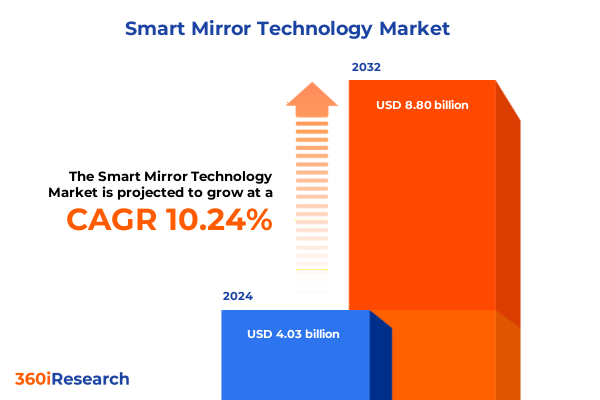

The Smart Mirror Technology Market size was estimated at USD 4.41 billion in 2025 and expected to reach USD 4.84 billion in 2026, at a CAGR of 10.36% to reach USD 8.80 billion by 2032.

Revolutionizing Everyday Interactions with Intelligent Reflective Surfaces That Merge Digital Information with Personal Environments

Smart mirror technology has ushered in a new era of interactive experiences by seamlessly integrating digital intelligence into everyday reflective surfaces. This evolution transforms ordinary mirrors into dynamic interfaces capable of displaying personalized information such as calendars, weather updates, and health metrics while maintaining the utility of a conventional mirror. In commercial environments, these smart surfaces foster engaging brand interactions through targeted advertisements and tailored customer journeys, whereas in residential settings they enhance daily routines by offering virtual try-on for apparel, skincare analysis, and ambient control functionalities.

In the broader context of Internet of Things (IoT) proliferation, smart mirrors exemplify the convergence of hardware innovation, advanced software algorithms, and ubiquitous connectivity. By leveraging embedded sensors, high-definition displays, and machine learning capabilities, these systems adapt to user preferences, anticipate needs, and deliver contextualized insights in real time. Moreover, the integration of voice control and gesture recognition breaks down user-interface barriers, making interactions more intuitive and inclusive. As digital transformation accelerates across sectors, smart mirrors stand at the forefront of human-machine convergence, redefining how individuals engage with their environments and access critical information at the point of interaction.

How Smart Mirror Innovations Are Disrupting Traditional Display Interfaces and Redefining Customer Engagement Across Industries

Over the past decade, smart mirror innovation has shifted from simple display add-ons to sophisticated platforms underpinned by artificial intelligence and edge computing. Initially valued for novelty and mid-level customization, today’s systems leverage predictive analytics to anticipate user behavior, driving deeper personalization and proactive recommendations. In parallel, advancements in anti-fog and dimmable LED technologies have addressed early usability challenges, ensuring that visual clarity and ambient adaptability meet the highest performance standards.

Simultaneously, the move from proprietary connectivity modules to open standards like Bluetooth and Wi-Fi has democratized integration with smart home ecosystems and enterprise networks, fostering greater interoperability. The emergence of voice control integrations and programmable sensor suites has redefined user expectations, pushing manufacturers to embrace modular architectures capable of continuous software upgrades. Consequently, smart mirrors are no longer standalone devices; they function as central nodes within IoT-enabled spaces, orchestrating interactions across lighting, security, and environmental control systems. This transformative landscape highlights a shift toward decentralized intelligence, where data flows bidirectionally between mirror interfaces, cloud analytics engines, and edge devices to deliver seamless and secure user experiences.

Analyzing the Ripple Effects of 2025 United States Tariff Policies on Smart Mirror Supply Chains, Component Costs, and Market Dynamics

In 2025, the implementation of new United States tariffs on electronic components has significantly influenced smart mirror manufacturing and supply chain strategies. Manufacturers have grappled with increased costs for digital displays, sensors, and two-way mirror substrates, as these core hardware elements predominantly originate from tariff-impacted regions. As a result, organizations have reevaluated supplier relationships, prioritizing partners in tariff-free trade zones and exploring nearshoring options to mitigate financial exposure.

Furthermore, software licensing fees and technology integration costs have been subject to indirect tariff pass-through effects, compelling vendors to optimize firmware distribution and adopt open-source frameworks where feasible. The cascading impact of tariffs has also catalyzed investments in domestic production capabilities, with select companies experimenting with local fabrication of optical-grade glass and advanced sensor modules. These shifts underscore a broader industry trend toward supply chain resilience and cost diversification while maintaining stringent quality assurance standards. In navigating this tariff environment, leaders are increasingly emphasizing strategic procurement agility, diversified manufacturing footprints, and collaborative R&D efforts to sustain innovation momentum without compromising on performance or user experience.

