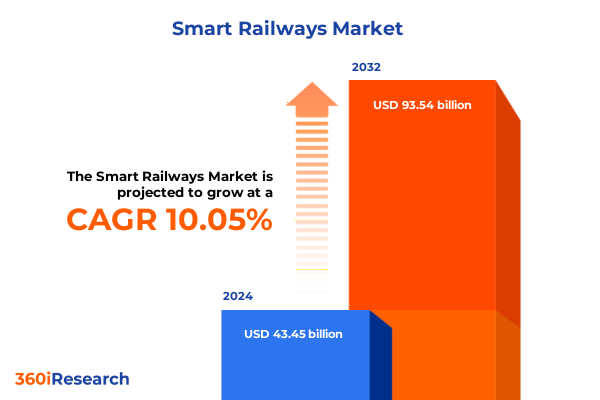

The Smart Railways Market size was estimated at USD 47.57 billion in 2025 and expected to reach USD 52.15 billion in 2026, at a CAGR of 10.14% to reach USD 93.54 billion by 2032.

Revolutionizing Rail Transport Through Intelligent Connectivity, Advanced Automation, and Sustainable Infrastructure for an Evolving Mobility Landscape

In an era defined by rapid urbanization, environmental imperatives, and technological breakthroughs, the railway sector is undergoing a profound transformation. Traditional rail systems, once driven primarily by mechanical reliability and geographic reach, are now evolving into interconnected, data-rich networks that seamlessly integrate digital solutions with physical infrastructure. This convergence of digital and physical realms has redefined the scope of rail transport, shifting the industry’s focus toward predictive maintenance, real-time passenger information, and energy-efficient operations.

Against this backdrop, stakeholders across governments, private operators, and infrastructure providers are collaborating to address the twin challenges of growing ridership and aging assets. Investments in communication equipment, advanced control systems, and sophisticated signaling hardware are being complemented by services for consulting, installation, and maintenance support. Software solutions-ranging from analytics platforms for asset management to cybersecurity defenses-are emerging as key enablers of reliability and safety.

This executive summary provides decision-makers with a concise yet comprehensive overview of the strategic forces reshaping the smart railway market. It elucidates the transformative landscape dynamics, examines the implications of United States tariff measures, highlights critical segmentation insights, and distills regional and competitive intelligence. By synthesizing these elements, industry leaders can chart a course that aligns innovation goals with evolving market realities.

Identifying Core Paradigm Shifts Fueling the Integration of IoT, AI, and Predictive Analytics in Next Generation Railway Systems

The landscape of rail transportation is being redefined by a series of core paradigm shifts that collectively drive the integration of digital technologies. First, the proliferation of Internet of Things devices has enabled asset management systems to evolve from reactive maintenance regimes to predictive and condition-based models, reducing unplanned downtime and extending the service life of critical components. Equally significant is the rise of artificial intelligence and machine learning algorithms within traffic management systems, which optimize scheduling, enhance safety through automatic train control, and improve energy efficiency via dynamic braking adjustments.

Furthermore, the expansion of high-bandwidth, low-latency communication infrastructure-embodied by fiber optic backbones and advanced radio systems-facilitates real-time data flows between trains, control centers, and passenger information platforms. This connectivity underpins enhanced passenger experiences, as digital display systems and real-time tracking applications deliver timely updates, while regenerative braking and energy monitoring subsystems contribute to sustainability targets.

In parallel, cybersecurity solutions have become indispensable, as interlocking and train control systems increasingly rely on networked architectures. Regulatory mandates for positive train control and stringent safety standards are accelerating the deployment of robust control software and integrated analytics suites. Collectively, these shifts are forging a new paradigm in which smart railway networks operate as intelligent ecosystems rather than isolated transport corridors.

Assessing the Comprehensive Effects of United States 2025 Tariff Policies on the Smart Railway Supply Chain and Technology Acquisition Costs

In 2025, the imposition of new tariff measures by the United States government has introduced significant cost considerations for the procurement of hardware components and signaling technology. Steel and aluminum duties on communication equipment chassis and control systems enclosures have directly increased capital expenditures for rolling stock manufacturers and station operators. At the same time, elevated duties on imported electronics and radio modules have prompted rail integrators to reassess supply chain dependencies and explore domestic sourcing alternatives to mitigate exposure to fluctuating duty rates.

These tariffs have further influenced the software and services segments, as international consulting firms face higher operational costs when delivering installation, integration, and training services that rely on specialized hardware imports. To offset these pressures, several major operators are negotiating strategic partnerships with local service providers and investing in cybersecurity solutions developed onshore. The net effect is a gradual realignment of procurement strategies toward hybrid sourcing models that balance cost predictability with technological capability.

Despite increased upfront charges, the tariff environment has accelerated innovation in materials engineering and control hardware design. Suppliers are adopting modular architectures to streamline certification processes under tariff constraints, while software developers are optimizing analytics and management platforms to extract maximum operational value from existing infrastructure. As a result, the tariff regime is serving as a catalyst for both supply chain resilience and technological advancement across the smart railway ecosystem.

