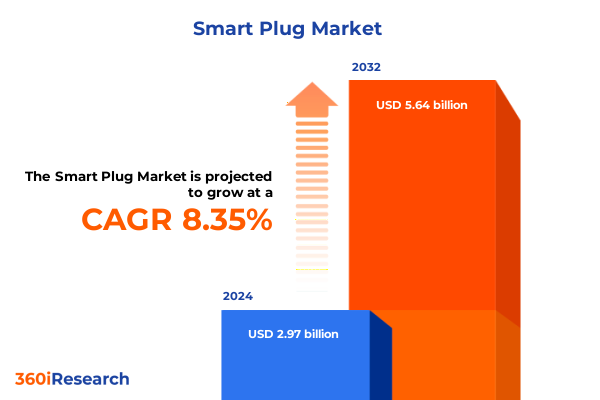

The Smart Plug Market size was estimated at USD 3.20 billion in 2025 and expected to reach USD 3.46 billion in 2026, at a CAGR of 8.40% to reach USD 5.64 billion by 2032.

Pioneering the Integration of Connectivity and Control Through Smart Plugs to Empower Energy Management and User Convenience at Home and Beyond

The evolution of smart plug technology represents a remarkable convergence of connectivity energy management and user empowerment. In the wake of proliferating Internet of Things ecosystems, these devices have transcended their origins as mere power switches to become integral components of intelligent home and commercial automation networks. Today’s smart plugs facilitate granular control over appliance usage, streamline energy consumption patterns and foster seamless integration with voice assistants edge computing platforms and advanced analytics engines.

As households and businesses increasingly prioritize sustainability and cost savings, smart plugs have emerged as accessible gateways to real-time monitoring and remote operation of electrical loads. Enhanced interoperability standards and the adoption of open communication protocols have further accelerated deployment, enabling cross-brand compatibility and unified control through centralized dashboards. In this context, the smart plug market stands at the forefront of digital transformation, poised to address rising consumer expectations for convenience, efficiency and data-driven insights in everyday operations.

Navigating the Rapid Emergence of IoT Ecosystems Edge Computing and Voice Assistants Redefining the Use Cases and Functionalities of Smart Plugs Globally

Recent years have witnessed a cascade of transformative shifts that have redefined the functional and strategic dimensions of smart plugs. The maturation of low-power wireless technologies, such as Zigbee and Z-Wave, alongside enhancements in Wi-Fi bandwidth and latency reduction, has enabled more robust device ecosystems capable of supporting complex sequencing and automation logic. Meanwhile, the ascendancy of voice-driven interfaces, powered by leading virtual assistants, has shifted user expectations toward hands-free operation, driving manufacturers to embed advanced natural language processing capabilities at the device level.

Concurrently, the integration of edge analytics and machine learning algorithms allows smart plugs to autonomously detect usage anomalies and optimize schedules for peak and off-peak energy rates. This shift from reactive control to predictive orchestration underscores a broader industry pivot toward anticipatory computing, where devices actively participate in energy optimization and grid stability initiatives. As interoperability frameworks converge and open APIs proliferate, the smart plug landscape is rapidly transforming from isolated point solutions into cohesive intelligent infrastructures capable of dynamic adaptation and cross-device collaboration.

Examining the Layers of Trade Policy Interventions and the Ripple Effects of 2025 United States Tariffs on Supply Chains and Product Pricing Dynamics

The introduction of new United States tariff schedules in early 2025 has introduced significant cost pressures across the smart plug supply chain, triggering a reevaluation of component sourcing strategies and pricing frameworks. Import duty adjustments on key semiconductor components and wireless modules have elevated landed costs, particularly for devices dependent on advanced system-on-chip architectures. In response, original design manufacturers and component suppliers have accelerated efforts to diversify their manufacturing footprints, exploring near-shoring opportunities and regional assembly hubs to mitigate duty impacts.

These policy shifts have also catalyzed renegotiations of supplier agreements and the exploration of alternative chipset partnerships, with a growing focus on domestic semiconductor foundries. End users are experiencing adjusted MSRP structures as a result of these ripple effects, which in turn are influencing procurement cycles, long-term purchasing commitments and aftermarket service agreements. As market participants adapt to this new tariff environment, collaborative models between brands, distributors and system integrators are emerging as viable pathways to stabilize costs and sustain innovation momentum within the smart plug sector.