Dissecting Smart Mirror Market Segmentation Insights to Illuminate Component, Technology, Connectivity, Display, Application, and End-User Trends

An in-depth examination of the smart mirror ecosystem reveals a multifaceted market shaped by distinct component and technology dimensions. The core hardware segment comprises high-resolution digital displays, precision sensors, and reflective two-way mirror assemblies, each playing a pivotal role in delivering immersive functionality. Complementing this, the software layer integrates advanced anti-fog algorithms, LED lighting controls, touchscreen responsiveness, and sophisticated voice control modules, thereby elevating the interactive dimension of user engagement.

Connectivity emerges as another critical axis, with Bluetooth serving as a low-latency conduit for device-to-device pairing, Wi-Fi enabling seamless remote updates and cloud connectivity, and Zigbee facilitating robust mesh networking in large-scale deployments. Display technology further differentiates offerings, spanning conventional light-emitting diodes for cost-effective implementations, liquid-crystal displays for high-contrast imagery, and organic light-emitting diodes for superior color fidelity and energy efficiency. These component, technology, and connectivity configurations find practical applications across automotive interiors, fitness and wellness facilities, healthcare environments, retail storefronts, and residential settings, each demanding tailored functionalities to meet unique use-case requirements. Lastly, market dynamics are influenced by customer segments bifurcated into commercial enterprises seeking operational efficiencies and residential adopters prioritizing personalization and lifestyle enhancements.

This comprehensive research report categorizes the Smart Mirror Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Connectivity

- Display Technology

- Application

- End-User

Unearthing Regional Dynamics in Smart Mirror Adoption: Distinct Drivers and Barriers Across Americas, EMEA, and Asia-Pacific Markets

Regional adoption of smart mirror solutions varies significantly across the Americas, Europe, the Middle East & Africa, and Asia-Pacific, driven by divergent strategic priorities, infrastructural readiness, and regulatory landscapes. In North America and Latin America, the convergence of advanced retail ecosystems, fitness culture growth, and burgeoning smart home penetration has fueled demand for integrated mirror systems that offer both experiential retail engagement and personalized wellness tracking. Meanwhile, across Europe, the Middle East & Africa, stringent data privacy regulations coexist with robust smart city initiatives, prompting developers to adhere to localized compliance frameworks while integrating dashboards for municipal and healthcare applications.

In the Asia-Pacific region, rapid urbanization, high smartphone saturation, and an affinity for immersive retail experiences have spurred extensive pilot programs and full-scale deployments, particularly within densely populated urban centers. Local manufacturers and international consortiums alike are collaborating on standards for connectivity protocols and user interface localization to address linguistic and cultural nuances. Despite varying adoption rates, a shared emphasis on energy efficiency, modular design, and cybersecurity measures underscores a global recognition of smart mirrors as critical nodes within larger intelligent infrastructure ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Smart Mirror Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Rapidly Shaping the Competitive Landscape of the Global Smart Mirror Industry

Key players in the smart mirror sector are defined by their commitment to cross-disciplinary innovation, strategic alliances, and ecosystem integration. Market leaders have forged partnerships with sensor manufacturers to develop next-generation optical modules that deliver enhanced accuracy for health diagnostics and gesture recognition. Concurrently, collaborations between software developers and lighting technology firms have yielded integrated solutions that dynamically adjust color temperature and brightness based on user profiles and environmental conditions.

Beyond technological prowess, industry frontrunners distinguish themselves through agile go-to-market strategies, leveraging channel partnerships with fitness equipment providers, automotive OEMs, and premium home automation integrators. Their research and development initiatives frequently intersect with academic institutions and standards bodies to influence emerging connectivity protocols and interoperability guidelines. Simultaneously, a cohort of nimble startups is injecting creativity into the market by focusing on niche applications such as virtual styling, dermatological monitoring, and multilingual voice assistants, challenging established incumbents to continuously refine their value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Mirror Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ad notam AG

- Cisco Systems, Inc.

- Continental AG

- Denso Corporation

- Electric Mirror Inc.

- Evervue USA Inc.

- Ficosa Internacional SA

- GENTEX CORPORATION

- iFIT Inc.

- Intel Corporation

- Japan Display Inc.

- Keonn Technologies, S.L.

- LG Electronics, Inc.

- Magna International Inc.

- Murakami Corporation

- Nvidia Corporation

- Panasonic Corporation

- Pro Display

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Séura

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Smart Mirror Opportunities and Navigate Market Challenges

To capitalize on the evolving smart mirror ecosystem, industry leaders must prioritize the cultivation of flexible supply chains and modular product architectures that can swiftly adapt to shifting tariff environments and component availability. Investing in localized manufacturing and assembly capabilities, particularly for critical hardware elements, will minimize exposure to geopolitical fluctuations while accelerating time-to-market. At the same time, forging alliances with cloud service providers and IoT platform integrators will unlock advanced analytics and machine learning services, enabling more personalized and context-aware user experiences.