Uncovering Nuanced Component, System, Application, and End User Segmentation Drivers Shaping Tailored Smart Railway Solutions Across Multiple Industry Verticals

A nuanced understanding of market segmentation illuminates how component-level innovations, system architectures, application contexts, and end user priorities intersect to shape tailored solutions. Within the component framework, traditional communication equipment, advanced control systems, and precision signaling hardware form the backbone of smart rail connectivity, while consulting, integration, and ongoing maintenance services ensure reliability and operational excellence. Analytics and management software platforms extract actionable insights from sensor data, control software orchestrates train movements, and cybersecurity modules safeguard against emerging digital threats.

System type segmentation further refines this picture by distinguishing between asset management platforms that enable condition monitoring and predictive maintenance, communication networks leveraging fiber optics and radio links, and control ecosystems encompassing automatic train supervision and traffic management. Energy management systems integrate power monitoring, regenerative braking technologies, and grid interface modules, whereas passenger information infrastructures combine announcement, display, and real-time tracking capabilities. Interlocking and positive train control subsystems sit at the heart of signaling networks, providing fail-safe operations and ensuring compliance with rigorous safety mandates.

Applications vary from freight corridors focused on heavy haul efficiency to high-speed passenger lines prioritizing throughput and punctuality, and urban transit networks where metro systems demand high-frequency, low-latency control loops. End users span government transportation agencies driving national mobility agendas, infrastructure providers responsible for station operations and track stewardship, and private operators delivering commuter services or specialized freight logistics. By overlaying these segmentation dimensions, stakeholders can craft bespoke strategies that align technological investments with specific performance objectives.

This comprehensive research report categorizes the Smart Railways market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Application

- End User

Examining Strategic Regional Dynamics and Growth Opportunities in the Americas, Europe Middle East & Africa, and Asia Pacific Railway Markets

Regional market dynamics reveal divergent growth trajectories shaped by regulatory frameworks, funding mechanisms, and infrastructure maturity. In the Americas, substantial public-private partnerships underpin the modernization of both urban transit and intercity passenger corridors, where asset management systems and predictive maintenance services have gained traction to address aging networks. Communication systems employing fiber optic backbones, along with advanced signaling hardware, are prioritized to enhance safety and resilience against weather-related disruptions.

Across Europe, the Middle East, and Africa, standardized rail protocols and cross-border interoperability initiatives drive investment in control systems and positive train control deployments. Energy management strategies, including regenerative braking and grid-tied power monitoring, receive strong support under sustainability mandates. Meanwhile, passenger information systems featuring real-time tracking and dynamic display networks are being rolled out in rapidly growing metro and high-speed segments, particularly in the Gulf Cooperation Council countries.

In the Asia-Pacific region, explosive urbanization fuels substantial capital flows into metro and high-speed rail projects, often led by state-owned infrastructure providers collaborating with global technology suppliers. Predictive analytics for lifecycle management, integrated communication networks leveraging both fiber and radio technologies, and comprehensive cybersecurity suites emerge as critical enablers. This regional mosaic underscores the importance of localized strategies that accommodate regulatory diversity, funding structures, and operational priorities.

This comprehensive research report examines key regions that drive the evolution of the Smart Railways market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players, Strategic Partnerships, and Innovation Pathways Defining Competitive Advantage in the Smart Railway Ecosystem

The competitive landscape of the smart railway industry is characterized by a blend of established engineering firms, emerging technology innovators, and service specialists forging alliances to tackle complex challenges. Leading hardware manufacturers are investing heavily in modular signaling solutions and next-generation control systems, while software-centric companies are expanding their footprints by integrating analytics, cybersecurity, and real-time passenger information into cohesive platforms.

Strategic partnerships between global technology vendors and regional integrators are redefining value chains, enabling localized deployment of asset management and traffic supervision systems. Collaborations with consulting firms and academic research centers also facilitate rapid prototyping of artificial intelligence algorithms for predictive maintenance. At the same time, joint ventures among component suppliers are catalyzing advances in communication equipment, blending fiber optic backbones with advanced radio subsystems to meet diverse network requirements.

Mergers and acquisitions continue to reshape the market, as infrastructure providers acquire software specialists to internalize analytics capabilities, and traditional rolling stock manufacturers partner with cybersecurity companies to deliver end-to-end solutions. These strategic moves underscore the imperative for companies to scale their offerings and maintain agility in an ecosystem driven by digital transformation, regulatory compliance, and evolving customer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Railways market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alstom S.A.

- Cisco Systems, Inc.

- Construcciones y Auxiliar de Ferrocarriles, S.A.

- CRRC Corporation Limited

- Hitachi Rail Ltd.

- Huawei Technologies Co., Ltd.

- Hyundai Rotem Company

- IBM Corporation

- Indra Sistemas, S.A.

- Kawasaki Heavy Industries, Ltd.

