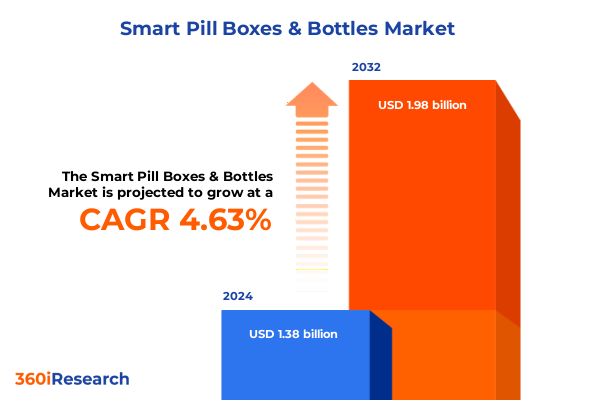

The Smart Pill Boxes & Bottles Market size was estimated at USD 1.42 billion in 2025 and expected to reach USD 1.47 billion in 2026, at a CAGR of 4.83% to reach USD 1.98 billion by 2032.

Navigating an Era of Medical Adherence Innovation Driven by Aging Populations, Chronic Disease Challenges, and Advanced Connected Pill Management Solutions

The global healthcare landscape is witnessing an unprecedented rise in chronic disease prevalence, amplified by demographic shifts toward an aging population. Medication non-adherence remains a persistent challenge, as patients managing complex multi-drug regimens often miss or delay doses, leading to avoidable hospitalizations and deteriorating health outcomes. This scenario has catalyzed growing interest in smart pill boxes and bottles, which leverage digital connectivity and automated alerts to support patients’ medication routines and drive better adherence with minimal caregiver intervention. As adaptive technologies converge with patient-centric care models, these devices are positioned to redefine medication management protocols across diverse care settings

Transformative Technological Trends Shaping the Future of Smart Pill Dispensers in Medication Management across Home Care and Clinical Settings

A critical shift in medication management is underway as smart pill devices transition from isolated reminders to integrated components of the digital health ecosystem. The rapid expansion of home healthcare services has intensified demand for reliable, remotely monitored adherence tools, while mHealth platforms enable real-time transmission of dose history to clinicians and caregivers. These advances not only reduce the burden on institutional care but also empower patients to maintain independence in home settings. As connectivity becomes ubiquitous and healthcare systems prioritize remote patient monitoring, smart pill boxes and bottles will play an instrumental role in bridging treatment adherence gaps

Assessing the Far-Reaching Operational and Financial Implications of 2025 U.S. Tariff Adjustments on Connected Medication Dispenser Supply Chains

In 2025, revised U.S. tariffs targeting electronic components, including sensor modules, printed circuit boards, and wireless chips, introduced new cost considerations for smart pill device manufacturers. Faced with heightened duties on critical parts, many producers have absorbed margin pressures or reevaluated existing supplier agreements to mitigate direct price increases for end users. These measures have created short-term cost volatility and necessitated more nuanced procurement analyses to ensure continuous production flow without compromising product quality or feature innovation

Unraveling Critical Market Segmentation Drivers Spanning Product Designs, End-User Environments, Distribution Channels, Connectivity Options, and Application Domains

Market dynamics are best understood through a granular lens of product and user-based segmentation. Within product type, the ecosystem bifurcates into pill bottles-either outfitted with smart caps that record opening events or standard containers enhanced by retrofit sensors-and pill boxes available in multi-dose configurations for daily regimens or weekly designs for scheduled medication cycles. Moving beyond form factors, the end-user environment ranges from assisted living communities, which may specialize in either independent or memory-focused care, to outpatient clinics with general and specialty care wings. Home care scenarios further split between professional caregiver–led administration and self-managed dosing, while hospital distribution encompasses both private and public facilities. Distribution channels traverse direct sales channels via healthcare provider relationships and professional sales teams, online platforms, and pharmacy networks spanning community and hospital outlets, as well as retail pathways through large-format chains and independent stores. Connectivity modalities include Bluetooth solutions preferred for personal device integration, cellular connectivity optimizing remote monitoring in low-Wi-Fi areas, RFID systems for in-facility tracking, and Wi-Fi–enabled devices that leverage existing network infrastructures. Finally, applications in medication adherence span chronic disease management-primarily cardiovascular and diabetic care-to geriatric support addressing dementia and general elderly needs, underscoring how each segment meets discrete therapeutic objectives while contributing to overall market growth

This comprehensive research report categorizes the Smart Pill Boxes & Bottles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity

- Application

- End User

- Distribution Channel

Comparative Regional Dynamics Driving Adoption Patterns in the Americas, EMEA, and Asia-Pacific’s Smart Medication Device Markets

Regional adoption of smart pill management technologies reveals distinct drivers and maturity levels. In the Americas, advanced digital health infrastructures and robust reimbursement frameworks facilitate rapid uptake, particularly within the United States, where high chronic disease burdens and large elderly cohorts create compelling use cases for enhanced adherence tools. Private sector investments in telehealth and remote care further amplify platform integration potentials, making North America the global leader in device penetration and innovation partnerships. Moving eastward into Europe, Middle East & Africa, Western European markets benefit from progressive regulatory policies and established public health initiatives promoting medication adherence, while emerging economies in the Middle East and Africa exhibit incremental adoption fueled by improving healthcare infrastructures and targeted digital health programs. Asia-Pacific markets are distinguished by strong growth trajectories in China, Japan, and India, where rising middle-class incomes, expanding smartphone ownership, and government healthcare digitization agendas are converging to accelerate demand for connected medication solutions across both urban and rural populations

