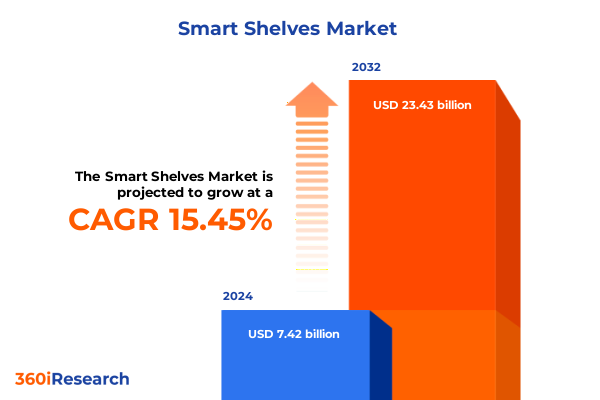

The Smart Shelves Market size was estimated at USD 8.54 billion in 2025 and expected to reach USD 9.84 billion in 2026, at a CAGR of 15.49% to reach USD 23.43 billion by 2032.

Revolutionizing Retail Operations Through Intelligent Shelf Solutions That Optimize Inventory, Enhance Shopper Experiences, And Empower Data-Driven Decisions

Revolutionizing shelf management and consumer engagement, smart shelves are emerging as a cornerstone of modern retail and industrial operations. These intelligent fixtures seamlessly integrate hardware components such as high-resolution displays, advanced proximity and weight sensors, and dynamic shelf indicators with sophisticated software platforms. By unifying physical infrastructure with predictive analytics and real-time monitoring capabilities, organizations can achieve unprecedented levels of inventory visibility, reduce shrinkage, and optimize restocking processes.

Beyond mere efficiency gains, smart shelves catalyze a deeper transformation of the customer experience. In retail environments, these systems dynamically adjust pricing, showcase targeted promotions, and support interactive product demonstrations that heighten consumer engagement. Meanwhile, in warehouses and manufacturing plants, real-time data streams from weight and proximity sensors enable continuous tracking of part usage, accelerate order fulfillment, and improve worker safety. As enterprises embrace these solutions, smart shelves are poised to redefine traditional workflows, bridging the gap between digital intelligence and on-shelf execution.

Navigating The Intersection Of Technological Breakthroughs And Consumer Expectations That Are Redefining The Smart Shelving Landscape Across Verticals

The convergence of artificial intelligence, edge computing, and machine vision has propelled smart shelves from conceptual prototypes to scalable solutions. AI-driven object recognition and real-time monitoring now enable systems to detect stockouts, planogram deviations, and customer interactions with precision. As a result, retailers are transitioning from reactive restocking models to proactive inventory management that anticipates demand spikes and prevents lost sales.

Simultaneously, the rise of IoT-enabled ecosystems has strengthened the connectivity backbone supporting smart shelf deployments. Integration with storewide networks and cloud platforms ensures that data captured at the shelf edge is instantly accessible for enterprise-wide analytics. These transformative shifts are further driven by consumer expectations for seamless omnichannel experiences, where in-store and online journeys converge. As digital natives demand personalized engagements, organizations are deploying intelligent shelving solutions that adapt displays, pricing, and product assortments on the fly, elevating both operational agility and customer satisfaction.

Assessing The Ripple Effects Of United States Tariff Policies In 2025 On Supply Chains, Component Costs, And Strategic Sourcing For Smart Shelf Technologies

The enactment of new tariff measures in the United States during 2025 has introduced a tangible shift in cost structures for hardware-intensive industries, including smart shelving. Elevated import levies on electronic components and display modules have prompted vendors to reassess their supply chains, accelerating moves toward regional manufacturing hubs and nearshoring initiatives. This strategic realignment not only mitigates tariff exposure but also fosters improved lead times and localized inventory buffers.

Yet the cumulative impact extends beyond simple cost containment. As hardware manufacturers explore alternative sourcing for sensors, displays, and printed circuit boards, design teams are optimizing product architectures to accommodate a broader range of components. This diversification reduces reliance on any single supplier or geography. Concurrently, service providers are adjusting pricing and support models to reflect increased logistics and integration complexities. Ultimately, organizations that embrace agile sourcing and modular design principles stand to weather tariff-driven headwinds while maintaining robust performance and quality.

Uncovering Precise Segmentation Insights Across Components, Connectivity, Deployment Models, Applications, And End User Profiles Shaping Intelligent Shelf Markets

By examining the landscape through a component lens, we observe three core pillars shaping solution architecture. Hardware encompasses displays, sensors, and shelf indicators, with sensors further bifurcated into proximity and weight variants that deliver critical stock-level data. The services spectrum covers installation, integration, and maintenance, ensuring each deployment achieves peak performance and adaptability over its lifecycle. Software features analytic tools and management suites, the former extending into predictive analytics and real-time monitoring, which together transform raw data into actionable insights.

