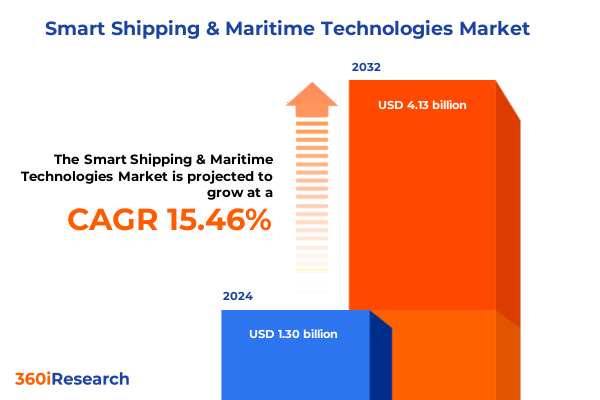

The Smart Shipping & Maritime Technologies Market size was estimated at USD 1.49 billion in 2025 and expected to reach USD 1.70 billion in 2026, at a CAGR of 15.69% to reach USD 4.13 billion by 2032.

Catalyzing the Future of Maritime Operations Through Intelligent Technologies While Addressing Sustainability, Resilience Across Global Supply Chains

The proliferation of advanced digital solutions and the imperative for sustainability are converging to redefine how goods traverse the world’s oceans. In an era marked by intensified regulatory scrutiny, fluctuating trade policies, and heightened stakeholder expectations for environmental stewardship, shipping entities are compelled to embrace smart technologies that deliver efficiency, transparency, and resilience. From autonomous navigation systems that optimize voyage routes to integrated sensor networks that provide real-time performance metrics, a new generation of maritime infrastructure is emerging to meet the demands of global commerce. This transformation is further accelerated by the adoption of cloud-based platforms capable of aggregating multi-sourced data streams, enabling predictive analytics that anticipate maintenance needs and preemptively mitigate downtime risks.

Against this backdrop, the industry’s focus on decarbonization has galvanized investments in energy-efficient propulsion, alternative fuels, and carbon offset mechanisms. Simultaneously, digitalization initiatives are streamlining port operations and supply chain orchestration, reducing dwell times and unlocking new levels of asset utilization. These parallel, synergistic trends form the foundation for a resilient shipping ecosystem that can adapt to evolving geopolitical dynamics and economic cycles. This executive summary outlines the key forces shaping the smart shipping landscape, examines the impact of recent tariff adjustments, and delivers actionable insights for decision-makers seeking to harness the full potential of maritime technologies.

Navigating the Wave of Digitalization, Automation, and Collaborative Ecosystems Redefining Maritime Logistics and Shipping Practices Worldwide

Over the past decade, the maritime sector has undergone transformative shifts as digitalization and automation converge to deliver unprecedented operational efficiency. Traditional vessel management paradigms are yielding to integrated ecosystems where machine learning algorithms continuously analyze performance indicators, enabling dynamic route optimization that adapts to real-time weather and traffic conditions. Concurrently, the emergence of blockchain-based documentation is revolutionizing cargo traceability, ensuring tamper-proof transactional records and enhancing trust across multi-party logistics networks. These technological advances have catalyzed new service models, such as remote condition monitoring and predictive maintenance subscriptions, which are rapidly gaining traction among shipping lines and terminal operators alike.

In parallel, collaborative initiatives between technology providers, port authorities, and regulatory bodies are fostering standardized protocols for data sharing and cybersecurity. As maritime stakeholders coalesce around common frameworks, interoperability across diverse systems is becoming a reality, reducing integration costs and accelerating deployment timelines. Moreover, the growing emphasis on digital twins as virtual representations of vessels and port assets is enabling scenario simulations that inform strategic investments and contingency planning. Taken together, these shifts are dismantling legacy barriers, unlocking new revenue streams, and laying the groundwork for a truly connected and intelligent maritime value chain.

