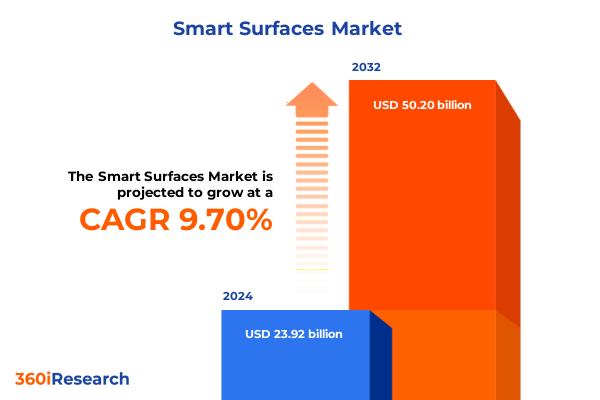

The Smart Surfaces Market size was estimated at USD 26.20 billion in 2025 and expected to reach USD 28.71 billion in 2026, at a CAGR of 9.73% to reach USD 50.20 billion by 2032.

Exploring the Emergence and Impact of Smart Surfaces as the Next Frontier Revolutionizing Material Innovation and Functional Design

Smart surfaces represent a groundbreaking convergence of advanced materials science and engineering innovation, enabling fabrics, ceramics, metals and polymers to adapt dynamically to their environment. From hydrogels that regulate moisture levels to nanomaterials that alter optical properties under specific triggers, these next-generation interfaces are designed with multi-functional layers capable of self-healing scratches, repelling contaminants and even regulating temperature autonomously. This evolution extends beyond conventional coatings and paints, encompassing smart glass that tints on demand, smart ceramics with enhanced thermo-mechanical resilience, and smart metals that respond to magnetic or electrical stimuli. Each of these technologies leverages sophisticated chemistries and fabrication techniques to deliver surfaces that improve performance and longevity across diverse end markets

By fusing nano-scale engineering with novel material formulations, smart surfaces are reshaping product design paradigms across sectors such as automotive, healthcare, building construction and electronics. Automakers are integrating self-healing coatings and adaptive glass into vehicle exteriors and interiors to enhance safety, comfort and aesthetic appeal. In medical settings, antimicrobial and self-cleaning surfaces are reducing infection risks on hospital equipment and surgical tools, while responsive hydrogels in diagnostic devices enable more precise biosensing. Meanwhile, in electronics and optoelectronics, smart polymers and conductive nanofilms are powering flexible displays, smart cards and next-generation sensors. The strategic implications of these innovations are profound, offering manufacturers and end-users alike pathways to sustainable performance gains and differentiated product experiences

Unveiling the Technological and Market Currents Redefining Smart Surface Capabilities and Industry Dynamics in the Digital Era

The smart surfaces landscape is undergoing transformative shifts driven by the rapid integration of artificial intelligence, the proliferation of Internet of Things (IoT) networks and breakthroughs in nanotechnology. IoT sensors embedded in advanced coatings and conductive films enable real-time monitoring of environmental factors such as temperature, humidity and structural integrity, while AI-powered analytics deliver predictive maintenance insights and autonomously adjust surface properties in response to changing conditions. This symbiotic fusion of hardware and software is ushering in a new era of ‘intelligent’ interfaces that not only protect and extend asset lifecycles but also unlock data-driven optimization across industrial and consumer applications

At the same time, breakthroughs in nanomaterials and smart polymers are fueling the development of ultra-thin, stimuli-responsive layers that can self-assemble, repair microscopic damage and actively modulate optical and thermal characteristics. The rollout of 5G and edge-computing architectures further amplifies these capabilities by reducing latency for local decision-making, enabling complex control loops for facades and windows in smart buildings. Sustainability has become another potent catalyst: green chemistries and life-cycle assessments are driving material suppliers to innovate low-VOC formulations and biodegradable composites. Collectively, these trends are redefining the competitive landscape, compelling traditional coatings and materials companies to adopt digital-first, eco-centric strategies to remain relevant in a rapidly evolving market

