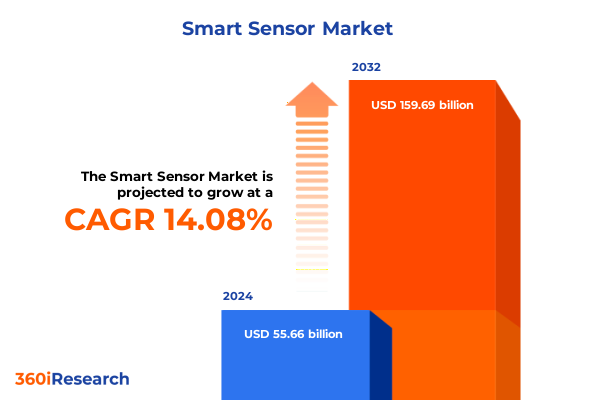

The Smart Sensor Market size was estimated at USD 63.39 billion in 2025 and expected to reach USD 72.20 billion in 2026, at a CAGR of 14.10% to reach USD 159.69 billion by 2032.

Exploring the Emergence of Smart Sensor Technologies That Are Revolutionizing Data Collection, Device Intelligence, and Operational Efficiency Across Industries

Smart sensors represent the convergence of advanced sensing elements, edge computing capabilities, and intelligent data processing to transform how industries collect, analyze, and act upon data. By embedding microelectromechanical systems (MEMS), signal conditioning, and on-chip analytics directly within sensing modules, these devices eliminate traditional latency and bandwidth constraints. As a result, end users gain real-time visibility into operational parameters, leading to more efficient processes, predictive maintenance, and optimized resource utilization. This evolution is particularly critical in environments demanding high reliability and rapid decision making, such as autonomous vehicles, industrial automation lines, and healthcare monitoring systems. Moreover, the proliferation of machine learning algorithms executed at the sensor level enables anomaly detection and adaptive calibration without dependency on centralized cloud infrastructure, aligning with the edge computing trend that processes upwards of three-quarters of IoT data at the network’s periphery.

Transitioning from reactive to proactive management, smart sensors empower organizations to move beyond simple threshold triggers toward contextual awareness. By receiving continuous streams of granular measurements-ranging from pressure and motion to environmental conditions-stakeholders can derive actionable insights on asset performance and environmental safety. This capability underpins Industry 4.0 initiatives, where data-driven feedback loops facilitate self-correcting mechanisms, minimize downtime, and enhance overall system resilience. With 5G rollouts accelerating low-latency connectivity, the integration of next-generation networks further amplifies sensor-based intelligence by enabling large-scale, high-reliability device orchestration in applications such as coordinated drone fleets or smart city infrastructure.

Unveiling the Transformative Technological Shifts Driving the Evolution of Smart Sensor Platforms Through AI Connectivity and Sustainability

The smart sensor landscape is undergoing seismic transformation driven by several interrelated forces. First, the advent of edge AI has reshaped device architectures by embedding machine learning engines within sensors themselves. This on-device intelligence reduces data transfer requirements, lowers latency, and enables real-time anomaly detection directly at the source, critical for applications like autonomous driving and industrial control systems. A recent analysis highlights that federated learning models and custom hardware accelerators now allow sensors to execute complex inference tasks locally, accelerating decision cycles while preserving network bandwidth.

Simultaneously, the expansion of 5G networks is unlocking new frontiers for sensor connectivity. Ultra-reliable, low-latency communications enable seamless coordination among vast sensor arrays, empowering large-scale deployments in smart factories and urban environments. With private 5G deployments gaining momentum in Japanese manufacturing facilities and dedicated industrial campuses, sensors can now transmit high-fidelity data streams at gigabit speeds, fostering unprecedented levels of automation and process optimization.