Another imperative is to establish robust data governance frameworks that align with global privacy regulations while fostering user trust. Companies should implement end-to-end encryption, decentralized identity management, and transparent consent mechanisms to differentiate their offerings. From a product development standpoint, embedding scalable anti-fog and touchscreen technologies alongside dual-mode connectivity options enhances compatibility across diverse deployment scenarios. Finally, adopting a customer-centric innovation approach-iterating features based on feedback from residential users, retailers, healthcare institutions, and automotive partners-will ensure that roadmaps remain tightly aligned with real-world requirements and emerging use cases.

Comprehensive Research Methodology Employing Balanced Qualitative and Quantitative Approaches to Unveil In-Depth Smart Mirror Market Insights

This report’s insights are founded on a rigorous research methodology that combines qualitative interviews, quantitative surveys, and secondary data analysis. Our primary research encompassed in-depth discussions with senior executives, product managers, and technology architects from leading hardware and software companies. These engagements provided firsthand perspectives on innovation roadmaps, supply chain adaptations, and user adoption patterns. Complementing this, a broad-based survey targeting end users across commercial and residential segments offered empirical data on feature preferences, usability thresholds, and purchase drivers.

Secondary research efforts involved systematic reviews of industry publications, patent filings, regulatory documents, and technology white papers to trace the evolution of key component and connectivity standards. Additionally, market activity was mapped through company announcements, partnership disclosures, and M&A transactions to identify competitive dynamics and investment trends. Data triangulation and cross-validation techniques ensured the reliability of findings, while scenario analysis provided a framework for understanding potential future developments. Throughout the process, adherence to ethical research principles and data privacy regulations was maintained to guarantee the integrity and confidentiality of all collected information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Mirror Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Mirror Technology Market, by Component

- Smart Mirror Technology Market, by Technology Type

- Smart Mirror Technology Market, by Connectivity

- Smart Mirror Technology Market, by Display Technology

- Smart Mirror Technology Market, by Application

- Smart Mirror Technology Market, by End-User

- Smart Mirror Technology Market, by Region

- Smart Mirror Technology Market, by Group

- Smart Mirror Technology Market, by Country

- United States Smart Mirror Technology Market

- China Smart Mirror Technology Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesis of Critical Insights and Forward-Looking Considerations for Stakeholders Navigating the Dynamic Smart Mirror Ecosystem

As the smart mirror landscape continues to mature, stakeholders must synthesize the transformative potential of integrated hardware, adaptive software, and resilient supply chains to seize emerging opportunities. The convergence of component innovation-spanning digital displays, sensors, and reflective substrates-with advanced features such as voice control and anti-fog technologies paves the way for differentiated offerings across industries. Equally pivotal are connectivity strategies that balance low-latency local interactions with cloud-driven analytics, ensuring that user experiences remain seamless and secure.

Moreover, regional dynamics underscore the necessity for context-specific approaches, whether addressing privacy requirements in EMEA, harnessing retail innovation in the Americas, or scaling deployments in Asia-Pacific’s urban centers. The strategic alliances and partnerships that shape the competitive landscape highlight the value of cross-sector collaboration, while the evolving tariff environment serves as a reminder of the importance of supply chain agility. By grounding decisions in robust data and fostering continuous dialogue between innovators, integrators, and end users, businesses can navigate uncertainties and drive sustained growth within the dynamic smart mirror ecosystem.

Unlock Exclusive Expert Perspectives and Empower Your Strategic Decisions with Direct Access to the Comprehensive Smart Mirror Market Report

If you seek to harness the full potential of smart mirror technology to revolutionize customer experiences, streamline operations, and strengthen competitive positioning, our comprehensive market research report stands as your definitive resource. Crafted with rigorous analysis, proprietary data insights, and a nuanced understanding of the evolving ecosystem, this report equips you with actionable intelligence that underpins confident decision-making. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how tailored insights can address your strategic priorities and uncover untapped opportunities. Whether you aim to optimize your supply chain resilience, refine product roadmaps, or explore new growth avenues across diverse industries, this resource provides the clarity and depth you require. Reach out to schedule a personalized briefing and secure exclusive access to data-driven recommendations that accelerate innovation and drive sustained market success. Let us partner with you in shaping the future of reflective intelligence and ensuring that your organization leads the way in the smart mirror revolution.

- How big is the Smart Mirror Technology Market?

- What is the Smart Mirror Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?