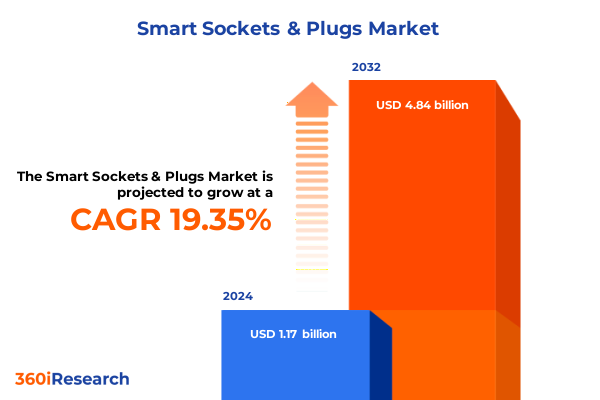

The Smart Sockets & Plugs Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.65 billion in 2026, at a CAGR of 19.49% to reach USD 4.84 billion by 2032.

Unveiling the Pivotal Role of Smart Sockets and Plugs in Revolutionizing Energy Management and Connectivity Across Residential and Commercial Sectors

In recent years, smart sockets and plugs have emerged as cornerstone devices in the evolution of intelligent buildings and connected homes. These compact yet powerful modules seamlessly integrate with the Internet of Things (IoT), enabling users to remotely monitor and control electrical devices via smartphones, voice assistants, or centralized automation platforms. Beyond simple on/off functionality, modern smart sockets embed features such as energy monitoring, overload protection, and child locks, bridging the gap between convenience, safety, and sustainability. As energy costs and environmental awareness rise, the ability to track usage patterns and optimize consumption in real time has elevated these devices from novelty gadgets to essential components in homes, offices, manufacturing facilities, and hospitality venues.

Transitioning from early iterations reliant on proprietary hubs, the current generation of smart sockets leverages standardized connectivity technologies-ranging from Bluetooth Low Energy and Wi-Fi to Z-Wave and Zigbee-to ensure interoperability with a diverse ecosystem of sensors and controllers. This migration toward open protocols has been instrumental in expanding adoption among tech-savvy consumers and enterprise integrators alike, fostering a more vibrant marketplace of interoperable solutions. Moreover, the infusion of advanced capabilities such as voice command recognition and app-based scheduling has heightened user engagement, positioning smart sockets as a crucial entry point for broader smart building and smart grid initiatives. By contextualizing these trends, this report lays the groundwork for a comprehensive exploration of the market’s structural shifts, regional dynamics, and actionable strategies.

Exploring the Paradigm Shift in the Smart Socket and Plug Landscape Driven by Integrations in IoT Platforms, AI Capabilities, and Evolving Consumer Demands

Over the past five years, the smart socket and plug industry has undergone a series of transformative shifts propelled by technological advancements, evolving consumer expectations, and an intensified focus on energy efficiency. Initially characterized by standalone devices offering rudimentary remote control capabilities, the market now prioritizes holistic integrations with IoT platforms and cloud-based analytics, delivering data-driven insights and predictive maintenance functionalities. Embedded edge computing modules reduce latency for critical commands, while machine learning algorithms enable anomaly detection, alerting users to abnormal consumption patterns that could signify inefficiencies or safety hazards.

Furthermore, the rise of voice-activated ecosystems-powered by leading-edge digital assistants-has redefined user interaction paradigms. A growing segment of consumers now expects hands-free operation, prompting manufacturers to embed microphones and develop seamless integrations with major voice platforms. Concurrently, the migration toward universal interoperability has spurred wider adoption of industry standards, with solutions certified across Bluetooth SIG, Z-Wave Alliance, and Connectivity Standards Alliance programs. These shifts are not solely technological; they reflect a deeper change in buyer behavior, as users seek scalable solutions that can integrate lighting, HVAC, and security systems under unified management interfaces. Consequently, companies are reengineering their roadmaps to emphasize modularity, ensuring that smart socket and plug offerings evolve in concert with broader smart building and smart city deployments.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Smart Socket and Plug Manufacturing, Distribution Costs, and Supply Chain Resilience Strategies

