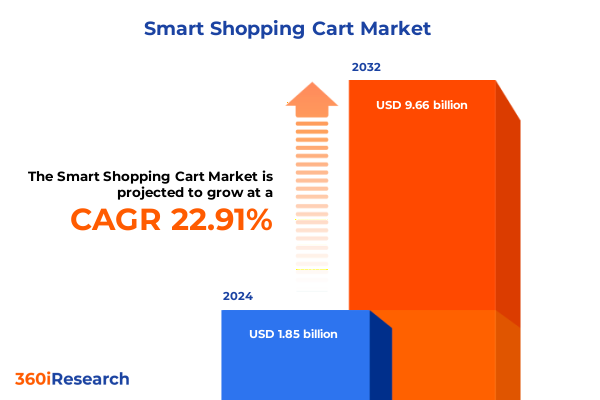

The Smart Shopping Cart Market size was estimated at USD 2.25 billion in 2025 and expected to reach USD 2.74 billion in 2026, at a CAGR of 23.12% to reach USD 9.66 billion by 2032.

Revolutionizing Retail with Intelligent Smart Shopping Carts That Elevate Consumer Convenience and Drive Operational Efficiency Across Brick-and-Mortar

Smart shopping carts represent the convergence of Internet of Things sensors, computer vision, and artificial intelligence to create an immersive in-aisle experience that goes well beyond traditional self-checkout systems. These intelligent trolleys feature real-time basket tracking, personalized promotions, and seamless payment integration, radically transforming the way consumers interact with products and store environments.

Across major retail markets, early deployments have demonstrated significant improvements in operational efficiency and customer satisfaction. By embedding digital scales, cameras, and touchscreen interfaces, smart carts enable retailers to deliver interactive shelf navigation, instant cost transparency, and automated loyalty discount applications. As a result, frontline staff can shift focus from basic transaction processing to higher-value advisory roles, enhancing the overall shopping journey.

Uncovering The Transformative Shifts Driving The Smart Shopping Cart Revolution Through AI, IoT, Autonomous Systems, And Seamless Omnichannel Integration

The smart shopping cart landscape is being reshaped by rapid advancements in artificial intelligence, cloud computing, and the Internet of Things. Retailers are leveraging computer vision algorithms to recognize products instantly, enabling real-time basket updates without manual scanning. Furthermore, integration with cloud-based analytics platforms allows for on-the-fly personalization, dynamically generating offers and recommendations as shoppers navigate the store.

Autonomous retail environments are also emerging as transformative testbeds. At NRF 2025, Sensei unveiled the world’s largest autonomous supermarket, demonstrating real-time basket technology that tracks customer selections with unprecedented accuracy. This milestone highlights the potential for seamless checkout-free experiences at scale, where shoppers simply grab items and proceed to confirmation screens without traditional scanning or checkout lanes.

Simultaneously, voice-enabled interactions and gamified interfaces are gaining traction to cater to diverse consumer preferences. These features, combined with IoT-driven inventory monitoring, empower retailers to optimize stock levels, reduce shrinkage, and deliver an omnichannel experience that bridges in-store and digital touchpoints.

Analyzing The Comprehensive Impact Of New United States Tariffs On Component Sourcing And Smart Shopping Cart Supply Chains By 2025

In April 2025, the U.S. government implemented a baseline 10% reciprocal tariff on all imports, intensifying cost pressures on consumer electronics and associated components critical to smart shopping cart production. Industry analysts warn that these duties may inflate the cost of key modules, prompting retailers and technology providers to reevaluate sourcing strategies and production timelines.

Tariffs on imported IoT sensors and printed circuit board assemblies are projected to raise production expenses by approximately 4–6%, directly affecting essential cart components like weight sensors, cameras, and connectivity modules. This increase could force manufacturers to absorb additional costs or pass them on to retailers, potentially hindering adoption among price-sensitive segments and smaller chains.

Supply chain disruptions are exacerbated by uncertainty over duty applicability and retaliation risks, prompting companies to stockpile critical parts and invest in nearshoring initiatives. Such tactics, while mitigating short-term shortages, tie up capital and elevate inventory carrying costs, challenging profit margins for both OEMs and retailers.

To navigate this landscape, industry leaders are diversifying their manufacturing footprints by expanding partnerships in cost-advantaged regions such as Mexico and Vietnam. While reshoring to U.S.-based facilities offers long-term resilience, it demands substantial upfront investment and extended ramp-up periods, underscoring the complex trade-offs between cost, speed, and supply chain security.

