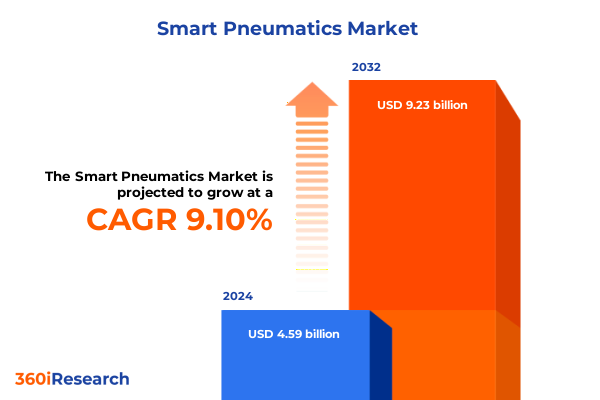

The Smart Pneumatics Market size was estimated at USD 5.02 billion in 2025 and expected to reach USD 5.48 billion in 2026, at a CAGR of 9.08% to reach USD 9.23 billion by 2032.

Discovering the Rise of Smart Pneumatics Shaping the Future of Compressed-Air Technologies through Digital Intelligence and Connectivity

Smart pneumatics represent a significant leap forward from traditional compressed-air systems by embedding sensors, transmitters, and connectivity modules into actuators and valves to generate real-time performance data. This transformation empowers manufacturers to monitor critical parameters such as pressure, position, and flow remotely, enabling early anomaly detection and predictive maintenance strategies that minimize unplanned downtime and operational disruptions

Beyond diagnostics, smart pneumatics play a crucial role in enhancing energy efficiency and sustainability across industrial operations. By continuously analyzing system performance, advanced control algorithms dynamically optimize air consumption, reducing leakage losses and aligning supply with demand. These energy-saving capabilities support regulatory compliance and environmental goals while simultaneously lowering lifecycle costs

Within the broader Industry 4.0 framework, smart pneumatics bridge the gap between mechanical hardware and digital ecosystems. Seamless integration with Manufacturing Execution Systems and cloud-based analytics platforms enables cross-plant performance benchmarking, automated process adjustments, and scalable data-driven decision-making. As IIoT adoption matures, pneumatic systems that once operated in isolation are now pivotal components of fully connected, autonomous production lines

Exploring the Transformative Impact of AI Edge Computing and 5G Networks on the Evolution of Pneumatic Systems toward Intelligent Industry 4.0 Operations

Advancements in artificial intelligence and machine learning are redefining the intelligence of pneumatic systems, enabling real-time data analytics and autonomous decision-making at the device level. AI-driven algorithms can analyze large volumes of sensor data to identify performance patterns, forecast component wear, and optimize control strategies without human intervention. This integration of cognitive capabilities elevates smart pneumatics from passive reporting tools to active collaborators in process optimization

Alongside AI, edge computing has emerged as a critical enabler for latency-sensitive pneumatic applications. By processing data directly on controllers or gateway devices near the actuator, edge architectures eliminate the delays and bandwidth constraints associated with centralized cloud analytics. This localized intelligence ensures continuous operation even under intermittent connectivity scenarios, preserving real-time responsiveness for safety-critical and high-speed production processes

The widespread deployment of 5G networks further accelerates the capabilities of smart pneumatic ecosystems by providing ultra-low latency and high-bandwidth connectivity. Secure private 5G installations allow pneumatic valves and sensors to communicate large data packets instantaneously, supporting coordinated control schemes and synchronized actuation across vast manufacturing floors. As a result, complex motion sequences and distributed control logic become feasible at unprecedented scales

Digital twin technologies complement these trends by creating virtual replicas of pneumatic components and systems for simulation and scenario testing. Combined with hyperautomation initiatives, digital twins enable manufacturers to simulate fault conditions, evaluate process changes, and train AI models in a risk-free environment, closing the loop between digital design and physical operation

Assessing the Cumulative Effects of United States Tariff Measures in 2025 on the Supply Chain Resilience and Cost Structures of Pneumatic Components