In 2025, the landscape for smart sockets and plugs in the United States was reshaped significantly by the implementation of additional tariffs on imported electronic components and finished goods. The extension of Section 301 duties to encompass semiconductor modules and PCB assemblies elevated the landed cost of many core inputs, prompting device makers to revise procurement strategies. Companies faced pressure to either absorb higher expenses or transfer costs through pricing adjustments, which risked dampening consumer demand in cost-sensitive segments. These tariff measures also spurred a reevaluation of global supply chains, as stakeholders sought to mitigate future exposure by diversifying sources and exploring near-shoring opportunities within North America.

At the same time, distributors and channel partners grappled with inventory management challenges in a volatile duty environment, accelerating interest in digital procurement platforms that offer real-time visibility into landed cost calculations. To counterbalance the tariff burden, a number of manufacturers have forged partnerships with domestic electronics assemblers, leveraging localized production to reclaim preferential trade treatment. While this strategic pivot introduces transition costs and retooling investments, it ultimately strengthens supply chain resilience by reducing dependency on single sourcing from tariffed regions. As the industry absorbs these cumulative impacts, the result is a more agile value chain capable of adapting to shifting trade policies and preserving continuity of product availability.

Illuminating Critical Segmentation Insights Across Connectivity Technology, Control Methods, Distribution Channels, Applications, and End-Use Categories

A detailed segmentation analysis reveals distinct performance and adoption patterns across connectivity technology, control method, distribution channel, application, and end-use dimensions. Within connectivity technology, Wi-Fi–enabled smart sockets demonstrate broad appeal in deployments requiring direct internet access and higher bandwidth for energy-monitoring analytics, whereas Zigbee units gain traction in multi-device mesh networks for commercial automation scenarios. Bluetooth Low Energy appeals to residential consumers seeking energy efficiency and straightforward pairing, while Z-Wave continues to serve specialized security-focused installations, prized for its robust interference-resistant mesh topology.

Control methods exhibit parallel diversity: app-controlled interfaces dominate early adopter segments due to their intuitive dashboards and scheduling flexibility, remote-controlled solutions retain relevance where simple point-to-point operations suffice, and voice-controlled devices are surging as digital assistant ecosystems proliferate. On the distribution front, brick-and-mortar retail remains an essential touchpoint for consumer trial and immediate fulfillment, while online channels-via both brand websites and e-commerce platforms-drive convenience-oriented purchase behavior and support direct-to-consumer subscription models.

The smart plug feature set further differentiates usage scenarios: consumer demand for integrated child lock and overload protection functions is rising in family households, energy monitoring capabilities appeal to environmentally conscious users and small businesses, and surge protection remains a cornerstone requirement for safeguarding sensitive electronics. End-use segmentation underscores residential deployments in single-family and multi-unit environments as primary drivers, yet commercial offices and retail-and-hospitality venues increasingly integrate smart outlets to optimize operational efficiencies, and industrial sites including manufacturing facilities and warehouses employ ruggedized variants for remote power control and predictive maintenance initiatives.

This comprehensive research report categorizes the Smart Sockets & Plugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity

- Distribution Channel

- Application

- End-Use

Mapping Key Regional Insights Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets for Smart Sockets and Plugs Adoption and Growth Drivers

Regional dynamics within the smart socket and plug market reflect unique regulatory, infrastructural, and consumer behavior influences across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, strong regulatory incentives for energy management, combined with utility rebate programs in key states, have accelerated adoption among both residential and commercial end users. North America, particularly the United States and Canada, leads in pilot integrations with smart grid platforms, enabling demand response participation and time-of-use rate automation.