Furthermore, sustainability imperatives have driven innovation in energy harvesting and low-power design. Solar, thermoelectric, and vibrational energy harvesters are increasingly integrated into sensor modules, extending operational lifespans and reducing battery replacement cycles. This trend addresses environmental concerns and lowers total cost of ownership, especially in remote or hard-to-service sites. Regulatory developments around data privacy and electromagnetic compatibility have also prompted sensor manufacturers to enhance encryption protocols and shielding techniques, ensuring secure, compliant deployments across global markets.

Analyzing the Cumulative Impact of Recent U.S. Tariff Policies on Smart Sensor Supply Chains Component Costs and Market Dynamics in 2025

In early 2025, the United States implemented a universal baseline tariff of 10% on virtually all imports, layered atop existing duties, significantly impacting electronic component supply chains and smart sensor manufacturing costs. For key trading partners such as China, additional Section 301 tariffs were increased by 10% on top of previous duties, resulting in effectively 50% tariff rates on certain high-tech components, including semiconductors and advanced integrated circuits.

These elevated tariffs have translated into higher raw material and component expenses for sensor producers reliant on global sourcing. Key inputs like MEMS chips, microcontrollers, and precision analog components, often manufactured in Asia, saw cost escalations that manufacturers either absorbed-eroding profit margins-or passed through to end customers, thereby affecting pricing in sensitive segments like consumer electronics and industrial IoT deployments. In parallel, ambiguity around future exclusion lists has led many companies to temporarily stockpile critical parts, creating working capital challenges and inventory management complexities.

While certain electronic goods, including select semiconductors and integrated circuits, were retroactively exempted under an executive order signed in April 2025, the exemptions are not guaranteed to remain permanent, heightening strategic uncertainty for long-term planning. Consequently, sensor manufacturers are diversifying their supply chains by sourcing from alternative hubs in Vietnam, Mexico, and India. A growing subset of firms is also evaluating partial reshoring initiatives to domestic facilities, balancing higher labor costs against tariff avoidance and supply chain resilience.

Deriving Key Market Segmentation Insights to Unlock Opportunities Across Sensor Types Connectivity Options Applications and End-User Verticals

The smart sensor market can be deconstructed into distinct segments-sensor types, connectivity modes, end-use applications, and customer profiles-each revealing unique growth drivers and adoption patterns. Sensor types encompass environmental monitoring devices such as humidity and temperature sensors alongside motion detectors built on accelerometers and gyroscopes, and proximity modules leveraging infrared and ultrasonic methods. Connectivity layers span legacy wired interfaces including Ethernet and RS-485, as well as a suite of wireless protocols from Bluetooth and Wi-Fi to LoRa and Zigbee. Across use cases, applications range from advanced driver assistance systems, infotainment, and telematics in the automotive sector, to smart home appliances, diagnostics in healthcare, process and discrete manufacturing in industrial automation, and HVAC, lighting, and security controls within smart buildings. Finally, end users bifurcate into original equipment manufacturers, who integrate sensors into broader product portfolios, and system integrators, who deploy turnkey solutions across enterprise and municipal projects. This multifaceted framework allows stakeholders to pinpoint high-growth niches, tailor product roadmaps to specific technical requirements, and align go-to-market strategies with the precise needs of each vertical ecosystem.

This comprehensive research report categorizes the Smart Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Connectivity

- Application

- End User

Exploring Critical Regional Market Dynamics Revealing How Americas Europe Middle East Africa and Asia Pacific Shape Global Smart Sensor Adoption

Regional dynamics play a pivotal role in shaping smart sensor adoption and innovation pipelines. In the Americas, mandated rollout of fleet-telematics regulations and advancing collision-avoidance standards have spurred demand for high-precision motion and proximity sensors in automotive and commercial transport fleets. North American industrial end users, keen to capitalize on reshoring incentives, are accelerating investments in local advanced manufacturing facilities, driving sensor procurement for robotics and machine-vision systems, with private 5G testbeds increasingly underpinning pilot deployments.