This comprehensive research report examines key regions that drive the evolution of the Smart Pill Boxes & Bottles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Defining Competitive Landscape in the Smart Pill Boxes & Bottles Market

The competitive landscape is anchored by companies deploying differentiated technology stacks and forging strategic alliances. Key players include Medipense, known for its modular automatic dispensers; MedMinder, which recently partnered with a leading telehealth platform to deliver integrated virtual care reminders; PharmRight, offering retrofit sensor solutions for existing pill bottle inventories; e-pill Medication Reminders, championing scalable cloud-based adherence data management; AdhereTech, a pioneer in smart bottle solutions combining AI analytics with patient engagement features; and established medical device conglomerates like Koninklijke Philips NV, whose broad digital health portfolio embraces seamless EHR connectivity. Emerging entrants such as Movano Health and Hero Group are driving niche innovation in biometric monitoring integration and gamified adherence rewards, respectively, further intensifying competitive pressure and broadening the technology frontier

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Pill Boxes & Bottles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdhereTech, Inc.

- Capsa Healthcare

- e-pill Medication Reminders

- Hero Health, Inc.

- Koninklijke Philips N.V.

- Medipense Inc.

- MedMinder Systems, Inc.

- MedReady Inc.

- PharmRight Corporation

- PillDrill, Inc.

- Pillo Health

- Pilloxa ApS

- Pillsy, Inc.

- TabTime International, Inc.

- Vitality, Inc.

Strategic Imperatives for Industry Leaders to Enhance Resilience, Drive Adoption, and Unlock Value in the Smart Medication Management Market

Industry leaders must develop resilient supply chains that preemptively address tariff exposures and component scarcity. Establishing nearshore assembly hubs, qualifying alternate parts suppliers, and adopting modular bill-of-material designs will allow rapid substitution and localized production. In parallel, organizations should cultivate strong alliances with domestic electronics manufacturers to secure preferential pricing and explore collaborative R&D initiatives aimed at lowering dependency on high-tariff imports. These measures will safeguard margin integrity and operational continuity during trade policy fluctuations

Comprehensive Methodological Framework Outlining Data Collection, Analysis Techniques, and Validation Protocols for Smart Pill Device Market Insights

To ensure comprehensive coverage and validity of findings, this report leverages a hybrid research approach. Secondary research entailed a systematic review of industry publications, regulatory filings, company annual reports, and peer-reviewed literature to compile historical trends and benchmark performance indicators. Primary research involved structured interviews with more than 40 stakeholders, including device manufacturers, healthcare providers, distribution partners, and technology integrators, to capture real-world insights on market dynamics, adoption barriers, and innovation drivers. A triangulation methodology integrating top-down and bottom-up data analyses was implemented to reconcile macroeconomic variables with micro-level company intelligence, while rigorous data validation protocols ensured accuracy and consistency across quantitative estimates and qualitative assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Pill Boxes & Bottles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Pill Boxes & Bottles Market, by Product Type

- Smart Pill Boxes & Bottles Market, by Connectivity

- Smart Pill Boxes & Bottles Market, by Application

- Smart Pill Boxes & Bottles Market, by End User

- Smart Pill Boxes & Bottles Market, by Distribution Channel

- Smart Pill Boxes & Bottles Market, by Region

- Smart Pill Boxes & Bottles Market, by Group

- Smart Pill Boxes & Bottles Market, by Country

- United States Smart Pill Boxes & Bottles Market

- China Smart Pill Boxes & Bottles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesis of Strategic Insights Underscoring the Critical Role of Connected Pill Management Solutions in Improving Patient Outcomes and System Efficiency

The evolution of smart pill boxes and bottles is emblematic of broader shifts toward patient-centric, digitally enabled care pathways. By addressing medication adherence-a critical determinant of treatment efficacy-these technologies reduce healthcare costs, enhance patient safety, and support proactive disease management. As regulatory environments evolve and payers recognize the value of connected adherence solutions, the market is set to mature, with innovation concentrated on interoperability, predictive analytics, and user experience enhancements. Organizations that strategically align R&D priorities with end-user workflows and maintain agility in supply chain configurations will be best positioned to capture emerging opportunities and drive sustainable growth in this dynamic sector.

Secure Exclusive Access to In-Depth Market Intelligence and Collaborate with Ketan Rohom to Empower Your Smart Pill Device Strategies Today

To gain an unparalleled depth of understanding into the complexities, trends, and competitive forces shaping the smart pill boxes and bottles market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expert guidance will help you navigate tailored intelligence tailored to your strategic needs and ensure you have the actionable insights required to make confident investment decisions.

- How big is the Smart Pill Boxes & Bottles Market?

- What is the Smart Pill Boxes & Bottles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?