Assessing the Multifaceted Consequences of New United States Tariff Regimes on Smart Surface Supply Chains and Cost Structures

New tariff measures implemented by the Office of the U.S. Trade Representative under Section 301 are exerting significant cost pressures on imported raw materials critical to smart surface production, notably solar wafers, polysilicon and certain metal substrates. As of January 1, 2025, tariffs on solar wafers and polysilicon increased to 50%, while tungsten-based products faced a 25% levy. These adjustments, aimed at bolstering domestic clean energy manufacturing, have cascading effects on smart glass and conductive film costs, with many manufacturers now reevaluating supply chain strategies to mitigate elevated duties

In parallel, the administration’s additional 10% duty on a broad array of Chinese-origin materials and a 25% surcharge on imports from Canada and Mexico-effective February and March 2025-are reshaping cross-border sourcing calculus for nanomaterials, polymers and specialized ceramics. Industry stakeholders are responding by diversifying supplier bases, accelerating domestic qualification of alternative feedstocks and engaging in tariff exclusion petitions where feasible. These tactics, while helping to stabilize input costs, require careful regulatory navigation and underscore the importance of agile procurement models in a landscape characterized by shifting trade policies and geopolitical tensions

Decoding Market Segmentation to Illuminate Material, Function and Application Trends Driving Smart Surface Adoption

Material innovation lies at the heart of smart surfaces, with distinct categories such as hydrogels, nanomaterials, smart ceramics, smart coatings, smart glass, smart metals and smart polymers each delivering tailored performance characteristics. Hydrogels provide adaptive moisture management and ion-exchange capabilities, whereas nanomaterials leverage size-dependent phenomena to enable tunable optical and electrical responses. Smart ceramics contribute high-temperature stability, while multifunctional coatings and films offer stimuli-responsive self-cleaning, anti-bacterial and anti-fog functionalities. Meanwhile, smart glass solutions dynamically regulate light transmission, and smart metals and polymers introduce properties like shape-memory and self-healing, creating a diverse toolbox for manufacturers to meet application-specific demands.

Functional segmentation further distinguishes the market by anti-bacterial, anti-fog, anti-reflection and self-cleaning attributes, driving adoption across sectors that demand hygiene, clarity and low maintenance. Self-cleaning and antimicrobial coatings find ubiquitous use in healthcare facilities and public spaces, enabling continuous disinfection and reducing pathogen transmission risks. In industrial settings, anti-fog and anti-reflective films enhance safety and visibility for automotive mirrors, building facades and electronic displays. This function-driven differentiation empowers end users to select the precise surface behavior required for each operating environment, from surgical tools to smart cards and beyond.

Beyond materials and functionality, application segmentation reveals distinct dynamics across automotive, building and construction, electronics and optoelectronics, and healthcare and medical sectors. Within automotive, exterior and interior surface solutions are engineered for durability and comfort, integrating scratch-resistant self-healing coatings and ambient-adaptive glazing. The building and construction domain leverages responsive facades, temperature-regulating roofs, corrosion-resistant wall coatings and glare-reducing windows to enhance energy efficiency and occupant well-being. Electronics and optoelectronics rely on anti-smudge displays, sensor encapsulations and secure smart card coatings that balance protection with performance. In healthcare, diagnostic device interfaces, hospital surfaces and surgical instruments incorporate antimicrobial and self-cleaning chemistries to maintain sterile conditions in critical environments

This comprehensive research report categorizes the Smart Surfaces market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Function

- Surface Structure

- Substrate Type

- Application

- End User Industry

Mapping Regional Divergences and Growth Drivers Across Americas, EMEA and Asia-Pacific Smart Surface Markets

The Americas continue to spearhead technological adoption, buoyed by robust R&D ecosystems, advanced manufacturing bases and significant government incentives for smart building initiatives and electric vehicle production. The United States, in particular, has seen hospital and medical facility retrofits with antimicrobial surfaces accelerate, while automotive OEMs are integrating self-healing and anti-reflection coatings into next-generation EV models. Canada’s pipeline corrosion mitigation programs, leveraging anti-icing and anti-fouling chemistries, are another salient driver of regional uptake and innovation.