In early 2025, U.S. trade policy underwent a marked shift as average import tariff rates surged to levels not seen since the mid-20th century. Steel and aluminum imports, including many pneumatic fittings and actuator housings, became subject to a 25% duty, while derivative products also faced stringent classification rules and reporting requirements. These measures effectively tax imported pneumatic hardware and raw materials, eroding cost competitiveness for supply chains reliant on foreign manufacturers

The immediate consequence of elevated tariffs has been a tangible increase in landed costs and extended procurement lead times for pneumatic components. Companies report material price fluctuations of up to 35% on critical alloys, alongside average shipping delays of two to three weeks due to rerouted logistics and customs processing. Such volatility challenges project timelines and compels manufacturers to incorporate buffer inventory or expedited sourcing strategies

Beyond cost pressures, the persistence and unpredictability of tariff policy have dampened capital investment in automation projects. Survey data indicate that uncertainty over tariff duration and scope has prompted many capital expenditure decisions to be deferred, with business equipment spending growth cooling precipitously in the second quarter of 2025. This wait-and-see stance risks undermining modernization efforts and prolonging reliance on outdated pneumatic systems

Over time, the cumulative impact of trade measures is prompting a strategic pivot toward domestic production and supplier diversification within the fluid power sector. Manufacturers are prioritizing ruggedized, locally sourced pneumatic components with integrated diagnostics to offset the cost and complexity of international procurement. Concurrently, industry players are bolstering resilience by exploring alternative markets and adjusting production footprints to mitigate future tariff shocks

Unveiling Key Market Segmentation Insights across Technology Components End Users Distribution Channels and Applications within Smart Pneumatics Ecosystem

The smart pneumatics landscape is delineated by the integration technology that underpins system intelligence, ranging from AI and machine learning–driven pneumatic solutions to IoT-enabled devices. Wired smart pneumatic platforms often serve high-reliability sectors where minimal interference is paramount, while wireless smart pneumatics leverage Bluetooth and other mesh networks to deliver flexible, plug-and-play configurations for retrofits and mobile equipment. Each technological category addresses specific operational needs, from predictive analytics powered by embedded AI to real-time remote control via IoT gateways

On the component front, smart pneumatics encompass a broad spectrum of controllers and software suites that orchestrate system logic, sensors and transmitters that capture pressure, flow and position data, as well as advanced pneumatic actuators and valves engineered for energy-optimized performance. Software solutions provide user interfaces, data visualization and integration with higher-level automation and enterprise systems, while hardware components serve as the data-generation nodes that enable closed-loop control and diagnostic capabilities

End-user segmentation further refines the market into discrete customer groups, including industrial end-user industries that deploy turnkey smart pneumatic solutions, original equipment manufacturers that integrate pneumatic intelligence into their machinery, and system integrators that architect customized automation projects. Each category channels distinct requirements and purchase drivers, from application engineering expertise to seamless integration into multi-vendor automation environments

Distribution channels are similarly bifurcated between aftermarket offerings that support retrofit upgrades and field services and OEM channels that embed smart pneumatic modules into new machine designs. Aftermarket providers focus on modular, plug-and-play sensor upgrades for legacy equipment, whereas OEM channels emphasize design-for-manufacturability, supply chain synchronization and lifecycle service agreements

In terms of application, smart pneumatics finds use across automotive manufacturing for line automation, electronics and semiconductor assembly for precision handling, food and beverage processing for hygiene-compliant actuation, general manufacturing and industrial automation for high-speed operation, logistics and material handling for automated sorting and packaging, pharmaceuticals for clean-room compatible systems, and textile production for precise tension control. These diverse applications highlight the versatility of pneumatic intelligence in optimizing performance across industry verticals

This comprehensive research report categorizes the Smart Pneumatics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component Type

- End User

- Distribution Channel

- Application

Analyzing Regional Dynamics and Adoption Patterns in the Americas EMEA and Asia-Pacific for Advanced Smart Pneumatics Solutions

In the Americas, the convergence of policy incentives and a resurgence in domestic manufacturing has accelerated the adoption of smart pneumatics. U.S. producers, contending with elevated import tariffs, are increasingly investing in local pneumatic innovations and retrofit solutions to reduce reliance on global supply chains. Meanwhile, Canada and Mexico’s proximity to key U.S. markets under near-shoring strategies has bolstered regional integration, driving demand for intelligent pneumatic modules that support agile production models