When viewed by shelf type, intelligent solutions span autonomous configurations, cart-mounted units, fixed installations, and mobile platforms, each tailored to unique operational contexts and mobility requirements. Connectivity options range from AI-powered vision systems leveraging both 2D and 3D cameras, to barcode scanners and RFID architectures that ensure seamless data capture. Application domains highlight substantial uptake in healthcare environments-from hospitals to pharmacies-industrial settings including IoT-enabled factories, logistics, and manufacturing, and retail segments featuring apparel, e-commerce integration, and grocery. Finally, end users encompass healthcare providers at hospitals and pharmacies, diverse retail formats from franchises to specialty stores and supermarkets, and warehouse operators across cold storage and distribution centers, reflecting the broad impact of smart shelving across key industry stakeholders.

This comprehensive research report categorizes the Smart Shelves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Connectivity

- Application

- End User

Examining Regional Dynamics Across The Americas, EMEA, And Asia-Pacific That Are Driving Divergent Adoption Rates And Technology Preferences For Smart Shelving

In the Americas, advanced retail chains and grocers are deploying smart shelves to streamline operations and enrich in-store experiences. Early adopters leverage integrated weight and proximity sensors to monitor high-turnover items, while predictive analytics platforms forecast restocking needs with exceptional accuracy. Cross-industry collaborations between technology firms and retail conglomerates further accelerate adoption, creating a robust ecosystem for pilot initiatives and large-scale rollouts.

Moving to Europe, the Middle East & Africa, stringent regulatory frameworks and high labor costs have spurred investment in automation, with RFID and AI vision solutions gaining significant traction. Retailers in major European markets are prioritizing sustainability by embedding energy-efficient displays and sensors, whereas logistics operators in the Middle East are focusing on reducing errors and bottlenecks through real-time monitoring. Concurrently, select African distributors are piloting low-cost mobile shelf units to enhance inventory visibility in emerging retail channels.

In Asia-Pacific, the appetite for digital transformation is particularly pronounced. Leading markets in East Asia are witnessing widespread integration of 3D vision systems to support cashierless stores, while Southeast Asian grocers embrace cloud-based management platforms for centralized control. Government initiatives in smart manufacturing and IoT infrastructure development underpin growth across Japan, South Korea, and Australia, making the region a hotbed for next-generation smart shelf innovations.

This comprehensive research report examines key regions that drive the evolution of the Smart Shelves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strengths And Strategic Innovations From Leading Providers That Are Pioneering The Future Of Smart Shelf Solutions Globally

Global hardware leaders are distinguished by their sensor innovations and manufacturing depth, enabling rapid scalability and customization. Vision system pioneers have capitalized on advancements in AI algorithms to achieve high object recognition accuracy in challenging retail environments. Concurrently, software vendors specializing in analytics and management platforms are forging strategic alliances with integrators to deliver end-to-end solutions that encompass installation, training, and ongoing support.

Service-centric organizations are differentiating through comprehensive maintenance offerings, leveraging IoT telemetry to conduct predictive upkeep and minimize downtime. In parallel, emerging startups are disrupting traditional value chains with modular designs and API-first platforms that simplify integration with existing enterprise resource planning and point-of-sale systems. These companies emphasize interoperability and open standards, positioning themselves to capture opportunities across healthcare, industrial, and retail segments.

Partnerships between leading component manufacturers and cloud providers are driving innovation in edge computing, reducing latency and enhancing data security. As a result, the competitive landscape is increasingly defined by the ability to deliver cohesive solutions that blend hardware excellence, software intelligence, and superior service models under a unified commercial framework.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Shelves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avery Dennison Corporation

- E Ink Holdings Inc.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- HY-LINE Holding GmbH

- Intel Corporation

- Keonn Technologies, S.L.

- Mago S.A.

- NEXCOM International Co., Ltd.

- NXP Semiconductors N.V.

- Pricer AB

- RAINUS Co., Ltd.

- Samsung Electronics Co., Ltd.

Delivering Strategic Recommendations To Industry Leaders On Navigating Integration Complexities Maximizing ROI, And Seizing Emerging Opportunities In Smart Shelving

Industry leaders are advised to adopt a modular deployment strategy that balances off-the-shelf hardware with customizable software layers, ensuring rapid implementation while retaining flexibility for future enhancements. By establishing pilot programs in representative store formats or facilities, stakeholders can validate performance metrics and refine integration workflows before committing to broader rollouts.