In Europe, Middle East & Africa, sustainability mandates and circular economy regulations are catalyzing demand for eco-friendly smart coatings and reusable substrate technologies. Germany’s automotive and aerospace clusters are investing heavily in self-healing composites, whereas France is pioneering photocatalytic treatments for infrastructure maintenance. Meanwhile, Gulf nations in the Middle East are introducing solar-adaptive glazing in new construction projects, and South Africa is trialing corrosion-resistant smart coatings in its mining sector, reflecting a diverse set of market entry strategies and growth accelerators across the EMEA landscape.

Asia-Pacific remains the largest and fastest-growing region, driven by large-scale smart city programs, rapid industrialization and a flourishing electronics manufacturing sector. China’s intensive R&D initiatives have propelled over 500 nanomaterial projects dedicated to smart surfaces, while India’s construction boom is adopting temperature-regulating roof coatings to address extreme climate conditions. Japan’s healthcare institutions are standardizing antimicrobial surface protocols, and South Korea is showcasing conductive silver nanowire solutions at major electronics exhibitions, collectively cementing the region’s leadership in material innovation and scale-up capacity

This comprehensive research report examines key regions that drive the evolution of the Smart Surfaces market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Smart Surfaces Ecosystem Through R&D, Partnerships and Strategic Initiatives

Leading companies are carving distinct competitive positions through targeted investments in next-generation smart surface technologies and strategic collaborations. DuPont, for instance, unveiled silver nanowire product lines for transparent heaters and smart surface applications in automotive and electronics sectors at key industry exhibitions in South Korea, underscoring its commitment to advanced material platforms and partnership ecosystems

Major specialty chemicals and coatings firms such as The Sherwin-Williams Company, 3M, AkzoNobel, BASF and PPG Industries are expanding their portfolios with self-healing films, antimicrobial treatments and stimuli-responsive compounds. These incumbents are augmenting their R&D pipelines via acquisitions of innovative startups and dedicated labs focused on nano-engineered composites and eco-friendly formulations. Tesla NanoCoatings, Dow and Gentex are similarly forging niche leadership in conductive and anti-reflective solutions, often collaborating with automotive OEMs and consumer electronics manufacturers to co-develop application-specific smart surface integrations.

To reinforce their sustainability credentials, several key players have established science-based targets and circularity programs. DuPont’s 2025 Sustainability Report highlights a 55% reduction in Scope 1, 2 and 3 emissions, the launch of over 30 high-impact sustainable products and recognition for Nanofiltration membranes that advance water purification. These achievements reflect the industry’s broader pivot toward green manufacturing practices and underscore the strategic advantage conferred by aligning innovation roadmaps with rigorous ESG objectives

This comprehensive research report delivers an in-depth overview of the principal market players in the Smart Surfaces market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Acciona, S.A.

- AGC Inc.

- Akzo Nobel N.V.

- Arkema S.A.

- Axalta Coating Systems Ltd.

- BASF SE

- Bayer Aktiengesellschaft

- Clariant AG

- Compagnie de Saint-Gobain

- Corning Incorporated

- Covestro AG

- Dow Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Gentex Corporation

- Hempel A/S

- Henkel AG & Co. KGaA

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- The Lubrizol Corporation

- The Sherwin-Williams Company

- View, Inc.

Defining Actionable Strategies for Industry Leaders to Capitalize on Smart Surface Innovations and Mitigate Market Challenges

To thrive amid evolving technological demands and trade policy uncertainties, industry leaders should fortify domestic and regional supply chains by investing in local manufacturing hubs and qualifying alternative feedstocks. This approach will mitigate exposure to volatile tariff landscapes and ensure consistency in critical raw material availability. Additionally, forging strategic alliances with specialized nanotechnology startups and academic research centers can accelerate the co-development of proprietary hydrogels, ceramics and polymers, enabling faster time to market and differentiated value propositions.

