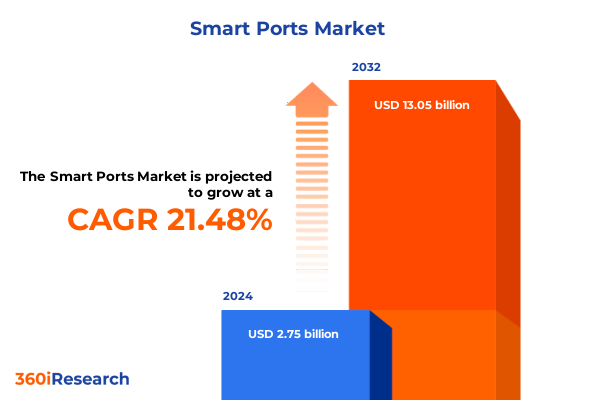

The Smart Ports Market size was estimated at USD 2.82 billion in 2025 and expected to reach USD 3.42 billion in 2026, at a CAGR of 21.79% to reach USD 11.25 billion by 2032.

Harnessing Connected Infrastructure and Advanced Analytics for Unprecedented Efficiency in Modern Port Operations through IoT and AI Integration to Drive Resilience, Security, and Sustainability

Ports worldwide are undergoing a profound transformation as they harness the power of interconnected devices and advanced computational models to orchestrate complex logistical operations with unprecedented precision and speed. The emergence of digital twin platforms has elevated situational awareness to new levels, allowing port authorities to simulate vessel movements, crane operations, and environmental scenarios in a virtual environment before executing them in the real world. This fusion of data streams and predictive analytics is redefining how maritime stakeholders manage berthing schedules, optimize cargo flows, and coordinate maintenance tasks.

Navigating Disruptive Technological Waves and Regulatory Evolutions that Are Redefining the Global Maritime Supply Chain Landscape

The pace of technological innovation and shifting regulatory priorities has unleashed a wave of disruption across the global port landscape, compelling operators to rethink long-standing processes. Artificial intelligence now powers advanced forecasting engines that anticipate cargo volumes and berth congestion, reducing vessel wait times and streamlining resource allocation. Simultaneously, private 5G networks are emerging as the backbone of real-time operations; for example, one European port recently installed over 15 base stations to connect thousands of sensors, cameras, and autonomous vehicles, achieving low-latency data exchange and improved safety protocols. Beyond connectivity, blockchain solutions are gaining traction to secure trade documentation and enforce smart contracts, creating tamper-proof transaction trails that enhance trust among shipping lines, customs, and terminal operators. Moreover, the integration of edge computing with digital twins empowers on-site decision-making without reliance on distant data centers, enabling rapid responses to emerging risks and operational anomalies. Underpinning all these advances is a heightened focus on sustainability and cybersecurity, as ports adopt renewable energy systems and AI-driven threat detection to safeguard critical infrastructure in an increasingly connected ecosystem.

Assessing the Far-Reaching Consequences of New Trade Policies and Tariffs on United States Port Infrastructure and Operational Costs

The introduction of sweeping 25% tariffs on steel and aluminum imports in early 2025 has reverberated through port infrastructure budgets and operational models, forcing stakeholders to recalibrate capital expenditure plans and supply chain strategies. Port authorities that relied on state-of-the-art cranes from dominant Chinese manufacturers have faced surcharges that inflate equipment costs by more than one-quarter, prompting accelerated efforts to diversify sourcing and explore domestic production partnerships. At one major Gulf Coast terminal, executives reported that each new ship-to-shore crane now carries an incremental multimillion-dollar tariff burden, directly impacting planned expansions and maintenance schedules.

Meanwhile, importers and carriers have shifted cargo routing strategies in anticipation of escalated duties, resulting in a temporary spike in container volumes at West Coast gateways followed by a projected slowdown once tariff deadlines pass. U.S. steel producers enjoyed short-term price gains as global supply tightened, but inconsistent demand and the reinstatement of long-term contracts have tempered profitability, leaving equipment fabricators and maintenance providers grappling with volatile input costs. The legal landscape also remains unsettled, with industry groups contesting presidential authority and seeking clarity on exclusion criteria, adding complexity to investment decisions and project timelines.