To mitigate supply chain volatility, organizations should invest in multi-sourcing agreements and cultivate relationships with both regional suppliers and global partners. Integrating predictive maintenance protocols will further extend equipment lifecycles and reduce unplanned service interruptions. On the software front, prioritizing platforms with open APIs and robust developer ecosystems accelerates integration with point-of-sale, ERP, and CRM systems, facilitating seamless data exchange.

Furthermore, teams must design change management initiatives to equip frontline associates with the skills needed to interpret analytics dashboards and act on real-time alerts. By fostering cross-functional governance bodies that include IT, operations, and merchandising leaders, enterprises can align objectives and create accountability for smart shelf performance. Finally, embedding sustainability criteria into vendor selection processes will ensure technology investments support broader environmental and social responsibility goals.

Detailing A Robust Research Methodology Combining Primary Interviews With Secondary Data Analysis And Qualitative Validation For Rigorous Market Intelligence

This research harnessed a triangulated approach to ensure robustness and depth. Primary interviews were conducted with senior executives and operational leaders from retail chains, healthcare providers, logistics operators, and solution vendors. These discussions illuminated real-world deployment challenges, use cases, and decision drivers.

Secondary data analysis encompassed trade publications, industry association reports, public company disclosures, and regulatory filings. This phase provided historical context on tariff developments, technology roadmaps, and standardization efforts. Key themes emerged around cost pressures, interoperability requirements, and regional policy impacts.

To validate findings, workshops were held with cross-functional stakeholder groups, including IT architects, procurement specialists, and process engineers, ensuring that conclusions resonated with diverse operational perspectives. Qualitative insights were synthesized with market intelligence frameworks to distill strategic imperatives. The combined methodology delivers a balanced, real-world view of the intelligent shelving landscape, supporting confident decision-making for both technology adopters and solution providers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Shelves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Shelves Market, by Component

- Smart Shelves Market, by Type

- Smart Shelves Market, by Connectivity

- Smart Shelves Market, by Application

- Smart Shelves Market, by End User

- Smart Shelves Market, by Region

- Smart Shelves Market, by Group

- Smart Shelves Market, by Country

- United States Smart Shelves Market

- China Smart Shelves Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Drawing Strategic Conclusions On The Evolution, Adoption Drivers, And Future Trajectories Of Intelligent Shelf Technologies In Diverse Market Environments

As organizations navigate an increasingly complex supply chain environment, smart shelving solutions have emerged as a critical enabler of operational excellence and customer-centric innovation. The convergence of advanced sensors, AI-driven analytics, and cloud-native management platforms is shifting the paradigm from manual, labor-intensive processes to automated, data-infused workflows.

Adoption drivers extend beyond cost savings and efficiency gains; they include enhanced shopper engagement through dynamic pricing and interactive displays, improved compliance with safety and regulatory standards in healthcare and industrial contexts, and resilience against tariff-induced cost disruptions. Moreover, the expansion of connectivity options-from RFID to sophisticated vision systems-broadens the scope for customization across diverse applications and end-user segments.

Looking ahead, the trajectory of intelligent shelf technologies will be shaped by emerging trends such as expanded edge AI capabilities, increased emphasis on sustainability, and the standardization of interoperability protocols. Decision-makers who integrate these solutions strategically, align cross-functional teams around shared objectives, and maintain agility in sourcing and deployment will be best positioned to capitalize on the next wave of smart shelving innovation.

Encouraging Immediate Engagement With Ketan Rohom To Access Authoritative Insights And Secure Comprehensive Smart Shelf Market Intelligence Today

With the unprecedented pace of innovation reshaping the retail and industrial landscapes, securing comprehensive insights is no longer optional but imperative. Partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, offers an unmatched opportunity to gain early access to a meticulously curated market research report that delves into the most critical trends, competitive benchmarks, and strategic imperatives defining the smart shelf ecosystem.

Ketan’s expertise in connecting leading enterprises with actionable intelligence ensures a tailored experience that aligns with your organization’s strategic goals. By reaching out today, you will access detailed analyses of regulatory shifts, pricing dynamics, vendor positioning, and regional adoption patterns. This collaboration provides not just data, but a pathway to translate intelligence into competitive advantage, equipping your teams to anticipate disruptions, optimize supply chains, and drive superior customer experiences.

Embark on a privileged partnership that delivers more than market insights: it empowers decisive action. Contact Ketan Rohom to secure your copy of the definitive smart shelf market research report, and begin transforming opportunities into measurable outcomes.

- How big is the Smart Shelves Market?

- What is the Smart Shelves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?