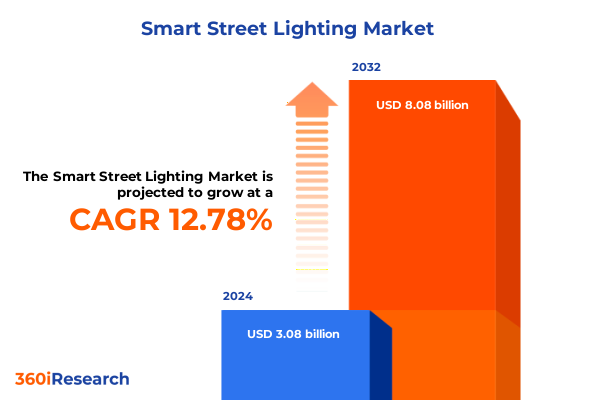

The Smart Street Lighting Market size was estimated at USD 3.44 billion in 2025 and expected to reach USD 3.86 billion in 2026, at a CAGR of 12.75% to reach USD 7.99 billion by 2032.

Envision the Next Generation of Urban Illumination: Harnessing Smart Street Lighting Technologies for Sustainable, Efficient, and Connected Cities

Smart street lighting represents a fundamental shift in urban infrastructure, moving beyond traditional illumination to integrate advanced connectivity, data analytics, and intelligent controls. By harnessing IoT-enabled luminaires equipped with sensors and communication modules, municipalities can monitor lighting performance in real time, optimize brightness levels based on traffic and ambient conditions, and perform predictive maintenance to prevent outages. These systems rely on robust networks-ranging from 5G to RF mesh-to ensure seamless data exchange between poles and centralized management platforms, driving both energy efficiency and operational transparency.

How Intelligent Connectivity, Data Analytics, and Renewable Energy Innovations Are Redefining Urban Lighting for Safer, Greener, and Smarter Communities

The convergence of intelligent connectivity, AI-driven automation, and renewable energy is redefining the smart street lighting landscape. Smart poles are evolving into multifunctional assets that host environmental sensors, public Wi-Fi, and electric vehicle charging ports, creating a unified platform for smart city applications. These poles leverage AI to adjust light intensity dynamically, learning from historical traffic patterns and environmental data to reduce energy consumption while maintaining optimal safety levels.

Sustainability has become a cornerstone of lighting innovation, with solar-powered fixtures and hybrid energy solutions gaining traction in regions with abundant sunlight. The adoption of carbon-neutral materials and recyclable components further aligns with global eco-design mandates, pushing manufacturers to minimize the lifecycle impact of their products. Government regulations, such as the European Union’s ecodesign requirements, are incentivizing the shift toward longer-lasting, energy-efficient luminaires that deliver both environmental and cost benefits.

As smart lighting systems become more connected, cybersecurity and interoperability emerge as critical considerations. Ensuring secure data encryption and adherence to open communication standards is essential to protect city infrastructure from potential threats and to facilitate seamless integration across diverse vendor ecosystems. Standardization efforts and the development of common protocols will be key to overcoming fragmentation and unlocking the full potential of smart street lighting deployments.

Assessing the Broad Economic and Operational Ramifications of 2025 U.S. Tariff Measures on Smart Street Lighting Supply Chains and Project Costs

The U.S. government’s 2025 tariff measures have significantly reshaped the economics of smart street lighting by imposing steep duties on key imported components. LEDs and semiconductor sensors sourced from China faced combined tariffs of up to 104%, leading many manufacturers and municipalities to reassess their supply chains. Importers responded by diversifying production to markets like India and Vietnam or by accelerating nearshoring initiatives. A temporary truce announced in May 2025 eased U.S. levies on Chinese lighting goods from 145% down to 30%, providing short-term relief but underscoring continued uncertainty in trade policy.

Parallel to electronics duties, renewed 25% tariffs on Canadian steel and aluminum in early 2025, later doubled to 50% under national security provisions, have driven up the costs of fixture frames, pole bases, and mounting hardware. Cities now face higher raw material budgets and longer lead times as North American supply chains adjust to volatile pricing. These metal tariffs have prompted some agencies to explore alternative composite materials to mitigate price pressures and ensure project viability.

Collectively, these trade measures have led to upward price adjustments for smart lighting projects, extended procurement timelines, and a renewed focus on redesigning fixtures to balance performance with cost. Industry stakeholders are responding by strengthening domestic manufacturing capabilities, investing in R&D for tariff-resistant materials, and establishing more resilient, geographically diverse sourcing strategies to safeguard future deployments against further policy shifts.

Unveiling Critical Segmentation Perspectives: Components, Light Sources, Communication Channels, Installation Methods, Distribution Pathways, and Application Domains Shaping Market Strategies

Analyzing the market through the lens of component segmentation reveals critical insights into product architecture and application potential. Hardware components, encompassing communication modules, controls and sensors, and fixtures, dictate both installation complexity and maintenance requirements. Service offerings, which include installation, integration, maintenance, and support, underscore the growing shift toward managed solutions that provide lifecycle assurance. Meanwhile, software capabilities in data analytics and remote monitoring form the backbone of operational efficiency, enabling cities to harness real-time intelligence for strategic decision-making.

