by the United States government have introduced new cost pressures and supply chain complexities for medical device manufacturers and healthcare providers. President Donald Trump’s administration imposed 25% duties on certain medical equipment sourced from Canada and Mexico, along with a 10% tariff on imports from China, creating a layered tariff structure that has elevated input costs for devices containing electronics, steel, and aluminum components. Companies that rely on global supply chains for imaging systems, diagnostic analyzers, and patient monitoring hardware have had to revisit sourcing strategies and partner with distributors to manage landed costs and preserve margin integrity.

These tariffs have directly impacted the availability and pricing of critical medical equipment. Diagnostic tools such as MRI machines, CT scanners, and bedside monitors-often assembled from multiple international components-have experienced extended lead times as suppliers adjust production schedules to navigate duty regimes and logistical constraints. Hospitals and clinics have reported delays in onboarding new imaging systems and diagnostic analyzers, with prioritization given to existing service agreements and critical care settings. Patient monitors, infusion pumps, and electronic respiratory devices that were previously exempt from tariffs under early trade agreements are now subject to duties, prompting facility managers to explore domestic alternatives or stockpile essential equipment.

Beyond procurement hurdles, tariffs have reverberated through R&D pipelines. Some medical technology firms have diverted budget allocations from innovation initiatives to tariff compliance measures, risk assessments, and supply chain diversification efforts, potentially slowing the pace of product launches and clinical validations. At the same time, manufacturers are lobbying U.S. trade authorities and industry groups for carve-outs on life-saving devices, citing concerns over patient safety and the public interest. Major stakeholders such as the American Hospital Association and medical device trade associations continue to press for exemptions or phased implementations to minimize impact on care delivery and to ensure uninterrupted access to essential healthcare devices.

This cumulative tariff environment has underscored the strategic imperative for industry participants to enhance supply chain resilience. Opportunities have emerged for nearshoring component production, strengthening domestic OEM partnerships, and negotiating long-term fixed-price contracts to hedge against future duty escalations. As companies navigate these complexities, the lessons learned in tariff risk management will likely inform broader strategies for operational agility and financial stability in an increasingly geopolitically dynamic marketplace.

Unlocking Growth: Detailed Insights into Device Type, End User, Technology, and Application Segmentation Shaping Smart Medical Device Markets

Insight into market segmentation offers a critical lens to appreciate the dynamics of the smart medical device sector. Device category delineations reveal that wearable solutions-spanning sensor-based wearables, smart watches, and patches-have emerged as pivotal tools in continuous patient monitoring, fostering proactive intervention and chronic disease management. Within the portable device segment, handheld ultrasound devices and portable ECG monitors have enhanced point-of-care diagnostics, supporting mobile clinics and emergency response teams. Stationary platforms, such as bedside monitors, clinical laboratory analyzers, and advanced imaging systems, anchor acute care settings and provide high-fidelity data for complex treatment decisions. Meanwhile, therapeutic devices-including connected inhalers, smart insulin pens, smart hearing aids, and pain management platforms-offer patients control over treatment adherence and dosing personalization.

End user perspectives shed further light on market dynamics. Hospitals remain the principal adopters of high-capacity imaging and in-hospital monitoring devices, leveraging economies of scale to support large patient volumes. Home care services are increasingly integrating wearable and portable solutions to extend care delivery beyond institutional walls, reducing readmission rates and supporting value-based care models. Ambulatory care centers and outpatient clinics have embraced minimally invasive and non-invasive technologies, deploying devices that facilitate same-day diagnostics and therapeutic procedures with minimal downtime.

Technological considerations underscore divergent innovation pathways. Implantable devices continue to benefit from miniaturization and biocompatible materials, while non-invasive technologies leverage advances in sensor accuracy and signal processing to capture physiological data without breaching the skin. Minimally invasive platforms bridge these domains, offering enhanced diagnostic precision with reduced patient discomfort. Applications across cardiology, diabetes management, neurology, oncology, and orthopedics each demand tailored device configurations and data analytics, illuminating the importance of specialized solutions that address unique clinical workflows and patient cohorts.

This multi-dimensional segmentation framework guides strategic decision-making, enabling manufacturers and healthcare stakeholders to align product development, distribution, and service models with targeted use cases and user requirements across the smart medical device ecosystem.

This comprehensive research report categorizes the Smart Medical Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- End User

- Technology

- Application

Regional Dynamics and Market Trends in the Americas, Europe Middle East & Africa, and Asia-Pacific Smart Medical Device Ecosystems

Regional market dynamics are shaped by distinct regulatory environments, infrastructure maturity, and healthcare delivery models. In the Americas, the United States leads with a robust ecosystem of digital health adoption and significant investment in telehealth platforms, reinforced by supportive Medicare reimbursement policies for remote monitoring services. Canada’s single-payer system has fostered pilot programs integrating connected devices into chronic care pathways, with an emphasis on rural and Indigenous populations. Latin America is experiencing nascent growth in smart medical solutions, driven by public-private partnerships aimed at addressing gaps in specialist access and improving resource allocation through cloud-based analytics.