Examining the Comprehensive Consequences of New Tariff Regimes on US Maritime Trade Flows, Vessel Profitability, and Supply Chain Dynamics

The introduction of revised tariff structures in 2025 has exerted a substantial cumulative effect on US maritime trade, prompting industry leaders to reassess cost models, supply chain configurations, and voyage planning strategies. As duties on key imported machinery components and advanced navigation equipment have risen, vessel operators have begun exploring alternative sourcing avenues and onshoring assembly functions to mitigate escalating input costs. These adjustments have created ripples across freight rates, with some carriers opting to revise fuel surcharges and pass through incremental expenses to end customers. The net outcome has been a recalibration of contract negotiations, where long-term freight agreements now include more granular clauses addressing future tariff fluctuations.

Furthermore, the heightened financial burden on spare parts and sensors has accelerated the shift toward in-house diagnostics and repair capabilities, reducing reliance on expensive third-party maintenance services. Simultaneously, insurance providers have updated their risk assessments to account for supply chain vulnerabilities introduced by tariff-induced delays and redirected shipping lanes. Despite these headwinds, the industry has displayed resilience by leveraging digital platforms to real-time monitor cost impacts, rebalance routes, and capitalize on underutilized trade corridors. Moving forward, sustained collaboration among carriers, shippers, and port operators will be critical in stabilizing trade flows and preserving margin integrity under continued tariff volatility.

Unveiling Deep Insights Across Component, Vessel, Application, and End-User Dimensions to Illuminate Strategic Opportunities in Maritime Technology Markets

A granular examination of maritime technology market segmentation reveals nuanced strategic opportunities across multiple dimensions. When viewed through the lens of component composition, hardware elements such as communication modules, handling equipment, navigation gear, and radar and sensor arrays serve as the foundational infrastructure, while service offerings encompassing repair and maintenance alongside support and training ensure peak operational performance. Equally pivotal are solution frameworks integrating robust cybersecurity and compliance protocols, optimization engines for route and resource efficiency, and predictive analytics paired with digital twin constructs that drive proactive decision-making.

Turning to vessel typologies, the segment spanning bulk carriers, container ships, passenger liners, and tankers exhibits distinct adoption curves for digital tools, with asset-heavy industries prioritizing predictive maintenance and safety enhancements. In application contexts, modules geared toward comprehensive asset and fleet management, cargo and logistics optimization, port and terminal orchestration, and advanced safety and security measures are delivering differentiated value propositions aligned to operator needs. Finally, end-user segmentation underscores demand dynamics among commercial shipping conglomerates, military and defense agencies, as well as oil exploration firms, each of which leverages specific aspects of the smart shipping ecosystem to fulfill stringent performance, security, and regulatory requirements.

This comprehensive research report categorizes the Smart Shipping & Maritime Technologies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Ship Type

- Application

- End-User

Exploring Regional Variations in Maritime Technology Adoption, Infrastructure Readiness, and Regulatory Frameworks Across Americas, EMEA, and Asia-Pacific Markets

Regional nuances in the adoption and deployment of maritime technologies underscore the importance of localized strategies and tailored innovation roadmaps. In the Americas, the convergence of legacy port infrastructures with an emphasis on digital twin pilots has accelerated investments in optimization platforms to address bottlenecks along key trade corridors such as the Panama Canal and Gulf Coast terminals. Meanwhile, robust governmental incentives for green shipping practices are propelling the use of alternative fuels and retrofit programs aimed at reducing carbon footprints.

Across Europe, the Middle East, and Africa, a complex tapestry of regulatory regimes and infrastructural disparities has driven a modular approach to technology rollouts. Leading European ports are integrating blockchain consortia for streamlined customs procedures, while Gulf Cooperation Council states are deploying autonomous vessel trials to enhance offshore logistics. In Africa, strategic partnerships are focusing on leapfrog initiatives, combining low-cost sensor networks with cloud analytics to extend port coverage where traditional infrastructure investment lags.