In Europe, the Middle East, and Africa, harmonized regulatory frameworks-spanning data privacy, product certification, and energy efficiency directives-have compelled sensor suppliers to develop solutions that meet stringent compliance thresholds. Smart building initiatives across major European capitals, aligned with the European Green Deal, have elevated demand for integrated environmental and occupancy sensors that optimize HVAC and lighting, while Middle Eastern smart city projects in the Gulf Cooperation Council nations leverage sensor networks for water management and security systems.

Asia-Pacific remains the largest manufacturing powerhouse for sensor technology, hosting advanced foundries and specialized MEMS fabs. Government-backed smart city initiatives in China and India, combined with private 5G rollouts in Japanese industrial parks, sustain robust market uptake. This region’s sizeable R&D investments in materials science and sensor fusion algorithms continue to set global benchmarks for performance and cost efficiency.

This comprehensive research report examines key regions that drive the evolution of the Smart Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players’ Strategic Moves and Innovations Highlighting Competitive Dynamics in the Global Smart Sensor Ecosystem

Leading technology companies are executing strategic initiatives to secure competitive advantage in the smart sensor ecosystem. Texas Instruments recently introduced the AWRL6844, the industry’s first single-chip 60 GHz millimeter-wave radar sensor with integrated edge AI, enabling high-accuracy in-cabin occupancy monitoring and child presence detection with 98% reliability, while reducing system costs by replacing multiple discrete sensors. TI has also expanded its automotive portfolio with the LMH13000 high-speed lidar laser driver and AWR2944P radar sensor, offering enhanced range and accuracy to support next-generation ADAS features and autonomous driving functions.

STMicroelectronics is strengthening its MEMS sensor leadership through targeted acquisitions and product innovations. In July 2025, ST announced the acquisition of NXP Semiconductors’ MEMS sensor business for up to $950 million, bolstering its electromechanical sensing portfolio for automotive safety and industrial monitoring applications. Concurrently, ST has launched the LSM6DSV320X miniature inertial measurement unit, integrating dual accelerometers and an embedded AI engine to deliver activity tracking up to 16g and high-impact detection up to 320g in a compact 3 mm x 2.5 mm module, catering to wearables, smart home, and industrial IoT use cases.

Analog Devices has capitalized on recovering chip demand to enhance its analog and mixed-signal sensor offerings. After reporting a 19% increase in consumer segment revenue driven by AI-enabled devices and smart home products, ADI is focusing on sensor fusion platforms for industrial automation, bolstered by strong bookings in its aerospace and automotive divisions. These strategic moves underscore the intensifying race to embed intelligence, reduce form factors, and expand functional scope across diverse sensing modalities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams AG

- Analog Devices, Inc.

- Bosch Sensortec GmbH

- Honeywell International Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Omron Corporation

- Renesas Electronics Corporation

- Sensirion AG

- STMicroelectronics N.V.

- TE Connectivity Ltd.

- Texas Instruments Incorporated

Delivering Actionable Recommendations for Industry Leaders to Enhance Resilience Drive Innovation and Capturing Value in the Smart Sensor Market

Industry leaders must proactively embrace edge AI integration to differentiate their sensor offerings. By investing in custom inference accelerators and optimized machine learning models tailored to on-device resource constraints, companies can deliver advanced anomaly detection, predictive maintenance, and context-aware functionality that outperforms legacy solutions. Equally important is the diversification of supply chains; nearshoring production to Mexico or Southeast Asia can mitigate tariff exposure, while partnerships with local contract manufacturers provide flexibility without compromising quality.

To capitalize on sustainability trends, sensor manufacturers should incorporate energy harvesting methods and ultra-low-power modes into product roadmaps, targeting applications where battery replacement is impractical or cost-prohibitive. Standardization and interoperability must also be prioritized by participating in global consortia to establish open frameworks that facilitate multi-vendor integration, simplifying deployment for end users. Engaging with policymakers to shape fair tariff policies and secure long-term exemptions for critical electronic components will further enhance supply chain resilience.