Within Europe, Middle East & Africa, regulatory harmonization via the European Medical Device Regulation has elevated quality and safety standards while enabling cross-border device circulation. Major European markets such as Germany and France leverage dense hospital networks to adopt advanced imaging and postmarket surveillance systems. The United Kingdom’s National Health Service has prioritized predictive analytics and telehealth integration to optimize workflow efficiency amid workforce constraints. In the Middle East, governments are investing in smart hospitals and AI-driven diagnostics to support rapidly expanding healthcare infrastructure, with the United Arab Emirates and Saudi Arabia at the forefront of digital transformation initiatives.

Asia-Pacific represents one of the fastest-growing regions, underpinned by rising healthcare expenditure and mobile penetration. China’s domestic champions are advancing AI-enabled diagnostic platforms, while Japan and South Korea focus on robotics and sensor miniaturization for home healthcare applications. Southeast Asian nations are leveraging telemedicine to bridge urban-rural divides, incorporating wearable devices and cloud-connected analytics into primary care networks. Across the region, collaboration between government agencies, academic institutions, and private sector players is accelerating innovation, with cross-border data-sharing agreements emerging to support multi-center clinical studies.

These regional insights underscore the imperative for market participants to calibrate strategies in line with localized regulatory frameworks, reimbursement structures, and infrastructure capabilities. Tailoring device features, service offerings, and partnership models to regional nuances will be instrumental in capturing value across the global smart medical device landscape.

This comprehensive research report examines key regions that drive the evolution of the Smart Medical Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators: How Key Medical Device Companies Are Pioneering Smart Healthcare Solutions with AI, Connectivity, and Collaboration

Several industry leaders are setting benchmarks in the integration of AI, connectivity, and strategic partnerships to deliver next-generation smart medical solutions. Siemens Healthineers, for example, faced significant headwinds when the U.S. proposed global tariffs threatened to impose a 50% duty on advanced imaging platforms like the Naeotom Alpha photon-counting CT scanner. This technology, developed in Germany, delivers superior image clarity and reduced radiation exposure but relies on complex, globally sourced components. Despite the tariff risk, adoption surged across U.S. health systems due to its clinical value, although some procurement cycles were delayed as hospital administrators reassessed total cost implications.

Philips and Medtronic have reinforced their long-standing collaboration by extending a multi-year strategic partnership that integrates vital sign sensor technologies-such as Nellcor pulse oximetry and Microstream capnography-into Philips’ patient monitoring platforms. The enhanced agreement now includes non-invasive blood pressure modules, electrocardiogram sensors, and comprehensive training programs, enabling healthcare providers to deploy holistic monitoring systems that improve workflow efficiency and patient safety.

GE HealthCare has embraced AI at scale, adding 27 FDA-cleared AI-enabled medical devices to its portfolio since 2023 and upgrading approximately 30% of its MRI scanners with deep-learning algorithms like AIR Recon DL for sharper images and shorter scan durations. Strategic acquisitions of workflow analytics firms and clinical AI businesses have expanded its capabilities in image reconstruction and diagnostic automation, positioning the company as a pivotal partner for health systems seeking to modernize imaging infrastructure.

Tech conglomerate Samsung Electronics is also advancing in the medical domain through its acquisition of Xealth, a digital health platform that connects over 500 U.S. hospitals with patients for mobile healthcare services. This move aligns Samsung’s wearable sensor expertise with Xealth’s program management capabilities to create a unified platform for prescription digital therapeutics, patient engagement, and remote monitoring-highlighting the convergence of consumer electronics with clinical care delivery.

Through these initiatives, leading companies are defining the competitive contours of smart medical devices by blending core competencies in hardware, software, and services to deliver integrated, patient-centric solutions across care settings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Medical Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Baxter International Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Canon Medical Systems Corporation

- Dexcom, Inc.

- GE HealthCare Technologies Inc.

- Intuitive Surgical, Inc.

- Johnson & Johnson

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic plc

- Nihon Kohden Corporation

- Olympus Corporation

- Omron Healthcare Co., Ltd.

- ResMed Inc.

- Siemens Healthineers AG

- Stryker Corporation

- Terumo Corporation

- Zimmer Biomet Holdings, Inc.

Strategic Imperatives for Industry Leaders to Navigate Tariffs, Cybersecurity, and Digital Transformation in the Smart Medical Device Sector

To excel in the evolving smart medical device market, industry leaders must adopt a multifaceted strategic playbook. First, supply chain resilience is paramount: companies should diversify component sourcing across multiple geographies, negotiate long-term contracts to stabilize pricing, and evaluate nearshoring options to minimize exposure to future tariff fluctuations. Developing agile inventory management systems and leveraging predictive analytics can further mitigate disruption risk.

