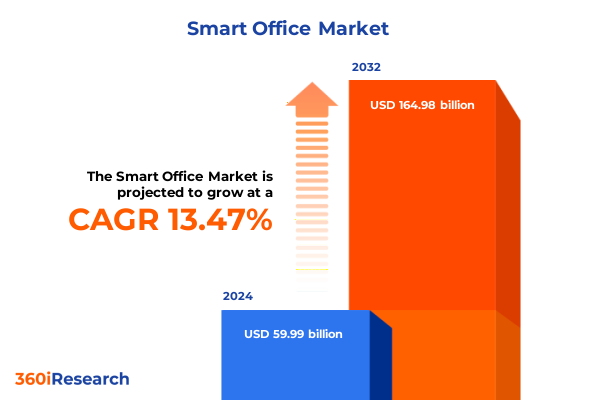

The Smart Office Market size was estimated at USD 67.88 billion in 2025 and expected to reach USD 76.90 billion in 2026, at a CAGR of 13.52% to reach USD 164.98 billion by 2032.

Unlocking the Future of Work Through Integrated Smart Office Technologies That Harmonize Digital Transformation with Employee Experience and Efficiency

In the digital-first era, organizations are reimagining traditional office spaces to meet the demands of a hybrid workforce. Smart office technologies-spanning artificial intelligence, Internet of Things sensors, cloud computing, and advanced analytics-are converging to create environments that optimize energy usage, automate routine tasks, and enhance overall occupant comfort. Integration of IoT devices is enabling real-time monitoring of lighting, temperature, and security systems, allowing facilities managers to make data-driven decisions that reduce operational costs and improve sustainability efforts. As companies pursue greater agility, they are adopting connected devices that facilitate personalized workspace experiences and predictive maintenance, laying the groundwork for truly intelligent work environments.

Moreover, the evolution of collaboration tools and immersive technologies is reshaping how teams interact within these intelligent spaces. AI-driven workplace analytics provide insights into space utilization and employee behaviors, guiding leaders in configuring workstations and meeting rooms for maximum productivity. Meanwhile, the rise of hybrid work models has heightened the need for seamless integration between in-office and remote experiences, with smart lighting, automated climate controls, and intuitive room scheduling platforms collectively creating frictionless transitions. Consequently, modern enterprises are positioning smart office investments as strategic priorities, not only to enhance the employee experience but also to drive competitive advantage through operational excellence.

As emerging technologies such as augmented reality, digital twins, and edge computing gain momentum, organizations are exploring new frontiers for workplace customization. Augmented reality overlays can streamline on-site training and maintenance by projecting contextual information onto physical equipment, while digital twin simulations help real estate teams model space efficiency before committing to capital projects. With heightened emphasis on sustainability, firms are integrating smart sensors to monitor air quality, humidity, and occupancy levels, ensuring healthier workspaces and aligning with corporate ESG goals. By embracing these interconnected innovations, companies are redefining what an office can be-transforming static real estate assets into dynamic, adaptive ecosystems that empower employees and drive long-term value.

How Hybrid Work Models, AI Integration, and Sustainability Imperatives Are Reshaping the Smart Office Landscape for the Modern Enterprise

The transition to hybrid work models has accelerated the need for office environments that can flexibly adapt to evolving workforce patterns. Organizations are investing in modular furniture, adaptable layouts, and smart entry systems to accommodate fluctuating occupancy levels and ensure social distancing when necessary. Real-time space utilization analytics, powered by occupancy sensors, are enabling facility managers to understand peak usage times and reconfigure floor plans for optimal performance. As a result, workspaces are becoming more dynamic and responsive to both planned and impromptu collaboration needs.

Simultaneously, artificial intelligence and machine learning are driving a paradigm shift in how office systems are managed. Predictive maintenance algorithms leverage data from smart sensors to anticipate equipment failures, reducing downtime and prolonging asset lifecycles. AI-powered room scheduling software optimizes meeting allocations based on historical usage patterns, conserving energy by shutting down unoccupied spaces and streamlining workflows. By automating these functions, businesses are not only improving operational efficiency but also freeing human resources for more strategic tasks.