Europe Middle East & Africa markets exhibit a patchwork of maturity levels, from advanced deployments in Western Europe-buoyed by EU directives on energy efficiency and building automation-to emerging use cases in the Gulf Cooperation Council driven by smart city initiatives. Infrastructure challenges in select African nations temper near-term expansion, yet off-grid solar-plus-smart-socket solutions are gaining momentum in decentralized electrification projects. Meanwhile, Asia-Pacific stands out for its rapid urbanization and robust manufacturing ecosystems. China and India are both investing heavily in domestic IoT platforms, fostering local smart socket innovations, while Southeast Asian nations report growing interest in cost-effective Wi-Fi solutions tailored to dense residential complexes.

Cross-regional partnerships are increasingly common, with manufacturers leveraging localized firmware customization and multilingual support to address regional interoperability requirements. These differentiated regional insights underscore the importance of adaptive go-to-market strategies that align product roadmaps with the specific regulatory, infrastructural, and cultural contexts prevailing in each territory.

This comprehensive research report examines key regions that drive the evolution of the Smart Sockets & Plugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping the Smart Socket and Plug Market Through Innovation, Strategic Partnerships, and Competitive Differentiation Strategies

Leading players in the smart sockets and plugs landscape continue to shape the competitive environment through differentiated innovation, strategic alliances, and customer-centric service models. Established consumer electronics brands have expanded their portfolios with energy-monitoring sockets that integrate seamlessly into existing smart home ecosystems, capitalizing on brand trust to drive penetration. Networking specialists partner with chipset providers to co-develop Wi-Fi modules optimized for low-power operation and minimal latency, enhancing the performance of app-controlled and voice-activated deployments.

Simultaneously, facility-automation vendors are engineering ruggedized smart outlets for industrial use cases, embedding advanced overload protection and remote diagnostics to meet stringent safety standards. These incumbents often pursue partnerships with renewable energy integrators, enabling sockets to interface with solar inverters and battery management systems for optimized off-grid or grid-interactive applications. Moreover, a wave of nimble start-ups has carved out niches by emphasizing eco-design, developing compacts capable of high-precision load sensing for energy-conscious consumers and small businesses. Collectively, these varied company strategies reflect an ecosystem where innovation velocity and ecosystem collaboration define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Sockets & Plugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeotec Group GmbH

- Belkin International, Inc.

- Broadlink International

- CUCO Inc.

- Dell Inc.

- Eve Systems GmbH

- GE Appliances, Inc.

- IKEA Limited

- ITEAD Intelligent Systems Co.,Ltd

- LEGRAND S.A.

- Leviton Manufacturing Co., Inc.

- Lumi United Technology Co., Ltd

- Lutron Electronics Co., Inc

- Meross Technology Limited

- ORVIBO, Inc.

- Panasonic Corporation

- Robert Bosch Smart Home GmbH

- Schneider Electric SE

- Shelly Group PLC

- Shenzhen Gosund Technology Co., Ltd.

- Signify Holding.

- TP-Link India Private Limited.

- Wipro Limited.

- Wyze Labs, Inc.

- Xiaomi Technology Netherlands B.V.

Delivering Actionable Recommendations for Smart Socket and Plug Industry Leaders to Enhance Innovation, Diversify Portfolios, and Strengthen Market Positioning

Industry leaders can harness several actionable strategies to reinforce their market positions and catalyze sustained growth in the smart socket and plug domain. Foremost, diversifying the sourcing footprint to include qualified domestic and near-shoring partners mitigates tariff exposure and enhances inventory flexibility, enabling faster adaptation to trade policy shifts. Simultaneously, embedding edge-analytics capabilities directly within socket firmware reduces reliance on cloud backend services, improving responsiveness for critical safety and control functions.