Across Europe, the Middle East and Africa, stringent environmental regulations and carbon reduction mandates are steering investments toward energy-efficient pneumatic technologies. The robust automotive manufacturing base in Germany, France and Italy continues to deploy AI-enabled pneumatic systems for assembly line optimization, while emerging markets in the Gulf region leverage smart pneumatics for oil-and-gas wellhead controls and process automation. These regional dynamics underscore a growing emphasis on sustainable, data-driven pneumatic solutions

The Asia-Pacific region stands out as a major growth engine for smart pneumatics, propelled by large-scale semiconductor and electronics investments in China, Taiwan and South Korea. Government programs aimed at creating smart factories and Industry 4.0 clusters have spurred adoption of AI-powered pneumatic actuators and digital twin platforms. Local manufacturers such as Ningbo Smart Pneumatic Co. Ltd. are forging strategic partnerships to introduce next-generation sensor-embedded components, reinforcing APAC’s position at the forefront of pneumatic innovation

This comprehensive research report examines key regions that drive the evolution of the Smart Pneumatics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Technology Providers Driving the Smart Pneumatics Market with Advanced Actuators Valves Controllers and Analytics

The competitive landscape of smart pneumatics features a blend of established automation giants and specialized innovators. Major global contributors include Emerson Electric Co. through its Aventics brand, Festo AG & Co. KG with its modular Motion Terminal, SMC Corporation renowned for its sensor-equipped valves, Parker Hannifin Corporation offering energy-saving actuators, Bimba Manufacturing Co. delivering plug-and-play smart cylinders, and Rotork plc specializing in rugged flow-control solutions. Emerging regional players such as Ningbo Smart Pneumatic Co. Ltd. are also gaining traction in Asia-Pacific markets

Core offerings across these key companies encompass pneumatic actuators with integrated pressure and position sensors, electro-pneumatic controllers featuring onboard diagnostics, and software platforms that deliver cloud-based performance analytics. Festo’s Motion Terminal combines mechanics, electronics and IoT within a single module; Emerson’s Aventics Smart Pneumatics Analyzer provides real-time equipment health metrics; SMC’s modular actuator systems facilitate rapid deployment; and Parker’s energy-optimized controllers support closed-loop control and sustainability objectives

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Pneumatics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airtac International Group

- Aventics GmbH

- Bimba Manufacturing Company

- Bosch Rexroth AG

- Bürkert GmbH & Co. KG

- Camozzi S.p.A.

- CKD Corporation

- Eaton Corporation plc

- Emerson Electric Co.

- Festo SE & Co. KG

- Gardner Denver, Inc.

- Hitachi Koki Co., Ltd.

- Ingersoll Rand Inc.

- Makita Corporation

- Metso Corporation

- Parker-Hannifin Corporation

- Rotork plc

- SMC Corporation

- The Smart Actuator Company Ltd.

- Thomson Industries, Inc.

Strategic Recommendations for Industry Leaders to Capitalize on Smart Pneumatics Innovation and Navigate Market Disruptions with Agility

Industry leaders should prioritize the integration of AI-powered analytics and digital twin technologies to unlock the full potential of smart pneumatics. By deploying machine learning models trained on historical performance data, organizations can transition from reactive maintenance to predictive strategies that minimize downtime. Virtual replicas of pneumatic systems also enable scenario testing and rapid iteration of control logic, accelerating time to insight and operational refinement

Given ongoing tariff uncertainties and geopolitical shifts, companies must bolster supply chain resilience by diversifying supplier bases and expanding regional manufacturing footprints. Strategic partnerships with localized component producers and the development of near-shored assembly centers can mitigate cost volatility and logistical delays, ensuring continuous access to critical pneumatic parts and modules

To extend the lifespan of existing infrastructure, organizations should adopt modular, retrofittable smart pneumatic solutions that seamlessly integrate with legacy equipment. Plug-and-play sensor modules and wireless communication kits facilitate incremental upgrades without large capital expenditures, unlocking immediate benefits in monitoring and control while preserving asset value

As connectivity proliferates, safeguarding pneumatic networks against cyber threats is paramount. Implementing layered security frameworks-encompassing encrypted communications, identity management and continuous anomaly detection-will protect mission-critical pneumatic control systems from unauthorized access and operational disruptions

Comprehensive Research Methodology Detailing Primary Secondary Data Sources Analytical Framework and Validation Processes Employed

This report is grounded in a rigorous research methodology that combines both primary and secondary data collection to deliver an authoritative view of the smart pneumatics market. Primary research involved in-depth interviews with industry experts, including pneumatic system manufacturers, original equipment manufacturers, and system integrators. These conversations provided qualitative insights into emerging use cases, technology adoption barriers, and strategic imperatives.