Augmented reality and virtual reality technologies are emerging as transformative tools for immersive collaboration and facility management. AR-guided workflows simplify equipment maintenance and calibration, overlaying critical instructions directly onto the physical environment. Virtual reality enables remote teams to virtually explore digital twins of office layouts, facilitating stakeholder alignment on design decisions without the need for physical walkthroughs. These immersive experiences help break down geographical barriers and foster a sense of presence among dispersed teams.

In tandem with technological innovation, sustainability imperatives are influencing smart office deployments. Energy optimization platforms use machine learning to adjust HVAC settings and lighting schedules based on occupancy and weather forecasts, reducing carbon footprints and utility expenses. Additionally, smart materials and green building practices, such as integrating adaptive facades and energy-harvesting components, are becoming standard expectations for employers committed to environmental responsibility and regulatory compliance.

Assessing the Ripple Effects of 2025 United States Tariff Policies on Smart Office Hardware, Software Supply Chains, and Implementation Costs

In 2025, the United States Trade Representative has undertaken a series of measures that will collectively reshape cost structures for smart office solutions. A significant decision on May 31, 2025, extended existing exclusions under Section 301 tariffs on Chinese-origin goods, including critical electronics components and equipment, through August 31, 2025. This extension provides temporary relief for hardware imports such as smart sensors and collaboration systems, allowing companies additional time to procure essential devices without the immediate burden of 25% duties and higher. However, organizations must prepare for the imminent conclusion of these exclusions and associated financial implications.

Concurrently, the administration’s reciprocal tariff framework-initially imposing a baseline 10% levy on the majority of imports-remains paused until July 8, 2025, after which duties of up to 30% on goods from select trading partners may resume. Following the expiration of temporary tariff reductions enacted under a negotiated U.S.–China trade agreement, new 30% tariffs on European Union and Mexican imports are slated to take effect on August 1, 2025. These developments introduce pricing volatility for hardware categories essential to smart office implementations, notably audio-visual equipment and IoT devices, potentially increasing acquisition costs and project budgets.

Layers of complexity are further added by retained duties from previous administrations. The Biden administration has maintained substantial tariffs on strategic goods-including 100% duties on electric vehicles and 25% on steel and aluminum-that indirectly affect smart office configurations by raising logistical and manufacturing costs for metal-intensive and energy-efficient hardware. While software and cloud-based services remain mostly exempt, the hardware cost escalation translates into higher total cost of ownership for integrated workplace management systems and digital twins, urging stakeholders to reassess procurement strategies and supply chain resilience.

Looking ahead, industry leaders are advised to adopt a multifaceted approach to mitigate tariff-related risks. Strategies such as diversifying supplier bases, negotiating long-term contracts ahead of tariff expirations, and exploring domestic manufacturing partnerships can help stabilize costs and maintain deployment timelines. Furthermore, monitoring regulatory updates and planning capital expenditure acceleration before tariff reinstatements will be critical for preserving project viability in a shifting trade policy environment.

Understanding Critical Market Segments from Hardware to Software and Services to Drive Tailored Smart Office Solutions Across Diverse Enterprise Needs

Based on Offering Type, the market encompasses hardware, services, and software, each contributing unique value propositions for smart offices. Hardware offerings range from advanced audio-visual and collaboration systems to intelligent security networks and environmental controls, including smart climate, lighting, sensors, and ergonomically designed workplace furniture. Managed services deliver essential lifecycle management, maintenance support, and remote monitoring, while professional services offer consulting, installation, customization, and system integration expertise. Software platforms, such as building energy management systems, integrated workplace management suites, room scheduling tools, and video analytics applications, orchestrate these elements into cohesive, automated ecosystems.

Based on Technology and Function, innovations like artificial intelligence and machine learning enable predictive maintenance, intelligent automation, and space utilization analytics. Augmented reality and virtual reality foster immersive collaboration and efficient on-site workflows, while big data and blockchain secure and analyze operational data. Cloud computing facilitates scalable deployments, digital twins simulate performance scenarios, and edge computing supports low-latency sensor networks. Functions span collaboration enablement, energy optimization, climate and lighting automation, health and wellness monitoring, occupancy analytics, security surveillance, smart entry systems, and holistic workspace optimization.