Unlocking Strategic Opportunities by Delving into Diverse Segmentation Perspectives to Illuminate Product Preferences and Consumption Behaviors in the Market

In analyzing the smart plug environment through multiple segmentation dimensions, it becomes clear that distinct product types cater to diverse technical requirements and consumer preferences. Devices utilizing Bluetooth excel in localized, battery-efficient applications, whereas hybrid models offer multispectral connectivity that balances range and reliability. Wi-Fi variants, by contrast, deliver seamless cloud integration and broad network reach, while Zigbee and Z-Wave products excel in mesh-network configurations and low-power operations.

Diving deeper, segmentation by outlet configuration illuminates how single-socket designs prioritize compact form factors and point-of-use installations, while multiple-outlet units address scenarios demanding centralized load control and space efficiency. Power rating analysis reveals that sub-1000W plugs are ideal for lightweight electronics, 1000W to 2000W models support mainstream appliances, and above-2000W solutions accommodate high-load industrial equipment. Application insights differentiate between residential adoption for smart home enthusiasts, commercial deployment in office and retail environments, and industrial usage where stringent reliability and safety standards prevail. Finally, the distribution channel mix, split between online marketplaces and traditional brick-and-mortar outlets, underscores shifting procurement behaviors as end users seek both virtual convenience and in-person technical support.

This comprehensive research report categorizes the Smart Plug market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Outlet

- Power Rating

- Application

- Sales Channel

Revealing Regional Nuances in Demand Patterns and Regulatory Frameworks Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics within the smart plug arena reflect a tapestry of regulatory frameworks technology readiness levels and consumer adoption velocities. In the Americas, aggressive incentives for energy efficiency and established broadband infrastructures have catalyzed rapid penetration into both residential and commercial segments. Meanwhile, Europe Middle East and Africa illustrate a heterogeneous landscape: stringent energy labeling requirements in Western Europe coexist with emerging smart grid pilot programs in select Middle Eastern markets and nascent e-mobility integration initiatives across parts of Africa.

Asia Pacific stands out for its sheer scale of manufacturing capabilities and a broad spectrum of maturity across national markets. Advanced IoT standards in East Asia drive innovation in ultra-compact form factors and integrated sensor arrays, while Southeast Asian countries are witnessing accelerated urbanization and smart city projects that incorporate smart plugs as enabling nodes for district-level energy management. Australia and New Zealand are advancing regulatory frameworks for residential battery storage pairing with smart plugs, signaling the next frontier of distributed energy resource orchestration in the region.

This comprehensive research report examines key regions that drive the evolution of the Smart Plug market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Differentiation Strategies Employed by Industry Leaders to Drive Innovation Partnerships and Market Penetration in the Smart Plug Sector

Leading participants in the smart plug sector are differentiating through a blend of technological innovation channel partnerships and value-added services. Certain OEMs have doubled down on proprietary chipset development to optimize power efficiency and security, while others forge alliances with cloud platform providers to deliver turnkey management portals and advanced analytics suites. Strategic collaborations with telecommunications operators and energy utilities are also emerging, positioning smart plugs as integral components of demand response and grid-stabilization programs.

Simultaneously, brand owners are investing in modular hardware architectures that support firmware-over-the-air updates and third-party integration via open APIs, thus fostering developer ecosystems and accelerating feature rollouts. Distribution strategies vary widely, with some players leveraging direct-to-consumer channels to cultivate brand loyalty and retail partnerships to tap into legacy customer bases. Taken together, these competitive maneuvers underscore a broader industry imperative to balance differentiation through user experiences, product scalability and ecosystem interoperability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Plug market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeotec Group GmbH

- Belkin International, Inc.

- Broadlink International

- CUCO Inc.

- Dell Inc.

- Eve Systems GmbH

- GE Appliances, Inc.

- IKEA Limited

- ITEAD Intelligent Systems Co.,Ltd

- LEGRAND S.A.

- Leviton Manufacturing Co., Inc.

- Lumi United Technology Co., Ltd

- Lutron Electronics Co., Inc

- Meross Technology Limited

- ORVIBO, Inc.

- Panasonic Corporation

- Robert Bosch Smart Home GmbH

- Schneider Electric SE

- Shelly PLC

- Shenzhen Gosund Technology Co., Ltd.

- Signify Holding.

- TP-Link India Private Limited.

- Wipro Limited.

- Wyze Labs, Inc.

- Xiaomi Technology Netherlands B.V.