Organizations must also prioritize digital enablement, embedding IoT sensors and AI-driven control systems within surface architectures to unlock new service-oriented revenue streams-such as predictive maintenance subscriptions and performance analytics. Concurrently, emphasizing sustainable material selection by adopting green chemistry principles and circular design frameworks will resonate with regulatory bodies and end users, driving broader market acceptance. Finally, tailoring product offerings to regional end-use requirements-informed by granular segmentation insights-will help companies capture high-growth niches in automotive EV applications, smart building facades and advanced healthcare devices

Detailing the Rigorous Multi-Source Research Methodology Underpinning This Comprehensive Smart Surfaces Industry Analysis

This analysis is grounded in a mixed-method research framework that includes primary interviews with industry stakeholders, material scientists and procurement leaders, coupled with secondary data synthesis from reputable press releases, government filings and open-source intelligence platforms. The tariff impact assessment leverages official USTR announcements under Section 301 and regulatory updates from trade associations to model cost sensitivity scenarios. Primary research insights are triangulated against secondary sources to validate technology adoption rates, R&D trajectories and regional demand patterns.

Our methodology also integrates qualitative analysis of corporate sustainability reports and technical briefings to evaluate ESG performance metrics and innovation pipelines. Application-level trends were mapped by reviewing industry conference proceedings and patent filings, ensuring a comprehensive view of emerging functionalities across smart coatings, glass, ceramics and polymers. This rigorous approach underpins the credibility of the strategic recommendations and market insights presented herein, offering decision-makers a robust foundation for developing forward-looking business strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Smart Surfaces market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Smart Surfaces Market, by Material Type

- Smart Surfaces Market, by Function

- Smart Surfaces Market, by Surface Structure

- Smart Surfaces Market, by Substrate Type

- Smart Surfaces Market, by Application

- Smart Surfaces Market, by End User Industry

- Smart Surfaces Market, by Region

- Smart Surfaces Market, by Group

- Smart Surfaces Market, by Country

- United States Smart Surfaces Market

- China Smart Surfaces Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3975 ]

Synthesizing Key Insights and Strategic Implications to Chart the Future Trajectory of the Global Smart Surfaces Landscape

The smart surfaces domain is poised for sustained growth, underwritten by convergent technology trends and increasing end-user demand for adaptable, durable and sustainable material interfaces. As IoT and AI integration accelerates, surfaces will evolve from passive substrates to active data-driven assets that optimize performance, reduce maintenance costs and enhance user experiences. Meanwhile, trade policy shifts underscore the importance of resilient supply chain strategies and regional manufacturing capabilities in maintaining competitive cost structures.

Market segmentation insights reveal compelling avenues across material types-from self-healing hydrogels to anti-reflective glass-and application verticals ranging from next-generation EV interiors to sterile medical surfaces. Regional analysis further highlights the necessity of tailoring go-to-market approaches to local regulatory environments and infrastructure initiatives. By synthesizing these multifaceted insights, industry participants can anticipate disruption vectors, prioritize investment in high-impact innovations and forge strategic partnerships that deliver sustainable differentiation in a rapidly evolving landscape.

Secure Your Competitive Edge Today by Partnering with Ketan Rohom to Access the Definitive Smart Surfaces Market Research Report

Don’t miss the opportunity to transform your strategic roadmap with unparalleled market insights. Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, is ready to guide you through the latest findings, data visualizations, and expert analyses that will empower your organization to navigate emerging opportunities and mitigate risks in the smart surfaces arena. Reach out today to secure your copy of the definitive market research report and gain the competitive intelligence you need to stay ahead of the curve-because in a market defined by rapid technological evolution and shifting trade policies, informed decisions are your greatest advantage.

- How big is the Smart Surfaces Market?

- What is the Smart Surfaces Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?