Based on Office Type and End-User, solutions are tailored for environments from co-working hubs and executive suites to home offices, open-plan areas, and private offices, each demanding specific configurations. Industry verticals such as banking, education, government, healthcare, IT and telecom, legal and consulting, manufacturing, media and entertainment, and retail and e-commerce have distinct requirements for security, compliance, collaboration, and environmental monitoring, driving customized deployments.

Based on Building Type and Organization Size, new construction projects embed smart technologies during the design phase for full interoperability, while retrofit initiatives leverage modular, non-intrusive installations in existing structures. Large enterprises deploy enterprise-grade platforms with centralized management, whereas small and medium enterprises opt for flexible, cost-efficient packages that scale with growth needs.

This comprehensive research report categorizes the Smart Office market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technology

- Office Type

- Building Type

- Application

- Organization Size

- End User Industry

Mapping Regional Trends in the Smart Office Ecosystem to Highlight Growth Drivers, Regulatory Influences, and Innovation Hotspots Across Americas, EMEA, and APAC

In the Americas, adoption of smart office technologies is propelled by corporate commitments to energy efficiency and employee experience. Over 64% of enterprises have implemented intelligent lighting and automated climate control systems, and approximately 57% utilize occupancy sensors to optimize space utilization. Around 61% of organizations now integrate connected meeting room solutions and collaboration tools to support hybrid workflows, while 46% employ AI-driven virtual assistants and smart desks to streamline administrative tasks. Furthermore, about 52% of offices have incorporated IoT-enabled access control systems for enhanced security, and 58% have transitioned to centralized, cloud-based control platforms for real-time facility management.

In Europe, Middle East & Africa, regulatory mandates and sustainability directives are significant growth catalysts. Energy efficiency regulations in Germany and the UK have driven nearly half of commercial buildings to adopt AI-based management platforms for optimized operations. The region contributes approximately 18% to the global smart office market, with leading investments in the UAE and Saudi Arabia where nearly 42% of new office developments now feature integrated automation and energy-efficient systems. Meanwhile, African urban centers are gradually embracing mobile-first office automation to accelerate digital transformation.

This comprehensive research report examines key regions that drive the evolution of the Smart Office market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Smart Office Arena with Cutting-Edge Solutions and Expansive Ecosystem Partnerships

Crestron Electronics continues to lead workplace technology innovation through strategic ecosystem partnerships and advanced collaboration solutions. In February 2025, Crestron announced its integration with the Microsoft Device Ecosystem Platform, enabling the development of purpose-built devices that combine Crestron’s digital workplace expertise with Microsoft’s enterprise-grade security and management standards. Additionally, Crestron has introduced visual AI features that automatically track speakers in hybrid meeting rooms and firmware updates for multi-camera switching, elevating the user experience and simplifying system deployments.

Cisco has also unveiled a secure network architecture designed to accelerate AI-powered workplace transformations. Announced in June 2025, the new architecture unifies AI-driven management capabilities with next-generation high-capacity networking devices and a quantum-resistant security model, enabling enterprises to scale AI solutions securely and efficiently. Cisco’s investments in immersive collaboration devices-such as Room Kit EQX, Room Bar Pro, and the Webex Suite with AI assistant-demonstrate its commitment to delivering unified experiences across physical and virtual workspaces.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Office market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Accenture PLC

- Amazon Web Services, Inc.

- Atos SE

- Cisco Systems, Inc.

- Comcast Corporation

- Coor Group

- Crestron Electronics, Inc.

- Eptura, Inc.

- Fujitsu Limited

- General Electric Company

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IDEX Biometrics ASA

- Intel Corporation

- International Business Machines Corporation

- Johnson Controls International PLC

- Komstadt Systems Limited

- KoreLock, Inc.

- KPMG International Limited

- König + Neurath AG

- Legrand SA

- Lenovo Group Limited

- Leviton Manufacturing Co., Inc.

- LG Electronics Inc.

- Lutron Electronics Co., Inc.

- Microsoft Corporation

- NTT DATA Group Corporation

- Panasonic Holdings Corporation

- PointGrab Inc.

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG

- TD SYNNEX Corporation

- URVE Smart Office

- XBP Global, Inc.