Examining light source segmentation highlights the ongoing transition toward LED technologies, driven by superior energy performance, long lifespans, and compliance with stricter environmental standards. High-pressure sodium and induction lighting, once prevalent in legacy systems, are now largely reserved for niche applications where retrofitting challenges or regulatory constraints persist.

Communication technologies play a pivotal role in network design, with cellular, power-line communication, and RF mesh networks offering diverse trade-offs between bandwidth, deployment costs, and grid independence. Installation type considerations-new installations versus retrofits-further shape project delivery models, budget allocations, and urban planning strategies. Distribution channels, whether offline through direct municipal procurement or online via specialized e-marketplaces, influence procurement agility and supplier competition. Lastly, application segmentation across highways and roads, residential and commercial zones, and urban centers reflects distinct functional requirements and aesthetic priorities that inform customized lighting solutions.

This comprehensive research report categorizes the Smart Street Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity Technology

- Power Source

- Installation Type

- Application

- End User

- Distribution Channel

Mapping Regional Dynamics in Smart Street Lighting Adoption: Uncovering Market Drivers, Policy Influences, and Technological Priorities Across the Americas, EMEA, and Asia-Pacific Territories

The Americas region leads smart street lighting adoption, buoyed by federal and state-level infrastructure initiatives that prioritize energy reduction and public safety. North American cities are increasingly leveraging funding programs to upgrade aging networks, integrating sensors for traffic management and environmental monitoring. In Latin America, pilot projects in major metropolises emphasize solar-powered street lights as cost-effective solutions for grid-constrained areas.

In Europe, Middle East & Africa, stringent energy efficiency mandates and urban resilience frameworks drive robust market growth. The European Union’s Ecodesign and Energy Labelling regulations set rigorous standards for lighting performance, pushing municipalities to replace outdated mercury vapor and induction systems with advanced LED controls. In the Middle East, major smart city projects such as those in the Gulf Cooperation Council states feature cutting-edge solar integration and sensor-rich poles to support tourism infrastructure.

Asia-Pacific markets present the fastest expansion trajectory, underpinned by rapid urbanization, public safety priorities, and significant government investment. China’s large-scale deployments of smart solar street lights demonstrate an emphasis on renewable integration, while Southeast Asian cities focus on cost-optimized retrofits. Australia and New Zealand exhibit a strong preference for human-centric lighting designs that align with progressive sustainability goals and community well-being.

This comprehensive research report examines key regions that drive the evolution of the Smart Street Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Powering the Smart Street Lighting Sector: Insights into Signify, Acuity Brands, Eaton, Cisco, and Itron’s Market Roles

Signify continues to lead global lighting innovation with a diversified production footprint spanning Europe, Asia, and North America. According to company leadership, less than one-fifth of its U.S. imports originate from China, enabling agile supply chain adjustments in response to trade tensions. Signify’s expertise in advanced controls and sensor-enabled fixtures positions it at the forefront of IoT integration within municipal networks.

Acuity Brands has reinforced its market position through strategic acquisitions and a focus on intelligent spaces. Recent quarterly reports highlight a slight dip in traditional lighting sales, offset by a more than 150% surge in its Intelligent Spaces segment following the QSC acquisition. Acuity continues to navigate tariff-related uncertainties through disciplined pricing actions and productivity initiatives, reflecting its view of trade measures as supply shocks to be managed proactively.

Eaton’s ConnectWorks platform, developed in collaboration with CIMCON, delivers a scalable wireless controller architecture that integrates ON/OFF switching, dimming, GPS capabilities, and utility-grade metering. This partnership underscores Eaton’s commitment to providing turnkey solutions that leverage existing lighting infrastructure to support broader smart city services, including public safety and EV charging hotspots.

Cisco has expanded its smart city portfolio by showcasing multi-sensor street pole nodes at major industry expos. In collaboration with Aero Wireless Group, Cisco demonstrated how integrating fiber, 5G, and IoT sensors on standard street poles can transform lighting infrastructure into a digital backbone for public safety, traffic management, and AI-driven analytics. These developments underscore Cisco’s focus on digital resilience and secure network design for urban environments.

Itron’s CityEdge platform and Networked Lighting Controllers (NLCs) have been adopted by cities like Helsingborg to modernize and automate street light operations. By embedding wireless communications and intelligent dimming features in over 30,000 fixtures, these deployments illustrate Itron’s capability to deliver energy savings, outage alarms, and centralized maintenance workflows on a city-wide scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Street Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Signify Holding

- Delta Electronics, Inc.

- Schneider Electric

- Acuity Inc.

- Huawei Technologies Co., Ltd.

- Zumtobel Group

- Hubbell Incorporated

- ITOCHU Corporation

- Itron Inc.