Second, cybersecurity must be engineered into devices from inception by adopting secure product development frameworks, integrating software bill of materials, and establishing robust postmarket vulnerability management protocols. Collaboration with regulatory agencies and participation in industry consortiums can help anticipate emerging security requirements and enable proactive compliance efforts. Embedding threat modeling and continuous monitoring capabilities will safeguard patient data and preserve device integrity across the lifecycle.

Third, leadership should prioritize partnerships that accelerate digital transformation. Alliances with cloud providers, AI specialists, and healthcare systems can facilitate end-to-end solutions that extend beyond hardware to encompass data analytics, remote service models, and patient engagement platforms. Co-development agreements and value-based contracting approaches can align incentives around clinical outcomes rather than unit volume.

Finally, investment in human capital is essential. Equipping clinical and technical teams with training on digital workflows, AI interpretation, and device interoperability fosters internal champions who can drive adoption and optimize clinical utilization. Establishing centers of excellence for smart device integration and offering comprehensive support services will reinforce market differentiation. By executing these imperatives, industry leaders can translate technological promise into sustainable competitive advantage.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Sources, and Rigorous Data Triangulation to Ensure Actionable Insights

This report synthesizes insights derived from a structured research methodology designed to ensure rigor and relevance. Primary research comprised in-depth interviews with device manufacturers, healthcare providers, regulatory experts, and technology partners, providing firsthand perspectives on market dynamics and strategic challenges. Secondary research entailed a systematic review of regulatory filings, industry publications, conference proceedings, and publicly available corporate disclosures to validate market trends and technological innovations.

Data triangulation techniques were employed to reconcile information across multiple sources, ensuring consistency and minimizing bias. Historical analyses of supply chain disruptions and tariff implementations were cross-referenced with company financial disclosures and trade association reports to assess cumulative impacts. Technological evaluations incorporated a comparative assessment of product specifications, FDA approval records, and cybersecurity guidance to map innovation trajectories.

Quantitative insights were augmented with qualitative inputs that captured the evolving stakeholder sentiment around regulatory developments, partnership models, and reimbursement frameworks. Regional dynamics were contextualized through localized case studies of pilot implementations and health system collaborations, elucidating the interplay between infrastructure readiness and adoption pathways.

Quality control protocols included peer review of key findings, validation workshops with subject matter experts, and iterative feedback loops to refine actionable recommendations. This integrated approach ensures that the conclusions and strategic imperatives presented herein are grounded in robust evidence and are readily translatable into operational strategies for market participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Medical Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Medical Devices Market, by Device Type

- Smart Medical Devices Market, by End User

- Smart Medical Devices Market, by Technology

- Smart Medical Devices Market, by Application

- Smart Medical Devices Market, by Region

- Smart Medical Devices Market, by Group

- Smart Medical Devices Market, by Country

- United States Smart Medical Devices Market

- China Smart Medical Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesis of Strategic Insights Illustrating How Smart Medical Devices Are Shaping the Future of Patient Care and Healthcare Delivery

The advent of smart medical devices marks a paradigm shift in healthcare delivery, driven by the confluence of advanced sensors, artificial intelligence, and ubiquitous connectivity. Across device categories-from wearable patches and smart watches to portable imaging units and advanced therapeutic platforms-innovation is reshaping diagnostic accuracy, treatment personalization, and care continuity. The integration of cybersecurity frameworks and regulatory guidance has further solidified the safety and reliability of these interconnected systems.

Tariff pressures in 2025 have illuminated the need for supply chain agility and strategic risk management, while segmentation analysis underscores the value of tailoring solutions to specific device types, end users, technological modalities, and clinical applications. Regional market variations reveal that success hinges on aligning product offerings with localized regulatory landscapes, reimbursement structures, and infrastructure maturity.

Leading companies are setting new benchmarks by combining hardware excellence with digital service models, forging partnerships that span AI pioneers, cloud platforms, and healthcare systems. The actionable imperatives outlined-ranging from cybersecurity integration to partnership-driven growth-offer a clear roadmap for navigating geopolitical uncertainties and accelerating digital transformation.

Ultimately, the smart medical device ecosystem is poised to enhance patient engagement, optimize clinical workflows, and unlock value through data-driven insights. Organizations that embrace resilience, prioritize security, and foster collaborative innovation will be best positioned to capture the opportunities this dynamic market presents.

Contact Ketan Rohom to Secure Your In-Depth Smart Medical Devices Market Research Report and Gain Competitive Advantage Today

Elevate your strategic vision with an in-depth exploration of the smart medical device market. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure a comprehensive market research report that delivers the insights you need to stay ahead of evolving regulatory landscapes, tariff implications, and technological breakthroughs. By partnering with Ketan, you’ll gain customized guidance on segment-specific growth drivers, regional market nuances, and actionable recommendations tailored to your organization’s priorities. Don’t miss the opportunity to leverage expert analysis, proprietary data, and bespoke scenarios that empower you to optimize investment strategies, streamline supply chains, and accelerate innovation. Contact Ketan today and transform uncertainty into opportunity with the definitive resource for smart medical devices market intelligence

- How big is the Smart Medical Devices Market?

- What is the Smart Medical Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?