Deciphering Critical Market Dynamics by Component Port Type Technology Application and End User to Unveil Strategic Growth Opportunities

In examining the component dimension, it becomes evident that hardware investments-from high-resolution cameras to advanced sensors-are forming the backbone of port digitization, while services such as custom integration and real-time information sharing are critical to unlocking their full potential, and software platforms from port management to security control orchestrate these elements into cohesive operational frameworks. Consideration of port typology reveals that inland hubs and seaports alike are adopting tailored solutions to address distinct connectivity constraints and cargo profiles, with inland facilities often focusing on seamless rail and road linkages while coastal terminals emphasize vessel traffic coordination. Across the technological spectrum, innovations from artificial intelligence and machine learning to blockchain and edge computing are converging with the Internet of Things and digital twin environments to deliver actionable intelligence. Meanwhile, application use cases span cargo handling optimization and traffic management to environmental monitoring and predictive maintenance, ensuring that every node of port activity can be supervised and refined. Finally, the end-user lens spotlights how logistics providers, port authorities, and shipping companies engage these diverse capabilities to reduce downtime, enhance security, and achieve more sustainable operations.

This comprehensive research report categorizes the Smart Ports market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Port Type

- Technology

- Applications

- End-User

Uncovering Distinctive Regional Competitive Advantages in the Americas Europe Middle East Africa and Asia Pacific Port Ecosystems

In the Americas, leading ports are capitalizing on advanced infrastructure funding and public-private collaboration to accelerate digital transformations, with U.S. and Canadian authorities piloting 5G-enabled surveillance and AI-driven cargo scheduling initiatives to bolster resilience against supply chain shocks. By contrast, Europe, the Middle East, and Africa are integrating stringent sustainability mandates and cross-border regulatory frameworks, driving the adoption of shore-to-ship power systems and blockchain-based customs procedures to reduce emissions and streamline trade flows. In Asia-Pacific, heavy investments in greenfield port projects and government-backed smart port clusters are fostering large-scale deployment of digital twin ecosystems and predictive analytics platforms, particularly in China, India, and Southeast Asia, where burgeoning trade corridors demand both capacity expansion and operational agility. Across all regions, alignment with national digitalization strategies and climate targets is becoming a decisive factor in unlocking new funding streams and forging strategic alliances with technology providers.

This comprehensive research report examines key regions that drive the evolution of the Smart Ports market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Industry Leaders Technology Providers and Port Operators Steering the Evolution of Smart Port Solutions

Across the industry landscape, technology leaders and incumbent port operators are forging partnerships to deliver end-to-end smart port solutions. Leading global firms such as IBM and Cisco are integrating AI-driven analytics with real-time monitoring platforms, while hardware specialists like Huawei and Siemens are supplying modular sensors, network devices, and automation equipment. Systems integrators including ABB and General Electric offer comprehensive deployment and maintenance services for port automation, and specialized software vendors provide port management and security control suites. At the same time, pioneering port authorities, exemplified by Europe’s Rotterdam Authority, are collaborating with local startups to pilot digital twin models that optimize vessel flows and energy consumption. Collectively, these stakeholders are shaping the smart ports frontier by combining their strengths in innovation, domain expertise, and ecosystem orchestration to deliver scalable, interoperable platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Ports market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Siemens AG

- Huawei Technologies Co., Ltd.

- ABB Ltd.

- Schneider Electric SE

- International Business Machines Corporation

- GE Vernova Inc.

- Continental AG

- Fujitsu Limited

- Hitachi Energy Ltd.

- Abu Dhabi Ports PSJC

- Advantech Co., Ltd.

- Awake.AI Ltd.

- Cargotec Corporation

- Cisco Systems, Inc.

- Deutsche Telekom AG

- Envision Enterprise Solutions Pvt. Ltd.

- Ericsson AB

- Getac Technology Corporation

- Hutchison Port Holdings Limited

- Identec Solutions AG

- Intel Corporation

- Konecranes PLC

- Koninklijke Haskoning Groep B.V.