Formulating Actionable Roadmaps and Tactical Initiatives to Guide Industry Leaders in Capturing Growth Imperatives and Mitigating Emerging Market Challenges

To capitalize on emerging opportunities and address evolving market challenges, industry leaders should prioritize investments in secure edge analytics capabilities and modular hardware platforms that can adapt to shifting interoperability standards. Strengthening partnerships with energy providers and regulatory bodies will enable joint creation of incentive programs and pilot deployments that demonstrate both performance gains and sustainability benefits. By embedding analytics engines directly within smart plug firmware, organizations can deliver predictive maintenance alerts and usage optimization recommendations, thereby enhancing value propositions for end users.

Furthermore, forging alliances with telecom carriers can unlock bundled service offerings, combining connectivity and device management under unified pricing models. Embracing a hybrid channel strategy-balancing digital storefronts with experiential retail environments-will cater to both technology-savvy consumers and professionals seeking hands-on demonstrations. Lastly, establishing cross-industry consortia to develop standardized security frameworks will mitigate fragmentation risks and foster consumer confidence, ensuring that the rapid evolution of smart plug functionalities is matched by robust trust mechanisms.

Outlining the Rigorous Research Protocols and Analytical Approaches Employed to Ensure Robust Data Integrity and Comprehensive Market Insights

This study was grounded in a systematic research methodology combining primary interviews secondary data aggregation and rigorous triangulation processes to validate insights. Primary engagement encompassed discussions with executive stakeholders technology architects and channel partners to capture firsthand perspectives on innovation pipelines and adoption barriers. Complementary secondary research drew upon publicly available corporate filings, regulatory mandates and technical whitepapers to contextualize these qualitative findings within broader industry developments.

Data synthesis employed a structured triangulation framework, cross-referencing vendor disclosures with customer feedback loops and third-party performance benchmarks. This approach ensured coherence between reported feature roadmaps and actual deployment experiences. Additionally, the research team conducted scenario analyses to stress-test the implications of policy adjustments and technology disruptions. All findings underwent multi-stage peer reviews to guarantee analytical rigor and eliminate potential biases, resulting in a robust intelligence foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Plug market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Plug Market, by Type

- Smart Plug Market, by Outlet

- Smart Plug Market, by Power Rating

- Smart Plug Market, by Application

- Smart Plug Market, by Sales Channel

- Smart Plug Market, by Region

- Smart Plug Market, by Group

- Smart Plug Market, by Country

- United States Smart Plug Market

- China Smart Plug Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Takeaways into a Cohesive Narrative to Emphasize Market Trajectories Strategic Imperatives and the Future Outlook of Smart Plug Adoption

The smart plug market is experiencing a pivotal moment as technology advancements converge with shifting regulatory landscapes and evolving consumer expectations. Interconnectivity enhancements and the rise of edge analytics are charting new functional horizons, while trade policy developments underscore the importance of supply chain agility. Through diverse segmentation lenses, we see that product type preferences outlet configurations power capacities application domains and channel strategies each reveal unique pockets of opportunity and risk.

Regionally, the Americas, EMEA and Asia Pacific showcase differentiated growth trajectories shaped by local incentives and infrastructure maturity. Meanwhile, leading companies are staking competitive positions through chipset innovation, ecosystem partnerships and hybrid distribution approaches. For industry leaders, the path forward lies in harnessing predictive intelligence, forging strategic alliances and championing open security standards. By aligning these imperatives with actionable roadmaps and rigorous research foundations, stakeholders can confidently navigate the dynamic smart plug landscape and unlock sustainable value.

Empowering Strategic Decisions by Engaging with Associate Director of Sales Marketing Ketan Rohom to Access In-Depth Market Intelligence and Custom Analyses

The smart plug market research report offers unparalleled depth in data analysis and strategic evaluation, equipping decision makers with high-resolution clarity on evolving customer preferences product life cycles and partner ecosystems. With a dedicated consultation led by Associate Director of Sales & Marketing Ketan Rohom, clients receive tailored guidance on leveraging granular competitive intelligence and aligning research insights with organizational priorities. His expertise bridges quantitative findings and qualitative narratives, enabling prospects to translate trend curves into actionable roadmaps and seize first-mover advantages.

By collaborating directly with Ketan Rohom, stakeholders gain access to a suite of customized dashboards interactive workshops and executive briefings, all designed to accelerate go-to-market timelines and optimize resource allocation. This partnership transcends off-the-shelf data, delivering bespoke scenario modeling and risk mitigation frameworks that address unique supply chain vulnerabilities and regulatory developments. Prospective buyers are invited to schedule an in-depth consultation to explore how this comprehensive intelligence can drive innovation, support new product introductions, and sustain competitive differentiation in a rapidly converging IoT environment.

- How big is the Smart Plug Market?

- What is the Smart Plug Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?