- Knorr-Bremse AG

- Mitsubishi Electric Corporation

- Nokia Corporation

- Oracle Corporation

- SAP SE

- Schneider Electric SE

- Siemens AG

- Stadler Rail AG

- Tech Mahindra Limited

- Telefonaktiebolaget LM Ericsson

- Teleste Corporation

- Thales Group

- Toshiba Corporation

- Wabtec Corporation

- Wipro Limited

Delivering Strategic and Operational Recommendations to Empower Infrastructure Stakeholders and Technology Providers for Smart Railway Transformation

To succeed in the rapidly evolving smart railway domain, stakeholders must adopt a multi-faceted strategy that spans technology, operations, and partnerships. Investing in modular architecture for control and signaling hardware allows for rapid scalability and streamlined certification under shifting regulatory requirements. Concurrently, diversifying supply chains with a balanced mix of domestic and international suppliers mitigates the risk of tariff-induced cost increases while preserving access to cutting-edge components.

In parallel, organizations should establish cross-functional teams that integrate data scientists, cybersecurity experts, and rail operations specialists. This collaborative approach ensures that analytics platforms and predictive algorithms are tuned to real-world operational parameters and safety standards. Furthermore, forming strategic alliances with regional service providers enhances local support capabilities and accelerates deployment timelines.

Finally, embracing sustainability as a core pillar of railway modernization not only aligns with environmental mandates but also unlocks new opportunities in renewable energy integration and energy-efficient control systems. By synthesizing these recommendations into a cohesive roadmap, industry leaders can steer their initiatives toward tangible performance gains and long-term competitive differentiation.

Detailing Rigorous Research Methodology and Data Collection Framework Underpinning the Comprehensive Analysis of Smart Railway Innovations and Market Dynamics

This analysis was underpinned by a rigorous research framework combining primary and secondary methodologies to ensure both depth and reliability. Primary research encompassed in-depth interviews with senior executives from infrastructure providers, rolling stock manufacturers, and government agencies, alongside technical workshops with system integrators and cybersecurity specialists. These engagements provided firsthand insights into procurement strategies, operational challenges, and innovation roadmaps.

Secondary research involved the systematic review of academic journals, regulatory filings, and industry white papers to contextualize emerging trends in IoT deployments, AI-driven maintenance platforms, and energy management innovations. Data triangulation techniques were applied to reconcile quantitative figures with qualitative assessments, minimizing bias and enhancing the robustness of the findings.

Finally, a validation phase featured a panel of external experts-comprising academic researchers, industry consultants, and standards body representatives-who corroborated the analysis through iterative feedback cycles. This structured approach ensured that the report’s segmentation criteria, tariff impact assessments, and regional insights accurately reflect current market realities and anticipate future inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Railways market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Railways Market, by Component

- Smart Railways Market, by System Type

- Smart Railways Market, by Application

- Smart Railways Market, by End User

- Smart Railways Market, by Region

- Smart Railways Market, by Group

- Smart Railways Market, by Country

- United States Smart Railways Market

- China Smart Railways Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Critical Findings and Future Outlook to Illuminate the Path Forward for Stakeholders in the Evolving Smart Railway Sector

The convergence of digital architectures, advanced analytics, and sustainable energy management is propelling the railway industry toward a new epoch of efficiency and resilience. From the integration of predictive maintenance platforms that minimize operational disruptions to the deployment of high-speed communication systems ensuring real-time control, the smart railway landscape is being reshaped by technological synergies and strategic collaborations.

Tariff policies, while introducing cost considerations, have simultaneously acted as catalysts for domestic innovation and supply chain diversification. Segmentation insights reveal that success hinges on aligning component, system, application, and end user priorities to create tailored solutions that address specific operational objectives. Regionally, the Americas, Europe Middle East & Africa, and Asia-Pacific each present distinct regulatory, investment, and infrastructure profiles that demand customized approaches.

As stakeholders navigate these complex dynamics, the themes of interoperability, cybersecurity, and modular design emerge as foundational pillars. By synthesizing the critical findings of this report, decision-makers are equipped to anticipate future challenges, harness emerging opportunities, and chart a strategic course in a sector defined by continuous innovation and evolving mobility demands.

Drive Strategic Growth with an In-Depth Smart Railway Market Report by Connecting with Associate Director Sales & Marketing Ketan Rohom Today

If you are poised to capitalize on the transformative potential of smart railway technologies, opportunities for strategic differentiation and competitive advantage await those who act decisively. To unlock the full breadth of insights, strategic analysis, and region-specific intelligence contained in this comprehensive market research report, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Through a tailored consultation, you can explore how the detailed findings align with your organization’s strategic priorities, uncover bespoke recommendations, and evaluate investment scenarios with the precision you need to make informed decisions.

By connecting with Ketan Rohom, you will gain personalized guidance on navigating tariff pressures, optimizing segmentation strategies, and leveraging emerging regional growth corridors. This direct dialogue ensures you receive the clarity, data-driven analysis, and actionable roadmaps that empower you to stay ahead of industry shifts and accelerate your smart railway initiatives. Reach out today to secure access to the definitive resource that will inform your blueprint for success in the rapidly evolving landscape of rail transport innovation.

- How big is the Smart Railways Market?

- What is the Smart Railways Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?