Deriving Strategic Market Intelligence Through Comprehensive Segmentation Insights Across Offerings, Technology Types, And End-User Sectors

The smart shopping cart market’s complexity is best understood through three core segmentation lenses. Based on offerings, strategic investments focus on hardware innovations-encompassing camera modules, payment systems, scanners, touchscreen displays in both LCD and LED variants, and weight sensors-complemented by service offerings that range from high-value consulting engagements to installation and ongoing maintenance, alongside software platforms that enable AI-driven analytics and shopper engagement. When viewed through the technology type perspective, cost-sensitive deployments continue to favor barcodes for their simplicity and affordability, whereas high-throughput environments are increasingly adopting RFID systems to accelerate item recognition and enhance inventory visibility. From an end-user standpoint, grocery stores prioritize accuracy and speed to handle high item counts, shopping malls emphasize enriched customer experiences with interactive elements, and supermarket and hypermarket operators demand scalable, reliable solutions capable of supporting large shopper volumes and complex assortments.

This comprehensive research report categorizes the Smart Shopping Cart market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technology Type

- End-User

Examining Key Regional Dynamics Shaping Smart Shopping Cart Adoption Patterns Across The Americas, EMEA, And The Asia-Pacific Markets

Across the Americas, United States grocery chains and club stores have led the charge in piloting AI-powered carts. Walmart Chile has rolled out detachable dual-camera devices in multiple Lider Express locations, demonstrating sub-one-minute checkout times and over 95% product recognition accuracy. In the U.S., Wegmans is trialing Caper Carts in New York outlets, showcasing real-time spending updates and in-cart payment to streamline in-store experiences.

In Europe, Middle East & Africa, cashier-less models are gaining momentum in high-traffic venues. REWE Group’s Lekkerland subsidiary launched an autonomous pilot shop at Frankfurt Airport, employing AI-powered cameras that monitor selections and automatically process transactions upon exit. This initiative underscores the region’s appetite for seamless convenience and operational efficiency within travel retail environments.

The Asia-Pacific region has witnessed early adoption through prominent supermarket chains exploring in-aisle digitalization. Coles in Australia has initiated trials of AI-enabled trolleys in Melbourne, incorporating digital screens for locating specials, in-built scales for precise weighing, and integrated EFTPOS terminals for frictionless payment. These deployments reflect a broader commitment to omnichannel integration and enhancing the customer journey in mature markets.

This comprehensive research report examines key regions that drive the evolution of the Smart Shopping Cart market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying The Most Influential Companies And Their Competitive Strategies Driving Innovation And Expansion In The Smart Shopping Cart Ecosystem

Several pioneering technology providers and retailers are shaping today’s smart shopping cart ecosystem. Veeve, founded by former Amazon engineers, has partnered with Albertsons to deploy self-checkout carts that tally items in real time as they are placed inside, eliminating traditional lanes and reducing time in-store. Instacart’s Caper carts have gained traction across multiple U.S. and international grocers, leveraging computer vision and barcode scanning to deliver instant total cost visibility, recipe suggestions, and interactive promotional features.

Startups such as Shopic have collaborated with Walmart Chile to integrate AI-powered modules onto standard carts, enhancing cashier-less operations with detachable dual-camera systems that recognize thousands of SKUs with high accuracy. Meanwhile, Sensei’s autonomous supermarkets exemplify the frontier of checkout-free retailing by combining AI, computer vision, and sensor fusion to offer a fully autonomous shopping environment at scale.

Established enterprise technology firms are also expanding their offerings to capture a share of this emerging market. Companies specializing in point-of-sale systems and retail analytics are embedding smart cart functionalities-such as embedded AI engines and cloud-based insights platforms-into their product portfolios, signaling that mainstream providers acknowledge the long-term potential of in-aisle digitalization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Shopping Cart market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Caper Inc.

- Cart Technologies, LLC

- Cust2mate Ltd.

- Focal Systems Inc.

- Grabango Co.

- HiCart Corporation

- IMAGR Limited

- International Business Machines Corporation

- MetroClick, Inc.

- Microsoft Corporation

- Mitsui & Co., Ltd.

- Pentland Firth Software GmbH

- Retail AI, Inc.

- SAP SE

- Shopic Technologies Ltd.

- SK Telecom Co., Ltd.

- Standard Cognition, Corp.

- Superhii Corporation

- SuperSmart Ltd.

- Tracxpoint, Inc.