Complementing primary insights, secondary research encompassed a comprehensive review of industry publications, technical whitepapers, regulatory filings and corporate communications to capture quantitative indicators and contextualize market dynamics. Data triangulation techniques were employed to validate findings, ensuring consistency across multiple information sources.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces and scenario planning were applied to evaluate competitive pressure, market attractiveness and potential disruption vectors. Segmentation matrices were developed based on technology, component, end user, distribution channel and application to structure the analysis and highlight growth opportunities.

Data quality assurance processes, including peer review and iterative feedback loops with subject matter specialists, were integral to the research process. This meticulous approach ensures that the resulting insights accurately reflect current conditions and equip decision-makers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Pneumatics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Pneumatics Market, by Technology

- Smart Pneumatics Market, by Component Type

- Smart Pneumatics Market, by End User

- Smart Pneumatics Market, by Distribution Channel

- Smart Pneumatics Market, by Application

- Smart Pneumatics Market, by Region

- Smart Pneumatics Market, by Group

- Smart Pneumatics Market, by Country

- United States Smart Pneumatics Market

- China Smart Pneumatics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on Smart Pneumatics Highlighting Key Trends Strategic Imperatives and the Road Ahead for Intelligent Automation

Smart pneumatics have emerged as a cornerstone of Industry 4.0, blending traditional compressed-air mechanisms with advanced digital technologies to deliver enhanced reliability, efficiency and intelligence. The integration of AI, edge computing and 5G connectivity is transforming actuators and valves into autonomous agents capable of self-diagnosis and adaptive control, fundamentally reshaping industrial automation.

Trade policy shifts and tariff uncertainties underscore the importance of resilient supply chains and localized manufacturing strategies. Organizations that strategically diversify sourcing, invest in modular upgrades and leverage predictive analytics will gain a competitive advantage in a volatile environment.

Regional dynamics highlight divergent adoption pathways, with the Americas focusing on retrofit and near-shoring initiatives, EMEA emphasizing sustainability and OEM integration, and Asia-Pacific driving growth through semiconductor investments and smart factory mandates. These patterns underscore the need for tailored market approaches that align with local drivers and regulatory landscapes.

Leading companies are advancing the frontier with modular controller platforms, sensor-embedded actuators and cloud-based analytics, positioning smart pneumatics as a critical enabler of next-generation manufacturing. As the ecosystem continues to mature, strategic collaboration across technology providers, integrators and end-users will be essential to unlock the full potential of pneumatic intelligence.

The road ahead for smart pneumatics is defined by continuous innovation, heightened interoperability and ever-greater system autonomy. Stakeholders who proactively embrace these trends and execute on strategic imperatives will be well-positioned to lead the intelligent automation era.

Actionable Next Steps to Engage with Our Expert Team Led by Ketan Rohom and Secure the Definitive Smart Pneumatics Market Research Report

To capitalize on the strategic insights presented in this executive summary, we invite you to connect with Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch. Ketan’s expertise in industrial automation and market intelligence uniquely positions him to guide you through a detailed, customized briefing of the smart pneumatics landscape.

Engaging with our research team will provide you with unparalleled visibility into competitive strategies, technology roadmaps and tariff-driven supply chain adjustments tailored to your organization’s priorities. Our comprehensive report includes granular segmentation analysis, regional adoption profiles and actionable recommendations to inform critical investment and product development decisions.

Secure your copy of the definitive smart pneumatics market research report to gain a competitive edge in evolving industrial ecosystems. Reach out to Ketan today to schedule a personalized consultation and explore how these insights can support your long-term growth objectives.

- How big is the Smart Pneumatics Market?

- What is the Smart Pneumatics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?