A distinctly different dynamic emerges in the Asia-Pacific region, where high-volume container hubs and passenger ferry markets are at the forefront of large-scale digital platforms. National mandates for emission reductions are catalyzing the adoption of route optimization and fuel-management solutions, while comprehensive end-to-end logistics suites are delivering real-time visibility from vessel departure through final cargo delivery.

This comprehensive research report examines key regions that drive the evolution of the Smart Shipping & Maritime Technologies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Innovation Roadmaps, and Collaborative Initiatives Employed by Leading Players in the Smart Shipping Ecosystem

Leading participants in the smart shipping ecosystem are charting divergent yet complementary courses to secure competitive advantage. Key hardware manufacturers are expanding their portfolios to include integrated sensor suites that seamlessly interface with cloud-native analytics tools, thereby reducing time to value for end customers. Simultaneously, service providers are enhancing their value propositions through turnkey support models that bundle preventive maintenance programs with remote diagnostics and operator training modules.

On the solutions front, technology disruptors are distinguishing themselves by embedding advanced machine learning algorithms within optimization engines, enabling dynamic real-time adjustments that yield incremental fuel savings and throughput improvements. Collaborative initiatives between major enterprises and specialized startups are fostering co-development of cybersecurity architectures designed to counter evolving threats targeting vessel control systems and port infrastructure. Additionally, strategic alliances between defense contractors and commercial shipping lines are prompting the cross-pollination of secure communications and resilience protocols, driving innovation in dual-use applications.

Across all segments, the emphasis is shifting from point solutions toward end-to-end digital ecosystems. Firms that can demonstrate seamless integration across hardware, services, and software layers are best positioned to capture market share and establish long-term partnerships with high-value clients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Shipping & Maritime Technologies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Accenture PLC

- APM Terminals

- Bureau Veritas

- Cargotec Corporation

- Cavotec SA

- Cobham Limited

- Dataloy Systems AS

- Dell Inc.

- Det Norske Veritas Group

- Dualog AS

- Emerson Electric Co.

- Hyundai Heavy Industries Co., Ltd.

- Inmarsat Global Limited

- Intel Corporation

- Intellian Technologies, Inc.

- Kongsberg Gruppen ASA

- Kpler Holding SA

- Maritech Holdings Limited

- Microsoft Corporation

- Mitsubishi Heavy Industries, Ltd.

- Moxa Inc.

- Navis LLC

- Northrop Grumman Sperry Marine B.V.

- OrbitMI, Inc.

- Pole Star Space Applications Limited

- RightShip Group

- SEDNA Communications Ltd.

- Shipamax Ltd.

- Shipfix Technologies S.A.S.

- Siemens AG

- Siglar Carbon AS

- Trelleborg AB

- Trigonal Ltd.

- Veson Nautical LLC

- Volaris Group

- Wallem Group

- Wärtsilä Corporation

- ZeroNorth A/S

Empowering Industry Leaders to Capitalize on Emerging Technologies, Strengthen Resilience, and Drive Sustainable Growth in Maritime Operations

To effectively capitalize on emerging maritime technology trends, industry leaders should adopt a multi-pronged approach that balances innovation with operational pragmatism. First, executives must prioritize the establishment of innovation centers and digital incubators tailored to maritime use cases, allowing cross-functional teams to prototype and pilot new capabilities without disrupting core operations. Concurrently, organizations should strengthen data governance frameworks to ensure the integrity, security, and interoperability of information flowing between vessels, ports, and onshore control centers.

In parallel, stakeholders ought to forge strategic alliances with technology providers and academic institutions to co-develop next-generation solutions that address both regulatory imperatives and evolving market demands. By adopting flexible financing models-such as consumption-based pricing or outcome-oriented contracts-companies can mitigate upfront capital expenditures while retaining the ability to scale usage in line with demand. Lastly, robust talent development programs are essential to cultivate a workforce adept at leveraging digital twin modeling, artificial intelligence, and advanced cybersecurity techniques, thereby ensuring sustainable competitive differentiation.