To deepen customer engagement and brand loyalty, firms should forge alliances with utility providers and sustainability consultancies, bundling smart sockets with energy-efficiency audits and demand-response programs. These collaborations can unlock new revenue streams through performance-based incentives while reinforcing the value proposition to end users. Moreover, investing in robust security frameworks-including over-the-air firmware updates, encrypted communications, and intrusion detection-addresses a growing consumer concern over IoT device vulnerabilities. Finally, prioritizing modular product architectures and open-API integrations ensures that smart sockets evolve in alignment with broader smart building and smart city infrastructures, safeguarding relevance even as technology paradigms shift.

Detailing the Robust Research Methodology Integrating Primary Interviews, Comprehensive Secondary Data Analysis, and Rigorous Vendor Assessments

The research underpinning this analysis combines rigorous primary and secondary methodologies to ensure data integrity and relevance. Secondary research encompassed a thorough review of academic publications, industry white papers, patent filings, and regulatory documents to map the macro-economic drivers, tariff frameworks, and connectivity standards shaping market trajectories. Concurrently, extensive primary research involved structured interviews with senior executives from hardware manufacturers, IoT platform providers, and channel distributors, supplemented by surveys of end users spanning residential, commercial, and industrial segments.

Data triangulation techniques reconciled insights from these varied sources, while vendor assessments evaluated more than twenty leading smart socket and plug solutions against criteria such as feature breadth, interoperability, manufacturing footprint, and security protocols. This blended approach ensures that the conclusions and recommendations presented herein rest on a balanced foundation of quantitative metrics and qualitative expertise, delivering a comprehensive perspective on current dynamics and future opportunities within the smart sockets and plugs ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Sockets & Plugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Sockets & Plugs Market, by Product Type

- Smart Sockets & Plugs Market, by Connectivity

- Smart Sockets & Plugs Market, by Distribution Channel

- Smart Sockets & Plugs Market, by Application

- Smart Sockets & Plugs Market, by End-Use

- Smart Sockets & Plugs Market, by Region

- Smart Sockets & Plugs Market, by Group

- Smart Sockets & Plugs Market, by Country

- United States Smart Sockets & Plugs Market

- China Smart Sockets & Plugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Concluding Insights Highlighting the Strategic Imperatives, Emerging Opportunities, and Future Outlook for the Global Smart Socket and Plug Ecosystem

This executive summary underscores the multifaceted evolution of the smart socket and plug market, shaped by technological innovation, shifting trade dynamics, and nuanced regional demands. The integration of advanced connectivity protocols, machine learning-driven analytics, and voice controls has elevated these devices from simple remote power switches to critical enablers of energy efficiency and building automation. Concurrently, 2025 tariffs in the United States have prompted supply chain recalibrations that, while challenging in the short term, foster greater resilience and localization of production.

As segmentation insights illuminate divergent preferences across technologies, control methods, distribution channels, and end-use scenarios, leading companies refine their portfolios to address specific customer needs. Regional analysis further highlights the imperative of adaptive strategies that align product roadmaps with local regulatory and infrastructural contexts. In this competitive environment, industry leaders who embrace diversified sourcing, edge-analytics integration, and robust security measures will be best positioned to capture emerging opportunities. Ultimately, the confluence of innovation, agility, and strategic collaboration will determine which organizations lead the next wave of growth in the smart socket and plug ecosystem

Engage with Ketan Rohom to Unlock Comprehensive Market Intelligence and Secure Strategic Advantage Through the Definitive Smart Socket and Plug Market Research Report

To acquire an in-depth understanding of these transformative market dynamics and secure a competitive edge, connect with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the comprehensive Smart Sockets & Plugs market research report, tailored to your strategic objectives and operational needs. Discover the insights, data, and analyses that empower decision-makers to capitalize on emerging opportunities, navigate regulatory shifts, and optimize product roadmaps for sustained growth. Engage today to align your organization’s roadmap with the next wave of innovation in smart energy connectivity

- How big is the Smart Sockets & Plugs Market?

- What is the Smart Sockets & Plugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?