- Microsoft Corporation

- MITSUI E&S Co., Ltd.

- Nortal AS

- SINAY SAS

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Trelleborg AB

- Webb Fontaine Group

- Wipro Limited

- ZPMC Shanghai Zhenhua Heavy industries Co.Ltd.

Strategic Imperatives and Action Plans for Industry Stakeholders to Overcome Challenges and Capitalize on Smart Port Innovations

Industry leaders should prioritize the integration of private high-bandwidth networks and edge computing architectures to enable real-time analytics and remote operations, ensuring minimal latency and robust security. They must also cultivate cross-sector partnerships to share best practices in digital twin deployment and jointly invest in open-architecture frameworks that facilitate seamless data exchange across terminal operators, shipping lines, and regulatory bodies. Furthermore, stakeholders should develop adaptive sourcing strategies that mitigate trade policy risks by diversifying equipment procurement and fostering domestic manufacturing collaborations. Embracing sustainability targets through shore-power electrification, renewable energy microgrids, and AI-driven emissions monitoring will both strengthen environmental performance and unlock new green financing opportunities. Finally, organizations must invest in workforce development programs to upskill operators in data science, cybersecurity, and systems integration, thereby enabling a culture of continuous improvement and resilience in the face of rapid technological and regulatory change.

Explaining Rigorous Multi Method Research Approaches and Data Validation Protocols Ensuring Robust Insights into Port Digitalization Trends

This research employs a rigorous multi-method approach, combining primary interviews with port authorities, logistics providers, and technology executives to capture firsthand insights into deployment challenges and strategic priorities. Secondary data sources span trade publications, conference proceedings, and regulatory filings from leading maritime agencies to contextualize emerging trends. Qualitative findings are triangulated with case study analyses of pioneering smart ports to validate technology adoption pathways and performance outcomes. The report’s framework segments the ecosystem across components, port types, technologies, applications, and end-users, enabling granular assessment of value drivers and integration dynamics. Throughout, data validation protocols incorporate cross-referencing of vendor press releases, public infrastructure budgets, and scholarly research to ensure accuracy. This methodology underpins robust, unbiased insights designed to guide decision-makers through the complexities of port digitalization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Ports market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Ports Market, by Component

- Smart Ports Market, by Port Type

- Smart Ports Market, by Technology

- Smart Ports Market, by Applications

- Smart Ports Market, by End-User

- Smart Ports Market, by Region

- Smart Ports Market, by Group

- Smart Ports Market, by Country

- United States Smart Ports Market

- China Smart Ports Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Convergence of Technology Sustainability and Policy Shaping the Future of Intelligent Port Operations

The convergence of advanced connectivity, analytics, and automated systems is redefining port operations, shaping a future where terminals function as integrated digital platforms rather than standalone logistics hubs. By leveraging IoT sensors, digital twins, and AI frameworks, stakeholders can transition from reactive management to proactive orchestration, driving efficiency, safety, and sustainability. However, evolving trade policies and regulatory landscapes underscore the importance of adaptive strategies that incorporate flexible sourcing, resilient network infrastructures, and collaborative innovation models. As regional dynamics and technology priorities diverge, successful operators will be those that embrace modular, open-architecture solutions and foster continuous learning across their organizations. In this context, the smart port revolution represents not only a step change in operational performance but also a catalyst for broader supply chain transformation, enabling maritime ecosystems to thrive amidst complexity and uncertainty.

Reach Out to Ketan Rohom to Secure Exclusive Access to Comprehensive Smart Ports Insights and Strategic Roadmaps

To gain comprehensive insights into the evolving smart ports ecosystem and unlock actionable strategies tailored to your organization’s needs, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings deep industry expertise and can guide you through our in-depth analysis of the latest technological, regulatory, and economic factors transforming port operations globally. Engage with Ketan today to secure your exclusive copy of the complete market research report, equip your team with forward-looking intelligence, and position your organization at the forefront of the smart ports revolution.

- How big is the Smart Ports Market?

- What is the Smart Ports Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?