Revealing Rigorous Research Techniques, Data Sourcing Strategies, and Analytical Frameworks That Ensure the Integrity and Accuracy of Market Insights

This analysis is grounded in a rigorous combination of primary and secondary research methodologies designed to deliver comprehensive and validated market insights. Primary research activities encompassed in-depth interviews with senior executives across shipping lines, port authorities, technology vendors, and government bodies. These discussions yielded qualitative perspectives on adoption drivers, technology roadblocks, and strategic priorities. Complementing these engagements, a series of on-site visits at major maritime hubs provided direct observation of operational workflows and technology pilots in action.

Secondary research efforts involved systematic reviews of industry white papers, regulatory filings, company annual reports, and recognized academic journals. Proprietary databases were leveraged to extract historical trend data, which were then triangulated against real-time shipping statistics and customs records to ensure consistency and accuracy. Analytical frameworks, including SWOT analyses and PESTEL evaluations, were applied to contextualize findings within broader macroeconomic and geopolitical environments. Finally, all data inputs underwent rigorous validation through consensus workshops with subject-matter experts and cross-verification against publicly available trade data.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Shipping & Maritime Technologies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Shipping & Maritime Technologies Market, by Component

- Smart Shipping & Maritime Technologies Market, by Ship Type

- Smart Shipping & Maritime Technologies Market, by Application

- Smart Shipping & Maritime Technologies Market, by End-User

- Smart Shipping & Maritime Technologies Market, by Region

- Smart Shipping & Maritime Technologies Market, by Group

- Smart Shipping & Maritime Technologies Market, by Country

- United States Smart Shipping & Maritime Technologies Market

- China Smart Shipping & Maritime Technologies Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Key Findings, Strategic Imperatives, and Future Outlook That Will Guide Stakeholders Through the Ongoing Evolution of Smart Maritime Technologies

The convergence of digital transformation, regulatory evolution, and sustainability imperatives is reshaping the global maritime landscape with unprecedented speed and complexity. Smart shipping technologies-from autonomous navigation systems to integrated cybersecurity defenses-are no longer experimental concepts but essential components of resilient and efficient operations. The nuanced impacts of recent tariff adjustments have underscored the importance of adaptive supply chain strategies and real-time cost monitoring, compelling stakeholders to embrace greater agility in sourcing and route planning.

Segmentation analyses have highlighted diverse adoption patterns across components, vessel types, applications, and end-user groups, while regional insights have illuminated how local regulatory frameworks and infrastructure maturity levels influence technology deployment strategies. Competitive intelligence underscores that firms capable of delivering integrated ecosystems-spanning hardware, services, and solutions-are poised to lead the next wave of innovation. As the industry continues its trajectory toward digitalization and decarbonization, stakeholders must remain vigilant, collaborative, and forward-looking to secure enduring value.

Connect with Ketan Rohom to Access In-Depth Maritime Technology Market Analysis, Tailored Insights, and Bespoke Solutions for Your Strategic Initiatives Today

Harness unprecedented opportunities in maritime technology by engaging directly with Ketan Rohom, whose deep industry knowledge and strategic vision can unlock tailored market intelligence for your organization. Personalized consultations will delve into critical insights on digital twin integration, cybersecurity frameworks, and predictive maintenance strategies that align with your company’s operational objectives. By collaborating with Ketan, you gain exclusive access to enriched data sets, proprietary analytical tools, and early trend alerts, enabling you to stay ahead in a rapidly evolving landscape. Initiating contact today ensures that your team can swiftly incorporate evidence-based recommendations into current projects, optimize capital allocation, and reinforce competitive differentiation. Prepare to transform uncertainty into actionable advantage; reach out now to secure your comprehensive maritime technology market report and begin charting a course toward sustained growth and innovation.

- How big is the Smart Shipping & Maritime Technologies Market?

- What is the Smart Shipping & Maritime Technologies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?