- ams-OSRAM AG

- Schréder SA

- Lucy Group Ltd

- Silicon Laboratories

- Gewiss S.p.A.

- Dimonoff Inc.

- GIFAS ELECTRIC GmbH

- Cree Lighting USA LLC

- Gemma Lighting Ltd

- gridcomm

- Honeywell International, Inc.

- Schnell Energy Equipment P Ltd

- Shenzhen Bbier Lighting Co., ltd

- Siemens AG

- The Motwane Manufacturing Company Pvt. Ltd.

- Xiamen Iotcomm Technology Co., Ltd.

- Yunex GmbH

Strategic Imperatives and Best Practices for Industry Leaders to Optimize Smart Street Lighting Deployments, Enhance Sustainability, and Drive Competitive Advantage

Industry leaders should prioritize open and interoperable architectures to ensure future-proof deployments and seamless integration with diverse smart city systems. Aligning with global standards for communication protocols and cybersecurity will mitigate vendor lock-in risks and safeguard critical infrastructure from emerging threats.

Diversification of supply chains is essential to navigate ongoing trade volatility. By establishing production and assembly capabilities in tariff-neutral jurisdictions, companies can maintain cost stability and reduce exposure to sudden policy shifts. Nearshoring and partnership with regional manufacturers can also shorten lead times and support local economic development.

Incorporating human-centric lighting strategies-such as tunable color temperatures and adaptive motion-based controls-will enhance public well-being and support municipal health initiatives. Coupling these capabilities with data analytics platforms empowers decision-makers to fine-tune lighting performance against community-specific objectives.

Public-private collaborations remain a catalyst for large-scale smart lighting projects. Municipalities should foster partnerships with technology providers and utilities to share risk, access grant funding, and leverage operational expertise. Joint pilot programs can validate technical assumptions and build stakeholder confidence before full city-wide rollouts.

Comprehensive Research Framework: Detailing Methodological Rigor, Data Collection, and Analytical Approaches Underpinning the Smart Street Lighting Market Study

This study employs a multi-stage research methodology, beginning with a comprehensive review of secondary sources, including industry reports, regulatory filings, and vendor whitepapers. Key trends and market dynamics were distilled through desk research focused on technology, policy, and economic factors.

Primary research involved in-depth interviews with municipal technology officers, utility executives, and solution providers, ensuring practical insights into deployment challenges and success criteria. Insights from these discussions were triangulated with desk research findings to validate market observations and refine segmentation models.

Data analysis incorporated both qualitative and quantitative techniques, applying thematic coding to interview transcripts and evaluating component and regional segmentation against real-world case studies. The methodology prioritized transparency and reproducibility, with clear documentation of data sources and analytical frameworks.

Limitations include potential variability in tariff implementation timelines and the evolving nature of cybersecurity standards. Continuous monitoring of policy developments and standards initiatives is recommended to maintain the relevance of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Street Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Street Lighting Market, by Component

- Smart Street Lighting Market, by Connectivity Technology

- Smart Street Lighting Market, by Power Source

- Smart Street Lighting Market, by Installation Type

- Smart Street Lighting Market, by Application

- Smart Street Lighting Market, by End User

- Smart Street Lighting Market, by Distribution Channel

- Smart Street Lighting Market, by Region

- Smart Street Lighting Market, by Group

- Smart Street Lighting Market, by Country

- United States Smart Street Lighting Market

- China Smart Street Lighting Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Concluding Reflections on the Transformative Potential of Smart Street Lighting for Future Urban Ecosystems and Critical Success Factors for Stakeholder Alignment

Smart street lighting stands at the nexus of urban efficiency, safety, and sustainability, offering municipalities a pathway to modernize aging infrastructure while unlocking new data-driven services. The convergence of IoT connectivity, AI analytics, and renewable power sources has elevated streetlights from static fixtures to dynamic nodes within smart city ecosystems. Success hinges on strategic alignment across public agencies, technology vendors, and community stakeholders, ensuring that technical innovations translate into tangible societal benefits.

As cities worldwide embark on large-scale retrofits and new installations, balancing cost pressures, regulatory requirements, and performance objectives remains crucial. Adaptable platform architectures and robust cybersecurity measures underpin the long-term viability of deployments, protecting investments against policy shifts and technological obsolescence. Ultimately, the greatest impact arises from holistic approaches that integrate lighting with broader urban initiatives, reinforcing the role of smart street lighting as a cornerstone of resilient, human-centric cityscapes.

Secure In-Depth Market Intelligence Today: Connect with Ketan Rohom to Unlock Comprehensive Smart Street Lighting Insights and Drive Strategic Decision-Making

Elevate your strategic planning with comprehensive insights into smart street lighting market dynamics, technology trends, and regulatory impacts. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the full research report and empower your organization with the data and analysis needed to make informed decisions. Take advantage of this opportunity to stay ahead of the curve and drive operational excellence in your smart lighting initiatives by contacting Ketan today.

- How big is the Smart Street Lighting Market?

- What is the Smart Street Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?