Strategic Action Plans for Industry Leaders to Capitalize on Smart Office Innovations, Mitigate Risks, and Drive Sustainable Growth in Hybrid Work Environments

To capitalize on smart office advancements, industry leaders should prioritize the integration of cybersecurity measures across all IoT and connected systems, leveraging AI-driven threat detection and robust encryption protocols to protect sensitive data and operational continuity. Concurrently, organizations must diversify supply chains and negotiate long-term agreements ahead of tariff expirations to mitigate cost fluctuations and ensure timely hardware availability.

Leaders are advised to deepen investment in digital twin and simulation capabilities, using virtual environments to model space utilization and system performance before committing capital expenditures. Engaging end users through workshops and feedback loops during solution design phases will enhance adoption rates and align deployments with evolving workstyles. Furthermore, sustainability goals should be embedded into technology roadmaps by adopting adaptive façades, energy-harvesting systems, and AI-based energy management platforms, reducing carbon footprints and meeting regulatory requirements.

Finally, fostering strategic partnerships with ecosystem players-ranging from device manufacturers to managed service providers-can accelerate innovation cycles and extend the value proposition of smart office investments. By emphasizing continuous learning and agile governance, enterprises will be better positioned to adapt to emerging trends and maintain a competitive edge in hybrid work environments.

Transparent and Robust Research Methodology Outlining Data Collection, Analysis Techniques, and Validation Protocols to Ensure Credibility and Actionable Insights

This research combined comprehensive secondary analysis and primary stakeholder engagement to ensure rigorous, actionable insights. Secondary sources included trade publications, government documents, company filings, and reputable industry reports, which provided foundational market context and technology overviews.

Primary research involved in-depth interviews with C-level executives, facility managers, IT leaders, and channel partners across key regions, supplemented by an online survey capturing adoption drivers and deployment challenges. Data triangulation normalized disparate inputs, while expert panel reviews validated findings against real-world use cases.

Quantitative modeling employed scenario analysis to assess the impact of tariff policies and technology adoption rates, and qualitative frameworks evaluated organizational readiness, regulatory environments, and sustainability imperatives. Ethical protocols governed data confidentiality, and a continuous update cycle ensures relevance in a rapidly evolving market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Office market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Office Market, by Offering

- Smart Office Market, by Technology

- Smart Office Market, by Office Type

- Smart Office Market, by Building Type

- Smart Office Market, by Application

- Smart Office Market, by Organization Size

- Smart Office Market, by End User Industry

- Smart Office Market, by Region

- Smart Office Market, by Group

- Smart Office Market, by Country

- United States Smart Office Market

- China Smart Office Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesizing Key Takeaways from Technological, Economic, and Regulatory Perspectives to Chart the Next Course in Smart Office Evolution

The smart office landscape is defined by the convergence of digital, physical, and regulatory forces reshaping how organizations design, operate, and inhabit workspaces. Technological enablers such as AI, IoT, and immersive reality are unlocking new efficiencies, while sustainability imperatives are compelling investments in energy optimization and environmental monitoring. Trade policy shifts in 2025, notably U.S. tariff extensions and impending reciprocal duties, underscore the need for agile procurement strategies and supply chain diversification.

Segmentation analysis reveals that tailored bundles across offering types, technology platforms, and industry verticals are critical for meeting diverse enterprise needs. Regional dynamics-from high adoption rates in the Americas and APAC to stringent compliance requirements in EMEA-demand localized approaches to solution configuration and service delivery. Leading innovators like Crestron, Cisco, and Johnson Controls exemplify how ecosystem partnerships and AI-driven product roadmaps can maintain a competitive edge.

In actioning these insights, industry practitioners must balance risk mitigation-including cybersecurity and tariff exposure-with strategic investments in digital twins, sustainability initiatives, and user-centric design. By fostering collaborative governance models and continuous feedback mechanisms, organizations can evolve their workplaces into resilient, adaptive environments that drive productivity, well-being, and long-term value creation.

Engaging with Ketan Rohom to Secure Comprehensive Smart Office Intelligence and Drive Strategic Decision-Making with Our In-Depth Market Research Report

To explore how this comprehensive smart office intelligence can support your strategic planning and investment decisions, connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings a deep understanding of market drivers and industry challenges, and can guide you through tailored insights from the report to align with your organization’s priorities. Reach out to schedule a briefing or request a customized proposal that highlights the findings most relevant to your business objectives.

- How big is the Smart Office Market?

- What is the Smart Office Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?