- Veeve Inc.

- Walmart Inc.

- Wanzl India Pvt Ltd.

- ZooZ by PayU Company

Actionable Recommendations For Retailers And Technology Providers To Capitalize On Smart Shopping Cart Innovations And Mitigate Implementation Challenges

Retailers considering smart cart deployments should begin with well-defined pilot programs that establish clear performance metrics, such as reductions in transaction time, increases in average basket size, and customer satisfaction scores. By partnering with experienced technology vendors, they can ensure smooth system integration with existing POS, loyalty, and inventory management platforms, minimizing disruption to operations.

Given the current tariff environment, supply chain resilience must be a strategic priority. Diversifying component sourcing to include cost-advantaged nearshore partners in Mexico and Southeast Asia will help mitigate duty-related cost spikes. Simultaneously, investing in modular cart designs allows for future component substitution as geopolitical landscapes evolve.

To maximize return on investment, retailers should harness data captured by smart carts to refine store layouts, optimize product placement, and tailor promotions. Equally important is upskilling staff to transition from checkout-centric roles to customer engagement and support functions, thereby reinforcing the human element in technology-driven shopping environments.

Finally, industry stakeholders should advocate for interoperability standards and open APIs that foster a plug-and-play ecosystem, enabling seamless integration of new hardware and software innovations without costly custom development.

Detailing A Robust Mixed Methodology Combining Primary Qualitative Interviews And Secondary Data Analysis To Ensure Comprehensive Market Coverage And Insight

Our research methodology integrates primary qualitative insights with extensive secondary data analysis to deliver a holistic understanding of the smart shopping cart market. Through in-depth interviews with industry executives, technology developers, and retail operations leaders, we capture firsthand perspectives on adoption drivers, integration challenges, and future roadmaps.

Secondary research encompasses a rigorous review of trade publications, press releases, financial filings, and regulatory announcements, ensuring that our findings reflect the most current industry developments. We triangulate these sources to validate key trends and mitigate the risk of bias.

Quantitative surveys administered to global retail decision-makers provide statistical support for qualitative observations, enabling robust segmentation analysis across offerings, technology types, and end-user categories. This mixed-methods approach empowers our clients to make data-driven decisions with confidence.

Throughout the study, we maintain strict adherence to research ethics and data integrity protocols, ensuring transparency and reproducibility. Our comprehensive framework equips stakeholders with actionable insights, strategic recommendations, and a clear roadmap for navigating the dynamic landscape of smart shopping cart innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Shopping Cart market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Shopping Cart Market, by Offering

- Smart Shopping Cart Market, by Technology Type

- Smart Shopping Cart Market, by End-User

- Smart Shopping Cart Market, by Region

- Smart Shopping Cart Market, by Group

- Smart Shopping Cart Market, by Country

- United States Smart Shopping Cart Market

- China Smart Shopping Cart Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Concluding Perspectives On The Imperative Role Of Smart Shopping Carts In Shaping The Future Of Retail Experience And Operational Excellence

The emergence of smart shopping carts marks a pivotal moment in retail evolution, blending advanced technologies with human-centered design to deliver exceptional consumer experiences. As AI-driven analytics and autonomous systems become more accessible, retailers have the opportunity to differentiate through seamless in-aisle engagement, reduced friction at checkout, and enhanced operational intelligence.

Looking forward, the convergence of digital transformation initiatives, sustainability imperatives, and omnichannel strategies will reinforce the strategic role of smart carts within the broader retail ecosystem. Retailers that proactively embrace these innovations, invest in supply chain resilience, and cultivate strategic partnerships will be best positioned to unlock new revenue streams, strengthen customer loyalty, and achieve long-term competitive advantage.

By synthesizing the latest technological breakthroughs, tariff-related market dynamics, and segmentation-driven growth opportunities, this executive summary provides a foundational blueprint for stakeholders to capitalize on the smart shopping cart revolution and shape the future of retail experience.

Take The Next Step Toward Retail Innovation Leadership By Securing Your Comprehensive Smart Shopping Cart Market Research Report Today

Ready to transform your retail operations and stay ahead in a rapidly evolving market? Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure your definitive market research report on smart shopping cart innovations and gain exclusive insights, in-depth competitive analysis, and actionable strategies tailored to your organization’s unique needs. Begin your journey toward retail leadership today by contacting Ketan Rohom and unlocking the full potential of intelligent shopping solutions.

- How big is the Smart Shopping Cart Market?

- What is the Smart Shopping Cart Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?