Finally, fostering cross-sector alliances-linking automotive OEMs with industrial automation providers and healthcare innovators-will unlock hybrid applications and stimulate new revenue streams. By collaborating on reference architectures and joint pilot projects, stakeholders can accelerate technology validation, reduce time to market, and drive large-scale adoption of smart sensor ecosystems.

Detailing the Comprehensive Research Methodology Underpinning Robust Insights Including Data Collection Analysis and Validation Approaches

This research combined extensive secondary and primary methodologies to ensure data integrity and actionable insights. Initially, a comprehensive desk review of publicly available resources-including government trade regulations, company press releases, industry association reports, and credible news outlets-was conducted to establish baseline trends and policy impacts. Proprietary financial databases supplemented this analysis to extract relevant tariff schedules, product launch timelines, and corporate investment patterns.

Subsequently, in-depth interviews with ten senior executives, covering sensor design, manufacturing, supply chain, and end-user adoption, provided qualitative perspectives on strategic priorities, technology barriers, and regulatory implications. These discussions were complemented by a structured survey of 50 senior engineers and procurement specialists across the Americas, EMEA, and Asia-Pacific regions to quantify adoption rates, ROI expectations, and supplier perceptions.

Data triangulation techniques were employed to reconcile quantitative findings and qualitative insights, with cross-validation against third-party logistics and trade flow statistics. The final report underwent multiple peer reviews by domain experts to vet assumptions, refine segmentation schemas, and validate the forecast scenario frameworks, ensuring that conclusions reflect the latest developments and stakeholder realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Sensor Market, by Sensor Type

- Smart Sensor Market, by Connectivity

- Smart Sensor Market, by Application

- Smart Sensor Market, by End User

- Smart Sensor Market, by Region

- Smart Sensor Market, by Group

- Smart Sensor Market, by Country

- United States Smart Sensor Market

- China Smart Sensor Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Perspectives Emphasizing Critical Smart Sensor Trends Strategic Imperatives and the Path Forward for Industry Stakeholders

The convergence of AI, edge computing, and next-generation connectivity is propelling smart sensors from passive data collectors to active decision agents. Organizations that align their product strategies with these transformative shifts will capture significant efficiency gains and unlock new application frontiers. Meanwhile, evolving U.S. tariff landscapes demand agile supply chain configurations and proactive engagement with trade policy frameworks to safeguard cost competitiveness.

Segment-specific insights reveal high-growth pockets-such as industrial process automation leveraging discrete and process manufacturing sensors, and automotive safety systems integrating mmWave radar and lidar modules-where tailored offerings can command premium positioning. Regionally, the Americas, EMEA, and Asia-Pacific each exhibit distinct regulatory, infrastructure, and investment dynamics, underscoring the need for localized go-to-market models.

Leading players like Texas Instruments, STMicroelectronics, and Analog Devices demonstrate that strategic acquisitions, innovative product launches, and collaboration across ecosystems are critical to maintaining market leadership. By implementing the actionable recommendations provided-focusing on edge AI, sustainability, interoperability, and supply chain diversification-stakeholders can confidently navigate market complexities and propel growth in the smart sensor sector.

Connect with Ketan Rohom Associate Director Sales and Marketing to Unlock Exclusive Insights and Secure Your Comprehensive Smart Sensor Market Research Report

Don’t miss the opportunity to deepen your understanding of the smart sensor landscape and uncover strategic insights tailored to your organization’s needs. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to learn how our comprehensive market research report can support your decision-making, identify growth opportunities, and guide your next moves in the rapidly evolving smart sensor arena. Secure your copy today and ensure your team is equipped with authoritative, actionable intelligence to stay ahead of the competition.

- How big is the Smart Sensor Market?

- What is the Smart Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?